META Stock Forecast: Pioneer To New Heights

Highlights

- The underperformance in 2022 was attributed to significant currency risks, reduced advertising demand, and strict regulation on target advertising.

- The advertising revenue is resilient and a good sign shows that advertisers have a strong demand as the economy recovers from COVID and the recession.

- Restructuring, by implementing a series of cost management practices, reflects META’s determination to align business and strategic priorities for operating efficiency.

- Although it’s difficult to depict how the metaverse will develop and the operating losses kept increasing for Reality Labs, META expects this will be the next chapter of the Internet and will unlock monetization chances.

- DCF estimates META stock will grow to $313, an 4% upside potential for the year 2023.

Overview

Meta Platforms, Inc. (META) is an American multinational technology company, headquartered in Menlo Park, California. The company operates Facebook, Instagram, Messenger, WhatsApp (these four are also called Family of Apps), and other products and services. As the ten largest publicly-traded corporations in the U.S., META generated revenue of around US$116,609 million by the end of 2022 and earned sales at US$31,999 million in the recent Q2, an increase of 11% compared to last year. On October 28, 2021, the parent company of Facebook changed its name from Facebook, Inc., to Meta Platforms, Inc., to show its current strategy for building the metaverse.

Being Resilient and Ambitious to the Top

The 2022 10K report said the total revenue of META decreased by 1% compared to the previous year, partly because of the appreciation of the U.S. dollar against other foreign currencies. Excluding currency risk, actual sales would be approximately $122.57 billion, up 4% from 2021. The company’s profitability and financial strength were resilient and better than over 70% of companies in the Interactive Media industry.

Good Signal from Advertising Revenue Growth

Advertising is the primary revenue source for META, accounting for more than 98%. In addition to the aforementioned currency risks, the underperformance in 2022 can partially be attributed to reduced advertising demand due to a turbulent and complex macroeconomic environment. The rising pressure from the regulation also limited the ability of ad targeting and measurement tools, increasing administrative burdens and negatively impacting business operations.

Although there is a lot of uncertainty spreading around the market, META’s performance in the second quarter of 2023 is better than that of the previous year, with an 11% increase in revenue and a 16% increase in net profit. A potential growth back to the heyday is in sight. The table below supports the viewpoints by presenting strong profitability from advertising, other apps, and reality labs.

When deconstructing the advertising revenue, we can understand the reasons behind the fluctuations. In terms of Family Monthly Active People (MAP), defined as registered and logged-in users who visited at least one of these Family products in the last 30 days as of the date of measurement, it showed a steadily growing trend with 3.88 billion users in Q2’23. Customers are still having strong interest in Meta’s apps and there’s a chance to boost revenue by improving services and abilities to help target ads.

The constantly rising number of family monthly active people does inspire the company and investors, but the fluctuating Family Average Revenue per Person (ARPP) does sometimes bring a huge negative impact on the financial results, dragging down margins significantly. ARPP is defined as the total revenue during a given quarter, divided by the average number of MAP at the beginning and end of the quarter. If ARPP falls more than MAP rises, ad revenue will fall because the two effects cannot fully cancel out.

ARPP is affected by many factors, such as abilities, expectations on macroeconomics, competition from rivals, and so on. Even though a huge group of users is there, advertisers have a limited budget and will keep pushing down the price, especially during a hard time like 2022. Luckily, the Q2’23 figure rose to $8.32, a 5.2% increase from last year, contributing significantly to the sharp increase in revenue growth (around 11%). It’s a sign that advertisers have strong demand as the economy recovers from Covid, and it’s expected that a good start will lead to an upward trend in the future and the bargaining power of META is still strong.

META Restructuring Brings Higher Operating Efficiency

Because of the increased payroll and development of the data centers and technical infrastructure, the operation income in 2022 was reduced by $17.81 billion, or 38%, compared to 2021. To improve the operating efficiency to maximize margins, META began a series of cost management initiatives by consolidating facilities and laying off about $11,000 employees, which generated total restructuring fees of $4.61 billion in 2022. Despite the massive layoff, its headcount actually increased by 20% by recruiting more employees in engineering and technical departments for strategy purposes.

By Q2’23, the company has considerably completed the planned layoffs while enhancing the facility consolidation and data center restructuring initiatives, incurring approximately $1.64 billion in charges under the Family of Apps (FoA) segment and $286 million under the Reality Labs (RL) segment respectively. The expected full-year restructuring fees are approximately $4 billion in 2023. The expenses did drag down the operating margin by around 3% during the six months period and the diluted EPS was $0.61 ended June 30, 2023. The reorganization really reflects META’s determination to upgrade the entire ecosystem and align business and strategic goals for operating efficiency.

META Reality Labs, the Next Chapter of the Internet

As stated in the Q2’23 report, the full-year 2023 total expenses will range from $88 to $91 billion, increasing from a prior range of $86-90 billion. The growth of total expenses is driven by the following factors:

- Increased capital expenditure on both data centers and servers to support AI work;

- Higher payroll expenses as the workforce composition toward higher-cost technical roles ;

- More operating losses for Reality Labs (RL) due to ongoing product development in AR/VR.

The higher expenses are necessary for advanced technology and further development. We can see investments do not just pour in FoA but in RL as it’s related to the long-term and cutting-edge research and development of the metaverse. Although it’s difficult to depict how the metaverse will develop and the operating losses kept increasing for RL, the company expects this will be the next chapter of the Internet and will unlock monetization chances for businesses, developers, and creators. The growth in expenses also shows META’s ambition to win the AR/VR market, which will be the next battlefield and the most lucrative place.

An Unshakable Presence in the Interactive Media Industry

According to GuruFocus, META is one of the most profitable companies in the Interactive Media industry. Its Net Margin was 18.71%, better than 82.71% of companies in the industry and its ROE is 17.77%, better than 78.80% of similar firms. META has not only excellent profit generation ability but also strong financial strength in the Interactive Media industry. The company’s equity-to-asset ratio was 0.65, indicating that 65% of total assets were financed by equity and 35% by liabilities. Its interest coverage was 52.72, which means its EBIT could cover 52.72 times interest expenses and in the short team the company won’t face significant financial risks.

DCF Values META Stock at $313

The DCF analysis shows that the intrinsic, 1-year, and 2-year META stock price should be around $313, $335, and $356 respectively, which is 4%, 11%, and 18% upside potential from the price of $301.64 on August 11, 2023. It’s clear that the META stock price is undervalued and worth buying.

The META DCF model is built based on the following assumptions:

- The risk-free rate is 4.0% according to the US 10-year zero coupon bond as of August 2023. The risk premium of 5.5% comes from the average market risk premium in the U.S. from Statista.

- Beta 1.17 is calculated based on the slope of the change of monthly META stock price and S&P500 price from 2018 to 2023.

- The cost of debt is calculated as a weighted average interest expense of 4.12% and operating and finance lease discount rate of 3.0%, concluding at 3.4%.

- The tax rate is the effective tax rate of 16% derived from the 10-K 2022.

- The terminal growth rate is assumed at 4.0%.

Due to the uncertainties in the macroeconomic environment, it is difficult to accurately predict the impact of relevant risk factors such as epidemics and wars, and the assumption may not be valid. A sensitivity matrix is created to show the impacts on META’s intrinsic stock price by altering WACC (weighted average cost of capital) and terminal growth rate.

Viewpoints on META Stock Forecast

According to Yahoo Finance, there were 59 analysts presenting recommendation trends on July 2023, among which 18 recommended Strong Buy, 30 Buy, and 7 Hold. The recommendation rating is 1.8, standing between Buy and Strong Buy. The average price target from 49 analysts is around $363.33 within the lowest $100 and the highest $435 price range.

From TipRanks, there are 39 Buys, 2 Holds, and 0 Sell from 41 analysts’ ratings in the last 3 months. The expected stock price is $377.7 within the lowest $285 and the highest $435 price range.

Conclusion

I take a buy-side on META stock because the DCF target price is $313, an 4% upside difference from the current price. Although the restructuring charges and capital expenditure will be increased significantly til next year, the company is strongly confident in its future development by investing in Reality Labs and launching new products and services. Its strong fundamentals support its strategy implementation, manifesting its positive expectations in the next periods.

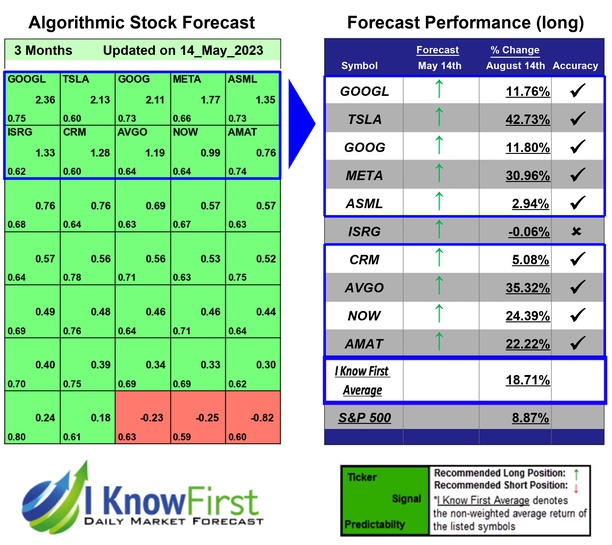

Past Success With META Forecast

I Know First has been bullish on the META stock forecast in the past. On May 14th, 2023 the I Know First algorithm issued a forecast for META stock price and recommended META as one of the best mega-cap stocks to buy. The AI-driven META stock prediction was successful on a 3-month time horizon resulting in more than 30.96%.

More By This Author:

Investment Strategies: Who Is Winning In The Battle Of Active Vs Passive Investors

Identifying The Dimension Where Deterministic Chaos Is Alive In The Stock Market

Market Anomaly: Weekend Effect Of Monday And Friday Stock Returns

To subscribe today click here.

Disclosure: This article originally appeared on more