More On Portfolio Crowding Out In The Context Of Normalized Fed Policy

The algebra and graphical analysis (from my undergrad course) is here. If you don’t understand it, don’t bother commenting.

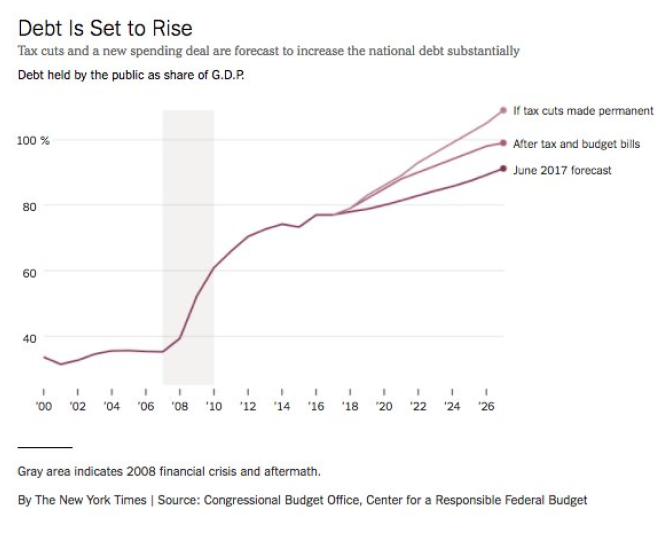

(Click on image to enlarge)

Source: Irwin, NYT, 9 Feb 2018.

Back in 2000, when I was an economist on the Council of Economic Advisers (under Bill Clinton), we worried about what would happen when the Federal debt was all retired, particularly with respect to the implementation of monetary policy. George W. Bush and the Republicans in Congress solved that problem with two sets of tax cuts, and gave us record deficits in subsequent years (little help — around a trillion — coming from the Iraq invasion). In 2017, we didn’t need to worry about retiring the Federal debt, nor did we need to worry about a negative output gap. But Mr. Trump and the Republican Congress will likely help solve the problem of too low sovereign interest rates.

Mission accomplished.

Disclosure: None.

I would like to think it could be a solution. But it may be a disaster if bonds are no longer trusted as a store of value. Could that happen?