Markets: Goldilocks

Stories led sales, sales lead markets, markets lead central bankers. This logic will be tested today as the Goldilocks story about the Fed gets tested with the FOMC minutes and more Fed speeches. The not-too-hot growth for 2019 – estimated back at 2% by Wall Street analysts mixes well with the tame CPI estimated back below 2% thanks to global slowdowns. We all love zero real rates except the investor community looking for returns. The Fed Mester and Williams comments yesterday suggest more of a Powell collar than put on the S&P500. A rate hike risk given the rebound in equities and financial conditions is in play and the minutes will highlight the risk of the dissenters on patience and pauses. Adding to this risk for a rate turnaround is the USD. The Trump team leaked that the US/China trade talks today center around FX and a stable CNY. The decades-long push for China to become more market-led and less communist party leader led is being reversed. The “stable” CNY means a weaker USD to Trump and this maybe enough to send the FOMC back to talking tough. But there are larger implications for the world order afoot as the stable CNY may also mean its too strong for exports to Europe and EM. The battle in China and FX rests on getting the balance of capital inflows, the right economic growth – whether recharged from profligate government spending or forced lending or by exports. This isn’t a Goldilocks tale but one of Hansel and Gretel as the path home looks to be lost as the bread crumbs of capitalism have been eaten by populism. Many fear that the Trump approach to China is wrong, that reversing a blind faith in open markets puts the US back a notch in credibility and trust with its brethren in the EU and UK. However, the first sign of madness is expecting a different outcome from the same old actions. The US approach to China over markets has failed in the last 20 years and something new has happen in order for globalization to continue. This isn’t just on the US, it’s on the rest of the world. Goldilocks maybe enjoying her last gulp of porridge today as the rest of the story progresses from a quick nap to a nightmare being chased by bears. The rapid gains in the CNY last night merit watching as this chart bleeds over to the EUR and JPY and EM and makes the USD valuation game return to focus for investors – making bonds look rich, EM look cheap and the rest look unappetizing.

Question for the Day: Is there a Brexit end? The resignation of 3 Conservative MPs today offsets the joy of 7 Labour dissenters yesterday. The push and pull of Brexit politics may be nearing an end and if so, markets could find some relief in that certainty. The hope that there is no Brexit may still prove out – as there are still a sold set of investors and politicians in the UK that want this almost 3-year nightmare to end. The risk of another referendum or a deal that looks more like Norway maybe in play but it’s a modest 30% at best. The ugly hard Brexit risk for no deal and an inglorious exit remains around 20%. The more likely risk that seems in play is that the lack of political will to support May’s plan and the lack of alternatives push the UK to delay another 6-months in search of the consensus. This is a 50% chance. Playing out what this means to the GBP isn’t so obvious. There will be a higher chance that UK May leaves and a new election is called after this happens. There is also a higher probability that the UK finds delaying unpleasant decisions means trouble for capital and that investment decisions continue to bleed out of the economy. This is how recessions start – slowly at first then rapidly. The UK risks losing out its financial dominance in the interim. The GBP maybe looking more like a short again given the odds.

What Happened?

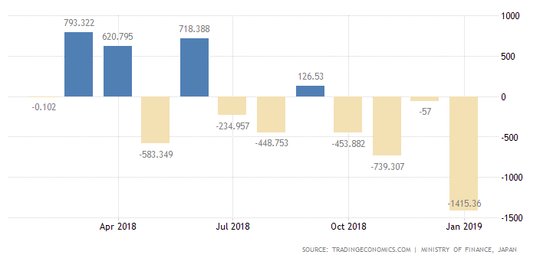

- Japan January trade deficit Y1.415trn after Y57bn- worse than expected.Exports off 8.4% y/y to 5.574trn after -3.8% y/y in Dec and worse than the -5.5% y/y expected. Imports fell 0.6% to 6.989trn after 1.9% y/y in December. Trade with China fell with exports -1.7.4% y/y, to Asia overall off 13.1% y/y, Europe exports off 6.6% y/y while exports to US rose 6.8% y/y.

- Australia January Westpac LEI 0% after -0.2% - weaker than +0.1% expected. The 6-month annualized growth fell to 0.43 from 0.29. “As discussed last month, despite some choppiness, the major trend is consistent with our view that growth has slowed from a solid above-trend pace to one that is at or below trend going forward,” said Westpac chief economist, Bill Evans.

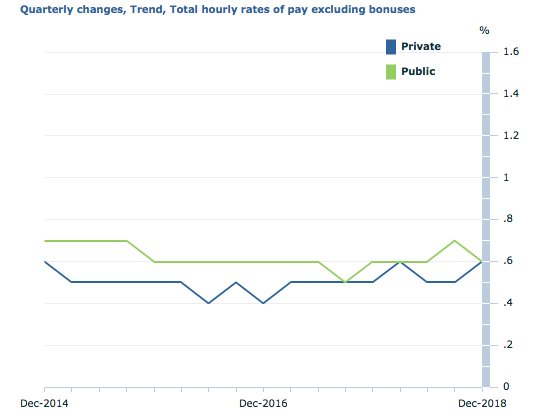

- Australia 4Q wage price index up 0.5% q/q, 2.3% y/y after 0.6% q/q, 2.3% y/y – less than the 0.6% expected. Private sector wages rose 2.3% y/y while public sector wages rose 2.5%. This was the highest private sector wage gain since 4Q 2014. By sector, there was wide variance from 1.6% y/y in Media to 2.8% in gas, water services and 2.8% y/y in health care.

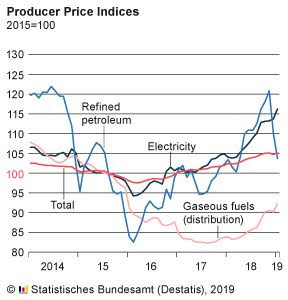

- German January PPI up 0.4% m/m, 2.6% y/y after-0.4% m/m, 2.7% y/y more than the -0.1% m/m, 2.2% y/y expected. Energy prices rose 7.2% y/y after 0.6% y/y, durable consumer goods up 1.6% y/y as were capital goods, intermediate goods rose 1.2% y/y and consumer goods up 0.6% y/y.

Market Recap:

Equities: The S&P 500 futures are off 0.1% after a 0.15% gain yesterday the Stoxx Europe 600 is up 0.35% while the MSCI Asia Pacific is up 0.7%.

- Japan Nikkei up 0.60% to 21,431.49

- Korea Kospi up 1.09% to 2,229.76

- Hong Kong Hang Seng up 1.01% to 28,514.05

- China Shanghai Composite up 0.20% to 2,761.22

- Australia ASX off 0.14% to 6,175.80

- India NSE50 up 1.24% to 10,735.45

- UK FTSE so far up 0.35% to 7,204

- German DAX so far up 0.30% to 11,344

- French CAC40 so far up 0.30% to 5,176

- Italian FTSE so far up 0.1% to 20,240

Fixed Income: Slight risk on helping stabilize the rush to bonds in Europe ahead of Brexit showdown and EU elections. German 10-year Bunds are flat at 0.10%, UK Gilts off 1bps to 1.16% and French OATs off 1bps to 0.52% - near historic lows. The Periphery mixed with Italy up 4bps to 2.82%, Spain off 1bps to 1.20%, Portugal up 3bps to 1.54% and Greece flat at 3.77%.

- Germany sold E4bn of 5Y 0% Bobl at -0.36% with 1.25 cover – previously -0.29% with 0.96 cover.

- US Bonds are bid with focus on FOMC minutes – 2Y off 1bps to 2.49%, 5Y off 1bps to 2.46%, 10Y off 1bps to 2.64%, 30Y off 1bps to 2.98%.

- Japan JGBs mixed curve flatter – 2Y flat at -0.18%, 5Y flat at -0.17%, 10Y off 1bps to -0.03%, 30Y off 1bps to 0.58%.

- Australian bonds rally on commodities, weaker wages – 3Y off 3bps to 1.66%, 10Y off 4pbs to 2.10%.

- China bonds are flat waiting for PBOC and US trade deal – 2Y up 1bps to 2.64%, 5Y flat at 2.91%, 10Y flat at 3.14%.

Foreign Exchange: The US dollar index is flat at 96.55. EM is mostly USD lower – KRW 1122.40 flat, INR up 0.2% to 71.158, ZAR off 1.35% to 14.224 – budget, RUB flat at 65.71

- EUR: 1.1340 flat. Range 1.1325-1.1358 with focus on FOMC now and 1.1380 break out risk for 1.1450 again.

- JPY: 110.75 up 0.15%. Range 110.53-110.95 with EUR/JPY 125.60 up 0.15%. Nothing to see here? CNY move matters 110 key.

- GBP: 1.3035 off 0.25%. Range 1.3012-1.3077 with EUR./GBP up 0.15% to .8695. All about politics and 1.30 pivot with 1.3150 cap.

- AUD: .7155 off 0.15%. Range .7141-.7177 with NZD .6860 off 0.35% fo us is on jobs tonight with .7050-.7225 in play.

- CAD: 1.3190 off 0.15%. Range 1.3177-1.3216 with Government risks rising but BOC hawks returning 1.3050 in play.

- CHF: 1.0010 flat. Range 1.0003-1.0021 with EUR/CHF 1.1345 off 0.05% - nothing new here but 1.00 pivot and .9880 return.

- CNY: 6.7210 off 0.5% - biggest move since Jan 24 – Range 6.711-6.7560 with focus on 6.70 and 6.80 for bigger moves – bias 6.62 again.

Commodities: Oil down, Gold up, Copper -0.1% to $2.8475.

- Oil: $56.14 off 0.5%. Range $56.00-$56.77. Brent off 0.7% to $66 with oil not looking as good as equities – focus turns on US rates and US growth with $55 base key for WTI and $66 the pivot for Brent.

- Gold: $1347.50 up 0.2%. Range $1342.40-$1349.80 with $1365 the next target but consolidation around $1345 more likely. USD key. Silver up 0.3% to $16.02, Platinum up 0.8% to $827.40 and Palladium up 1.5% to $1476.20.

Conclusions: Is this about communication? The Powell Put will be in play today. The market is going to focus on the FOMC and the balance sheet run down is where many see the biggest risk. The plan to leave the FOMC balance sheet closer to $3.5trn rather than $2trn is underway and its likely to come out in the minutes. This may offset anything that comes out about rate hike risks in 2019 as the run down in QE is QT and that has been blamed for much of the noise in global markets from 4Q. The risk-reward of trading around the minutes is unclear because of the communication games and may lead to a bigger risk-off move than some expect given the passive flows in February.

Economic Calendar:

- 1000 am Eurozone Feb flash confidence -7.9p -8e

- 0200 pm FOMC Minutes

- 0430 pm API weekly oil inventory -0.998mb p +1mb e

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.