NBER BCDC And Alternative Business Cycle Indicators For January

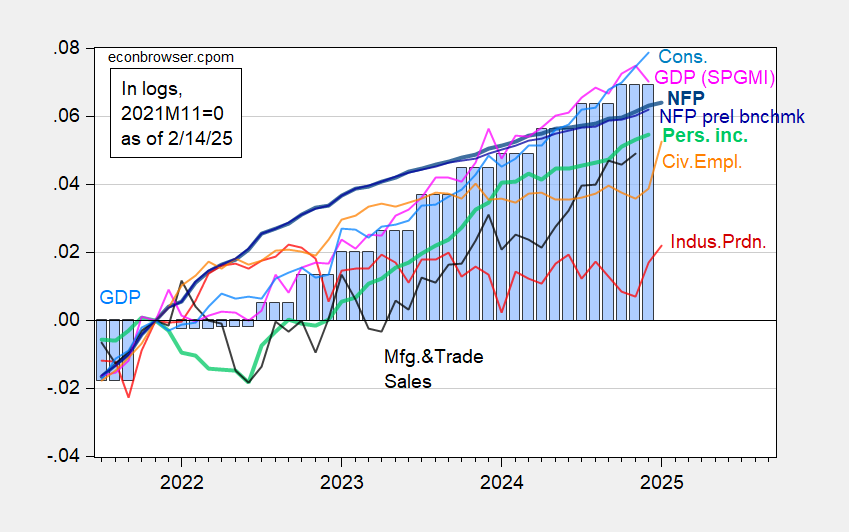

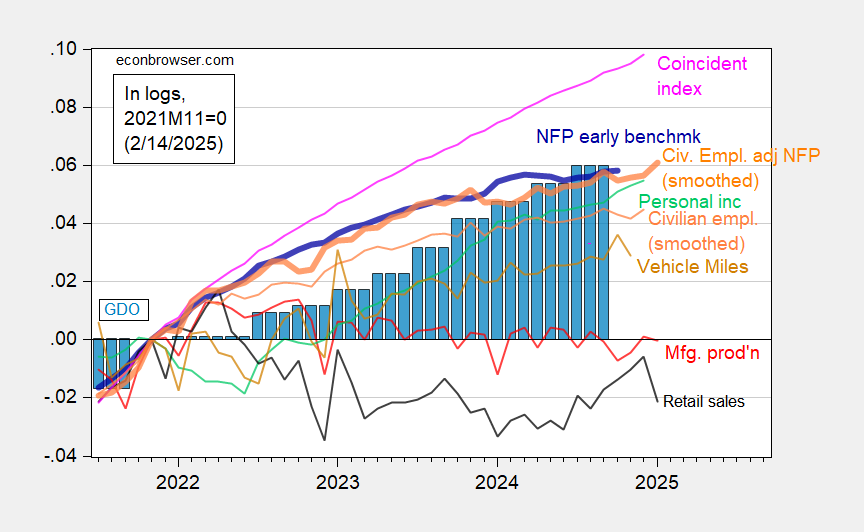

In the first set, industrial production continues to rise (as did employment). In the second set, while civilian employment and civilian employment adjusted to NFP concept rose, manufacturing output flat, and real retails sales fell noticeably.

(Click on image to enlarge)

Figure 1: Nonfarm Payroll incl benchmark revision employment from CES (bold blue), implied NFP from preliminary benchmark through December (blue), civilian employment as reported (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold light green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Source: BLS via FRED, Federal Reserve, BEA 2024Q4 advance release, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (2/3/2025 release), and author’s calculations.

Note the official civilian employment series evidences a sharp jump in January; that’s almost entirely due to incorporation of new population controls. BLS has produced several research series which smoothly incorporate population controls. I plot below the overall civilian employment and adjusted-to-NFP concept series. Both evidence upward movement.

(Click on image to enlarge)

Figure 2: Implied Nonfarm Payroll early benchmark (NFP) (bold blue), civilian employment adjusted smoothed population controls (bold orange), manufacturing production (red), personal income excluding current transfers in Ch.2017$ (bold green), real retail sales (black), and coincident index in Ch.2017$ (pink), GDO (blue bars), all log normalized to 2021M11=0. Source: Philadelphia Fed [1], Philadelphia Fed [2], Federal Reserve via FRED, BEA 2024Q4 advance release, and author’s calculations.

GS notes that unusually cold weather might have weighed on retails sales, which came in -0.9% m/m vs. Bloomberg consensus -0.2% (unusually cold weather also drove up industrial production via utilities output).

Still dubious on recession call, given upward movement in employment (see discussion here of research series and the CES/CPS gap)

More By This Author:

Eggs Retail Up 18%, PPI 32% Month-On-MonthEgg Prices in January — $4.95/Dozen Grade A, Large

Year-Ahead CPI Inflation Expectations In January: 3%-3.3%