Markets Waiting For Friday When Powell Speaks At Jackson Hole

Major US equity indices were down last week, but recovered from the lows, as dips were bought at important support. Jerome Powell’s Friday speech at Jackson Hole this week is important in that a possible announcement of tapering of bond purchases can have implications for stocks (DIA, QQQ).

Markets will be on pins and needles until Friday. At 10 a.m. that day, Jerome Powell, Federal Reserve chair, will virtually deliver his speech on “the economic outlook” at the annual Jackson Hole symposium. At issue is if he would announce tapering, and if he did, how stocks would react to it.

Last week’s minutes for the July 27-28 FOMC meeting showed that members were beginning to coalesce around tapering to begin toward the end of this year.

Currently, the Fed spends up to $80 billion in treasury notes and bonds and $40 billion in mortgage-backed securities every month. It is sitting on $8.34 trillion in assets, up from $4.24 trillion in early March last year. The US economy is no longer in crisis, as it was back then. Several metrics, including real GDP, have surpassed the pre-pandemic high. Calls for the removal of the ongoing stimulus are growing.

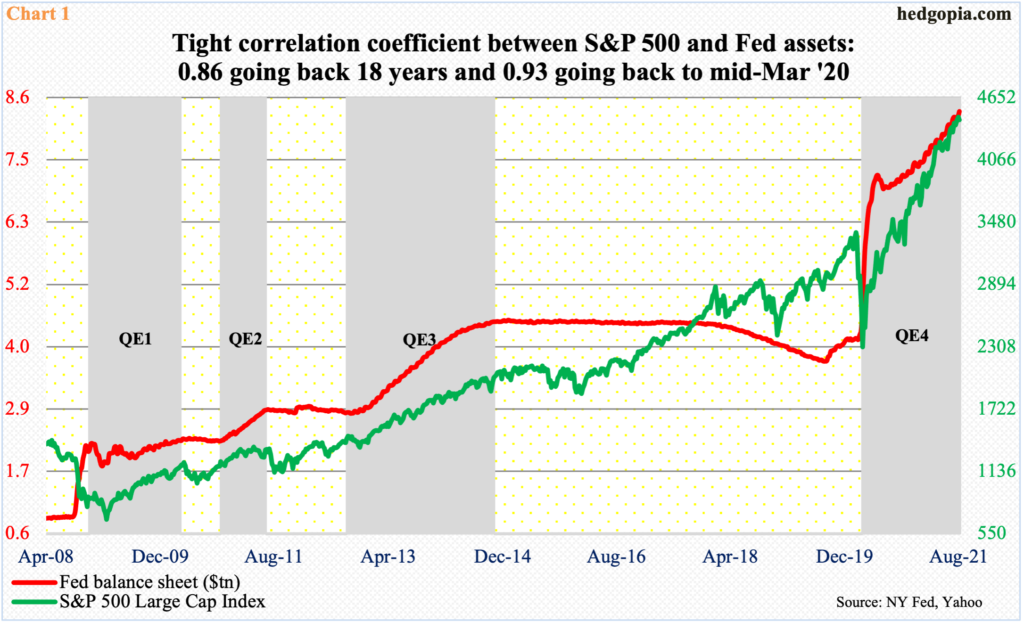

Should the Fed start to reduce its assets, this could adversely impact equities. Going back 18 years, the S&P 500 and the central bank’s assets show a correlation coefficient of 0.86, which is tight (Chart 1). The relationship got tighter – 0.93 – from March last year, which is when the Fed aggressively began to expand its balance sheet and the large cap index put in a major low. Both have since gone vertical.

Ahead of this, bulls pulled in their horns – a tad. Sentiment measures fell across the board last week.

In the week to Wednesday, American Association of Individual Investors (AAII) bulls dropped 3.8 percentage points week-over-week to 33.2 percent, while bears rose 3.6 percentage points to 35.1 percent. This survey measures retail investor sentiment.

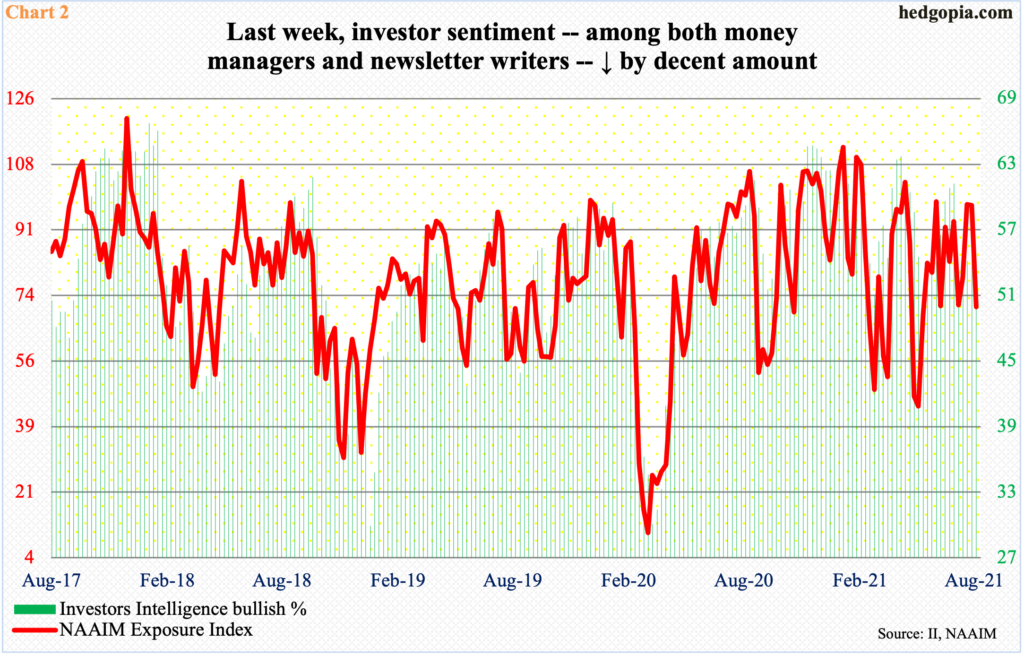

Also on the defensive were Investors Intelligence and National Association of Active Investment Managers (NAAIM) surveys, with the former measuring sentiment among newsletter writers and the latter among money managers.

In the week to Tuesday, Investors Intelligence bulls dropped 5.3 percentage points w/w to 51.1 percent – a 23-week low – while bears rose 2.6 percentage points to 18.5. Concurrently, in the week to Wednesday, the NAAIM exposure index, which measures members’ average exposure to US stocks, tumbled 27 points w/w to 70.6 – a 12-week low (Chart 2).

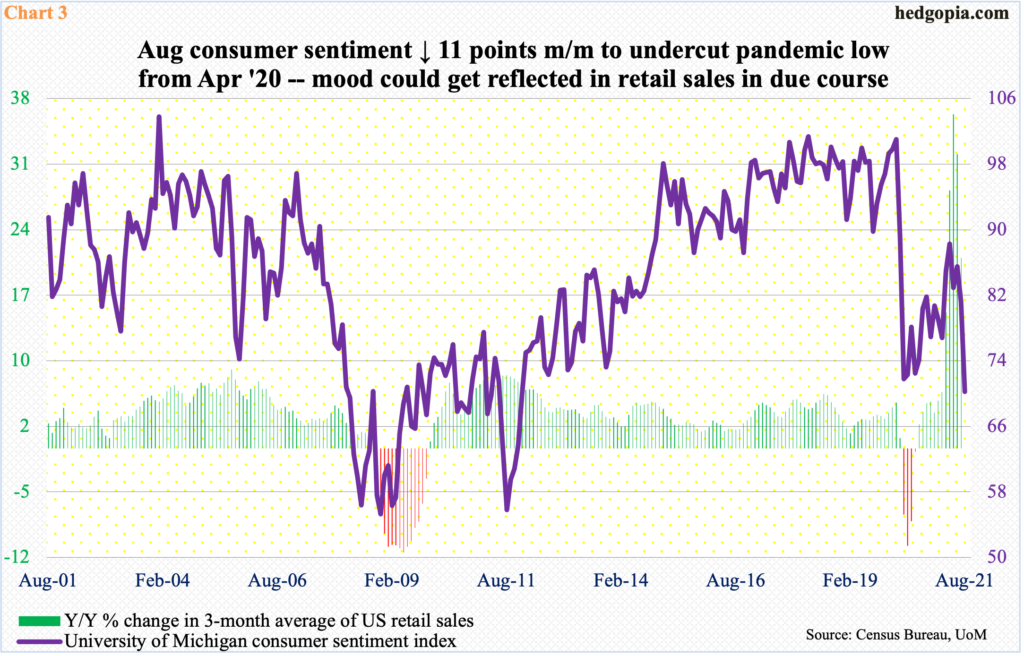

Rather interestingly, the drop in investor sentiment coincided with a drop in consumer sentiment. August’s preliminary reading showed the University of Michigan’s consumer sentiment index tumbled 11 points month-over-month to 70.2, undercutting the post-pandemic low of 71.8 from April last year. Just before Covid-19 began to ravage the economy, sentiment was 101 in February last year (Chart 3). (August’s final reading is due out this Friday.)

If past is prelude, consumer sentiment will get reflected in retail sales, which in April surged to a seasonally adjusted annual rate of $628.8 billion – a new record. In April last year, sales reached a post-pandemic low of $409.8 billion.

Sales have weakened after April’s record high, with July at $617.7 billion. Chart 4 calculates year-over-year percent change in the three-month average of retail sales. The deceleration in growth is evident, but this is still taking place at an elevated level. There is plenty of room for continued softness.

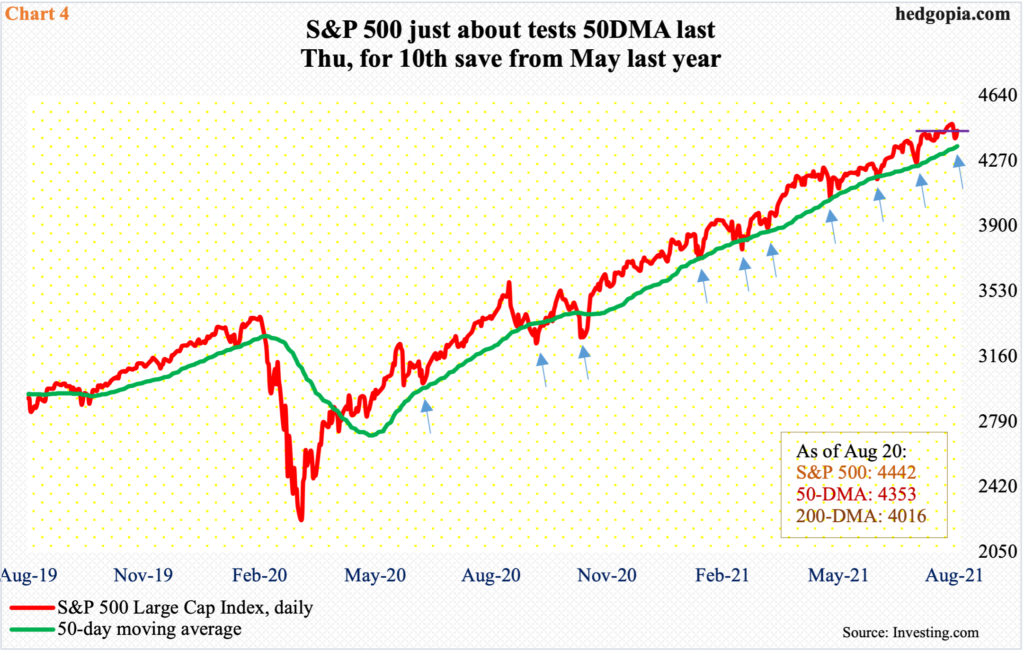

The S&P 500 (SPX, SPY) reached a fresh record of 4480 last Monday. Then, the decline in both consumer and investor sentiment possibly began to catch up. By Thursday, 4368 was tagged intraday; at the lows, the index was 0.4 percent from its 50-day. That low was bought. When it was all said and done, the S&P 500 (4442) ended the week down 0.6 percent, reversing higher from down 2.2 percent at Thursday’s lows.

Once again, the average drew bids. This was the 10th successful defense from May last year (arrows in Chart 4).

This reaction has come at a time when odds are rising of tapering to begin later this year. It is possible markets are betting on a win-win scenario.

If Powell does not lay out a tapering timetable on Friday, then that ensures continued flow of stimulus. If he does signal one, and tapering begins, that in due course could adversely impact the economy, which then sooner or later will force the Fed to reverse its decision to taper. A heads I win, tails you lose scenario – as far as equity bulls are concerned, or at least they hope things unfold this way.

As a matter of fact, small caps for several months now have been acting defensive. By nature, small-cap businesses have more domestic exposure than their large-cap cousins, which are also exposed internationally.

In March last year, the Russell 2000 (IWM) bottomed at 960s. A year later, it hit 2360, up a massive 144 percent, pricing in a lot of good news in the economy. In the meantime, several macro data points shot up with a V shape. Real GDP in 2Q20 posted a post-pandemic low of $17.3 trillion. Four quarters later, it reached a new high $19.4 trillion in 2Q21. Odds favor this pace of growth will not – and cannot – continue.

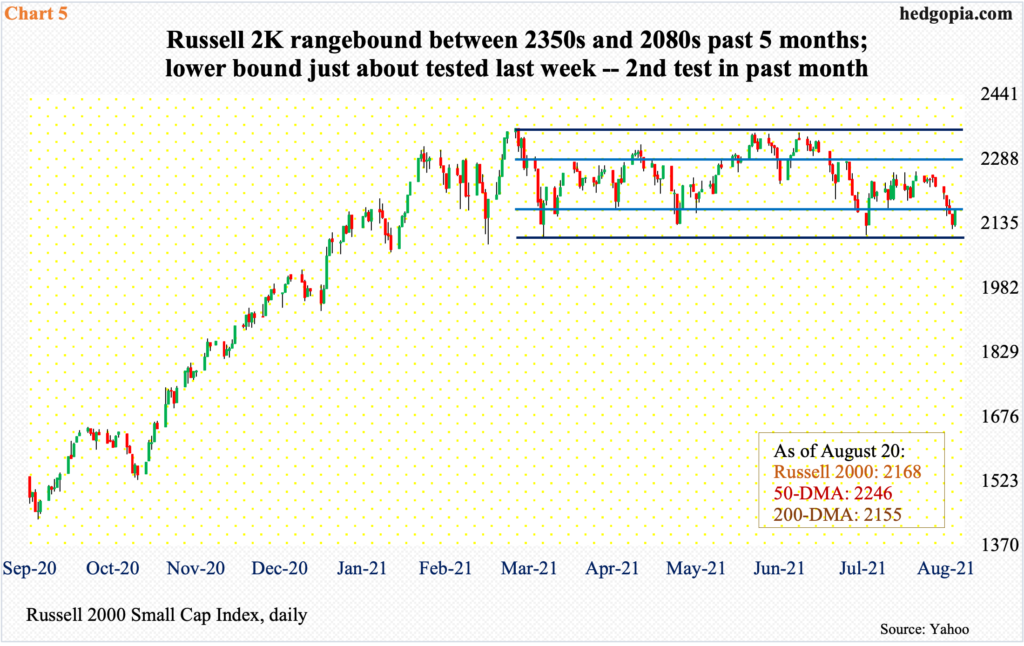

This is beginning to get reflected in small caps. Since reaching a new high mid-March, the Russell 2000 has essentially gone sideways, trapped within a rectangle between 2350s and 2080s (Chart 5). The lower bound was successfully tested mid-July, but the subsequent rally repeatedly failed at 2250s.

Last Thursday, the small cap index (2168) dropped to 2122 intraday before drawing bids. This was followed by Friday’s drop to 2127 which again elicited buying interest. Near term, bulls hope to at least test 2250s, and ideally, 2280s.

Longer-term, it increasingly feels like the bears will prevail. A decisive box breakdown opens the door toward 1800.

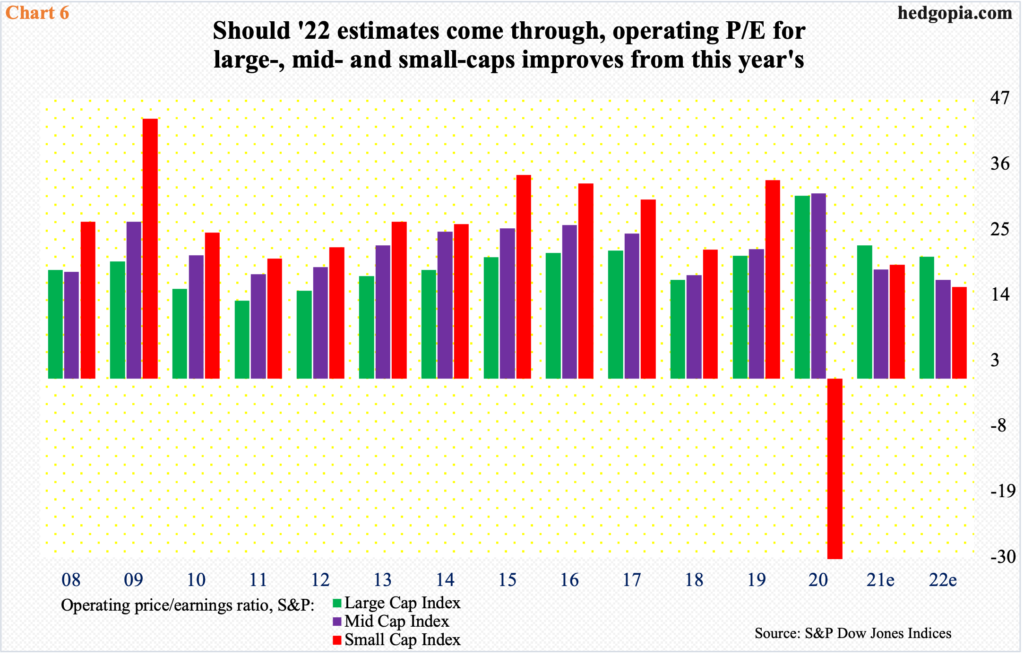

Currently, earnings expectations for all styles – large-, mid- and small-caps – are remotely priced in for growth deceleration.

Next year, S&P 500 companies are expected to ring up $217.52 in operating earnings. For S&P 400, estimates are $161.81 and $85.87 for S&P 600. With two more quarters to go this year, the sell-side respectively expects $198.56, $145.92, and $69.28 this year – for growth of 9.5 percent, 10.9 percent, and 23.9 percent next year.

If next year’s estimates come through, the P/E multiple improves next year (Chart 6), although they are anything but cheap. If the respective indexes rally further from here, the multiples of course expand.

Hence the significance of Friday’s speech. If Powell announces tapering, and equities still celebrate, we will have entered uncharted territory. Otherwise, it is likely to be a case of ‘history does not repeat itself, but it often rhymes.’

Thanks for reading!

Disclaimer: This article is not intended to be, nor shall it be construed as investment advice. Neither the information nor any opinion expressed here constitutes an offer to buy or sell any ...

more