Markets: Safe?

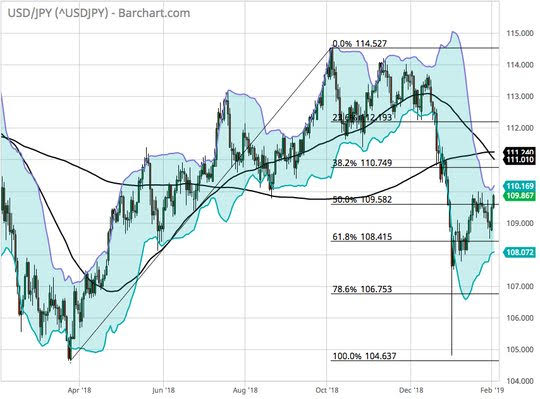

It’s quiet, almost too quiet. The hangovers in the US post the lowest scoring Superbowl in history sets the tone for trading today as many wait for more news and something to spike their coffee before getting excited about markets. The lack of new themes makes markets look boring and that lifts up the usual beta plays of selling volatility and chasing yield. The Xi/Trump meetings maybe set for Feb 27-28 in Da Nang according to the South China Morning Post. This coupled with the Lunar Holidays in much of Asia and a slightly better China Services PMI left markets waiting for Europe. The recognition of Guaido as Venezuelan President by nine EU nations along with the US puts oil higher with Brent at $64 and some of those disinflation fears easing accordingly. This hasn’t helped INR or some equities in Europe. As the all-clear for risk sirens blare today ECB Nowotny boldly suggest there is no recession risk even as all the present indicators suggest the 1Q soft patch is worse than 4Q. The Sentix investor sentiment for Europe drops to -3.7 from -1.5 – its sixth month of weakness and the worst since November 2014. The point being that the lack of interest in safe-haven’s today doesn’t mean markets are safer, only less fearful. This puts the USD/JPY as the bellwether to watch with an eye to gold and CHF as well.

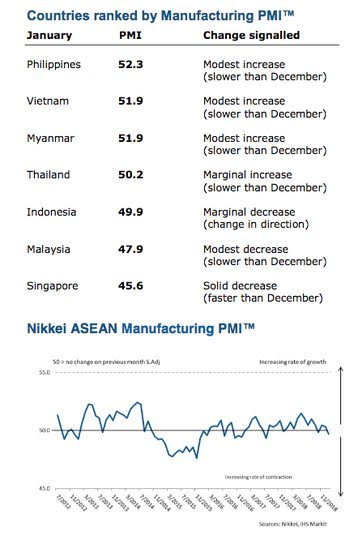

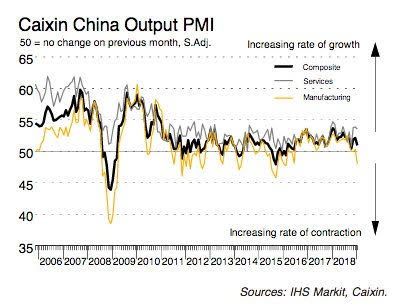

Question for the Day:Is Asia growth at risk? The China Services PMI was better today but the ASEAN Manufacturing PMI points to the pain in that sector getting worse. Domestic growth will lead in emerging markets making the present US/China trade focus and the FOMC pause less important to sketching out the bigger picture of growth for 2019. The ASEAN January Manufacturing PMI slips to 49.7 from 50.3 – the first drop in 3 months with six of the seven nations reporting lower PMI. Lower inflation is the boon, but only if domestic policy pushes can counterbalance export weakness. Perhaps the most important part of the story is that overall business outlook 12-month forward is still positive – with many hopeful new orders rebound. Asian corporate CEOs seem to be betting on a US/China trade deal.

What Happened?

- China January Caixin Services PMI 53.9 from 53.6 – better than 53.5 expected – still weakes since Oct 2018. New orders rose the most in seven months, new export orders expanded at the steepest pace in over a year, and employment growth accelerated to a 3-month high. Meanwhile, backlogs of work declined slightly. On the price front, input price inflation slowed to its lowest since May last year, while factory gate prices fell for the third month in a row and at a quicker rate. Finally, sentiment weakened. "The effects of China’s policies to support domestic demand and the development of the trade war between the country and the US will remain key to the prospects of the Chinese economy," noted the CEBM director. The Composite output index fell to 50.9 from 52.2 with manufacturing dragging down growth.

- Spain January unemployment change up 83,464 after -50,600 – worse than +60,500 expected. The total unemployment rose 2.61% to 3.29mn – first rise in 2-months – blamed on post-Christmas holiday job shedding. By sector, services saw +85,584 jobless, agriculture +4,920 and industry +1,202 while construction -6,896.

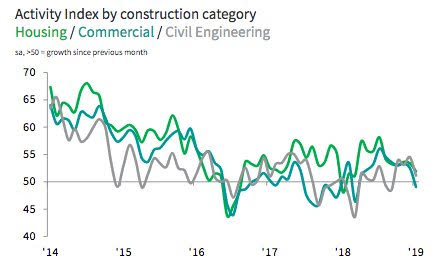

- UK January Construction PMI 50.6 from 52.8 – weaker than 52.4 expected – slowest in 10-months. The slower growth led to slower employment – weakest in 2 ½ years. Brexit uncertainty was again blamed. All three categories were weaker with residential the best, commercial work the worst. Outlook remains positive with large scale civil engineering projects a key driver.

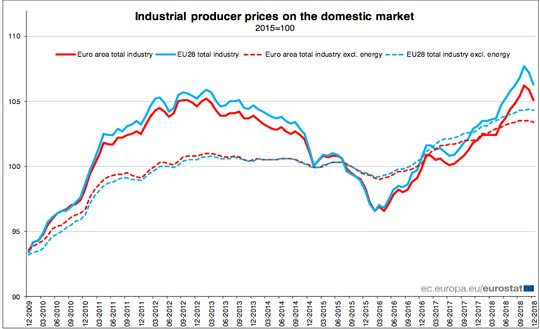

- Eurozone December PPI -0.8% m/m, 3% y/y after -0.3% m/m, 4% y/y – less than the -0.6% m/m, 3.3% y/y expected. By sector, energy off 2.6% m/m, intermediate goods -0.4%, while consumer goods rose 0.1% and capital goods up 0.2%. Overall, ex-energy, PPI fell 0.1% m/m.

Market Recap:

Equities: The US S&P 500 futures are up 0.05% after rising 0.09% Friday. The Stoxx Europe 600 is off 0.15% while the MSCI Asia Pacific rose 0.3% but with much of the region closed for holiday.

- Japan Nikkei up 0.46% to 20,883.77

- Korea Kospi closed for holiday

- Hong Kong Hang Seng up 0.21% to 27,990.21

- China Shanghai Composite closed for holiday

- Australia ASX up 0.47% to 5,963.00

- India NSE50 up 0.17% to 10,912.25

- UK FTSE so far up 0.3% to 7,040

- German DAX so far off 0.25% to 11,154

- French CAC40 so far off 0.45% to 4,995

- Italian FTSE so far flat at 19,577

Fixed Income: Quiet start to a heavy week for central bankers and with US and EU supply. Treading water for EU bonds – German 10-year yields flat at 0.16%, France flat at 0.58%, UK Gilts flat at 1.25%. Periphery mixed with Italy up 2bps to 2.76%, Spain up 1bps to 1.24%, Portugal up 1bps to 1.67% and Greece off 1bps to 3.91%.

- US Bonds mixed with curve steeper into data and supply– 2Y flat at 2.51%, 5Y flat at 2.50%, 10Y up 1bps to 2.70% and 30Y up 1bps to 3.04%.

- Japan JGBs lower with equities and supply - 2Y flat at -0.17%, 5Y up 1bps to -0.16%, 10Y up 1bps to -0.01%, 30Y up 1bps to 0.61%.

- Australian bonds sold into RBA risk and banking report– 3Y up 2bps to 1.76%, 10Y up 4bps to 2.24%.

Foreign Exchange: The US dollar index up 0.1% to 95.70. In EM – USD is bid: RUB off 0.3% to 65.62, ZAR off 0.5% to 13.378, INR off 0.45% to 71.77, KRW 1117.50 flat – on holiday.

- EUR: 1.1450 flat. Range 1.1438-1.1460 with focus on risk mood, safe-haven reversals. 1.1420-1.1500 keys.

- JPY: 109.85 up 0.3%. Range 109.43-109.92 with EUR/JPY 125.80 up 0.3%. 110 in play for 112 if risk mood holds and rates matter.

- GBP: 1.3065 off 0.1%. Range 1.3044-1.3096 with EUR/GBP .8765 up 0.1% - all about BOE this week, weaker Construction PMI with 1.30-1.32 keys.

- AUD: .7230 off 0.25%. Range .7223-.7254 with RBA tomorrow key, focus is on .7050-.7300 consolidation still. NZD .6890 flat – watching A$ and commodities.

- CAD: 1.3095 flat. Range 1.3085-1.3107 with risk for 1.32 before 1.30 with BOC speeches, oil driving – jobs on Friday key event risk.

- CHF: .9970 up 0.15%.Range .9945-.9978 with EUR/CHF 1.120 up 0.15%. Watching 1.00 for $ resistance.

- CNY: 6.7425 flat. On holiday all week so focus will be on region.

Commodities: Oil up, Gold down, Copper off 0.25% to $2.7560.

- Oil: $55.30 up 0.1%. Range $54.98-$55.75 with $55 base building as focus shift to US demand and Venezuela vs. Canada supply. Brent up 0.4% to $63 with $62 base for $65 test.

- Gold: $1315.10 off 0.5%. Range $1314.60-$1323.60 with USD up, stocks up, safe-haven buying stalls and profit taking wins with $1305-$1310 key support. Silver $15.74 off 1.2%, Platinum off 0.65% to $821.60 and Palladium up 0.15% to $1315.30.

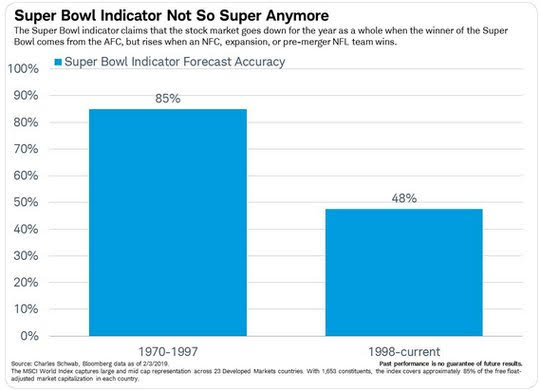

Conclusions: Does the Superbowl market forecast matter? Like all indicators, they stop working well when noticed by more than a handful of traders. The point is that equities in February in the US face more uncertainty after the 10% gains from the lows of December. The market has to get over the US auctions this week not mattering to bonds, the Trump SOTU not mattering to gridlock politics and the risk of another shutdown, the ongoing troubles in geopolitics from Russia missiles to failed states in Venezuela and ongoing troubles with Iran. For today, expect earnings, the US factory orders and the loan officer survey to matter.

Economic Calendar:

- 1000 am US Nov factory orders -2.1%p +0.2%e

- 1130 am US sells $45bn in 3M and $39bn in 6M bills

- 0200 pm US Fed senior loan officer survey

- 0730 pm Cleveland Fed Mester speech

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.