Markets: Soggy

The week begins with a soggy start as deal hopes for Brexit remain in play with Tory May and Labour Corbyn still trying to patch together an exit deal before April 12th while the EU has to decide to grant them an extension. The US/China talks ended and deal hopes remain without a clear summit or end date. The US military pulls out of Libya while that civil war heats up driving oil prices. The oil surge has helped spur interest in the $10bn of Saudi Aramco bond issuance – with talk of $30bn in orders – which may lead to resizing. The data overnight was light but soggy with Japan current account surplus higher on oil and foreign investments while its consumer confidence fell along with the EcoWatchers survey – back to 2-year lows. The German trade surplus widens even as exports dip more than expected. Markets are in a less sunny mood as there are fears that the US 1Q earnings season will drag down shares and slow the best rally in 20 years. There is a sense that value returns as a driver today even as the doubts about growth remain. The hope is sufficient for now and the place where this becomes most obvious is Europe. If there is a US/China deal and if there is a Brexit orderly process, then the value of European shares stands out – or at least that is the logic in play as Europe recovers in flows first. The EUR becomes a bellwether accordingly.

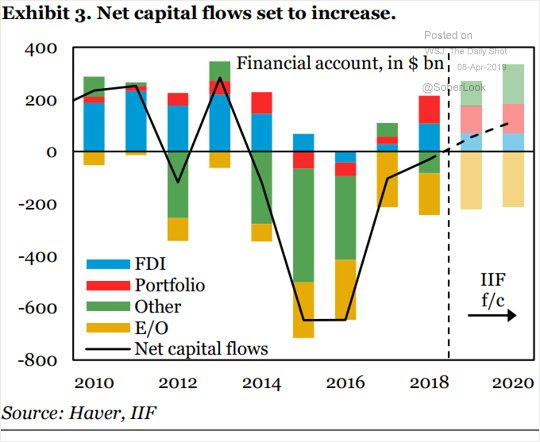

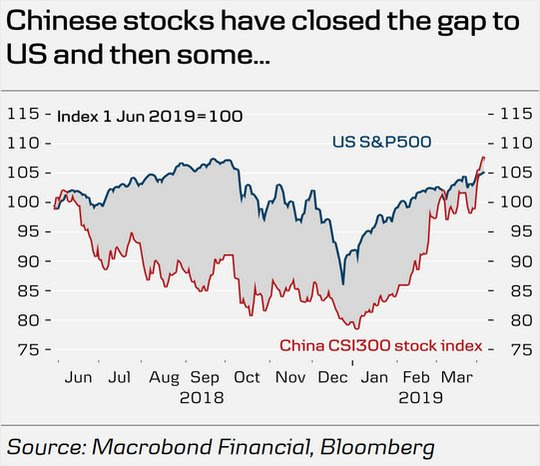

Question for the Day: Is China the key data for the week? The question many have about the present bull market rests on global recovery and China remains central to that story with a keen focus on the consumer. The reflation risks there play against the growth recovery. CPI this week looks important as it plays against factory prices and profits for SOE and the struggling private sector. The flow of money into China speculating that the government stimulus plans (tax cuts, perpetual bonds, infrastructure spending) all have worked so far. The IIF sees the flows continuing. The interesting story developing in China is around bonds which suffered their worst week with 19bps climb in 10Y yields. The speculation of an RRR cut in China is on the rise given there are nearly $55bn in MTL maturing this month. Higher yields in China aren’t going to help growth and will have some effect on equities. Foreign inflows into the bond market should help cap some of this pain trade but real economic data on CPI/PP

I will matter.

For the US the gains in China make the trade war discussions more complicated. There is a sense that the Chinese have lost the war and won the peace. As the stock market flows suggest.

What Happened?

- China March FX reserves rose $9bn to $3.099trn from $3.09trn – more than the $5bn expected. In March the CNY fell 0.3% against the USD, while the USD index rose 1%. The value of China’s gold reserves fell slightly to $78.525 billion from $79.498 billion at the end of February.

- Japan February current account surplus jumps 25% to Y2.676trn from Y600.4bn – as expected – mostly due to lower oil prices. This was the 56th month of surpluses. The goods trade surplus of ¥489.2 billion was helped by falling crude oil prices and a rebound from the previous month’s fall in exports to China. The primary income (reflecting returns on overseas investment) rose to Y2.01trn and was the key driver along with trade.

- Japan March consumer confidence 40.5 from 41.5 – weaker than 42.3 expected – lowest reading since Feb 2016. All sub-indexes were weaker – with overall livelihood off 1.5 to 37.7, employment off 1.1 to 43.7, willingness to buy off 1 to 39.9 and income growth off 0.6 to 40.6.

- Japan March EcoWatchers survey 44.8 from 47.5 – weaker than 46.7 expected. The outlook drops to 48.6 from 48.9 – also weaker than 49.3 expected.

- German February German trade surplus E17.9bn after E14.6bn – more than E16.5bn expected. Imports fell 1.6% m/m to E90.9bn after +1.4% m/m – weaker than -0.7% m/m expected - while exports fell 1.3% m/m after +0.1% m/m – worse than -0.5% m/m expected. The current account surplus narrows to E16.3bn from E18.8bn – less than the E17.5bn expected.

Market Recap:

Equities: The S&P 500 futures are off 0.1% after a 0.46% gain Friday. The Stoxx Europe 600 is flat after trading down 0.2%. The MSCI Asia Pacific is off 0.1%.

- Japan Nikkei off 0.21% to 21,761.65

- Hong Kong Hang Seng up 0.47% to 30,077.15

- China Shanghai Composite off 0.05% to 3,244.81

- Australia ASX up 0.64% to 6,310.80

- UK FTSE so far up 0.05% to 7,450

- German DAX so far off 0.30% to 11,973

- French CAC40 so far up 0.1% to 5,481

Fixed Income: The rush of risk-on last week pauses and leaves bonds mostly stuck or bid as in the case of Greece. The German 10-year Bund yields flat at 0%, France off 1bps to 0.36%, UK Gilts up 3bps to 1.11% while Italy is off 4bps to 2.64%, Greece off 7bps to 3.48%, Spain off 1bps to 1.10%, Portugal off 1bps to 1.25%.

- US bonds are slightly bid, waiting for FOMC minutes, auctions, more data – 2Y flat at 2.34%, 5Y flat at 2.31%, 10Y flat at 2.50%, 30Y off 1bps to 2.91%.

- Japan JGBs were bid with focus on weaker data, risk mood – 2Y off 1bps to -0.16%, 5Y off 1bps to -0.17%, 10Y off 1bps to -0.05%, 30Y off 1bps to 0.53%.

- Australian Bonds were bid with focus on election, China, US – 3Y off 3bps to 1.42%, 10Y off 1bps to 1.89% while NZ off 3bps to 2.00%.

- China bonds continue to be sold despite talk of RRR cut this month – 2Y up 2bps to 2.66%, 5Y up 4bps to 3.12%, 10Y up 3bps to 3.29%.

Foreign Exchange: The US dollar index is off 0.2% to 97.20. In emerging markets the USD is bid – ASIA: KRW off 0.7% to 1144.35, INR off 0.7% to 69.64 while EMEA: RUB up 0.1% to 62.215, ZAR off 0.1% to 14.098, TRY off 0.9% to 5.675.

- EUR: 1.1245 up 0.3%. Range 1.1211-1.1251 with focus on rates, politics – Brexit deal hopes matter – focus is on 1.1280 and 1.1320 for momentum.

- JPY: 111.45 off 0.25%. Range 111.34-111.75 with EUR/JPY 125.35 flat. Early risk-off moves hardly matter with 111.20-112 now key. Weaker data ignored.

- GBP: 1.3055 up 0.15%. Range 1.3022-1.3072 with EUR/GBP .8615 up 0.15%. Focus is on Brexit politics still and EU extension hopes with 1.30 still the pivot.

- CHF: .9995 flat. Range .9983-1.0003 with EUR/CHF 1.1240 up 0.2% - slight risk-off early but 1.00 is more a sticking level than pivot with cross watching 1.1160 for wake-up.

- CAD: 1.3370 off 0.1%. Range 1.3367-1.3388 with oil and rates in play watching crosses – data still.

- AUD: .7105 flat. Range .7087-.7109 with NZD .6735 up 0.1%. Nothing exciting here – focus is on rates, China and crosses with .7050-.7250 holding.

- CNY: 6.7185 flat. Range 6.7130-6.7210 with trade and data key – some speculation on rates also matters with 6.69-6.74 prison.

Commodities: Oil up 0.5%, Gold up 0.45%, Copper is up 1% to $2.9295.

- Oil: $63.39 up 0.5%. Range $63.24-$63.53 with Libya the focus and $64 resistance for $65 next. Brent up 0.5% to $70.70 with $70 base for $72.

- Gold: $1301.80 up 0.5%. Range $1295.50-$1302.30 with some USD weakness and Libya helping add to $1302 test and potential for $1310 and $1326 tests later. Silver up 0.3% to $15.14, Platinum up 1.35% to $917.80 and Palladium up 0.4% to $1352.

Economic Calendar:

- 0815 am Canada Mar housing starts 173.1k p 193k e

- 1000 am US Feb factory orders (m/m) 0.1%p -0.6%e / ex trans -0.2%p 0.1%e

- 1100 am US Mar consumer inflation expectations 2.79%p 2.8%e

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.