Markets: Stupid Decisions

The age of civility in politics died many years ago and as any American knows in the time of fake news and Trump, shock value and video drive viewers but not voters. Perhaps the UK will learn the same as the Labour leader Corbyn mouthing of “stupid, woman” assaults the credibility of British civility and perhaps superiority to US political debates. This is the sideshow to the larger issue of central bankers losing their credibility as the fixers of markets and economic confidence as they try vainly to normalize. Yesterday it was the FOMC, today it’s the Riksbank, and next year we see the BOE, the SNB and the ECB all in tow.

Some argue that the central bank decisions over the last 24 hours (with more to come still today from Mexico) are “stupid” as well but at least not sexist. Rate hikes are blunt tools and the paradox of the Fed hiking overnight rates to 2.25-2.50% has driven down rates elsewhere, with the 10-year yield break of 2.80% technically important. The market is still betting on a Fed policy mistake leading to a recession and lower rates in the next 5-years. The shape of the US curve and its effect on stocks and FX matters more than usual but the sharp divergence of correlation away from commodities particularly oil is the anomaly. The oil market is reflecting supply overhang and demand collapse.

The drop in forward growth data is being reflected first in oil prices. The risk for today is that any modest bounce back in risk post FOMC and into the holiday trading week will fizzle on growth data. Overnight, other central bankers also cut growth forecasts. The fears about policy mistakes aren’t just a US thing – as the UK can see. The GBP rally back from 1.25 opens up some 1.2875 risks but the larger downtrend remains. This is the bigger picture story about how politics and policy clash with markets today regardless of stupid decisions.

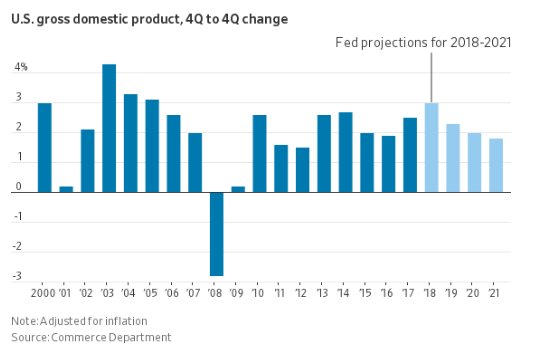

Question for the Day: Do other central bank decisions matter? The market volatility around the FOMC decision and Powell press conference suggests that the actions matter less than the words for central banks – as forward guidance as a tool has an unintended splash-back when rates rise. The FOMC cut its growth projections and its rate hike pace plans from 3 to 2 and that isn’t helping risk-taking anywhere. The FOMC was damned as they hiked (increasing fears of a recession or policy mistake). They were also going to be damned if they cut as it merely confirms fears of a recession – and so the hope for a rate pause will continue to be seen as a key for balancing bond yields against equity appreciation into 2019.

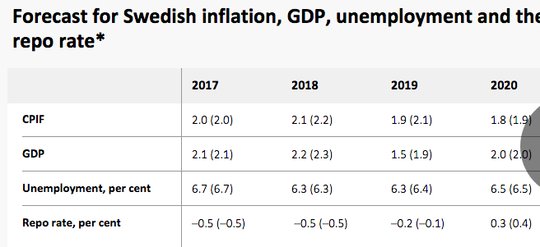

Overnight there were 4 other central bank decisions, with the Swedish Riksbank half-surprising the market with a 25bps hike to -0.25%. Despite GDP and inflation being weaker than expected and forecast being cut, the Swedish central bank justified the hike arguing:“As inflation and inflation expectations have become established at around 2 per cent, the need for a highly expansionary monetary policy has decreased slightly.”

The Indonesia central bank kept rates on hold at 6% while the Bank of Japan kept its Y80trn bond buying and 0% 10-year bond yield target with the usual 7-2 vote. The BOJ didn’t sound worried about a recession – they see the economy expanding moderately and exports increasing on trend. The Bank of England was also on hold at 0.75%. What the BOE says about markets matters – as it’s the forward guidance around financial conditions and Brexit that worry traders.

- Financial Conditionsand Oil: “…the near-term outlook for global growth has softened and downside risks to growth have increased. Global financial conditions have tightened noticeably, particularly in corporate credit markets. Oil prices have fallen significantly, however, which should provide some support to demand in advanced economies. The decline in oil prices also means that UK CPI inflation is likely to fall below 2% in coming months. The Committee judges that the loosening of fiscal policy in Budget 2018, announced after the November Inflation Report projections were finalised, will boost UK GDP by the end of the MPC’s forecast period by around 0.3%, all else equal.”

- Brexit and GBP: “Brexit uncertainties have intensified considerably since the Committee’s last meeting. These uncertainties are weighing on UK financial markets. UK bank funding costs and non-financial high-yield corporate bond spreads have risen sharply and by more than in other advanced economies. UK-focused equity prices have fallen materially. Sterling has depreciated further, and its volatility has risen substantially.”

What Happened?

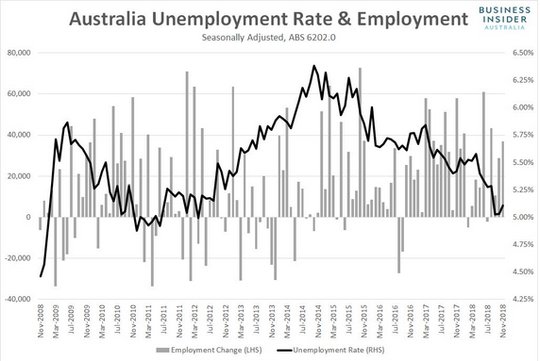

- Australia November jobs rise 37,000 after revised +28,600 – more than the +20,000 expected. September revised from 32,800. The unemployment rate rises to 5.1% from 5% -worse than the 5% expected– as the participation rate rises to 65.7% from 65.5%, which was revised lower from 65.6% and more than expected. Full-time jobs fell 6,400 after a 39,400 rise – missing 2,000 gains expected – while part-time jobs rose 43,400. Overall, employment growth slowed to 2.3% from 2.5% - well below the 1H 3.5% rate. Also the underemployment rate rose 0.2% to 8.5% - lifting underutilization rate 0.3% to 13.6%.

- Japan October all industry activity index up 1.9% m/m after revised -1% m/m – as expected. The September revised lower from -0.9% m/m. The bounce came from production with the tertiary index up 1.4% m/m, while construction fell 0.07%.

- Eurozone October current account surplus E26.6bn from E24.7bn – more than E21.7bn expected. This is down from E37.4bn in Oct 2017. The goods trade surplus fell to E19.5bn from E28.8bn in Oct 2017 while the services rose to E10.4bn from E9.1bn. The primary income surplus barely moves to E10.4bn from E10.3bn. As a percentage of GDP, the surplus is 3.5% up from 3.4%.

- Italy November PPI -0.7% m/m, 4.5% y/y after +1.3% m/mm, 5.8% y/y/ - less than the 5.2% y/y expected. Domestic market was -0.8% m/m, +2.3% q/q and foreign +0.1% m/m, +0.2% q/q. Construction prices rose 0.3% m/m, 1.7% y/y and 0.2% q/q – that compares to the Services sector up 0.5% q/q, 1.7% y/y with air transport the main driver.

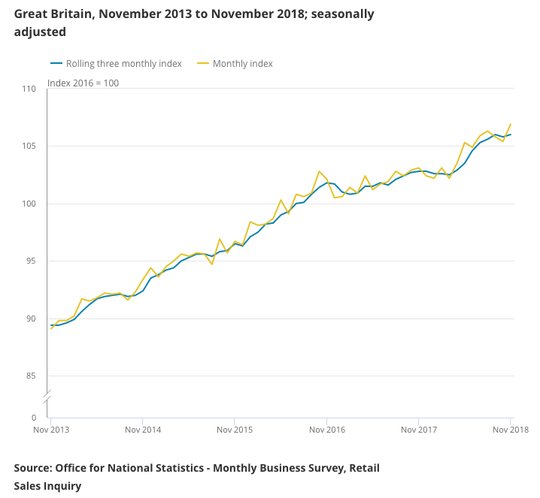

- UK November retail sales rise 1.4% m/m, 3.6% y/y after -0.4% m/m, 2.4% y/y revised – more than the +0.3% m/m, 1.9% y/y expected. October revised higher from -0.5% m/m, 2.2% y/y. The ex-fuel sales rose 3.8% after 2.8% y/y – also more than the 2.3% y/y expected.

- UK December CBI retail trade -13 from +19 – weaker than 16 expected – worst since Nov 2011. Annie Leach, CBI head economist said: “Retailers report a sharp drop in sales volumes in the year to December, so it’s clear the sector continues to feel the impact from pressures on household incomes and digital disruption. Brexit uncertainty may also be affecting consumer sentiment and spending.” Sales outlook for jan 0%, volumes of orders fell to -23% - worst since Oct 2017 but outlook moderates to -18%.

Market Recap:

Equities: The US S&P500 futures are up 0.1% after lowing 1.54% yesterday. The Stoxx Europe 600 is off 0.85% with steady gains from the open.

- Japan Nikkei off 2.84% to 20,392.58

- Korea Kospi off 0.90% to 2,060.12

- Hong Kong Hang Seng off 0.94% to 25,623.53

- China Shanghai Composite off 0.52% to 2,536.27

- Australia ASX off 1.36% to 5,572.90

- India NSE50 off 0.14% to 10,951.70

- UK FTSE so far off 0.4% to 6,737

- German DAX so far off 0.95% to 10,666

- French CAC40 so far off 1.5% to 4,705

- Italian FTSE so far off 1.0% to 18,749

Fixed Income: Yield curve focus with more US flattening and year-end $ funding clashing. Catch-up to US moves dominates with risk-aversion still the wagging tail for traders – German 10-year Bunds off 1bps to 0.24%, French OATs off 1bps to 0.69%, UK Gilts flat at 1.27% while periphery split with Italy off 4bps to 2.75%, Spain flat at 1.39%, Portugal flat at 1.66% and Greece off 1bps to 4.29%.

- US Bonds focus on equities and yield curve, relief on stop-gap budget– 2Y up 2bps to 2.66%, 5Y up 1bps to 2.64%, 10Y off 1bps to 2.77%, 30Y off 4bps to 2.98%.

- Japan JGBs see curve flatter after BOJ, catch-up to US– 2Y up 1bps to -0.14%, 5Y flat at -0.14%, 10Y flat at 0.03%, 30Y off 3bps to 0.73%.

- Australian bonds rally in catch up to US– 3Y off 3bps to 1.88%, 10Y off 4bps to 2.35%.

- China bonds mixed with new targeted MLF, curve flatter– 2Y up 15bps to 2.96%, 5Y flat at 3.07% and 10Y off 6bps to 3.34%. The new TMLF plan set rate at 3.15% - 15bps below market with 3Y duration. PBOC also set new $14.5bn credit line for small businesses

Foreign Exchange: The US dollar index 96.30 off 0.75%. The US dollar is weaker across EM with EMEA: TRY up 0.9% to 5.237, RUB up 0.15% to 67.33 and ZAR up 1.15% to 14.208; ASIA: KRW up 0.75% to 1120.30 and INR up 0.85% to 69.68.

- EUR: 1.1465 up 0.8%. Range 1.1370-1.1486 with focus on 1.15 and data/central bank speakers, US rates.

- JPY: 111.75 off 0.7%. Range 111.67-112.60 with focus on 112 break and 110.80 next as equities and US rates drive.

- GBP: 1.2695 up 0.7%. Range 1.2608-1.2707 with EUR/GBP .9030 up 0.1% - Brexit and politics and BOE all driving still with 1.2750 key for bigger bounce.

- AUD: .7145 up 0.5%. Range .7086-.7147 with NZD up 0.25% to .6785 both lag other FX with commodities and China focus .7050 A$ and .6880 NZ$ important still.

- CAD: 1.3460 off 0.15%. Range 1.3447-1.3504 with 1.33-1.36 the new keys with US rates and commodities driving – data ahead still important.

- CHF: .9875 off 0.7%. Range .9864-.9953 with focus on .98 next – risk is USD not EUR.

- CNY: 6.8830 off 0.3%. CNY gains with broader USD weakness.

Commodities: Oil down, Gold up, Copper up 0.2% to $2.7285.

- Oil: $46.64 off 3.2%.Range $45.82-$47.51. Brent off 3.3% to $55.37 with $54.66 lows - $45 WTI and $55 Brent are big psychological levels – USD weakness not as important as global demand doubts – equities driving.

- Gold: $1259.00 up 0.25%.Range $1246.20-$1260.60. USD weakness and equity pain are driving with $1268 next hurdle and $1250 base building.

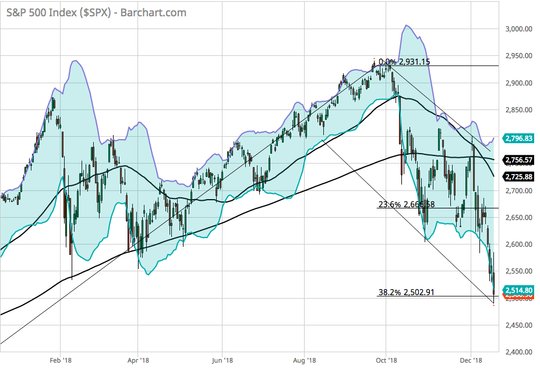

Conclusions: Are we all just S&P500 traders? The risk-taking mood balances bonds and stocks. We are all now paying for the very stupid decision that owning bonds for capital appreciation and stocks for their yield works even when the FOMC hikes and QE unwinds. The S&P500 collapse over the month of December surprises and the technical picture is ugly with the 200-55 day cross suggesting a test of 2350 to the 200-week average.

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.

I have never thought of the central bank or the central bankers, as fixers or as the basis of confidence in the government or the economy. They have always been a bunch of rich men determined to get more at the expense of the rest of us. Worse yet, they lack integrity while they speak so well about how they are saving us from disaster. Shades of "Boss Hogg" but far more sophisticated and much more corrupt.