Markets: Faith

First, I will take a break next week. We wish everyone a Merry Christmas and a Happy New Year. Second, the last full week of trading is ending badly. Markets are spooked about the risk of a US government shutdown, an FOMC policy mistake and at the slowing global economic picture – Larry Summers weighs in with his 2020 recession risk at over 50%.

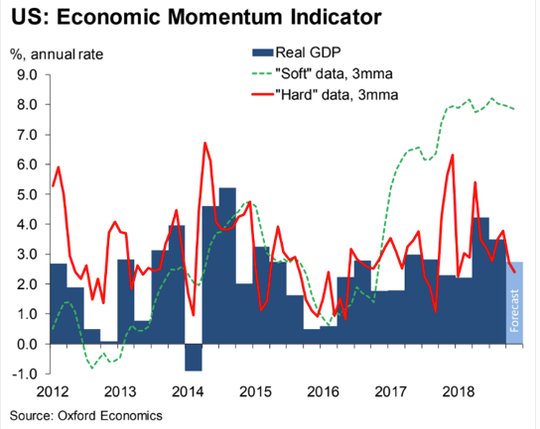

Throw in the renewed US cyber crime push back on China and you get more trade fears than truce hopes. The exit trade for risk has brought more volatility and volume – yesterday was the 3rd highest of the year – suggesting that this correction in the US and bear market elsewhere has true believers. Faith is a key part of the season and for enjoying stories with the suspension of disbelief essential. When you believe its even better. However, what you believe matters particularly in a market filled with volatility. This is the problem of the moment as the current conditions suggest a 2.6% 4Q GDP but the outlook for 2019 is grim and the forward looking data are weaker. Throw in the risk of inventory overhangs thanks to trade war hoarding and 1Q growth fears are significant in the US.

The conundrum of the present revolves around the unwinding of the US Federal Reserve’s balance sheet and its shift in tools from forward guidance to the blunt axe of rate hikes. The ability for the Powell Fed to shift away from “normalization” to “data dependent” means the forward view on rates is useless. The credibility of the central bank is at risk unless they can prove their economic forecasts are good and that the economy can withstand more hikes regardless of weaker inflation. This is where oil plays a role – as it’s a double-edged sword for 2019 – helping consumers and companies on their energy costs but hurting the US oil sector, hitting business investment and driving up spreads in high yield. The US shift to energy independence makes this oil price collapse complicated. Until we see more data, after Christmas and New Year’s, there is little reason to see hope for a significant bounce back in risk or in oil. Global growth and its connection to oil is not particularly a strong correlation, but it’s the one that investors have taken to believe in 2018 and it’s the barometer to watch until 2019. Chances for a bounce back to $50 in WTI seem high but hard to see what headlines work. Overnight there was a host of news and not a stitch of it really mattered.

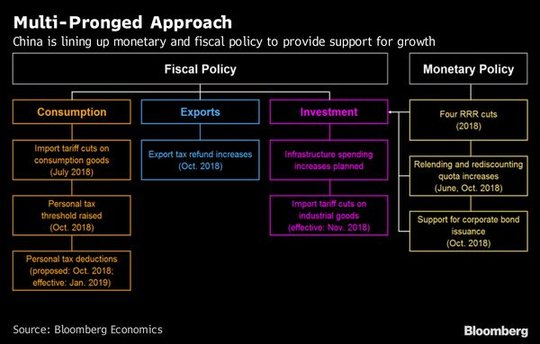

Question for the Day:Is China going to ring in a Happy New Year? Rumors of a China tax cut helped inspire a modest bounce back in risk in Europe. The least reported story from overnight comes from the China Central Economic Work Conference. China will keep next year’s economic growth within “a reasonable range,” with the government maintaining a pro-active fiscal policy and the PBOC holding a prudent monetary policy. The government will strengthen counter-cyclical adjustments of macro-policies, and make policy fine-tuning in a pre-emptive way, Xinhua said. China will strive to support jobs, trade and investment and resolve financing difficulties for small and private firms, while curbing risks and financial market volatility, it said. Note that the statement doesn’t increase spending or cut rates. The markets risk larger disappointment next week should the meeting produce no clear new programs.

The chart from Bloomberg sketches out the October promises of stimulus hasn’t worked to stave off further troubles in 4Q for China. Expect the market to continue to watch commodities, stocks and the CNY for direction on China growth risks for 2019. Bottom Line – the early reports on the meeting this week and the Xi speech on reform leave many worried that China isn’t going to do enough to counter the bigger downturn in growth for 2019.

What Happened?

- Japan November CPI -0.2%m/m, +0.8% y/y after +0.2% m/m, 1.4% y/y – less than the +0.1% m/m, 1.4% y/y expected. The core CPI 0% m/m, 0.9% y/y after 1% y/y – also less than 1% y/y expected. The core core CPI was up 0.3% y/y from 0.4% y/y. Food prices fell 0.8% m/m, up 0.5% y/y, Fuel/water was up 0.6% m/m, 5% y/y. Goods inflation was -0.5% m/m, up 1.4% y/y while Services 0% m/m, up 0.3% y/y.

- German January GfK consumer confidence 10.4 after 10.4 – better than 10.3 expected. At the end of the year, the schism between expectations regarding overall economic development (14.1 from 17.4) and development of personal finances (53.8 from 50.2) continues to grow. On the one hand, the downward trend in economic prospects is continuing, but on the other, the income expectations of households is still able to improve even at a high level. Since propensity to buy is also suffering losses (53.1 from 57.5), the consumer climate looks unchanged for January.

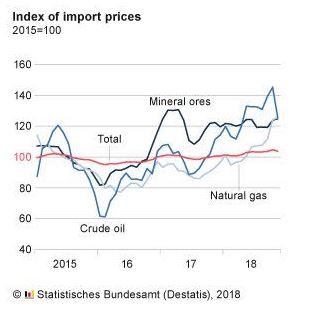

- German November import prices -1% m/m, up 3.1% y/y after +1% m/m, 4.8% y/y – less than 3.6% y/y expected. Export prices -0.1% m/m, +1.7% y/y.

- French 3Q final GDP revised to 0.3% q/q after 0.2% - less than 0.4% q/q expected. Household consumption rose to 0.4% q/q from -0.1% while government spending narrowed to 0.2% from 0.3% q/q. Imports -0.6% after up 0.6% while exports up 0.3% after 0%. Inventories -0.4% after _0.2%. Overall, domestic demand ex inventories was up 0.5% after 0.2% in 2Q.

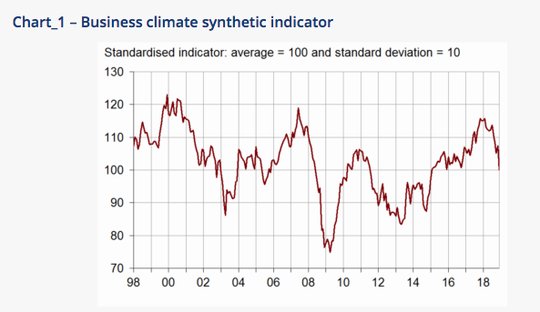

- French December business confidence 104 from 105 – better than 103 expected. This is the lowest since January 2015 and links back to the “yellow vests” movement. Many more managers than in November have also anticipated a decrease in their sales for the next three months. The corresponding balance of opinion has slipped back markedly and has moved below its long-term average, at its lowest since November 2016. By category – general outlook -38 from -21, sales -10 from -12, orders -4 from 0, employment outlook -6 from -2.

- French November household consumption -0.3% m/m after revised 0.9% m/m – weaker than -0.1% m/m expected- but October revised higher from 0.8% m/m

- Italy December manufacturing confidence 103.6 from 104.3 – weaker than 103.8 expected. The overall business confidence drops to 99.8 from 101. Services 99.5 from 101.7 and contruction 130.3 from 132.5. For manufacturing, Production expectations improved (balance from 9.1 to 9.8), while assessments on order books worsened (balance from -7.6 to -9.7). With regard to the assessments on inventories, the relative balance changed from 3.9 to 4.5.

- Italy December consumer confidence 113.1 from 114.7 – weaker than 114 expected. All the components lowered: the economic one from 131.5 to 129.4, the personal one from 108.9 to 107.0, the current one from 111.5 to 110.0 and, finally, the future one from 118.7 to 116.0.

- Sweden November retail sales up 0.8% m/m, 1.1% y/y after -1.1% m/m, 0% y/y – better than 0.6% m/m expected. Sales rose faster for information and communication equipment (12.3% from 8.7% y/y); cultural and recreation goods (3.3% from 2.9% y/y); and opticians (25.5% from 1.4% y/y).

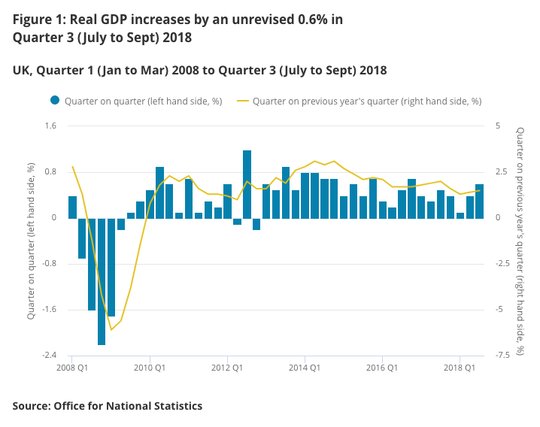

- UK 3Q final GDP 0.6% q/q, 1.5% y/y after 0.4% q/q, 1.4% y/y – as expected.Business investment -1.1% q/q after -0.4% - better than -1.2% expected. Services remained biggest contributor to growth, though it slowed slightly, but manufacturing and construction also added in 3Q.

- UK 3Q current account deficit GBP26.5bn after GBP20bn – more than the GBP21.2bn expected. The UK C/A is now 4.9% of GDP – largest since 3Q 2016. All components led to the worsening position -Primary income deficit –GBP3.6bn to GBP11.1bn, trade deficit wider by GBP1.8bn to GBP8.8bn.

- UK November PSNB GBP6.35bn after GBP5.957n - less than the GBP7.05bn expected. For the current FY borrowing is GBP32.8bn down GBP13.6bn from 2017 – best in 16-years. The total UK public debt is GBP1.795trn or 83.9% of GDP – up GBP59.3bn from 2017 – but unchanged on GDP ratio.

Market Recap:

Equities: The US S&P500 futures off 0.35% after -1.58% yesterday. The Stoxx Europe 600 is off 0.45% bouncing from down 0.8% while the MSCI Asia Pacific fell 0.5% even with Hong Kong and Korea bouncing.

- Japan Nikkei off 1.11% to 20,166.19

- Korea Kospi up 0.07% to 2,061.49

- Hong Kong Hang Seng up 0.51% to 25,753.42

- China Shanghai Composite off 0.79% to 2,516.25

- Australia ASX off 0.71% to 5,533.30

- India NSE50 off 1.81% to 10,754

- UK FTSE so far off 0.35% to 6,687

- German DAX so far off 0.35% to 10,574

- French CAC40 so far off 0.65% to 4,661

- Italian FTSE so far off 1.05% to 18,381

Fixed Income: Equities lead bonds more than central bankers right now. The waiting game is afoot for a bounce into the weekend as selling looks overdone in risk assets. For Europe, the bounce from the lows means bonds are sold – 10-year German Bund yields up 1bps to 0.25%, French OATs up 2bps to 0.70%, UK Gilts up 5bps to 1.31% while periphery is mixed – Italy up 6bps to 2.79%, Spain up 1bps to 1.39%, Portugal up 2bps to 1.67% and Greece up 8bps to 4.37%.

- US Bonds are flat into data and triple witching– 2Y off 1bps to 2.66%, 5Y flat at 2.65%, 10Y flat at 2.79% and 30Y flat at 3.01%.

- Japan JGBs steady despite ongoing equity pain, CPI miss– 2Y flat at -0.14%, 5Y up 1bps to -0.12%, 10Y up 1bps to 0.04%, 30Y up 2bps to 0.75%.

- Australian bonds sold off on profit taking, track US –3Y up 3bps to 1.90%, 10Y up 5bps to 2.38%.

- China bonds lower in bear flattening trade– with rate cut hopes dropping post Econ Conf – 2Y up 15bps to 2.96%, 5Y up 1bps to 3.08%, 10Y up 1bps to 3.36%.

Foreign Exchange: The US dollar index is up 0.3% to 96.55. In Emerging Markets, USD also bid – EMEA: TRY off 0.8% to 5.2975, ZAR off 0.25% to 14.429, RUB off 0.4% to 68.538; ASIA: KRW off 0.1% to 1122.85 and INR off 0.4% to 70.227.

- EUR: 1.1425 off 0.2%. Range $1.1412-1.1474 with US rates focus but 1.13-1.15 still key.

- JPY: 111.20 off 0.1%. Range 111.05-111.46 with 112 now resistance and equities key 110.80 and 110 next.

- GBP: 1.2660 flat. Range 1.2643-1.2698 with EUR/GBP .9020 off 0.25% - all about Brexit still with 1.25-1.28 holding.

- AUD: .7090 off 0.20%. Range .7072-.7124 with commodities lower and .7050 key. NZD .6740 off 0.5% tracking China

- CAD: 1.3535 up 0.2%. Range 1.3493-1.3541 with today’s data key and 1.3450 base for 1.36.

- CHF: .9895 up 0.2%. Range .9861-.9913 with .9820-1.00 holding for now – all about equities/ECB/safe-havens

- CNY: 6.9115 off 0.25%. Range 6.9085-6.9129. watching 6.92 and then 6.96 for $ breakouts. Trendline $ support now 6.8870 and rising.

Commodities: Oil lower, Gold lower, Copper off 0.4% to $2.7057

- Oil: $45.50 off 0.8%.Range $45.32-$46.77. Brent $53.34 off 1.8%. This is an oversold market without any interest leaves $45 WTI and $50 Brent as big levels that seem hard to break without news, but bounces look to be sold.

- Gold: $1263.30 off 0.3%.Range $1259.30-$1266.20 with $1268 the key upside resistance the $1275 and beyond. Silver $14.75 off 0.8% with $15 the big focus again. Platinum off 0.7% to $790.10 and Palladium off 1.05% to $1179.10.

Conclusions: Will the data matter today? The US growth momentum is slowing, but is it reversing into a recession? That is the key question for 2019 that most investors are trading now. The Fed surveys are forward looking and both New York and Philadelphia reports this week were much weaker than feared. The outlook for 2019 is weaker and today’s noisy durable goods orders maybe something to watch – particularly if they are better than expected as the market is set up for a bounce back.

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.

The best thing that could happen is that JP gets off his high horse and admits he blew it, Oil and Trump's Folly (tariffs) for now seems to be doing his dirty work so there need not be any further rate increases for 2019. If anything they should be lowered. The economy is very fragile.