Markets: Lunacy

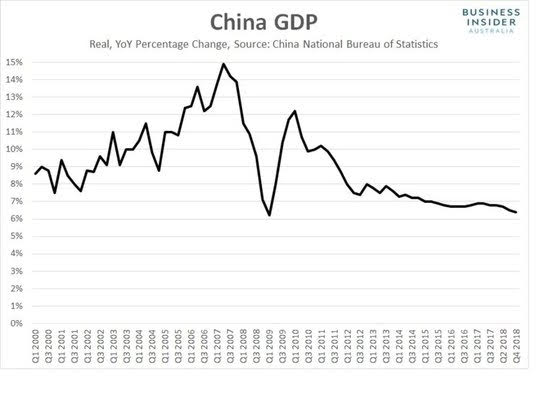

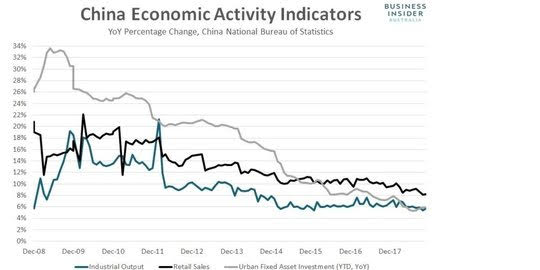

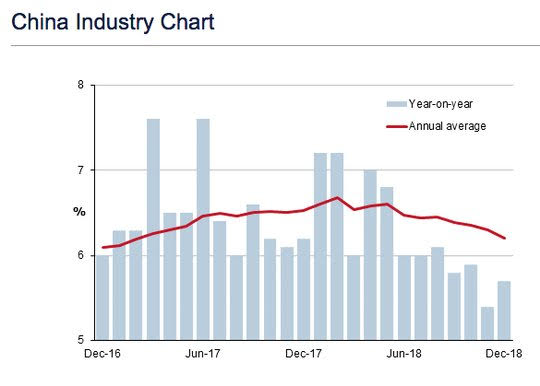

Over the full wolf blood moon and its eclipse, howling investors got more and less than they wanted. Eclipses bluntly remind us all of our prehistoric past when gods ate the moon and spit it out again when myths were the best explanation for the present chaos. Stories are the template for future action. The China economic data for 4Q was the slowest growth pace since 1Q2009. The retail sales are near 18-year lows. Industrial production surprised to the upside but fixed investments stalled. Perhaps the most important headlines were about the US/China trade talks stuck on intellectual property issues. The net reaction of markets in Asia was positive but in Europe less so as the markets are in doubt of the veracity of the data and the power of the present stimulus overlayed against the fears of a breakdown in the trade talks. This puts this week and the craziness of the rally up in risk against the well-worn fears of US politics, US growth, UK Brexit, central bank policy mistakes – with the ECB and BOJ this week – and geopolitical problems highlighted at Davos; all of this makes risk-on less easy to believe. The rally up in the USD/CNY overnight highlights the doubt in play and the need to hold 6.88 over the next few weeks as critical for those that yearn for the simplicity of buying and holding risk assets.

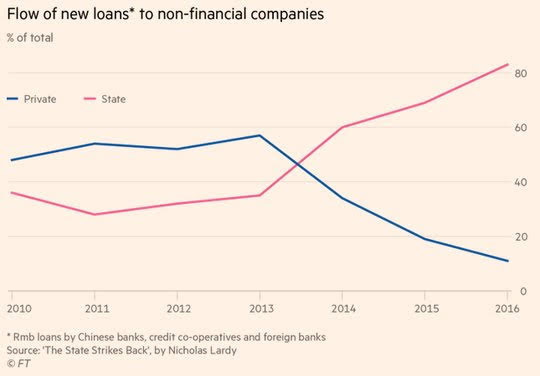

Question for the Day: Will China stimulus be enough? The feel-good moment for Asia post the GDP release came with the surprise uptick in China industrial production. The distraction is that electricity production zoomed higher while other things were less positive. The ability for China to grow out of the middle-income trap, to move from investment led to domestic-led growth and to have a centrally controlled economy dictate the best allocation of resources for growth all that is in doubt and in play for 2019. The stimulus hopes, post the data release, remain central to global markets in 2019. The key concern is that the private sector is no longer part of the growth story.

What Happened?

- Japan January Reuters Tankan drops to 18 from 23 – 2-year lows– hit by autos and steel. The outlook for April is now 17. The Services survey held steady at 31 but the outlook slips to 27 for April. Health of the global economy and trade tensions were cited.

- China 4Q GDP 1.5% q/q, 6.4% y/y from 6.5% y/y - as expected –weakest quarter since 1Q 2009. For all of 2018, growth was 6.6% - beating the governments 6.5% target but worst pace in 28 years. "In general, the national economy continued to operate in a reasonable range in 2018, achieving overall stability and stability," the NBS said in a statement. "At the same time, we must also see that the economic operation is stable and changeable, and the external environment is complicated and severe. The economy is facing downward pressure, and the problems in progress must be resolved in a targeted manner." The value added of the primary industry was CNY6,473.4bn, up by 3.5% y/y; that of the secondary industry was CNY36,600.1bn up by 5.8%; and that of the tertiary industry was CNY46,957.5bn, up by 7.6%. Consumption as the major driving force for economic growth was further strengthened with final consumption expenditure contributing 76.2% to GDP growth, 18.6% percentage points higher than that of last year, and 43.8% percentage points higher than the gross capital formation. Household consumption was upgraded and improved with quality.

- China December retail sales rise 8.2% y/y from 8.1% y/y – as expected – near 18-year lows. For all of 2018, sales rose 9% to CNY38,098.7bn. Consumer goods rose 5.7%. The on-line sales rose 23.9% y/y to CNY9,006.5bn.

- China December industrial production jumps to 0.5% m/m, 5.7% y/y from 5.4% y/y – better than the 5.3% y/y expected. For all of 2018, production rose 6.2% after 6.6% in 2017. High-tech sector rose 11.7%, strategic emerging industries rose 8.9% and equipment manufacturing rose 8.1% y/y. Manufacturing rose 6.5% while mining rose 2.3%. The SOE output rose 6.2% y/y while foreign-funded (Taiwan, Hong Kong) output rose 4.8% y/y.

- China December (ytd) fixed asset investment stalls at 5.9% y/y – weaker than 6% y/y expected. Real estate investment fell to 8.2% y/y from 9.3% y/y for December– with full year 9.5% down from 9.7% in November. Property sales rose to 0.9% y/y from -5.1% y/y drop – first gain in four months.

- China December urban unemployment fell 0.1% y/y to 4.9%with 13.61mn new jobs for 2018. Unemployment held a tight 4.8-5.1% in 2018. This is the 6thyear of job creation over 13mn. The total number of employed persons was 775.86 million and the number of urban employed persons was 434.19 million. The number of rural migrant workers reached 288.36 million, 1.84 million more than that of last year, up by 0.6%. '

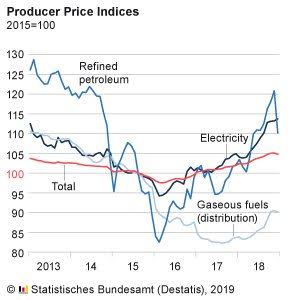

- German December PPI -0.4% m/m, +2.7% y/y after 0.1% m/m, 3.3% y/y – less than the -0.2% m/m, 2.9% y/y expected. In 2017, PPI also rose 2.7% y/y. Energy rose 6.9% y/y, intermediate goods and consumer goods rose 1.9%, while capital goods rose 1.4% y/y. Ex-energy PPI was up 0% m/m, 1.6% y/y

Market Recap:

Equities: The S&P500 futures are off 0.3% after a 1.32% gain Friday – MLK holiday today. The Stoxx Europe 600 is off 0.2% The MSCI Asia Pacific index rose 0.2% with China stimulus hopes.

- Japan Nikkei up 0.26% to 20,719.33

- Korea Kospi up 0.02% to 2,124.61

- Hong Kong Hang Seng up 0.39% to 27,196.54

- China Shanghai Composite up 0.56% to 2,610.51

- Australia ASX up 0.21% to 5,953.50

- India NSE50 up 0.5% to 10,961.85

- UK FTSE so far up 0.2% to 6,980.93

- German DAX so far off 0.35% to 11,165

- French CAC40 so far of 0.1% to 4,871

- Italian FTSE so far off 0.6% to 19,586

Fixed Income: Weaker data on margin from China, but with stimulus hope, weaker EU equities driving modest bond bid. German 10Y Bund yields off 1bps to 0.25%, French OATS off 1bps to 0.65%, UK Gilts off 4bps to 1.31% while in periphery mixed - Italy up 2bps to 2.76%, Spain flat at 1.36%, Portugal up 1bps to 1.6%0 and Greece off 3bps to 4.15%.

- US Bonds on holiday– 2Y 2.62%, 5Y 2.62%, 10Y 2.79% and 30Y 3.10%.

- Japan JGBs holding with focus on BOJ and data ahead– 2Y flat at -0.17%, 5Y flat at -0.15%, 10Y flat at 0.01%, 30Y flat at 0.70%.

- Australian bonds holding with focus on China data– 3Y flat at 1.82%, 10Y off 3bps to 2.31%

- China bonds steady with data in line or better– 2Y up 1bps to 2.59%, 5Y up 1bps to 2.93%, 10Y flat at 3.11%.

Foreign Exchange: The US dollar index up 0.1% to 96.40. Emerging markets see the USD bid– with Asia– INR flat at 71.219, KRW off 0.45% to 1130.4; EMEA– RUB off 0.4% to 66.432, ZAR off 0.2% to 13.867, TRY off 0.15% to 5.335.

- EUR: 1.1365 flat. Range 1.1360-1.1391 with little going through – focus is on ECB later in the week, trade and China growth.

- JPY: 109.65 off 0.15%.Range 109.47-109.76 with EUR/JPY 124.60 off 0.1% watching 125 still. Focus is on BOJ later in week, China data, with 110 barrier

- GBP: 1.2870 flat.Range 1.2831-1.2880 with Brexit Plan B focus – EUR/GBP .8830 up 0.1%. Watching 1.2780-1.2980.

- AUD: .7155 off 0.1%.Range .7150-.7182 with focus on commodities/China and jobs report later this week. NZD off 0.2% to .6725 with focus on CPI later this week.

- CAD: 1.3295 up 0.25%.Range 1.3251-1.3298 with 1.3250 base for 1.34 again. Oil and data important but rates and crosses driving now.

- CHF: .9985 up 0.3%.Range .9945-.9985 with EUR/CHF 1.1345 up 0.3% - less fear, more Davos.

- CNY: 6.7925 up 0.2%.Range 6.776-6.7960 with GDP driving more easing expectations 6.80 break opens 6.83-6.84 test.

Commodities: Oil up, Gold down, Copper off 0.5% to $2.7085

- Oil: $54.11 up 0.15%. Range $53.54-$54.41 with Brent up 0.1% to $62.75 with focus on China growth hopes. US cold weather.

- Gold: $1277.30 off 0.4%. Range $1276.70-$1283.00 with USD bid and equities holding driving $1268 next. Silver off 1.05% to $15.24 with focus on $15.20 and $15.00. Platinum off 0.4% to $798.80 and Palladium off 0.15% to $1332.90.

Economic Calendar: No major data today – US holiday

Data for January 22:

- 0600 pm Korea 4Q GDP 2%p 2.8%e

- 0400 am Spain Nov trade deficit E3.8bn p E3.0bn e

- 0430 am UK Dec claimant count 21.9k p 20k e / 3M Nov unemployment 4.1%p 4.1%e / average earnings 3.3%p 3.3%e / ex bonus 3.3%p 3.3%e

- 0430 am UK Dec PSNB GBP6.35bn p GBP1.2bn e

- 0500 am German Jan ZEW economic sentiment -21p -20.1e / current conditions 45.3p 43e

- 0830 am Canada Nov wholesale sales (m/m) 1%p 0.4%e / manufacturing sales -0.1%p -1.1%e

- 1000 am US Dec existing home sales (m/m) 1.9%p -1.3%e / 5.32mn p 5.25mn e

- 1130 am US sells 3M and 6M bills

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.

Comments

No Thumbs up yet!

No Thumbs up yet!