Markets: Moderation

“Everything in moderation, including moderation.” – Oscar Wilde

Global shares have stalled after testing 5-month highs yesterday. There is a list of drivers behind this moderation. No one of them stands out and so it’s the size of the list of worries that matter as investors have to climb the wall to see another rally. China slipping from 8-month highs, the GBP surging, these price stories aren’t extreme or surprising.

- Doubts about US/China trade deal return. The NYTimes warns that Democrats will likely use a weak China deal against Trump in 2020 and that many Republicans are wary of a bad deal. Also, the Times reports, “many of the biggest sticking points still remain, including China’s state subsidization of companies, which gives Chinese firms a competitive advantage. Beijing also still appears to be falling short of the administration’s demands to stop what it says is a pattern of cybertheft and to end a requirement that American companies hand over valuable intellectual property as a condition of doing business there, people familiar with the negotiations said.”

- The odds for a no-deal Brexit went down again but at the cost of UK PM May’s credibility. The prime minister will propose formally ruling out a no-deal Brexit in a bid to avoid a rebellion by lawmakers who are threatening to grab control of the divorce process, The Sun and Daily Mail newspapers reported.

- India air strike hits militant camp inside Pakistan. India claims 300 were killed in the raid on the JeM, the same group that killed 40 Indian police in the Kashmir on Feb 14. Intelligence that Jaish was planning more attacks led to the action.

- ECB Lane – the next central bank economist – plays down economic slowdown. Lane is the only candidate to replace Praet on the ECB Board in June. “I think it’s also fair to say that all of this is in the neighborhood of reasonably small adjustments to the forecasts,” Lane said in a confirmation hearing at the European Parliament’s Committee on Economic and Monetary Affairs in Brussels. “I think the current strategy can cater to limited downside revisions,” Lane said. “The forward guidance can accommodate revisions to the projections.”

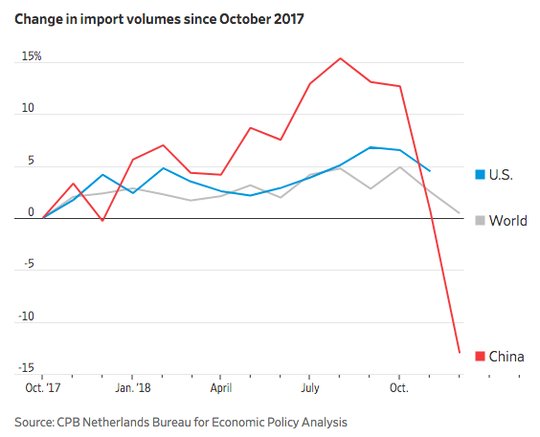

- Global trade slowdown in 2018 notable. The CPB Netherlands report on global trade yesterday maybe the best way to understand today’s price action. Total volume of goods for 2018 rose 3.3% down from 4.7% in 2017. Flows in 4Q 2018 were 0.9% down from the previous quarter, and China’s trade with the rest of the world accounted for most of the drop.

As we try to understand the hit of fear beating greed today, the barometer of the GBP matters as its clearly negatively correlated to the UK FTSE and it captures the risk of rate normalization against global trade. Watching 1.3250 for 1.34 and 1.36 test risk against 1.3200 pivot for 1.2850 again.

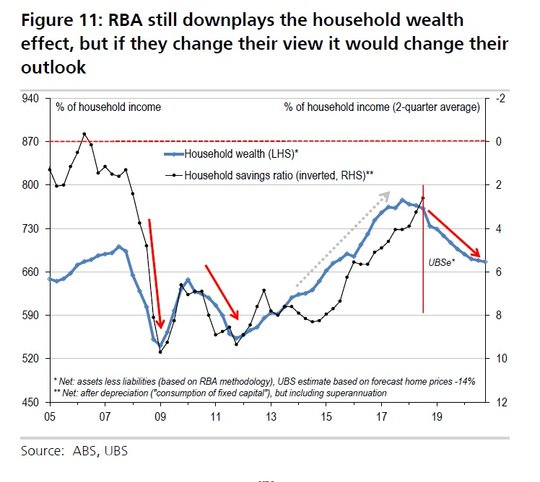

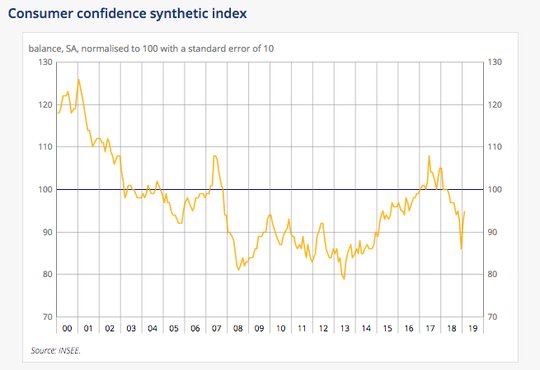

Question for the Day: Is the global housing market or corporate debt or China trade the real risk to global recession? Today is about moods – comparing and contrasting the stable German consumer against the bouncing French mood and waiting for the US conference board measure of the same. Throw in the reaction function of Chair Powell to the grim economic reports so far in February and you have some risk reduction afoot for the US. But the US isn’t alone in this moderation and the underlying focus is on bubbles. The RBA rate cut hopes remain in play for the AUD today. The reason we should pay attention to the Australia housing bubble pop is because its on the front lines of a global problem post the QE and since the QT of the FOMC. The correlation of shrinking balance sheets and higher rates is obvious. The risk of the “wealth effect” hitting global consumers and growth regardless of the China feel-good-stimulus talk and the hopes for a US/China trade deal are in balance. Australia is a good case study for the rest of the world as fiscal spending could help offset the gloom, as could a better trading environment, but the odds for a May rate cut from the RBA are rising because of the housing story.

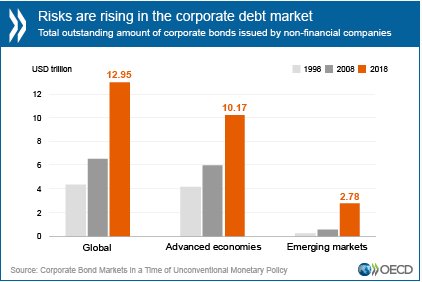

The other bubble being discussed by markets is that of corporate debt as the Telegraph Evans-Pritchard highlights today. His article like the reporting from the FT and others follows an OECD report on the risks from rising corporate debt with a clear link back to China. China moved from an almost zero corporate debt market in 2008 to $590bn in 2016 This is the stark warning: “The risks and vulnerabilities in the corporate debt market are also significantly different from that of the previous pre-crisis cycle. The share of lowest quality investment grade bonds stands at 54%, a historical high, and there has been a marked decrease in bondholder rights that could amplify negative effects in the event of market stress. At the same time, in the case of a financial shock similar to 2008, USD 500 billion worth of corporate bonds would migrate to the non-investment grade market within a year, forcing sales that are hard to absorb by non-investment grade investors.”

Growth and getting out of debt are linked and moderated by the reaction of central bankers to the inflation risks of too much leverage. The most interesting chart for the present set up comes from the FT yesterday.

As it links the leading indicators of growth in emerging markets against that of developed ones. Much of this is about Europe and China and how they compare to the US economy. The play out of FX in this correlation is the anomaly and the warning sign about growth.

What Happened?

- German March GfK consumer confidence holds 10.8- as expected. The GfK noted that “mood of consumers paints a mixed picture. Income expectations remain stable. But propensity to buy lost ground again. Economic expectations continued their “steep downward spiral.” Economic expectation dropped -6.5 points to 4.2. That’s the fifth decline in a row and the lowest reading since March 2016. Gfk said, “Consumers feel that the risk of the German economy slipping into recession again has tangibly increased in recent weeks.”

- French February consumer confidence bounces to 95 from 92 - better than 92 expected. January revised from 91. The financial situation outlook improved to -13 from -14, but savings plans rose to 2 from -1 and major purchase plans held at -22. The unemployment fears fell to 12 from 32 while consumer price expectations rose to -19 from -40.

- Austria February manufacturing PMI drops to 51.8 from 52.7 – weaker than 53 expected – 37-month lows. The drop was mainly on supplier delivery times, slower employment growth and weaker export orders. Overall order books also fell for the second month in a row. Despite this, output rose led by consumer goods. Manufacturers remain cautiously optimistic.

- BOE Ramsden Treasury Committee Report: Uncertainty over Brexit key. “If, as assumed in the Inflation Report forecast, a smooth transition to a new trading arrangement is agreed, then some reduction in uncertainty and a partial recovery of demand seems likely in the near-term. What kind of trading arrangement is eventually agreed will also matter for longer-term supply growth, with less open trading arrangements associated with worse outcomes for productivity. And as demonstrated by the sensitivities that the MPC set out in a Box in the November 2018 Inflation Report, how the exchange rate responds will also be important: a transition to a relatively open trading relationship is likely to result in an appreciation. For all these reasons, different outcomes will have different implications for monetary policy.”

Market Recap:

Equities: The US S&P 500 futures are off 0.3% after a 0.12% gain yesterday. The Stoxx Europe 600 is off 0.2% while the MSCI Asia Pacific fell 0.4%.

- Japan Nikkei off 0.37% to 21,449.39

- Korea Kospi off 0.27% to 2,226.60

- Hong Kong Hang Seng off 0.65% to 28,772.06

- China Shanghai Composite off 0.67% to 2,941.52

- Australia ASX off 0.87% to 6,209.00

- India NSE50 off 0.41% to 10,835.30

- UK FTSE so far off 1.1% to 7,102

- German DAX so far off 0.2% to 11.479

- French CAC40 so far off 0.35% to 5,213

- Italian FTSE so far off 0.1% to 20,412

Fixed Income: Another day where bonds don’t really matter to equities or headlines with ECB Lane story and better confidence reports driving core against rallying periphery – 10Y German Bund yields up 1bp to 0.12% - still below 0.15% pivot. French OATs flat at 0.52% while UK Gilts are up 4bps to 1.21% on less no-deal fear. Periphery is bid with Italy off 3bps to 2.74%, Spain off 3bps to 1.14%, Portugal off 3bps to 1.44% and Greece off 5bps to 3.73%.

- Germany sold E5bn of 2Y Schatz at -0.54% with 1.28 cover- previously -0.58% with 1.24 cover.

- US Bonds are bid with curve bull steepening – waiting for Powell and supply– 2Y off 2bps to 2.56%, 5Y off 2bps to 2.47%, 10Y off 1bps to 2.66%, 30Y flat at 3.03%.

- Japan JGBs sold off in curve steepening move– 2Y up 1bps to -0.16%, 5Y up 1bps to -0.16%, 10Y up 1bps to -0.03%, 30Y up 3bps to 0.61%.

- Australian bonds sold despite RBA talk and weak equities – 3Y up 1bps to 1.66%, 10Y up 2bps to 2.09%.

- China bonds continue lower– 2Y flat at 2.70%, 5Y up 8bps to 3.01%, 10Y up 3bps to 3.21%.

Foreign Exchange: The US dollar index fell 0.1% to 96.31. In Emerging Markets, USD is bid – ASIA: INR off 0.3% to 71.01, KRW off 0.2% to 1117.35; EMEA:ZAR off 0.2% to 13.861, RUB off 0.25% to 65.663, TRY up 0.1% to 5.2960.

- EUR: 1.1365 up 0.1%. Range 1.1346-1.1372 with 1.1380 and 1.1420 in play still – ECB vs. FOMC key along with trade talks

- JPY: 110.85 off 0.2%.Range 110.75-111.08 with EUR/JPY 125.95 off 0.15%. All about equities and 111.20-50 resistance holding.

- GBP: 1.3195 up 0.6%.Range 1.3093-1.3238 with EUR/GBP off 0.5% to .8610 – watching Brexit headlines and 1.3250 for 1.34 risk.

- AUD: .7145 off 0.3%.Range .7142-.7173 with NZD .6875 off 0.1%. RBA cut talk, weaker commodity start all driving, watching .7050-.7250 still.

- CAD: 1.3220 up 0.25%.Range 1.3182-1.3224 with focus on data and oil with 1.3250 pivotal resistance for 1.3320 again.

- CHF: 1.0005 flat.Range .9994-1.0012 with EUR/CHF 1.1370 up 0.1%. Watching 1.1320-1.1420 for now and Italian BTPs for direction.

- CNY: 6.6945 up 0.15%.Range 6.6870-6.7040. All about equities and trade talks. PBOC fixed 6.6952 from 6.7131.

Commodities: Oil mixed, Gold off, Copper is up 0.2% to $2.9660.

- Oil: $55.39 off 0.15%. Range $55.02-$55.65 with Trump OPEC blast reversed in London as Brent up 0.55% to $65.12 with $64 the key support. WTI watching API tonight and $55 as pivot.

- Gold: $1327.60 off 0.15%. Range $1326.40-$1332.40 with focus on risk mood and $1325 support against $1345 resistance. Silver off 0.2% to $15.80, Platinum off 0.2% to $852.10 and Palladium flat at $1496.30.

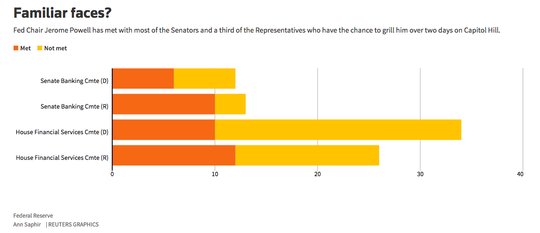

Conclusions: What will Powell Say? The Powell put or collar is in play for markets today as the Senate starts to grill the new Fed Chair and then the House tomorrow. There could be some confusion over what message he is trying to send as his audience is not the market but the Congress. At the heart of trading risk today is the reaction function of the central bank to the weaker US economic data but knowing the politicians matters in how that message gets delivered. Pausing rather than hiking isn’t the same as acting on the soft-patch and explaining that difference is central today. The Fed forecasts for 2019 and behind matter significantly in this regard. The oversight and independence of the FOMC is also at risk with the new Congress. The role of economic policy on the Fed matters and is in flux accordingly whether it’s the cost and effect of a “green new deal” or of ongoing Trump tax reform spillover. The oversight of banks and the state of the US budget maybe sideshows as the role of the FOMC plays into the swamp of Washington politics.

Economic Calendar:

- 0800 am Hungary central bank rate decision – no change from -0.15% / 0.9%

- 0830 am US Dec housing starts (m/m) 3.2%p -0.5%e / 1.256m p 1.253m e

- 0900 am US Dec FHA home prices (m/m) 0.4%p 0.4%e

- 0900 am US Dec S&P/Case-Shiller home prices (y/y) 4.7%p 4.5%e

- 1000 am FOMC Chair Powell testimony to Senate

- 1000 am US Feb Conference Board consumer confidence 120.2p 125e

- 1000 am US Feb Richmond Fed manufacturing -2p +1e

- 1130 am US Treasury sells 1Y bills

- 0100 pm US Treasury sell 7Y notes

- 0430 pm US weekly API crude oil inventory +1.26mb p +0.5mb e

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.