Markets Eye Record Highs As Powell’s Dovish Tone Fuels Rate-Cut Bets

Image Source: Unsplash

Looking at the current macro perspective, we can conclude that investors largely interpreted Powell’s Jackson Hole speech as dovish, with hints of possible rate cuts ahead. At the same time, some commentary online framed the speech as hawkish, leaving markets with a conflicted view that could encourage rotational behavior.

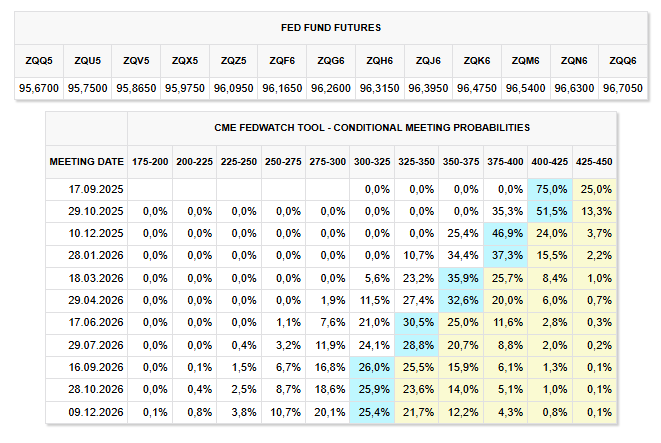

Rate cut odds for September have recovered back to around 75%, though still below the 99% seen one to two weeks ago, largely due to the hotter PPI print. While the dovish rate trajectory through 2027 supports the case for new equity highs, inflation risk remains the main wildcard. If investors perceive cuts as inflationary, the rally could quickly turn into pressure, so caution is warranted.

The E-mini S&P 500 jumped about 1.5% on Friday, erasing the prior week’s downside rotation and now eyeing new record highs. Yield curve dynamics add nuance: the 10s2s spread is steepening, suggesting easing Fed pressure on the short end and improved medium-term growth expectations, which is bullish near-term. However, rising long-end yields and inflation risk keep volatility in play. The 5s30s spread shows confidence in long-term growth, but also higher inflation risk.

In short, the market is doubling down on rate-cut expectations with a dovish interpretation of the Fed’s message, reinforcing risk-on sentiment. But one viral headline may have been misunderstood: Powell noted the Fed’s new framework removes references to averaging inflation at 2% and to only responding to “shortfalls” in employment. In practice, this means inflation is now a strict 2% target (not averaged), and employment will be balanced, both strong and weak conditions matter, not just the weak. Structurally, this is a less dovish framework than the Fed’s 2020 version.

Going forward, employment data will be the decisive factor for cuts, especially given the heavy revisions in the last NFP print that shook the macro outlook. Inflation remains the key risk to monitor.

More By This Author:

US Equities Signal Bullish Technicals, But Hot Inflation Data Clouds Rate-Cut Outlook

Markets Hold Firm Above Highs As Inflation Expectations Clash With Rate Policy

MicroStrategy, Now Strategy, Eyes High Returns As Bitcoin Surge Fuels Bullish Outlook: Equity Analysis

Enjoyed this article? Invest in a subscription to expand your horizon towards advanced wealth creation.

Visit our more