Markets: Subdued

The April Fools trick for markets was that the rally yesterday was no joke. The momentum higher in risk assets persists with a few exceptions like Turkey and Italian shares. The USD is up, bonds are up, stocks are up and oil is up world persists but in a more subdued fashion. This moderation in mood may pivot on US/China trade or Brexit or momentum continuing – I highlight 2 standouts as drivers from overnight that might matter in the US:

- Brexit Still- The UK Parliament rejected all 4 Brexit motions making the path to no-deal exit in 10 days that much more probable. Most analysts see another referendum as the only way out since neither party looks for another election, while UK press pushes for EU-customs union deal.

- BTC Breakout– Bitcoin rallies 15% in Asia breaking out of $4200 -$4400 resistance and opening $5000 retest (high $5089.90 so far) with bulls now targeting $6000. The rise in BTC in 1Q correlated to equities and the extension in Asia appears to be with good volume - $44bn average, the most since Jan 2018. This brings the digital asset market cap to $160bn – back to November 2018 levels.

Otherwise, we are back to a world watching to see if moderation in everything matters. The USD is the barometer of choice again for such divergence games as the theory goes if the FOMC starts to move away from dovish to hawkish again – watch out – and until then play beta and trade passively.

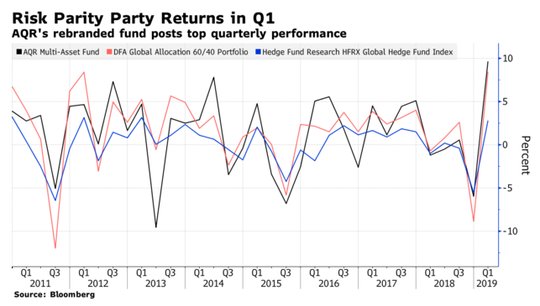

Question for the Day: Is risk-on now making for fatter tails later? After starting 2Q with risk-on for equities, most analysis points to momentum as the dominant factor driving with FOMO and TINA logic – (fear of missing out and there is no alternative). The return of “Goldilocks” policy came from the China PMI data and a bit of the US ISM manufacturing bounce. The return of equities as the main story kills macro fears and leaves passive plays beating active managers. Beta is king again – all asset-classes have gains in 2Q.

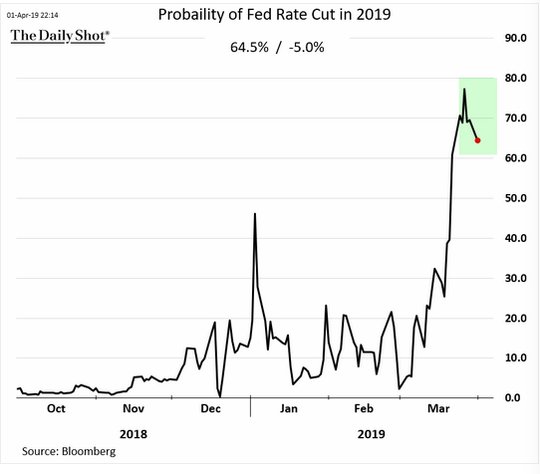

The doomsayers focus on how the present risk-on market ignores the divergence of FOMC talk to market expectations. Many in the Fed seem perplexed by expectations of a rate cut this year. At best the market is setting up for another Powell collar moment. There is still room for rates to shift from 2.25% 10Y to 2.75% and leave policy neutral.

Others see that the confidence in business for a bounce back in 2Q isn’t sufficient and point to the ongoing geopolitical risks from US/China trade talks to Brexit politics to more troublesome election results globally. The WSJ article to consider today is about the lack of diversity in asset classes as all risk markets gain in 1Q and seem intent on extending in 2Q. This is the curse of risk-parity when all asset classes gain, something is wrong and it won’t last – as we know that commodities and bonds should trade at odds just as stocks should to bonds and FX.

What Happened?

- Korea March CPI -0.2% m/m, 0.4% y/y after 0.4% m/m, 0.5% y/y – less than the +0.5% m/m, +0.9% y/y expected – lowest since 2016. The ex-food and energy fell 0.1% m/m, up 0.8% y/y – less than the 1.3% y/y expected.

- RBA rate decision no change from 1.5% - as expected. The statement took out the central scenario of 3% GDP for 2019. “The outlook for the global economy remains reasonable, although growth has slowed and downside risks have increased. Growth in international trade has declined and investment intentions have softened in a number of countries. In China, the authorities have taken steps to ease financing conditions, partly in response to slower growth in the economy. Globally, headline inflation rates have moved lower following the earlier decline in oil prices, although core inflation has picked up in a number of economies. In most advanced economies, unemployment rates are low and wages growth has picked up.”

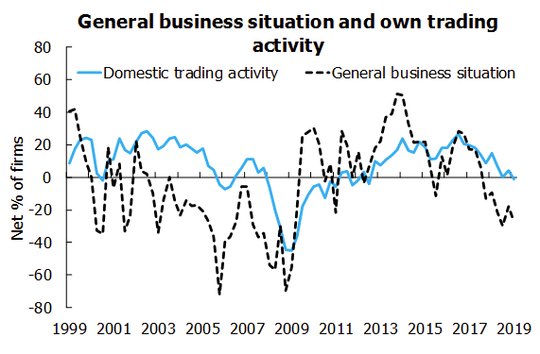

- New Zealand 1Q NZIER business confidence -29 from -17 – back to 3Q 2018 lows. Capacity utilization drops to 92.8% form 92.9%. Businesses across most sectors reported a weakening in domestic demand. In particular, manufacturers remained the most pessimistic, as domestic sales dropped sharply. In contrast, export demand strengthened despite the increasingly uncertain global growth outlook. Cost pressures remain intense in the sector, and with pricing still subdued, this is contributing to continued weak profitability.

- India March manufacturing PMI 52.6 from 54.3 – better than 51.9 expected –but weakest in six months. New orders was the slowest in six months with domestic concerns about elections, offset somewhat by export demand aided by marketing. Employment rose but at the slowest rate in 8-months. Both input and output prices softened.

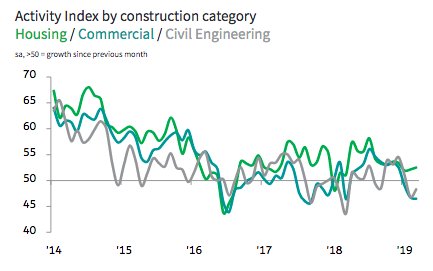

- UK March construction PMI 49.7 from 49.5 – less than the 49.8 expected. First back-to-back declines since August 2016. Commercial construction continued to drop – most since March 2018 with Brexit fears cited, while civil engineering also fell but slower than Feb. Residential building rose – the best for 2019 so far. The overall business optimism rose from 4-month lows.

- Spain March unemployment change -34,000 after +3,300 - near expectations. Number of unemployed fell 1.03% to 3.255mn with industry -4000, construction -4,555, services -32,401 while agriculture rose 1,722.

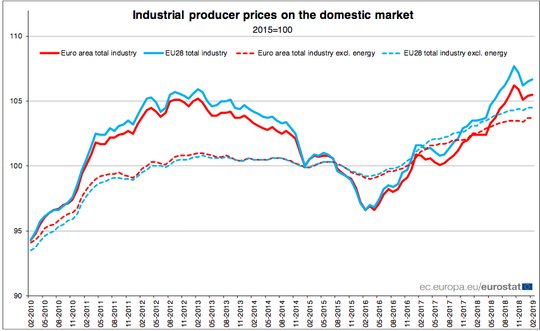

- Eurozone February PPI up 0.1% m/m, 3% y/y after 0.3% m/m, 2.9% y/y – as expected. January revised lower from 0.4% m/m, 3.0% y/y. Energy rose 0.2% m/m, capital and durable consumer goods rose 0.1% m/m and intermediate goods fell 0.1% m/m. The ex-energy PPI was 0% m/m. Prices rose the fastest in Greece up 1.2% while they fell 0.6% m/m in Denmark and -0.5% m/m in Portugal.

Market Recap:

Equities: The US S&P 500 futures are flat after a 1.16% gain. The Stoxx Europe 600 is up 0.15% with most regional indices near flat after 1.2% gains yesterday. The MSCI Asia Pacific was up 0.2% with subdued session focus in China on tech vs. property shares and RRR cut talk.

- Japan Nikkei off 0.02% to 21,505.31

- Korea Kospi up 0.41% to 2,177.18

- Hong Kong Hang Seng up 0.21% to 29,624.67

- China Shanghai Composite up 0.20% to 3,176.82

- Australia ASX up 0.45% to 6,327.80

- India NSE50 up 0.38% to 11,713.20

- UK FTSE so far up 0.7% to 7,368.87

- German DAX so far up 0.2% to 11,704

- French CAC40 so far up 0.2% to 5,415

- Italian FTSE so far off 0.05% to 21,510

Fixed Income: The rally up in equities cost bonds yesterday, so the subdued moves today help regain some buyers for the US, but the EU is in catch-up mode with no particular new data driving – German 10-year Bund yields up 4bps to -0.03%, French OATs off 1bps to 0.37%, UK Gilts off 3bps to 1.02% while periphery mixed Italy up 1bps to 2.53%, Spain off 2bps to 1.13%, Portugal off 1bps to 1.27% and Greece off 3bps to 3.68%.

- The UK DMO sold GBP3bn of 5Y 1% 2024 Gilts at 0.748% with 2.44 cover and 0.2bps tail.

- US Bonds bid with focus on jobs and FOMC still-2Y off 3bps to 2.30%, 5Y off 2bps to 2.29%, 10Y off 2bps to 2.47% and 30Y off 2bps to 2.82%.

- Japan JGBs lower tracking US, sees strong 10Y sale– 2Y up 2bps to -0.15%, 5Y up 2bps to -0.17%, 10Y up 1bps to -0.06%, 30Y up 1bps to 0.53%. MOF sold Y2.2trn of 10Y 0.1% JGB at -0.06% with 5.07 cover - previously -0.002% with 4.25 cover.

- Korea sold KRW1.7trn of 30Y bond at 1.91%- previously 2.075%.

- Australian bonds mixed, curve steeper after RBA– 3Y off 4bps to 1.39%, 10Y up 1bps to 1.82% while NZ 10Y up 2bps to 1.89% despite weaker Business Confidence.

- China PBOC skips open market operations for 10thday– leaves liquidity neutral. The PBOC wants a police investigation into rumors on RRR cut. The PBOC advisor in China Daily said it may act after 1Q data, but not much chance for a benchmark rate cut in 2019. China bonds are lower – 2Y flat at 2.62%, 5Y up 4bps to 3.01%, 10Y up 4bps to 3.17%.

Foreign Exchange: The US dollar index up 0.15% to 97.40. In emerging markets, USD is bid – ASIA: INR flat at 69.204, KRW off 0.3% to 1136.10; EMEA: RUB off 0.35% to 65.443, ZAR off 0.2% to 14.174, TRY off 1% to 5.538.

- EUR: 1.1200 off 0.1%.Range 1.1190-1.1218 with focus on ECB/FOMC and PMI divergence – watching 1.1160 for pain lower against 1.1280 bounces.

- JPY: 111.35 flat. Range 111.28-111.45 with EUR/JPY 124.70 off 0.1% - focus is on EU growth, not China.

- GBP: 1.3050 off 0.4%.Range 1.3023-1.3112 with EUR/GBP .8575 up 0.3%– focus remains on UK Brexit plan with referendum expectations rising.

- AUD: .7075 off 0.5%.Range .7064-.7130 with RBA on hold and sounding dovish as expected. NZD lower with biz confidence.

- CAD: 1.3325 up 0.15%.Range 1.3304-1.3337 with focus on crosses, Poloz speech yesterday leaves BOC behind curve. C$ 1.3250-1.3400 still.

- CHF: .9995 up 0.1%.Range .9977-1.0002 with EUR/CHF 1.1200 flat – focus is on risk mood, EUR and 1.00 pivot for 1.0080 restest

- CNY: 6.7204 up 0.15%.Range 6.7115-.67255 with focus on PBOC talk. PBOC fixed 6.7161 from 6.7193

Commodities: Oil up 0.9%, Gold off 0.2%, Copper off 0.2% to $2.9260

- Oil: $62.13 up 0.9%.Range $61.62-$62.19 with Brent up 0.45% to $69.31 - $70 now key pivot with $62.50 same in WTI as focus shifts to API tonight. OPEC output was at 4-year lows in March thanks to Venezuela and Saudi supply cuts over their target. Iran talk added to bid tone along with equity rally supporting global demand hopes.

- Gold: $1291.60 off 0.2%.Range $1289.50-$1293.90 with equities driving a bit more than USD but bonds and geopolitics still lurking as well – with $1286-$1301 keys. Silver off 0.6% to $15.01, Platinum off 0.2% to $853.60 and Palladium off 1.1% to $1375.50.

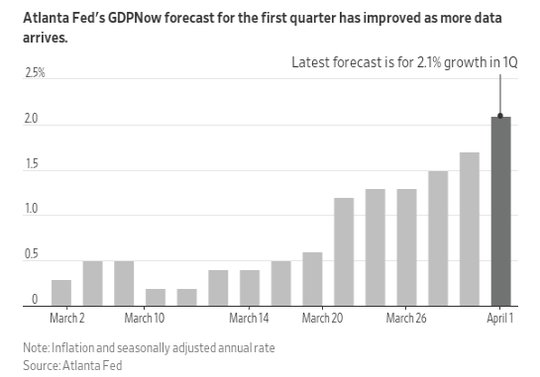

Conclusions: Are we all just trading on growth? The surprise of 1Q maybe in earnings beating forecasts, growth beating the same. Revisions to 1Q GDP hit the tape over the last week with JPM moving from 1.5% to 2%, Macroeconomic Advisers lifting to 1.7% from 1.3% and the more coincidental Atlanta Fed GDPnow now at 2.1% from 1.7% last week and 0.3% at March 1 start. Point is that March gains and revisions for February matter making the data ahead that much more important to trading risk now.

Economic Calendar:

- 0800 am Brazil Feb industrial production (m/m) -0.8%p 0%e (y/y) -2.6%p -2.3%e

- 0830 am US Feb durable goods orders (m/m) 0.4%p -1.1%e / ex trans -0.1%p 0.3%e

- 0300 pm US Mar total vehicle sales SAAR 16.6mn p 16.78mn e

- 0430 pm US weekly API oil inventories 1.93mb p 2.5mb

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.

Great read, thanks.