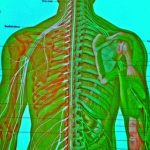

Market’s Central Nervous System

The spinal cord is the main pathway for information connecting the brain and the peripheral nervous system. Strong and well protected, we tend to take its health for granted.

The market’s rally since November mirrors our own central nervous system.

The main pathway for information that has helped spur the rally is the optimism of a continuing economic recovery.

Looking at President Trump’s policies since taking office, he has pulled out of a trade agreement in Asia, taken a tough stance with companies manufacturing in Mexico and, with an executive order, gave the greenlight to pipelines in the Midwest.

All with the intention of creating jobs in the U.S.A.

The Dow’s vertebrae, which protects its spinal cord (hence the bullish case), believes that he will get the economy moving faster. What’s good for companies, is good for the shareholder’s bottom line.

Spinal cord injuries can easily occur from overstretching, overexerting or by experiencing a spinal cord injury such as a sudden blow or cut to the spine.

Given the precarious nature of the spine, is the market taking its own healthy central nervous system for granted?

One possible spinal injury is if President Trump does not play nice with China. The Chinese government owns more than a trillion dollars in our government bonds.

Should China decide to sell those bonds, interest rates will go through the roof. If borrowing costs rise too much, the economy comes to a screeching halt.

A big blow to the spinal cord.

A trade war with Mexico? The U.S. by far, exceeds how much we buy from them versus what they buy from us (except for computer accessories, oil-related products and computer chips).

The U.S. imports over $295 billion dollars of Mexico’s auto parts, cars, trucks, crude oil, TV and video equipment, household appliances, fruits and vegetables. Nearly 15% of all goods the U.S imports from the entire world comes from Mexico.

Mexico spends about $50-75 billion dollars buying goods from us.

Just today, Trump proposed a 20% tax on all imports from Mexico. Doesn’t that mean we Americans pay even more for goods?

Healthy spinal cord-take that!

The bullish rally may have old bones. Nevertheless, the stock market continues to have reasons for taking its healthy central nervous system for granted.

The S&P 500 holds its runaway gap to new highs. Homebuilders and Transportation forge higher. Plus, the financial sector looks as though it has room to advance prices even more.

Perhaps the market is already taking steroids. After all, they are effective in treating many minor spinal cord injuries.

However, if a spinal cord tumor develops, watch for a loss of sensation, muscle weakness and increased back pain. That could lead to a sharp decrease in nerve function.

S&P 500 (SPY) Runaway gap to new all-time highs confirms which means cannot fill that gap to 228.34

Russell 2000 (IWM) 138 key resistance and 135.50 key support

Dow (DIA) Captain still has the seatbelt sign off as the Dow feels free to move about the cabin

Nasdaq (QQQ) Holding its runaway gap

KRE (Regional Banks) 56.73 now pivotal as this closes on new all-time highs

SMH (Semiconductors) Holding runaway gap

IYT (Transportation) 171.16 the high. Today’s high 171.15…double top? No evidence but worth watching

IBB (Biotechnology) 274 resistance 240 support

XRT (Retail) 43.90 pivotal resistance. Under 42 disastrous

IYR (Real Estate) A close this week over 78.25 would be interesting

GLD (Gold Trust) Maybe at 112 area worth a new shot

SLV (Silver) 15.75 should hold if good

GDX (Gold Miners) A drop to around 21.50 would be a gift

USO (US Oil Fund) Like how its holding

TAN (Solar Energy) 18.00 key

TLT (iShares 20+ Year Treasuries) Broke the 120.25-119.50 support.

UUP (Dollar Bull) 25.80 support held again. Key

FXI (China) 36.20 should hold now

Disclosure: None.

Thanks for sharing