May 2023 Inflation: Various Measures, Horizons

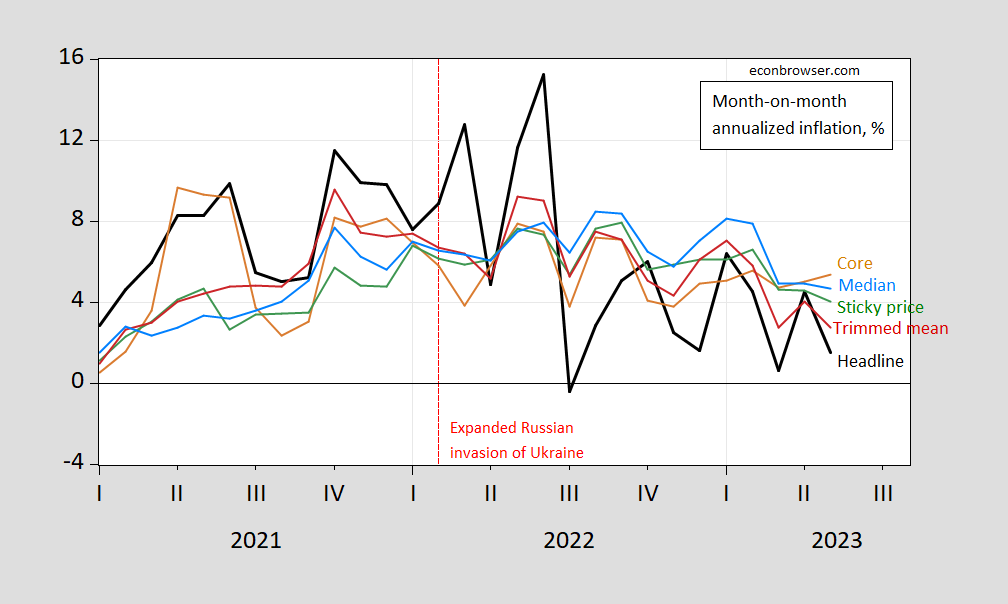

Headline m/m +0.1% vs. +0.2% Bloomberg consensus, core at +0.4% at consensus. Here are several measures on a month-to-month basis (annualized).

Figure 1: Month-on-month annualized inflation for headline CPI (bold black), core (tan), sticky price (green), trimmed mean (red), and median (sky blue), all in %. Source: BLS, Atlanta Fed, Cleveland Fed, and author’s calculations.

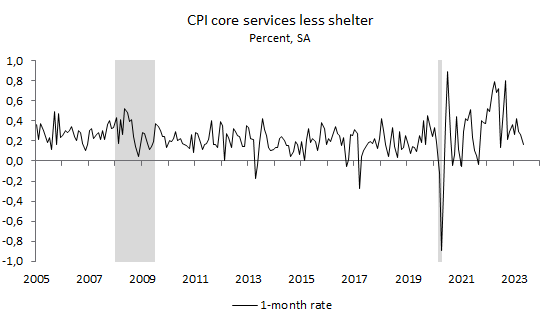

What about core services ex-shelter? Pawel Skrzypczynski has the data here.

Source: P. Skrzypczynski, 13 June 2023.

There’s a downward trend for all m/m measures, save core (although core services ex-shelter is down).

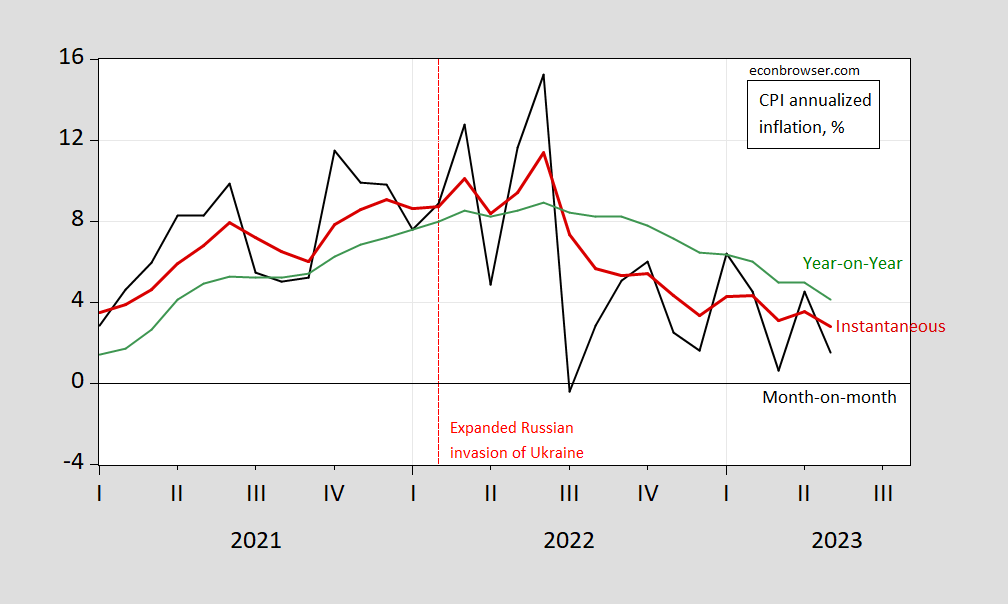

Can we infer something about headline trend. I plot instantaneous inflation (T=12, a=4) per Eeckhout (2023), compared against m/m and the conventional 12 month change.

Figure 2: Headline CPI month-on-month inflation (black), instantaneous (T=12, a=4) (bold red), and year-on-year (green), all in %. Source: BLS, and author’s calculations.

Instantaneous inflation in May is 2.8%. Over the 1986-2023M04 period, CPI inflation run about 43 bps higher than PCE price inflation, so translating accordingly, one can think of instantaneous inflation about 0.4 ppts higher than the level consistent with a 2% PCE inflation target.

Whether the downtrend in high frequency inflation will decline substantially and quickly is the big question. Jason Furman explains why he is skeptical.

More By This Author:

Plain Vanilla Term Spread Model Based Recession ProbabilitiesAre Imports A Leading Or Contemporaneous Indicator Of Recession?

SIFMA Semiannual Survey – The Outlook For Growth