Metallurgy

Time for a bit of a victory lap, even though it’s about a post from just Friday. On that day, I did my Range Exhaustion post for Gold & Platinum members, suggesting that the measured tool in SlopeCharts was indicating the good prospect of a fall in the metals fund XME:

(Click on image to enlarge)

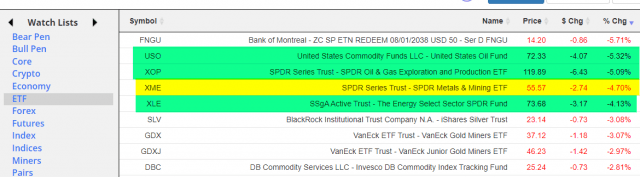

Indeed, my main thrust on Friday was about shorting energy and metals. As I look at the top losers from my ETF watch list, it’s crowded at the top with precisely those two sectors.

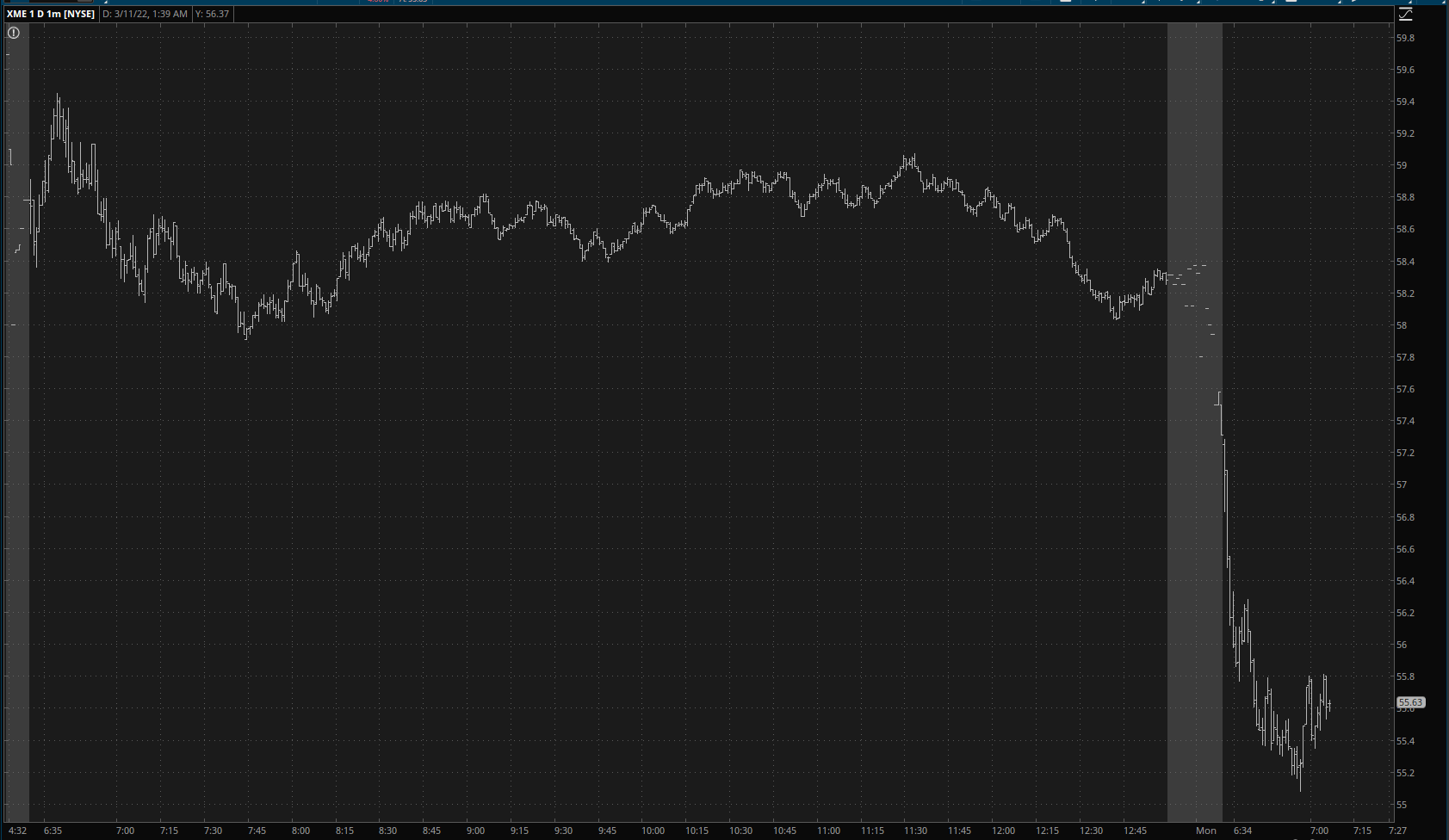

As we look at the intraday chart of XME, we can see the terrific fall. My options (which as always are incredibly conservative) have popped 20%, although anyone with aggressive options is looking at triple-digit percentage moves.

(Click on image to enlarge)

Errr, well, that’s just peachy, but am I going to dump my puts? Well, these things have a full 95 days until expiration (!!!!!!) so I hardly think holding my position for literally a few hours exhausts the possibilities of this position. As I look at the likes of Alcoa (one of the biggest components of XME) I don’t think we’re exactly at a major bottom here, folks.

(Click on image to enlarge)

Looking at the XME in general, I am open to the prospect of this thing retracing all the way back to its breakout. It might not, but even so, I am certainly not taking profits. Not a penny.

(Click on image to enlarge)