Markets: Tin

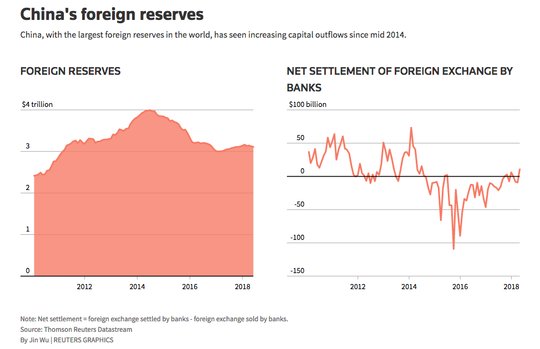

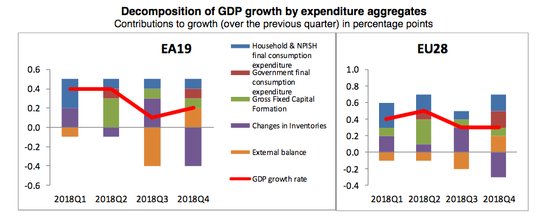

Welcome to the 10th anniversary of the S&P 500 market bottom. The proper gift is tin, a relatively rare metal for the world, found in about 2% of the earth mostly in Africa and South America. The history of the metal like that for markets is in its use, a key component for Bronze, which led to a technological boom, better weapons and tools, and a social dependence on trade to get it. Trade is clearly topical after the US $621bn 2018 deficit – the worst in ten years, the ongoing US/China talks, the Australian blockbuster report and the European GDP report highlighting that its meager 1.8% in 2018 was driven mostly by net exports. The China FX reserves were stable in February, like the new FX regime wanted by the Trump team, but their holding of gold rose and that maybe something to watch as the metal lost its luster in the last month despite calls for a larger breakout from $1350 by most analysts. The way of safe-havens in a world returning to thinking about easy money matters as it measures credibility for central bankers – and today with the ECB and Draghi that clearly is the focus as most see downgraded growth forecasts, some further TLTRO help and perhaps some pushing out of rate hike risks due to the soft-patch in growth extending in 1Q. Get your tin cups out for government largess and prepare to listen with your tin ear today as Draghi sings a siren song for a weaker EUR. Gold is likely the barometer that matters not tin and like everything in FX it’s flat and seemingly hard of hearing with the 55-day moving average at $1286.40 as the pivot for $1250 or $1345 breakouts.

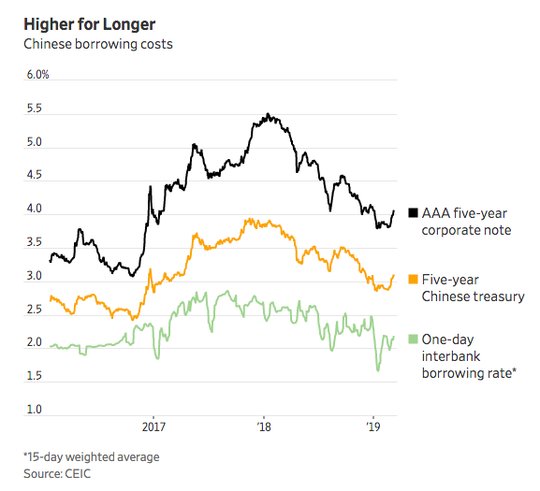

Question for the Day: Will China do QE next? The rally up in China shares stands out amongst of sea of red tape today. China short-term borrowing rates are too low stoking fears of a new bubble in equities but longer-term rates are too high and private borrowing weak – all this should sound familiar as this was what the FOMC faced 10-years ago after the GFC. The WSJ article on China QE risks is a must read today as growth and rate focus in Europe pivots still in the mind of many on what China does.

On the other side of the equation, the OECD cut to growth outlooks with a keen focus on China yesterday, followed with the FT report on the Brookings Institute paper saying China GDP is overstated by 12%due to local government reporting issues.

What Happened?

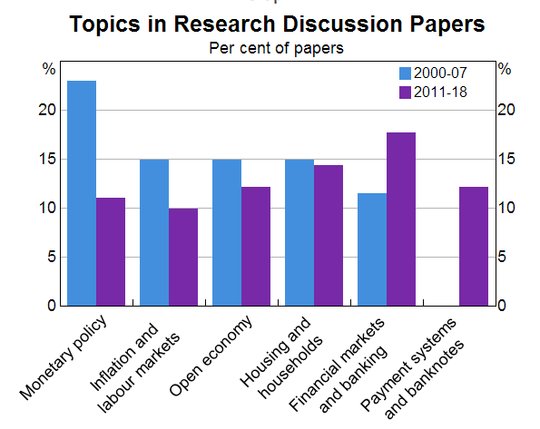

- RBA Simon: Lessons from the financial crisis on financial research – small things matter, rethinking regulation. The RBA head of research John Simon spoke at Griffith University on what was learned pos the great financial crisis. His speech covered the focus on open economics, monetary policy, and banking/financial stability. Key conclusion – “we have learnt that microeconomics provides useful ideas and tools to understand macroeconomic questions. The links between microeconomic behavior and macroeconomic outcomes are not, however, well understood. As a result, it is clear that we have a lot more to learn about this area.”

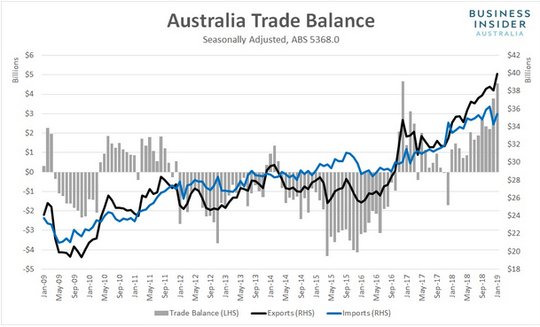

- Australia January trade surplus jumps to A$4.549bn after revised A$3769bn (prel A$3.68bn) – much more than A$3bn expected – linked to gold. The value of exports rose 5% to A$39.937bn after -1.2% m/m in December. Gold exports rose to A$1.373bn from A$396bn. Imports rose 3% m/m to A$35.388bn after -5.5% m/m – with capital goods again leading up 12%, consumer good up 6%.

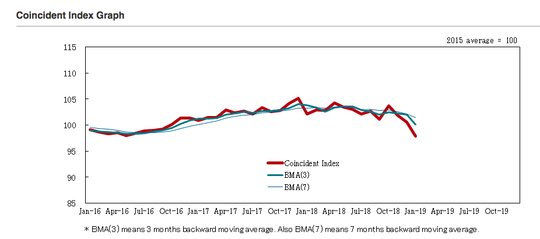

- Japan January LEI preliminary 95.9 from revised 97.2 (prel 97.5) – weaker than 96 expected. The coincident index 97.9 from revised 100.6 (prel 101.8) also weaker than 101.6 expected.

- China February FX reserves rise $2,26b to $3.09trn – as expected – 6-month highs. The gains were related to FX holding with CNY up 0.09% in Feb against the USD and basket up 0.6%. Net flows into the Shanghai and Shenzhen stock markets via the Stock Connect scheme as of end February topped 120 billion yuan ($17.9 billion), nearly four times that in the first two months of 2018. The value of China’s gold reserves rose slightly to $79.498 billion in February from $79.319 billion at the end of January, as the central bank increased the total amount of gold reserves to 60.260 million fine troy ounces from 59.940 million troy ounces.

- Italy January retail sales up 0.5% m/m, 1.3% y/y after revised -0.6% m/m, 0.8% y/y (prel -0.7% m/m) – better than +0.4% m/m expected. By category, sales were best in shoes, leather and travel items up 2.3% while weakness followed in books/papers -1.6% and pharmaceuticals -1.2%.

- Eurozone 4Q final GDP confirmed at 0.2% q/q, 1.1% y/y after 0.1% q/q, 1.6% y/y – as expected. For the full year growth slowed in 2018 to 1.8% y/y from 2.4% y/y. Eurozone 4Q employment rose 0.3% q/q, 1.3% y/y after 0.2% q/q, 1.4% y/y – as expected.

Market Recap:

Equities: The US S&P 500 futures are off 0.2% after losing 0.65% yesterday. The Stoxx Europe 600 is off 0.5% with a focus on global growth slowing and ECB next. The MSCI Asia Pacific fell 0.2% even with China again up for 4thday.

- Japan Nikkei off 0.65% to 21,456.01

- Korea Kospi off 0.45% to 2,165.79

- Hong Kong Hang Seng off 0.89% to 28,779.45

- China Shanghai Composite up 0.14% to 3,106.42

- Australia ASX up 0.28% to 6,344.20

- India NSE50 up 0.05% to 11,058.20

- UK FTSE so far off 0.45% to 7,165

- German DAX so far off 0.45% to 11,534

- French CAC40 so far off 0.40% to 5,268

- Italian FTSE so far off 0.30% to 20,789

Fixed Income: Waiting with thin volumes into ECB. UST bid but quietly on mild risk-off mood. Supply met with good demand overnight. German 10Y Bund yields off 1bps to 0.12% with 0.15% pivot broken yesterday and watched as key today for ECB. The French OATs of 1bps to 0.50% - with strong auction. The UK Gilts off 1bps to 1.21% as Brexit deal eludes still. Periphery suffers a touch – Spain up 1bps to 1.13%, Portugal up 1bps to 1.44%, Italy up 1bps to 2.62% and Greece up 1bps to 3.76%.

- Spain sold 5Y Bonos at 0.142%from 0.164% previously. Spain also sold 10Y Oblig at 1.222% from 0.1285% previously

- France sold 10Y OATS at 0.57%unchanged from previously.

- US Bonds are bid across the board with equities, Fed speakers key– 2Y off 1bps to 2.51%, 5Y off 1bps to 2.49%, 10y off 1bps to 2.69%, 30Y off 1bps to 3.06%.

- Japan JGBs are bid with focus on BOJ/US/China deal –2Y flat at -0.15%, 5Y flat at -0.14%, 10Y off 1bps to -0.01%, 30Y off 1bps to 0.62%. The MOF 30Y JGB sale came at 0.62% after 0.59%.

- Australian bonds mixed after trade, curve flatter– 3Y up 2bps to 1.62%, 10Y off 2bps to 2.08%.

- China sees further curve flattening– focus is on local bond promises from Beijing – 2Y up 3bps to 2.8%, 5Y off 2bps to 3.05%, 10Y off 3bps to 3.19%.

Foreign Exchange: The US dollar index is flat at 96.89. In emerging markets, the USD mostly bid - EMEA: RUB off 0.15% to 66.008, ZAR off 0.45% to 14.326, TRY off 0.2% to 5.437; ASIA: INR up 0.15% to 69.968, KRW off 0.2% to 1129.6.

- EUR: 1.1315 flat. Range 1.1301-1.1320 with ECB key and tight dull range – 1.1250-1.1420 in play.

- JPY: 111.70 flat. Range 111.58-111.80 with EUR/JPY 126.35 flat. Stuck waiting for news 110-112 holding.

- GBP: 1.3140 off 0.25%. Range 1.3129-1.3185 with EUR/GBP up 0.3% to .8610 – all about Brexit doubts still 1.3050-1.3350 in play.

- AUD: .7045 up 0.25%. Range .7020-.7052 with NZD .6785 up 0.3%. Better trade driving but .7050-80 resistance and US/China deal key.

- CAD: 1.3425 off 0.15%.Range 1.3422-1.3447 with BOC move unwinding a smidge on A$ sympathy but 1.3380 base to watch for 1.3650.

- CHF: 1.0045 flat. Range 1.0036-1.0054 with EUR/CHF 1.1360 flat. Stuck like JPY with 1.00 pivot and 1.0080 key.

- CNY: 6.7065 flat. Range 6.7020-6.7120 with weakness at mid-day from early opening gains reversed on FX reserves gain. PBOC fixed at 6.7110 from 6.7053.

Commodities: Oil up, Gold down, Copper off 0.9% to $2.9435.

- Oil: $56.80 up 1.05%.Range $56.08-$56.88 with Brent up 1.3% to $66.83. Bounce back in low volatility continues. EIA report showed gasoline draw offset crude build but trade deficit focus and US/China continue to dominate with $55-$58 WTI consolidation.

- Gold: $1286.80 off 0.1%.Range $1280.80-$1289.10 with USD holding bid and $1282 breaking opens $1268-$1275 again. Silver up 0.1% to $15.11, Platnium off 0.1% to $827.50 and Palladium up 1.1% to $1502.80.

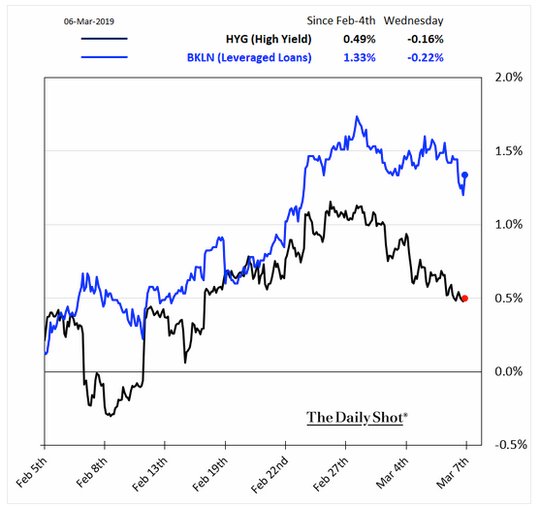

Conclusions: Are leveraged loans the key risk? The FSB is investigating the $1.4trn leveraged loan market. The study should have a report in the early Autumn and will be on so-called collateralized loan obligations, bundles of leveraged loans that are sold in tranches. The FSB wants to identify the holders of CLOs around the world and assess the risks that investors could pull money from exposed institutions during a severe downturn. Among the investors in CLOs are banks, investment funds, and insurers. Here is the key part of the FT report on the risks from the FSB work on global markets – consider global banks are now on call. Quarles said the Fed will “soon” unveil new proposals on foreign banks that are closely tailored to their individual business models as well as assets — mirroring the treatment of US equivalents. “They have a broad range of business models and levels of US activity and that should be recognized in a tailored regulatory framework for the foreign banks.”

Economic Calendar:

- 0745 am ECB rate decision – no change expected from -0.4%

- 0830 am ECB Draghi news conference

- 0830 am US weekly jobless claims 225k p 225k e

- 0830 am US 4Q productivity 2.3%p 1.7%e /ULC 0.9%p 1.6%e

- 0900 am Mexico Feb CPI 4.37%p 4.48%e

- 1215 pm Fed Brainard speech

- 1245 pm BOC Patterson speech

- 0300 pm US Jan consumer credit $16.55bn p $15.5bn e

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.