Markets: Goats

We are herding up the scapegoats in hopes for a quicker end to the blame game for trouble into Friday and the month-end next week.

Blame Brexit and the US government shutdown, blame the US/China trade talks stalling, blame the China slowdown, blame politics but don’t think this slowdown is a recession – that is the message of the economic analyst community as we grind into Friday and the month-end next week. Embrace the gloom but recognize it will pass with time as the UK figures out what to do about its EU divorce (see the UK Sun with the DUP and May deal) and Trump figures out what to do about his wall (expect some more talks with Trump and Democrats today.)

The difference between a slowdown and a recession matters to investors and corporations. The deterioration of the present conditions stings less than fear about the future. So the ECB reactions this week matter and lead the markets as any rate hike risk moves further away. “The slowdown has surprised us ... we have to be very careful to monitor the data,” ECB Coeure told Bloomberg television, arguing that the jury was still out on whether this growth dip is temporary. While ECB de Galhau noted, “We remain committed to maintaining interest rates very low, which is good for the economy.” ECB Villeroy added to the policy outlook shift on Bloomberg TV saying, “We could consider the provision liquidity and credit to banks, it’s part of our toolbox.”

Reuters reports that Germany is cutting its growth forecast from 1.8% to 1% in 2019 and 1.6% in 2020. What seems most interesting with the weaker German IFO, lower Sweden retail sales, gloomier CBI retail sales today is that nothing really moves down – EUR/JPY is 124.50 same as yesterday as equities bounce on easing hopes from the ECB and 4Q earnings. The biggest story remains the biggest goat – Brexit – as the Queen steps into the debate with a delicately coded message to Parliament to end its bickering and to get on with the search for a common ground the matter. The story that the DUP and UK May have found that leads today’s price action. The biggest story is GBP, which breaks out of its 1.3070 55-day resistance and looks set for a run back to 1.34-1.35 resistance. This makes it clear that the goats are working in keeping future fears in check with longer-term greed.

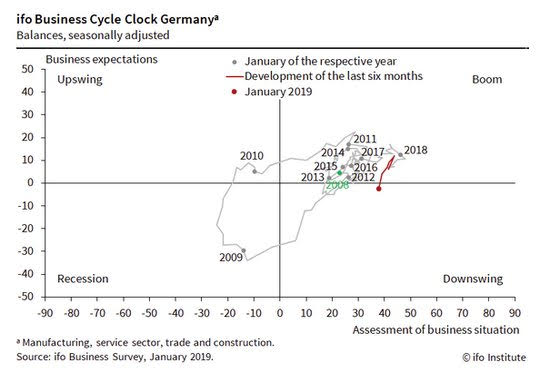

Question for the Day: Is the European downturn priced? Markets are trying to price the worst-case scenario still even as economists warn of downside risks to forecasts. The economic outlook from ECB Draghi press conference was cautious but didn’t outright declare a recession fear and the same is true for the forecasting community in Europe – as the usual ingredients for a recession like oil price shocks, inflation, credit bubbles, and leverage aren’t seen – in fact, the 3Q NPL loans at banks fell by E30bn. Evidence that the economy is fine remains harder to find in the PMI surveys yesterday or the IFO today. In fact, the German business cycle looks clearly in a downturn with risk for something worse ahead.

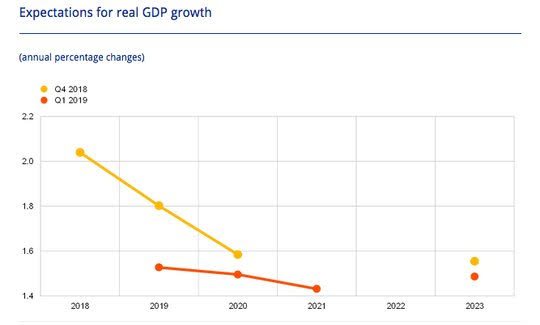

The 1Q 2019 ECB Survey of Professional Forecasters was released today. 1Q forecasts are lower for CPI by 0.2% with HICP seen as 1.5% in 2019, 1.6% in 2020 and 1.7% in 2021. 1Q GDP forecasts are lower by 0.3% with 1.5% in 2019, 1.5% in 2020 and 1.4% in 2021. Unemployment is expected to improve dropping to 7.8% in 2019, 7.6% in 2020 and 7.5% in 2021. The lack of fear that GDP will drop more than to potential or that unemployment will continue to fall stands out in these forecasts. The view that the US will see a recession in 2020 or 2021 also doesn’t seem connected to these views about Europe.

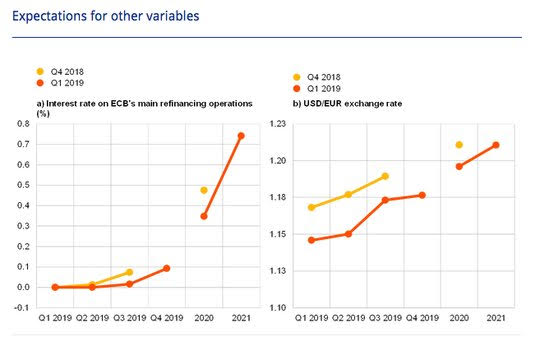

The role of the ECB in preventing the worst-case needs to be compared to that of the FOMC with available tools to off-set the stall of present growth being today’s main issue. Can the ECB do more targeted bank loans and will that suffice? Does a pause by the FOMC in rate hikes suffice in offsetting US government shutdowns and China trade concerns? Perhaps the most interesting part of the survey comes out of the EUR/USD forecasts where the EUR is seen rising along with the ECB refi rate – something that doesn’t square with the present gloom.

What Happened?

- Japan January Tokyo core CPI up 1.1% y/y after 0.9% y/y – more than the 0.9% y/y expected. The headline CPI was up 0.5% m/m, 0.4% y/y after 0.3% y/y. The core/core (Ex -food and energy) up 0.2% m/m, 0.7% y/y. By category: food +1% m/m, -1.7% y/y; Housing up 0.1% m/m, 0.5% y/y; fuel/water up 0.8% m/m, 7.1% y/y; culture and recreation -1.3% m/m, +2.3% y/y while tranport and communication -0.1% m/m, -0.6% y/y. Services were -0.2% m/m, +0.9% y/y while goods were up 0.3% m/m, -0.2% y/y

- Sweden December retail sales -1.4% m/m, -1.1% y/y after revised 1% m/m, 1.4% y/y – weaker than 0.2% m/m gain expected. November revised higher from 0.8% m/m. This was the biggest drop in sales since April 2010 on a y/y basis and worst month since Mar 2013. Internet / mail order sales fell 20.9% after -12.1% y/y, information and communications fell 2.9% after 13.3% y/y while trade stalls and market sales rose 17.1% after 6.5% y/y.

- German January IFO drops to 99.1 from 101 – weaker than 100.6 expected – lowest since Feb 2016. The current conditions ease to 104.3 from104.7 – better than the 104.2 expected – while the future expectations drop to 94.2 from 97.3 – weaker than the 97.0 expected. companies assessed their current business situation slightly less favorably. Their business expectations also deteriorated sharply and turned pessimistic for the first time since December 2012. The German economy is experiencing a downturn. By sector overall climate, manufacturing fell to 11.2 from 14.9, services 24.5 from 27.0 – but current conditions were higher, trade 4.6 from 9.2 and construction 20 from 29.3.

- UK January CBI retail trade 0% after -13% - weaker than +2% expected. Outlook for February +24%. Volume of sales was -37% - the lowest since Nov 2011. However, Orders rose +5% y/y – better than the -18% expected from December while February is seen +22%.

Market Recap:

Equities: The US S&P 500 futures are up 0.75% after a 0.14% gain yesterday. The Stoxx Europe 600 is up 0.7% and the MSCI Asia Pacific is up 1.1%. India is the exception today seeing a wave of profit taking into the close.

- Japan Nikkei up 0.97% to 20,773.56

- Korea Kospi up 1.52% to 2,177.73

- Hong Kong Hang Seng up 1.65% to 27,569.19

- China Shanghai Composite up 0.39% to 2,601.72

- Australia ASX up 0.68% to 5,971.10

- India NSE50 off 0.64% to 10,780.55

- UK FTSE so far up 0.2% to 6,832

- German DAX so far up 1.5% to 11,297

- French CAC40 so far up 0.9% to 4,915

- Italian FTSE so far up 0.8% to 19,716

Fixed Income: Dovish ECB, weaker data driving but equities and UK/US stories counter – German 10-year Bund yields flat at 0.18%, French OATs flat at 0.59% and UK Gilts flat at 1.27% while periphery mixed with Italy up 1bps to 2.68%, Spain of 2bps to 1.22%, Portugal off 3bps to 1.65% and Greece off 6bps to 4.10%.

- US Bonds are lower with equities driving and government opening hopes– 2Y up 2bps to 2.58%, 5Y up 2bps to 2.56%, 10Y up 2bps to 2.73% and 30Y up 1bps to 3.04%.

- Japan JGBs are bid with CPI and BOJ driving– 2Y off 1bps to -0.17%, 5Y off 1bps to -0.16%, 10Y off 2bps to -0.01%, 30Y off 1bps to 0.66%.

- Australian bonds rally in catch up post ECB– 3Y off 5bps to 1.73%, 10Y off 6bps to 2.22%.

- China stuck in thin, choppy market, new year focus– 2Y off 1bps to 2.63%, 5Y flat at 2.94%, 10Y up 1bps to 3.16%

Foreign Exchange: The US dollar index off 0.3% to 96.30. In EM, USD is mixed; EMEA -RUB off 0.8% to 66.233, ZAR up 13.68; ASIA - INR off 0.2% to 71.135,

- EUR: 1.1345 up 0.35%. Range 1.1300-1.1350 with 1.1280-1.1420 the hot points – focus is on US rates, politics and ECB.

- JPY: 109.80 up 0.2%. Range 109.52-109.91with EUR/JPY 124.55 up 0.6%. Equities, rates and 110 in play with risk-on mood.

- GBP: 1.3095 up 0.2%. Range 1.3057-1.3139 with EUR/GBP .8660 up 0.1%. Brexit deal hopes driving GBP breakout with 1.3250 next.

- AUD: .7115 up 0.3%. Range .7076-.7120 with NZD .7685 up 0.3%. Mixed commodities but China stimulus hopes and crosses driving with .7050-.7250 keys.

- CAD: 1.3320 off 0.2%. Range 1.3309-1.3361 with C$ stuck 1.3250-1.3400 – budget today unlikely to move story – watching rates/oil

- CHF: .9970 up 0.1%. Range .9950-.9969 with EUR/CHF 1.1305 up 0.4%. Risk mood better helps reverse cross but $1.00 capping.

- CNY: 6.7580 off 0.4%. Range 6.7560-6.79 with 6.73 back in play on stimulus beating trade talk.

Commodities: Oil lower, Gold higher, Copper flat at $2.6770

- Oil: $53.09 off 0.1%. Range $5300-$53.94 with $54 capping and focus on supply. Threat of US sanctions on Venezuela supports prices a bit but not enough to save the week, Brent off 0.35% to $60.89 with $60 pivotal. Brent is set for a 2.4% drop this week, the first in 4 as US inventories were larger yesterday and US/China trade talks seem stalled.

- Gold: $1283.70 up 0.3%. Range $1278.90-$1284.10 with USD driving and $1285 pivotal resistance. Silver up 0.45% to $15.37, Platinum up 0.45% to $808.70 and Palladium off 0.5% to $1274.40.

Economic Calendar: No major economic releases.

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.