Markets: Palaver

Another day of lackluster news but with a myriad of central bank speakers. Their palaver dominates into the FOMC. Rates may not yet matter but they are higher and this will glacially move the mountains of risk capital. Just as talking eventually makes forward guidance less powerful, so too, higher rates makes debt less acceptable. The key turning point for markets wasn’t last night but yesterday with ECB Draghi hawkish enough to push up yields in Europe. His 2% CPI target sounded at risk – and given the rise of oil – perhaps justified. Of course, today appeared to also be about the number 2:

- BOJ Kuroda unlikely to move before 2% CPI. There is no set period for easy policy.

- I China less than 2% chance for a US trade deal. China's Vice Commerce Min suggested that it is hard to progress in the U.S. trade talks with a knife to the neck. A new white paper argues that the US has not shown enough respect and has imposed unilateralism, protectionism and economic hegemonism on various countries, especially China.

- Italian Budget merges to 2% compromise. A report from Il Messaggero that Fin Min Tria is willing to run a deficit as high as 2.0% of GDP (vs his stated 1.6% preference), while another report from La Stampa cited 5-Star`s Di Maio backtracking from a 2.8% of GDP deficit.

- BOE Vliehe: 2 hikes a year about rate. Doubts impact of unwinding QE significant, more about forward guidance.

- Take 2 for US/Turkey talks over Pastor. The TRY continued to rally from yesterday’s Pompeo suggestion for more talks with Turkish leaders.

The biggest talking today will be at the UN where US President Trump tries to convince world leaders that America First doesn’t mean America Alone. He has penned a free-trade deal with Korea and hopes to do the same with Japan after his Abe meetings. This is a market that isn’t impressed with talking but will pay attention to rates and oil. So with 3.12% key for 10-year US rates, one has to watch oil at $72.50 for more trouble.

Question for the Day: Will higher oil prices mean trouble for growth? The US relationship to oil changed post-2008 with QE spurring shale oil efforts and supply. Now the US is mixed when oil prices rise as the energy sector supports the economy while consumers and some business suffer. For Europe, this is less obvious. Energy has always been a difficult issue for the ECB. Pass-through inflation matters everywhere but seems more inelastic there. A new article on oil and its effect on the EU economy from the ECB is worth considering today ahead of the US data and the ECB speakers.

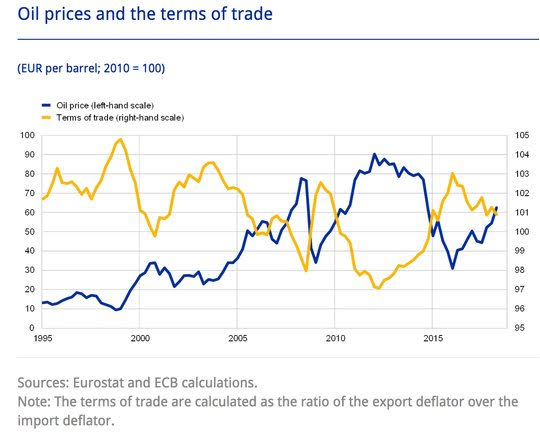

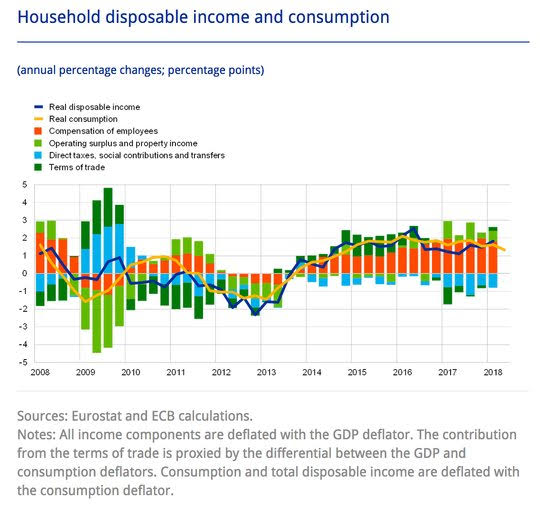

Here are a few of the main points – 1) Most of EU energy use is in production of goods. In the euro area, about one-third of the economy’s total oil use is in the form of final consumption….The other two-thirds comes from oil being used in the production of non-energy goods. A rise in oil prices implies an increase in the production costs of these sectors. If these costs cannot be passed on to the final prices of these goods, there will be an indirect impact on households’ purchasing power, since either wages or profits received from these sectors will be lower. 2) Terms of trade matters. When oil prices rise, the terms of trade deteriorate and household purchasing power falls. The strong correlation between oil prices and the terms of trade is widespread globally.3) Oil prices already moved up. While the drop in oil prices in 2014 and 2015 certainly supported the expansion of private consumption, the overall growth of real disposable income since 2013 has been largely driven by labor income (Chart C). From mid‑2017 to mid‑2018 oil prices increased from about USD 50 to about USD 75 per barrel. If they remain at their present level, the increase is unlikely to significantly dent the growth of real disposable income and private consumption.

What Happened?

- Japan August Corporate Service Prices rose 1.3% y/y after 1.1% y/y – more than 1.2% y/y expected. Notable rise in real estate services from 0.9% to 1.3% y/y, advertising rose from 0.4% to 1.3% y/y and communications rose from 0.6% to 0.8% y/y while civil engineering and architecture fell to 1.2% from 1.3% y/y.

- Japan BOJ July 30-31 Board Minutes: Highlight debate on flexible policy. Bank of Japan board members debated the pros and cons of making the bank's interest rate target and asset purchases more flexible while agreeing that prices face continued downside risks, according to the minutes of the July 30-31 meeting

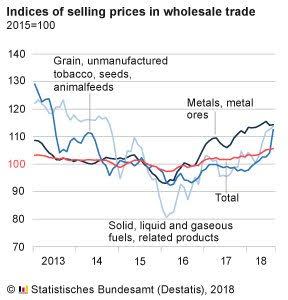

- German August WPI up 0.3% m/m, 3.8% y/y after 0.1% m/m, 3.6% y/y – near expectations. Fuels and oil products up 0.9% m/m, grains/seeds up 8.1% m/m, fruits/vegetables -1.5% m/m, food/beverages -0.7% m/m, data processing -0.1% m/m, ore/Steel up 0.9% m/m.

- French September Economic Sentiment 106 from 105 with Manufacturing Sentiment 107 from 110, Services 105 from 104. The drop in manufacturing showed export orders -5 from -4, with personal business outlook 9 from 20 and general outlook 9 from 11 – both are still above long-term averages but down sharply.

Market Recap:

Equities: The US S&P500 futures are up 0.25% after losing 0.35% yesterday. The Stoxx Europe 600 is up 0.3% with focus on Italy. The MSCI Asia Pacific was again holiday muted with index up 0.2%. The MSCI EM index fell 0.2%.

- Japan Nikkei up 0.29% to 23,940.26

- Korea Kospi closed for holiday

- Hong Kong Hang Seng closed for holiday

- China Shanghai Composite off 0.58% to 2,781.14

- Australia ASX off 0.01% to 6,299.10

- India NSE50 up 0.91% to 11,067.45

- UK FTSE so far up 0.3% to 7,479

- German DAX so far up 0.25% to 12,379

- French CAC40 so far up 0.25% to 5,488

- Italian FTSE so far up 1.3% to 21,614

Fixed Income: Yields drift higher into FOMC, Italian budget, more supply. Oil at 4-year highs means ECB Draghi is paying attention – EU bonds reflect this – German 10-year bond yields are up 2.7bps t 0.535%, French OATs up 2bps to 0.845%, UK Gilts up 2.5bp to 1.635%. The periphery is about budget hopes – Italy off 7.5bps to 2.87% while Spain is flat at 1.52% and Portugal off 0.5bps to 1.88%. Greece tracks Italy off 7bps to 4%.

- The UK sold 800mn of 30Y 0.125% inflation-linked Gilts at 1.432% with 2.06 cover.

- Italy sold E2.75bn of inflation-linked bond with mixed demand – E1.75bn of 2Y Mar 2020 CTZ at 0.715% with 2.1 cover previously 1.28% with 1.87 cover – and E1bn of 14Y 1.25% Sep 2032 BTPei at 1.65% with 1.72 cover – previously 0.75% with 1.94 cover.

- The Netherlands DTSA sold E2.12bn of 5Y 0% Jan 2024 DSL at 0.076%- previously 009%.

- US Bonds are lower waiting for more supply, more data, and FOMC – 2Y up 0.8bps to 2.839%, 3Y up 1.7bps to 2.919%, 5Y up 1.9bps to 2.987%, 10Y up 2.2bps to 3.111%, 30Y up 2bps to 3.246%.

- Japan JGBs see steeper curve - focus turns to 40Y sale tomorrow – BOJ left Rinban operations unchanged Y450bn of 5-10Y with cover ratio 1.96 from 2.50 and Y25b of JGBij with cover higher to 5.89 from 5.02. Closes - 2Y up 1bps to -0.112%, 5Y up 0.4bps to -0.062%, 10Y up 0.4bbps to 0.123% and 30Y up 1.7 to 0.902%.

- Australian bonds tracking US rates again – 3Y up 2.5bps to 2.122%, 10Y up 4.5bps to 2.747%.

- China PBOC net drains CNY90bn on the day, after injecting CNY60bn via 14-day reverse repos as CNY150bn roll off. This is the third day of drains. Money market rates rose with 7-day up 4bps to 2.685% and O/N up 1.5bps to 2.527%. 10Y bonds yields flat at 3.675%.

Foreign Exchange: The US dollar index is flat at 94.18 with range 94.13-94.37 – focus remains on 93.90 and 94.60. In EM USD mostly lower, ASIA: TWD up 0.05% to 30.67, INR off 0.1% to 72.705, KRW up 0.1% to 1119 – still on holiday. EMEA: ZAR up 0.1% to 14.36, RUB up 0.5% to 65.588, TRY up 0.3% to 6.1350.

- EUR: 1.1765 up 0.15%. Range 1.1731-1.1774 with ECB hawk talk clashing with FOMC – 1.18 caps against 1.1720

- JPY: 112.85 flat. Range 112.76-112.98 inching higher with 113 barrier and 113.40 target – watching equities, rates and Abe/Trump. EUR/JPY up 0.25% to 132.95.

- GBP: 1.3150 up 0.25%. Range 1.3095-1.3161 with EUR/GBP flat at .8950 – watching Brexit headlines still and ignoring BOE comments.

- AUD: .7245 off 0.1%. Range .7236-.7263 with focus on commodities, China, US rates and waiting for RBNZ – Orr comment put NZD flat at .6645 with .6630 lows as key.

- CAD: 1.2960 flat. Range 1.2946-1.2973 with focus on crosses, NAFTA hopes lower, oil higher countering 1.2880-1.3050 keys.

- CHF: .9660 up 0.2%. Range .9629-.9671 with EUR/CHF 1.1375 up 0.4% - all about Italy risk unwind.

- CNY: 6.8440 fixed 0.15% weaker from 6.8357, trades weaker to 6.8625 from 6.8390 Friday close. CNH

Commodities: Oil up, Gold up, Copper off 1.25% to $2.8095.

- Oil: $72.50 up 0.6%. Range $72.02-$72.66. WTI watching $75.46 as the next big target (Jan 2014 lows) against $70 base. Brent up 0.9% to $81.96 watching $87 target with $80 base. All about OPEC and equities still with momentum trade driving.

- Gold: $1201.20 up 0.2%. Range $1199-$1202. Watching $1195-$1215 now with USD key. Silver up 0.45% to $14.32 with $14.55 key. Platinum up 0.6% to $832.30 – favorite for global trade hopes – Palladium off 0.1% to $1060.90.

Conclusions: Are politics beginning to hit confidence in the US. As the US mid-term elections heat up, the focus on political headlines increases. The latest round of controversy in the US over the SCOTUS Kavanaugh hearings is a case in point. The WSJ highlights the hit to trust. The Edelman Trust Barometer, an annual survey of confidence in institutions around the world, found earlier this year “a staggering lack of faith in government” in the U.S. In fact, the survey found that trust in government, business, the media, and non-government organizations in the U.S. all had fallen in the last year, putting Americans’ trust in all those institutions below the average for the 28 nations surveyed. “The United States is enduring an unprecedented crisis of trust,” declared Richard Edelman, president, and CEO the Edelman organization.

Economic Calendar:

- 0900 am US July S&P/Case Shiller home prices (y/y) 6.3%p 6.2%e

- 0900 am US July FHA housing price (m/m) 0.2%p 0.4%e

- 1000 am US Sep Richmond Fed Manufacturing Index 24p 22e

- 1130 am US 1M Bill sale and $17bn in 2Y FRN

- 0100 am US 5Y $38bn note sale

- 0430 am US weekly API crude oil stocks 1.25mb p -0.5mb e

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.

In the stock market it is much more than just "confidence" in our leaders. Much of the market seems to be driven by emotions and fears, not by rational thinking. So there is a certainty that even a lackluster day will affect the emotions of a few. So now the question comes about the relative success: do those running on emotion profit more than those running on logic and insight??