Markets: Short

All traders learn that there are 3 positions to have – long, flat or short – with flat sometimes the best ahead of fundamental news which risks changing the mood. This is the case today where many are still reading their emails from the holidays and not quite sure what to do about today’s one-two punch of US jobs and FOMC Powell.

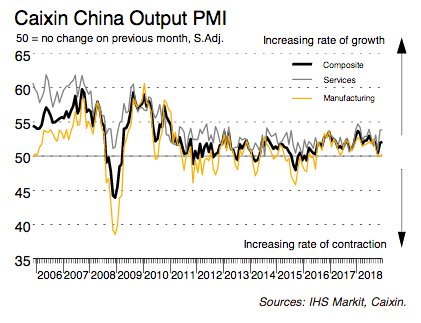

Short weeks can kill traders and this one is one for the history books with volatility and fear leading views for the entire year. The curse of trading the first 5 trading days foreshadowing the next 235 days is in play. The problem is short into events like today isn’t easy given the ongoing spike in volatility. The balancing act of risk/reward make today more about 8.31 am and less about the feel good hopes that started overnight – 1) Pelosi as the new Speaker of the House pushed a government spending bill – assumed dead in the water – but still a positive to some investors. 2) China PMI for Services jumped higher and lifted hopes that the worst fears about growth are overblown. 3) China PBOC cut the RRR by 1% with two stage easing 0.5% effective Jan15 and 0.5% more Jan25.

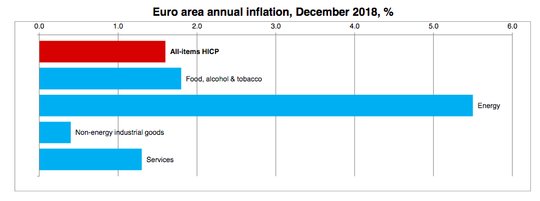

Markets are back up on these stories with hope that the US jobs will be just above average and good enough to make this short week hobble home for a longer weekend rethink about risks and asset allocation into 2019. For FX players, this is a time when the USD alternatives get interesting with the EUR back in play and looking perky with hopes for a 1.1580 breakout, that would reflect less about the ECB and more about the FOMC reactions into the data – as the Eurozone 1.6% HICP headline and the even weaker PMI Composite makes the changes for ECB hikes into 2020 even less logical.

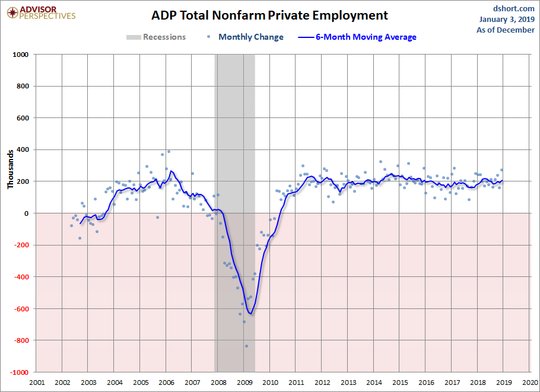

Question for the Day:Will the US employment report kill recession fears? This is the essential hope for those buying the dip in equities. There is a difficult balance to play out here where hopes for FOMC on hold or even easing matter as well. The data ahead needs to be “Goldilocks” perfect with better jobs but no need for FOMC responses. This puts the Powell speech in play as well today. A FOMC that loses its forward guidance tool and shifts to data dependency by definition increases market uncertainty. The response of the market to today’s data matters to the Fed as much as it does to the weak technicals. The US jobs report is a lagging indicator but it’s the one that remains in play even today. After the ADP report at 271,000, it seems likely that we have upside risks to the NFP with anything over 220,000 likely in the too hot to enjoy zone.

What Happened?

- Japan December manufacturing PMI 52.6 from 52.2 – better than 52.4 flash. The rebound from November’s 15-month lows was supported by output and new orders. New product launches and larger input needs were notable. However, employment was softer – weakest in 3 months – with retirements notable. Confidence fell for the 7th month to Nov 2016 lows but Olympic Games 2020 cited as an offset to upcoming sales tax hike fears.

- China December Caixin services PMI 53.9 from 53.8 – better than 52.9 expected – 6-month highs. The composite PMI 52.2 from 51.9 – also better than 50 expected – 5-month highs. While manufacturers saw new orders drop, services rose modestly. Employment rose slightly in services and fell in manufacturing. Backlogs for work rose across both sectors. Input prices fell for manufacturing and rose for services. The 12-month forward confidence rose for both manufacturing and services, albeit subdued against historic averages.

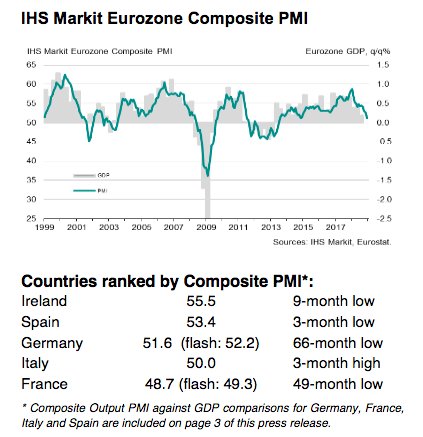

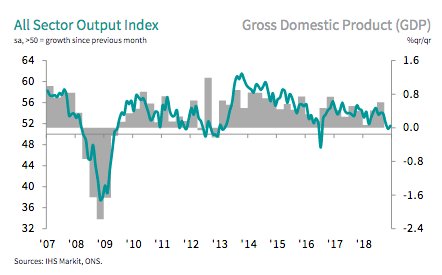

Eurozone December services PMI 51.2 from 53.4 –weaker than 51.4 flash. The composite PMI dips to 51.1 from 52.7 – also weaker than 51.3 flash. This is the slowest growth in 4-years.

- Spain services PMI holds 54 unchanged – better than 53.9 expected.

- Italy services PMI 50.5 from 50.3 – better than 50.3 expected.

- France services PMI 49 from 55.1 – weaker than 49.6 flash. The composite 48.7 from 54.2 – weaker than 49.4 flash.

- German services PMI 51.8 from 53.3 – weaker than 52.5 flash. The composite 51.6 from 52.3 – also weaker than 52.2 flash.

Eurozone December flash HICP 1.6% y/y after 1.9% y/y – less than 1.8% expected. The core steady at 1% y/y – as expected. Energy fell to 5.5% from 9.1%, food/alcohol slows to 1.8% from 1.9% and services stable at 1.3% y/y. Non-energy industrial goods also stable at 0.4% y/y.

- Italy December flash HICP -0.1% m/m, 1.2% y/y after -0.3% m/m, 1.6% y/y – less than +0.3% m/m, 1.6% y/y expected. The national CPI -0.1% m/m, 1.1% y/y after 1.6% y/y.

- French December flash HICP 0.1% m/m, 1.9% y/y after -0.2% m/m, 2.2% y/y – less than the 0.3% m/m, 2.0% y/y expected. The national CPI 0% m/m, 1.6% y/y from 1.9% y/y.

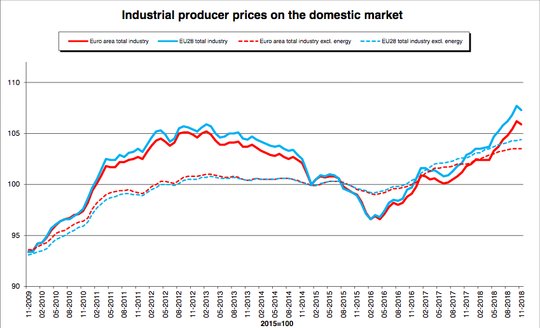

- Eurozone November PPI -0.3% m/m, 4% y/y after -0.8%, 4.9% y/y – less than -0.2% m/m, 4.1% y/y expected. Energy prices fell 1.1% m/m, while capital goods, durables and consumer goods were flat and intermediate goods rose 0.1% m/m. The ex-energy PPI was flat.

- German December unemployment change -14,000 after -16,000 – better than -12,000 expected– with rate unchanged at 5% - as expected. The November employment rose 1.1% y/y up 485,000 to 45.1mn while unemployment fell 45,000 to 1.4n

- UK November mortgage approvals 63,730 after 66,710 – less than 66,500 expected. The consumer credit GBP924mn after 745mn – near expectations.

- UK December CIPS Service PMI 51.2from 50.4 – better than 50.7 expected. The composite PMI rises to 51.6 from 51.00 – still the second slowest rate since July 2016. The Services bounce from 27-month lows still showed Brexit concerns with employment showing softer growth. Higher wages led to higher input costs along with higher import costs due to weaker GBP. Business optimism moderated for the 3rdmonth – second weakest since March 2009.

Market Recap:

Equities: The S&P500 futures are up 1.5% after losing 2.48% yesterday. The Stoxx Europe 600 is up 1.3% holding opening gains. The MSCI Asia Pacific rose 0.5% even with the return of Japan markets.

- Japan Nikkei off 2.26% to 19,561.96

- Korea Kospi up 0.83% to 2,010.25

- Hong Kong Hang Seng up 2.24% to 25,626.03

- China Shanghai Composite up 2.05% to 2,514.87

- Australia ASX off 0.31% to 5,677

- India NSE50 up 0.52% to 10,727.35

- UK FTSE so far up 1.1% to 6,767

- German DAX so far up 1.5% to 10,572

- French CAC40 so far up 1.1% to 4,662

- Italian FTSE so farup 1.9% to 18,559

Fixed Income: Better equities brings weaker bonds. The bounce up in yields in Europe notable – German Bund 10-year yields up 4bps to 0.19%, French OATs up 2bps to 0.68% and UK Gilts up 6bps to 1.25%. The periphery does better with Italy off 4bps to 2.87%, Spain up 2bps to 1.46%, Portugal up 2bps to 1.78% and Greece flat at 4.41%.

- US Bonds mixed with curve steeper into jobs/Powell– 2Y flat at 2.43%, 5Y up 2bps to 2.42%, 10Y up 2bps to 2.61%, 30Y up 2bps to 2.94%.

- Japan JGBs rally in catch up trade– 2Y off 2bps to -0.14%, 5Y off 2bps to -0.15%, 10Y off 4bps to -0.03%, 30Y off 5bps to 0.66%>

- Australian bonds sold on China PMI– 3Y up 7bps to 1.79%, 10Y up 9bps to 2.27%.

- China bonds mixed with focus on long-end– 2Y off 2bps to 2.75%, 5Y up 1bps to 2.96%, 10Y off 2bps to 3.18% and 30Y off 7bps to 3.43%.

Foreign Exchange: The US dollar index 95.78 off 0.1% with 95.69 lows. In EM, USD also weaker – KRW up 0.4% to 1120.60, INR up 0.55% to 69.72 despite oil, RUB up 1% to 67.996, ZAR up 1.3% to 14.102.

- EUR: 1.1410 up 0.15%. Range 1.1383-1.1419. Stuck 1.13-1.15 still with focus on US rates, jobs driving then Powell

- JPY: 107.95 up 0.3%. Range 107.51-108.45 with focus on 107.50 base building for 108.80 breakout. EUR/JPY up 0.45% to 123.15 with focus on 120-125 consolidation.

- GBP: 1.2670 up 0.3%. Range 1.2616-1.2695 with EUR/GBP .9005 off 0.1% - still about Brexit with EUR driving -1.25-1.28 keys.

- AUD: .7045 up 0.6%. Range .6994-.7054 with focus on .7080 and .7150 resistance. NZD flat at .6695.

- CAD: 1.3445 off 0.3%. Range 1.3431-1.3496 with C$ holding gains from yesterday into jobs today with 1.3380-1.3420 base building for 1.3550.

- CHF: .9870 flat. Range .9853-.9882 with EUR/CHF up 0.15% to 1.1260 – tracking equities/JPY, watching rates in periphery again.

- CNY: 6.8725 off 0.15%. Range 6.8671-6.8826. CNY gains with stocks, focus on talks with US next week.

Commodities: Oil up, Gold down, Copper up 2.5% to $2.6750

- Oil: $48.04 up 2%. Range $46.65-$48.32 with equities leading first, inventories key along with US growth story from jobs. Brent up 2.2% to $57.17 with focus on $58 resistance.

- Gold: $1293.20 off 0.15%. Range $1291-$1300.40 – unable to break $1300 even with USD weakness, opening $1285 and $1268 risks. Silver off 0.15% to $15.77, Platinum up 0.5% to $803.70 and Palladium up 0.3% to $1203.60.

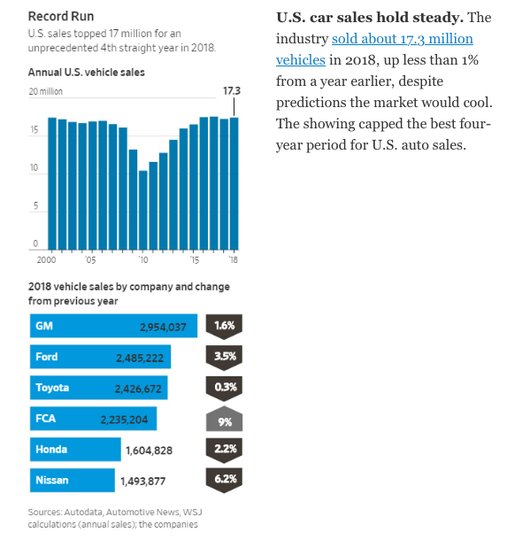

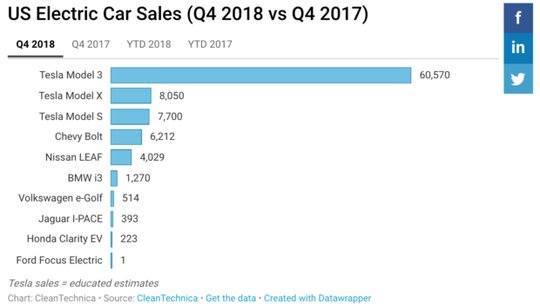

Conclusions: Driving it all? Consumers and their paychecks are still keys for US economic growth. Yesterday’s auto sales at 17.55mn up from 17.49mn SAAR surprised – most saw 17.20mn rate at best. The auto market is in contrast to housing but both reflect rate sensitive areas for consumers and matter to understanding the FOMC reaction function today to US jobs where wages will again be the central focus. Historic unemployment lows hasn’t translated into inflation yet. The focus on the consumer balance sheet in 2019 is unlikely to go away. There are other things in play for 2019 with electric cars and technology across all sectors worthy of consideration and surprises in the mix of inflation/jobs/consumer spending brews.

Economic Calendar:

- 0830 am US Dec non-farm payrolls 155k p 180k e / avg. hourly earnings 0.2%p 0.3%e / unemployment rate 3.7%p 3.7%e / participation 62.9%p

- 0830 am Canada Dec employment change 94.1k p 5k e rate 5.6%p 5.7%e / participation 65.4%p

- 0945 am US Dec final services PMI 54.7p 53.4 flash / composite 54.7p 53.6p 54.7e

- 1015 am FOMC Chair Powell speech

- 1100 am US weekly EIA crude oil inventories -0.046mb p

- 0130 pm St. Louis Fed Bullard speech

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.