Natural Gas Flashes Buy Signal With Cycles Confirming

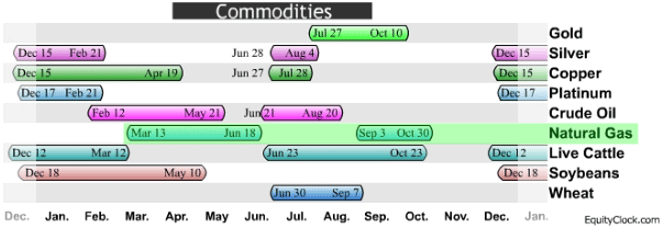

At first look at the seasonal chart showing the month which Natural Gas is generally strong.

This seasonality table refers to particular time frames when commodities are subjected to and influenced by recurring tendencies that produce patterns each year.

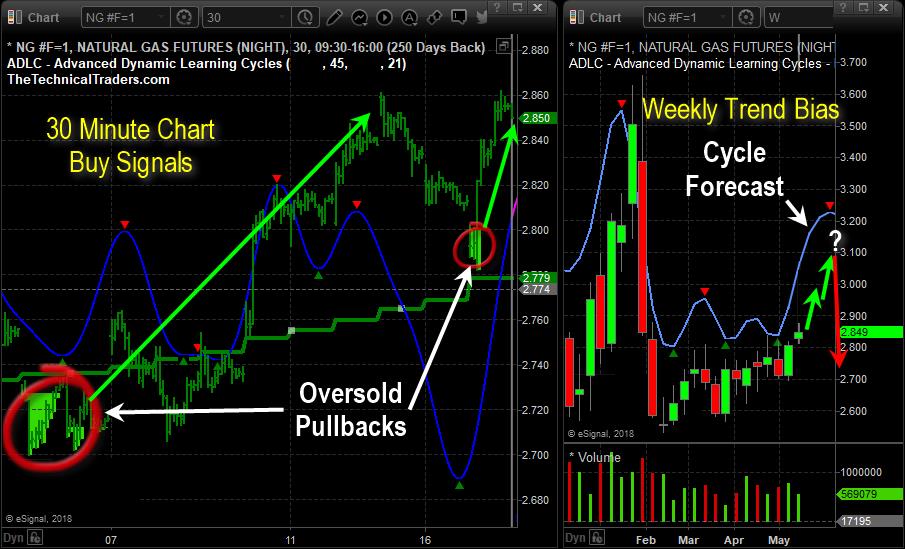

It is our belief that Natural Gas will continue to climb higher moving well above the $3.00 level before the end of this month as well as potentially pushing well above the $3.20 level on continued price advances in energy.

Quite a bit of concern globally is driving energy supply fear that is pushing energy prices higher. This unique seasonal pattern indicates the potential for some strong upside price moves. We believe smart traders were already positioned for this move weeks ago, yet there is still quite a bit of opportunity from the recent entry point. See the left side of chart; below with oversold pullbacks.

(Click on image to enlarge)

A price move from current levels to above $3.00 would reflect an additional 4~6% price gain and a advance above $3.20 would reflect a 11% price advance. Again, our predictive price modeling systems and cycle modeling systems are showing us this has the potential for quite a bit more, but we can only estimate the $3.00 to $3.20 level is a sufficient upside target for this initial move.

Disclosure: If you want to know where the market is headed each day and week, well in advance then be sure to join my Pre-Market Video Forecasting service which is: more

I hope you are right on pricing. I do not try to guess those but if my own views are correct they have only one way to go - up seekingalpha.com/article/4158962-gas-new-oil