Markets: Consensus

When you get consensus, you find common ground and get common returns. Risks perversely rise as they do for a herd of sheep with any surprise potentially leading to a panic. Shared outcomes are fine for society but not investors. There is the rub as the BOJ delivered nothing new except for the lower inflation forecast. The belief that Japan disinflation can end with keeping policy unchanged requires a suspension of disbelief. There is madness to central bankers in thinking the same policy that hasn’t worked in the last year will do so now. The consensus for US and China trade talks continues to be one of fragile hope for a deal or delay to the March 1 deadline. Perhaps its madness to think that the IP and tech issues will be resolved quickly even as Beijing promises more stimulus today. The consensus for UK Brexit is one for a delay as Plan B is Plan A and EU pushback on Ireland continues. Perhaps its madness that GBP trades over 1.30 now with 1.34 next in play. The consensus is that the US is going into a recession in 2020 or 2021 and that the USD is going down. This despite the fact that inflation is contained, FOMC policy mistakes are less obvious with their patience talk, US inventories and oil shocks are not obviously in play – leaving the fear for trouble ahead linked to financial risks for bubbles like 2000 and 2008 with Tech and Housing. The consensus bubble is about leveraged loans and credit globally being out of whack after a decade of QE and zero rate policies. This puts the BOJ, ECB and others on the block for risk watching. For trading this consensus you merely have to watch the USD as its weakness confirms that it’s a late stage game where equities can continue to climb a wall of worry and hopes for geopolitical peace from the UK and China hold. The USD star from yesterday wanes today with 95 on the index the next bear target. Watch the tiger not the sheep today.

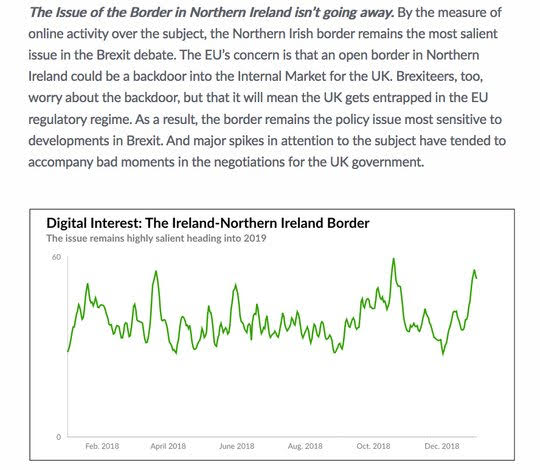

Question for the Day:Does Brexit matter anymore? There is a Brexit boredom in the US and Europe. Headlines matter less and less to markets and there is a growing sense consensus that the worst case won’t happen (hard Brexit), so all other outcomes are better. The sticky issue that remains in the news is about the Irish Border.

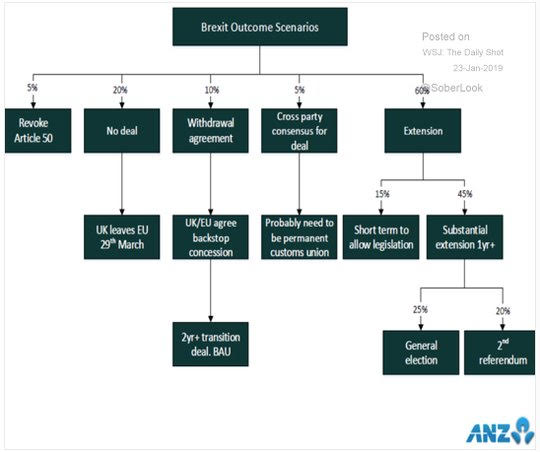

The timeline for any resolutions to Brexit matter as it’s the ongoing seemingly infinite process – that drives down future investments and growth in the UK. There is a hard deadline of March 29 to exit the EU. The PM appears to see going back to Brussels and get more assurances over her Irish backstop as the key for Plan B.

There is a vote on Plan B for January 29 where many expect Parliament to ask PM May to get a delay. The deadline to delay Brexit is setting up for Feb 26. The time line for such all matters to markets as it sets up the uncertainty around the GBP and the UK economy. Today’s CBI report highlighted the effect of such on business capex plans. There is a negative feedback loop at play here and even with the present GBP respite given higher hopes for a delay, markets maybe surprised by the cost of this on the real economy.

What Happened?

- New Zealand 4Q CPI up 0.1% q/q, 1.9% y/y after 0% q/q, 1.8% y/y – as expected. The average price of gasoline fell 0.6% q/q after +5.5% q/q – first drop since Sep 2017. The price gains were led by airfares (up 7.6% q/q) and toys/hobbies (up 13%) but countered by lower food )off 1.3% with vegetables off 21%) and tobacco prices. Housing and rent calculation changed – with housing up 3.1% y/y, rentals up 2.4% and construction up 3.6%.

- Japan December Trade deficit of Y55.2bn after a deficit Y738bn - slightly worse than Y30bn expected. The Japan exports fell 3.9% y/y to Y7.024trn – worst in 2 years - while imports rose 1.9% y/y to Y7.0779trn. By nation, exports fell to China by 7%, US up 1.6%, to Europe up 1.3% y/y.

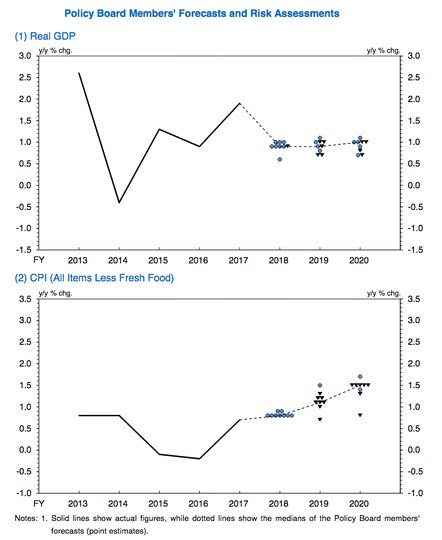

- Japan BOJ keeps policy unchanged as expected and lowers inflation outlook. The vote was 7-2 to keep yield curve control with 10-year target near 0% and short-term rates -0.1%. Dissents were from Harada who pushed for more forward guidance and from Kataoka who wanted more easing measures. The JGB buying was kept unchanged at Y80trn with unanimous vote. The forecast changes for inflation outlook were shifted down for FY2018 and mostly unchanged for 2019 and 2020. The risk balance for CPI and GDP were both seen on the downside.

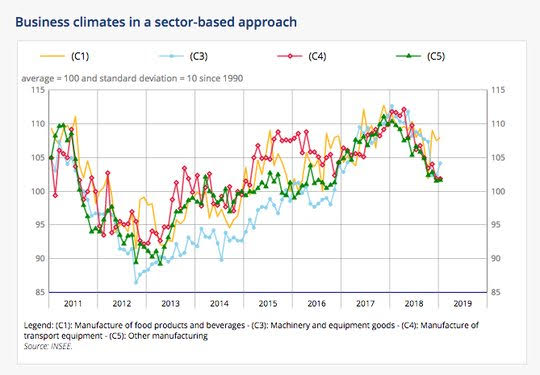

- French January business confidence steady at 103– as expected – but December revised from 104. Manufacturers remain pessimistic about general prospects -11 from -10 while personal expectations fell to 9 from 11. Workforce size slowed to 1 from 4, export orders -11 from -9 while overall orders improved to -12 from -13 and inventories fell to 8 from 10.

- UK January CBI industrial trends orders -1 after 8 – worse than 5 expected. The 1Q optimism -23 after -16 – as expected. The new domestic orders were flat in past 3M while export orders picked up. Orders were strong. However, optimism fell sharply amid Brexit uncertainty. Investment decisions are below their long-term average while inventories rose.

Market Recap:

Equities: The S&P500 futures are up 0.2% after losing 1.42% yesterday. The Stoxx Europe 600 is up 0.1% after opening down 0.2% and gaining 0.4% yesterday. The MSCI Asia Pacific fell 0.1% with mixed views on China growth/US trade deals.

- Japan Nikkei off 0.14% to 20,593.72

- Korea Kospi up 0.47% to 2,127.78

- Hong Kong Hang Seng up 0.01% to 27,008.20

- China Shanghai Composite up 0.05% to 2,581.00

- Australia ASX off 0.26% to 5,908.70

- India NSE50 off 0.84% to 10,831.50

- UK FTSE so far off 0.25% to 6,884

- German DAX so far off 0.10% to 11,077

- French CAC40 so far up 0.25% to 4,859

- Italian FTSE so far flat at 19,440

Fixed Income: Technically failed German sale, mixed equities, slightly better EU data, more hopes for Brexit delay – all that push rates up. German 10-year Bund yields up 3bps to 0.24%, French OATs flat at 0.65%, UK Gilts up 3bps to 1.35% while periphery mixed with Italy up 2bps to 2.77%, Spain off 1bps to 1.33%, Portugal off 2bps to 1.58% and Greece up 4bps to 4.16%.

- Germany sold E3.2bn of 0% 5Y Bobl at-0.29% with 0.96 cover but after Bundesbank retention 1.2 cover – previously in Nov sold E2.447bbn at -0.22% with 1.26 cover.

- US Bonds are lower with equity bounce– 2Y up 3bps to 2.60%, 5Y up 3bps to 2.60%, 10Y up 3bps to 2.76% and 30Y up 2bps to 3.08%.

- Japan JGBs stuck with BOJ on hold– 2Y flat at -0.16%, 5Y flat at -0.15%, 10Y up 1bps to 0.01%, 30Y flat at 0.68%.

- Australian bonds rally in catch-up to US move – 3Y off 2bps to 1.80%, 10Y off 1bps to 2.29%.

- China bonds mixed with focus on government stimulus plans– 2Y off 2bps to 2.64%, 5Y up 1bps to 2.96%, 10Y up 1bps to 3.15%.

Foreign Exchange: The US dollar index off 0.05% to 96.25 with focus on 96.60 resistance against 95.25 support.

- EUR: 1.1365 up 0.05%. Range 1.1351-1.1372 with 1.1320-1.1380 key for any momentum while 1.13-1.15 hold with ECB key tomorrow.

- JPY: 109.65 up 0.25%. Range 109.32-109.80 with 110 pivotal - EUR/JPY 124.65 up 0.3%. All about BOJ on hold, US rates and equity mood.

- GBP: 1.3040 up 0.65%. Range 1.2942-1.3042 with EUR/GBP .8720 off 0.55% - all about Brexit delay hopes and 1.30 breakout for 1.33-1.34 risk.

- AUD: .7135 up 0.2%. Range .7118-.7144 with .7220 key resistance and focus on China/commodities still. NZD up 0.6% to .6790 with CPI enough to slow RBNZ easing talk.

- CAD: 1.3315 off 0.3%. Range 1.3312-1.3359 with 1.325-1.340 holding – back to watching data/rates.

- CHF: .9975 flat. Range .9962-.9990 with EUR/CHF 1.1335 flat. Less fear means less CHF trading – 1.1280-1.1450 cross key.

- CNY: 6.7875 off 0.3%. Range 6.7760-6.8030 with US trade talk headlines driving, 6.80 pivot in play watching 6.77-6.83 now.

Commodities: Oil up, Gold up, Copper up 0.35% to $2.6920

- Oil: $53.48 up 0.9%.Range $52.69-$53.64 with focus on API and equities today - $54.50 key for WTI – while Brent up 0.9% to $62.06 as $62 pivot points to $64 retests.

- Gold: $1284.30 up 0.1%.Range $1282.40-$1286 with $1278 base for $1295 again depending on USD. Silver up 0.5% to $15.41, Platinum up 0.5% to $795 and Palladium off 0.2% to $1303.80 (FT story warning on tech risk key).

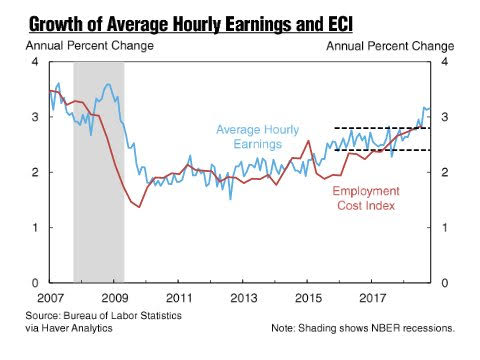

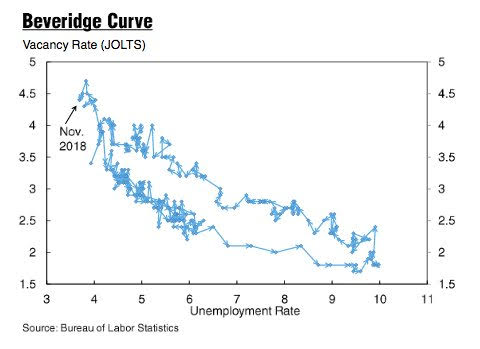

Conclusions: Are we about to return to wage inflation? The NY Fed research on the Beveridge Curve– job openings vs. unemployment – has finally returned to “normal” as shown in its latest US outlook.

Many see the risk now for higher wages to follow. This is at odds with the consensus for lower CPI and more downside risks in 2019. The risk for another round of rate hike talk from the Fed maybe in play after 1Q.

Economic Calendar:

- 0830 am Canada Nov retail sales (m/m) 0.3%p -0.5%e / ex autos 0%p -0.5%e

- 0900 am US Nov FHA house prices (m/m) 0.3%p 0.2%e

- 1000 am US Richmond Fed manufacturing index -8p -6e

- 0430 pm US weekly API oil inventories -0.56mb p

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.