Moody's Cuts USA's AAA Rating Outlook To 'Negative'; Treasury "Disagrees"

Who could have seen that coming?

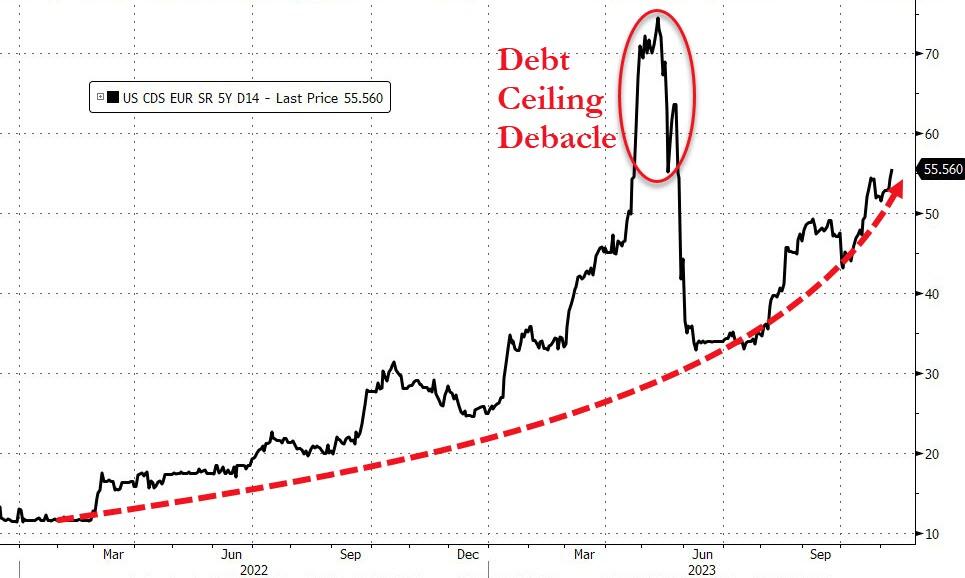

After a disastrous 30Y bond auction this week, a collapse in Treasury market liquidity, and an accelerating rise in the market's perception of the United States' credit risk, Moody's has just cut its outlook on US credit ratings to negative from stable.

Source: Bloomberg

The key driver of the outlook change to negative is Moody's assessment that the downside risks to the US' fiscal strength have increased and may no longer be fully offset by the sovereign's unique credit strengths.

In the context of higher interest rates, without effective fiscal policy measures to reduce government spending or increase revenues, Moody's expects that the US' fiscal deficits will remain very large, significantly weakening debt affordability.

Continued political polarization within US Congress raises the risk that successive governments will not be able to reach consensus on a fiscal plan to slow the decline in debt affordability.

Moody's does affirm the Aaa rating:

The affirmation of the Aaa ratings reflects Moody's view that the US' formidable credit strengths continue to preserve the sovereign's credit profile.

First, Moody's expects the US to retain its exceptional economic strength. Further positive growth surprises over the medium term could at least slow the deterioration in debt affordability.

Second, the US' institutional and governance strength is also very high, supported in particular by monetary and macroeconomic policy effectiveness. While the adjustment of the US economy and financial sector to higher-for-longer interest rates is underway, policymakers have facilitated the transition through transparent and effective policy.

Finally, the unique and central roles of the US dollar and Treasury bond market in the global financial system provide extraordinary funding capacity and significantly reduce the risk of a sudden spiraling of funding costs, which is particularly relevant in the context of high debt levels and weakening debt affordability.

The US' long-term local- and foreign-currency country ceilings remain unchanged at Aaa. The Aaa local-currency ceiling reflects a small government footprint in the economy, relatively predictable and reliable institutions, very low external imbalances and moderate political risks, all of which reduce the risks posed to non-government issuers by government actions or shocks that would commonly affect the government and the private sector. The foreign-currency ceiling at Aaa reflects the country's strong policy effectiveness and open capital account which reduce transfer and convertibility risks to minimal levels.

Full Rationale for Outrlook cut:

ABSENT POLICY ACTION, FISCAL STRENGTH WILL DECLINE

The sharp rise in US Treasury bond yields this year has increased pre-existing pressure on US debt affordability. In the absence of policy action, Moody's expects the US' debt affordability to decline further, steadily and significantly, to very weak levels compared to other highly-rated sovereigns, which may offset the sovereign's credit strengths.

Past increases in interest rates by the Federal Reserve will continue to drive the US government's interest bill higher over the next few years. Meanwhile, although the government's revenue base will rise in line with the economy as a whole, in the absence of specific policy action, this will occur at a much slower pace than the rise in interest payments.

Moody's expects federal interest payments relative to revenue and GDP to rise to around 26% and 4.5% by 2033, respectively, from 9.7% and 1.9% in 2022. These projections factor in Moody's expectation of higher-for-longer interest rates, with the average annual 10-year Treasury yield peaking at around 4.5% in 2024 and ultimately settling at around 4% over the medium term. The debt affordability forecasts also take into account Moody's expectations that, absent significant policy changes, the federal government will continue to run wide fiscal deficits of around 6% of GDP near term and to around 8% by 2033, the widening being driven by higher interest payments and aging-related entitlement spending.By comparison, deficits averaged around 3.5% of GDP from 2015-2019. Such deficits will raise the US federal government's debt burden to around 120% of GDP by 2033 from 96% in 2022. In turn, a higher debt burden will inflate the interest bill.

For a reserve currency country like the US, debt affordability - more than the debt burden - determines fiscal strength. As a result, in the absence of measures that limit the size of fiscal deficits, fiscal strength will increasingly weigh on the US' credit profile.

FISCAL RISKS ARE EXACERBATED BY ENTRENCHED POLITICAL POLARIZATION UNDERSCORING RISING POLITICAL RISK

At a time of weakening fiscal strength, there is an increased risk that political divisions could further constrain the effectiveness of policymaking by preventing policy action that would slow the deterioration in debt affordability. These risks underscore rising political risk to the US' fiscal position and overall sovereign credit profile.

Recently, multiple events have illustrated the depth of political divisions in the US: renewed debt limit brinkmanship, the first ouster of a House Speaker in US history, prolonged inability of Congress to select a new House Speaker, and increased threats of another partial government shutdown due to Congress' inability to agree on budgetary appropriations. In Moody's view, such political polarization is likely to continue. As a result, building political consensus around a comprehensive, credible multi-year plan to arrest and reverse widening fiscal deficits through measures that would increase government revenue or reform entitlement spending appears extremely difficult.

While the US' Aaa rating takes into account relative weaknesses with regards to the quality of the country's legislative and executive institutions and fiscal policy effectiveness compared to other Aaa-rated sovereigns, there is a risk that these weaknesses take greater credit relevance because the deteriorating debt affordability trend would call for a more significant and effective fiscal policy response.

In particular, the US' lack of an institutional focus on medium-term fiscal planning, either through legislated fiscal rules aimed at improving the fiscal balance or general bipartisan consensus on the need for fiscal consolidation, is fundamentally different from what is seen in most other Aaa-rated peers such as in Government of Germany (Aaa stable) and Government of Canada (Aaa stable). Meanwhile, the more short-term focus of US fiscal policymaking, along with limited fiscal flexibility - because a very large portion of nondiscretionary budgetary spending is on mandatory entitlement programs and debt service (around 75% of total outlays), exacerbates already fractious bipartisan politics around a relatively disjointed and disruptive budget process. As annual debt service costs continue to rise, fiscal flexibility will diminish even further.

And cue Janet Yellen to dismiss this as folly...

Five minutes later, US Deputy Treasury Secretary Wally Adeyemo comments in emailed statement to Bloomberg:

“While the statement by Moody’s maintains the United States’ Aaa rating, we disagree with the shift to a negative outlook. The American economy remains strong, and Treasury securities are the world’s preeminent safe and liquid asset”

“The Biden administration has demonstrated its commitment to fiscal sustainability, including through the more than $1 trillion in deficit reduction included in the June debt-limit deal as well as President Biden’s budget proposals that would reduce the deficit by nearly $2.5 trillion over the next decade”

Still, not a great look as she "negotiates" with the Chinese.

More By This Author:

Bitcoin 'Supply' Tightens As 'Tsunami' Of Institutional-Demand Looms

Tesla Shares Fall 5% On HSBC $146 Target, Continued Cybertruck Skepticism

Fed's Emergency Bank Funding Facility Explodes Higher, QT Stalls As Money-Market Funds Hit Record High

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more