Markets: Sanguine

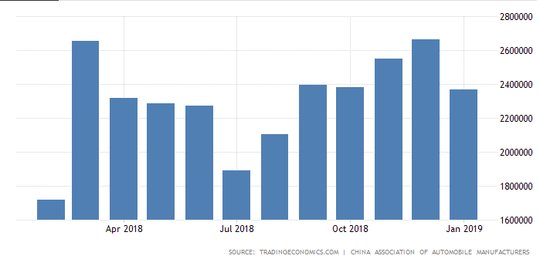

Thought experiment, how would you play out a conflict between two nuclear powers where the Prime Minister facing election in one of them vows to “avenge very tear” caused by a terror attack in the Kashmir linked back to the other nation? Throw in that the other nation has the tacit support of China, Russia, and Saudi. Clearly, India is weighing military options on its neighbor Pakistan. Now think about what global share markets might do? Rally, of course, as the bigger concern is about US/China trade relations and talks continue as they shuttle back to Washington from Beijing last week. The leaked hope being that the US takes up Xi on a deal to eliminate the US deficit by importing more goods and commodities by 2025. Markets like people have personality and we are in the Sanguine rather than Choleric state. The confidence game at play is clear even as the markets are thin with US and Canada holidays. Central bankers are widely expected to keep the taps open for liquidity, and bad news whether geopolitical or economic has quickly been cast aside. This is about greed not fear. The ugly weakness in China auto sales highlights the downside risks ahead where pumping money into banks and construction plans doesn’t feed the Chinese consumer. The rally up in Chinese shares (the best day in 3-months) reveals more about trade talk hopes and stimulus working than about geopolitical risks blowing up. We are in a market where looking at the pain trade matters – and so for FX its all about the INR with an election, a potential military conflict, oil prices and central bank independence all at risk – yet the chart isn’t flashing red but yellow – watching 74 for bears to be proved right or 69 for a bull run to return.

Question for the Day: Is any deal with China good for markets? The pricing of risk in the last 8 weeks has been connected to expectations that the US and China come to terms over trade. It has also been supported by the view that the FOMC and other central banks do nothing more towards tightening, with some looking or easing next. These two factors explain much of the price action. They beg the question about the medium term risk for many see a bad deal between Trump and Xi leading to larger problems later and others will point out that FOMC patience is more a collar than a free S&P500 put where higher inflation or asset prices will trigger further rate hikes. Clearly, the two are connected by what happens to financial conditions. The S&P500 is just 5% away from its record highs. Yet economic data is less convincing. The FOMC balance sheet maybe the more important consideration for risk in the week ahead with FOMC speakers and minutes shedding light on their thinking there.

The must-read on trade talks this week is the FT Gavyn Davies piece that argues China’s new trade offer is better than a tariff war. He argues the outcome of such a plan would lead to a Chinese C/A deficit requiring foreign capital inflows which would compete directly with the US. This is the rub – we can solve the US trade issue but reopen the US C/A problem in the process. US rates maybe the key concern in the weeks ahead should the FOMC and Trump trade deals play out as the market expects.

What Happened?

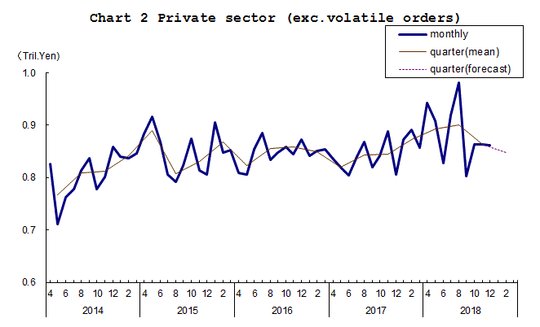

- Japan December core machinery orders fell 0.1% m/m after 0% - better than the -1.1% m/m expected. The 4Q orders fell -4.2% q/q after +0.9% q/q with the forecast for 1Q -1.8% q/q. The headline machinery orders were -18.6% after +8.3% with the 4Q up 3.9% after 2.7% but outlook for 1Q -13% q/q. The overseas orders were up 12.1% in 4Q after -1.6% but down -21.9% in December from +18.5% in November. However, sales of what they call ‘new energy vehicles’ rose to 95,700.

- China January vehicle sales fell 15.8% y/y after -13% y/y – car sales worst in 7-years at -17.7% y/y. This was the 7thconsecutive month of declines. Car sales fell to 2.02mn back to January 2012 lows while total vehicle sales fell to 2.37mn units. Sales of cars are expected to reach 23.7 million units, compared to 22.72 million in 2018, while sales of commercial vehicles are expected to hit 4.4 million units, an increase of only about 1% y/y.

Market Recap:

Equities: The S&P 500 futures are off 0.05% but this is a US holiday so markets remain thin. The S&P500 was up 1.09% Friday. The Stoxx Europe 600 is up 0.1% with German autofocus. The MSCI Asia Pacific jumps 1.1% with China leading on stimulus and trade talk hopes.

- Japan Nikkei up 1.82% to 21,281.85

- Korea Kospi up 0.67% to 2,210.89

- Hong Kong Hang Seng up 1.6% to 28,347.01

- China Shanghai Composite up 2.68% to 2,754.36

- Australia ASX up 0.36% to 6,170.70

- India NSE50 off 0.78% to 10,640.95

- UK FTSE so far off 0.2% to 7,222

- German DAX so far off 0.25% to 11,272

- French CAC40 so far up 0.1% to 5,159

- Italian FTSE so far up 0.5% to 20,311

Fixed Income: The better equities in Asia set a tone for risk-on but auto sales in China and usual noise over Brexit matter – safe-havens lose a bit as periphery rallies. German 10-year Bund yields up 1bps to 0.11%, French OATs up 1bps to 0.55% and UK Gilts up 1bps to 1.17% while Italy off 3bps to 2.77%, Spain off 2bps to 1.23% (snap election no worries?), Portugal off 3bps to 1.54% and Greece off 8bps to 3.75%.

- US Bonds holding pattern with holiday– 2Y up 1bps to 2.52%, 5Y flat at 2.49%, 10Y flat at 2.66%, 30Y off 1bps to 2.99%.

- Japan JGBs see front end rally despite equities– 2Y of 1bps to -0.17%, 5Y off 1bps to -0.17%, 10Y flat at -0.02%, 30Y flat at 0.60%.

- Australian bonds sold with equities bid, China deal hopes– 3Y up 4bps to 1.71%, 10Y up 5bps to 2.15%.

- China bonds sold with equitiesbid– 2 up 1bps to 2.63%, 5Y up 2bps to 2.89% and 10Y up 1bps to 3.12%. PBOC money market policy neutral with no operations and no repos maturing.

Foreign Exchange: The US dollar index off 0.25% to 96.65. In EM, USD mostly offered – Asia: INR off 0.05% to 71.355, KRW up 0.1% to 1124.80; EMEA: RUB up 0.15% to 66.167 and ZAR up 0.05% to 14.07.

- EUR: 1.1330 up 0.35%.Range 1.1289-1.1332 with focus on China talks and stimulus with 1.1250 base for 1.1380 resistance.

- JPY: 110.55 up 0.1%.Range 110.44-110.61 with EUR/JPY 125.25 up 0.4%. Stuck with 110-112 trading watching equities and rates.

- GBP: 1.2935 up 0.35%.Range 1.2891-1.2939 with EUR/GBP .8760 flat. Waiting for more on Brexit and driving on EUR.

- AUD: .7155 up 0.25%.Range .7133-.7159 with focus on metals and China – with NZD .6875 up 0.2% - watching .6920 for breakout.

- CAD: 1.3240 flat. Range 1.3225-1.3255 with holiday market focused on oil and rates – BOC speeches key. 1.3050 or 1.34 next?

- CHF: 1.0030 off 0.2%.Range 1.0028-1.0055 with EUR/CHF 1.1365 up 0.15% – no worries mean 1.00 retest

- CNY: 6.7645 off 0.05%. Range 6.7510-6.7730 with auto sales spooking nascent rally on talk hopes/equities. PBOC fixed 6.7659 form 6.7623.

Commodities: Oil mixed, Gold up, Copper up 0.3% to $2.8215.

- Oil: $56.23 up 0.45%. Range $56.10-$56.65 with Brent off 0.2% to $66.15 as worries about China demand (see auto sales) shift. $67.20 in Brent key resistance.

- Gold: $1327.60 up 0.4%. Range $1323.80-$1328.50 with $1325 the pivot and focus on $1330-$1340 next. Silver up 0.15% to $15.77, Platinum up 0.2% to $808.40 and Palladium up 1.7% to $1431.10.

Economic Calendar: US and Canadian Holiday

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.