Market Morsel: Cash And Carry

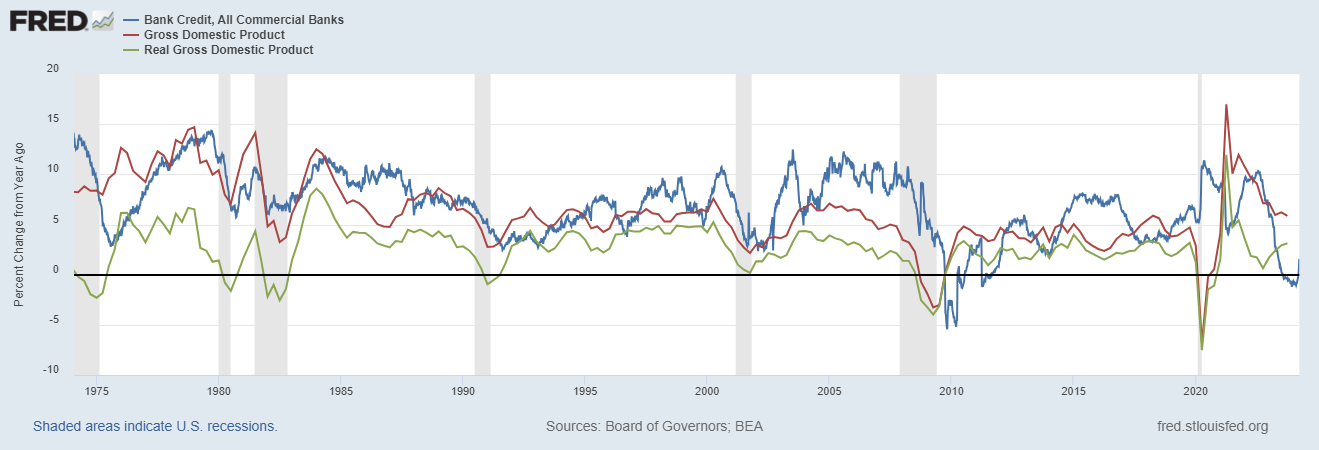

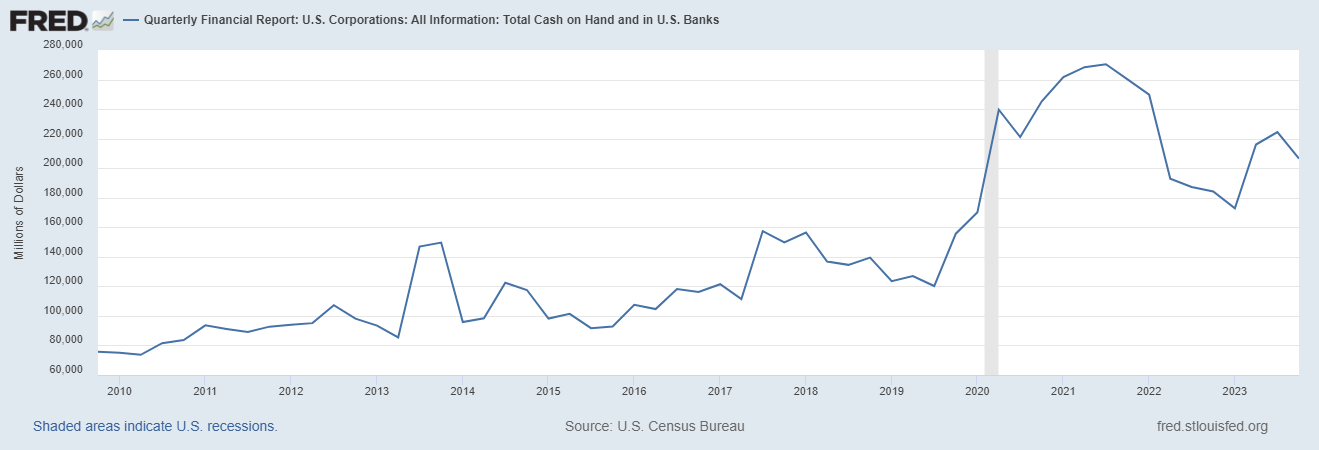

Total bank credit (blue line) vs Nominal GDP (red line) and Real GDP (green line). A lot of “analysts” were saying that the big drop in the year-over-year change in credit was pointing to a recession. But that isn’t how this works. GDP actually leads credit – economic growth increases the demand for credit – so the rise in credit we’re seeing now was predicted by GDP last year. Unfortunately, this doesn’t tell us much about future growth but with corporate cash still elevated compared to pre-COVID and corporate cash flow at an all-time high and household balance sheets are also flush with cash so there’s a lot of room for expansion.

(Click on image to enlarge)

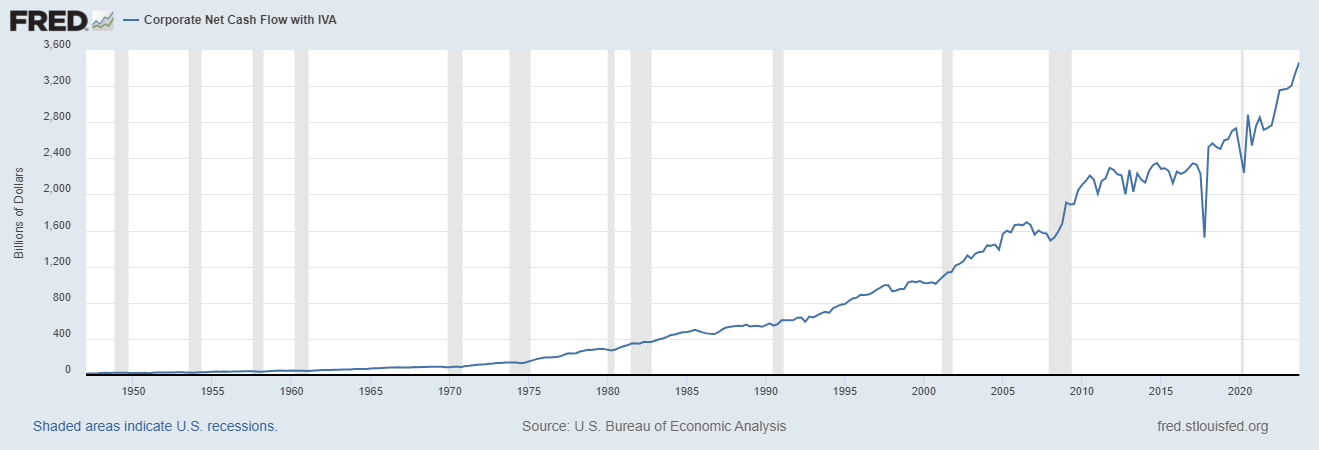

Corporate net cash flow

(Click on image to enlarge)

Corporate total cash on hand

(Click on image to enlarge)

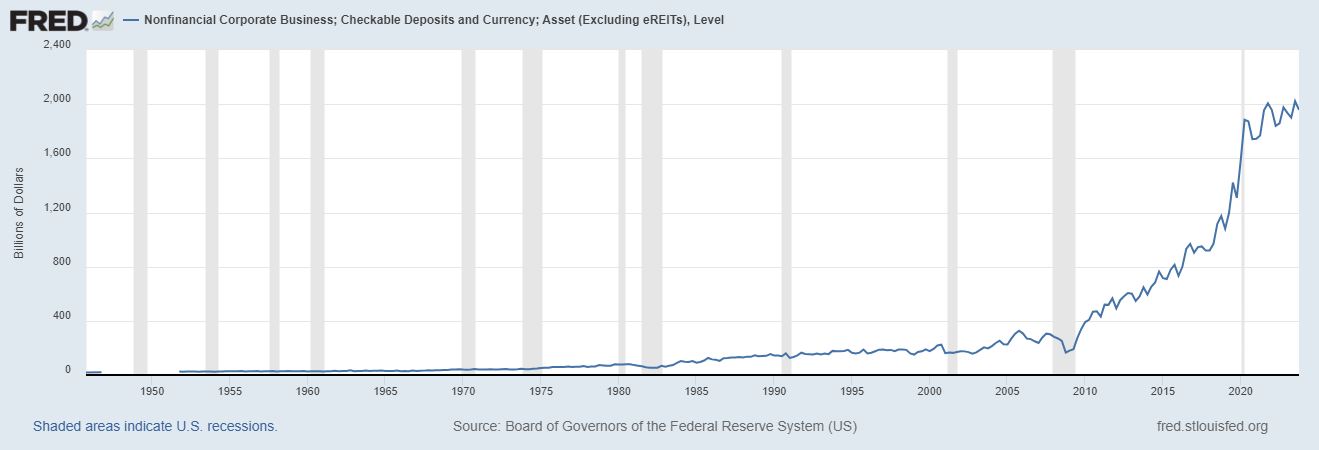

Corporate checkable deposits and currency

(Click on image to enlarge)

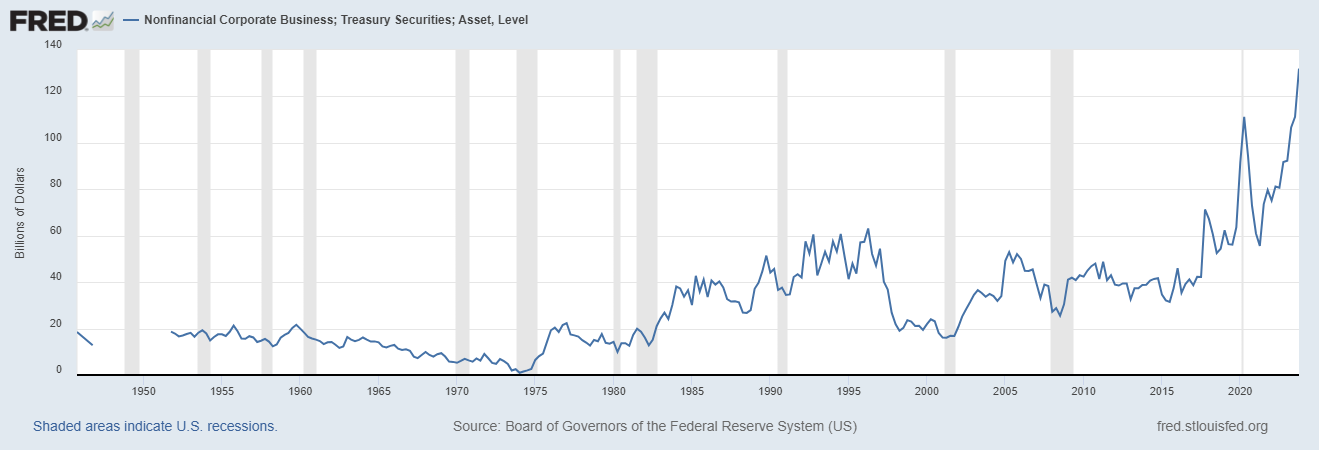

Corporate holdings of Treasury securities

Government budget deficits are highly correlated with corporate profits so a lot of the former means a lot of the latter. Companies are sitting on a lot of cash which they are recycling into Treasuries. Ah, the circle of life.

(Click on image to enlarge)

More By This Author:

Weekly Market Pulse: A New Paradigm?Weekly Market Pulse: Rational Exuberance?

Weekly Market Pulse: An Economic Overview

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more