|

Consolidated dynamics - would be a way to describe the choppy action dominating Tuesday's behavior, which was mostly static. Plus mild late defensiveness, all ahead of tomorrow's FOMC 'perspective'. Quite a few stocks that bounced nicely on Monday simply consolidated on Tuesday. Neither bulls nor bears got particular affirmations.

(There's continuing pushback against Trump's COVID remarks and his appointees in positions, there should be commendation for their efforts to broker these diplomatic achievements, which actually overshadow even the China trade or Nafta 2.0 efforts, at the same time there are critics aiming at our withdrawal from the TPP Agreement.)

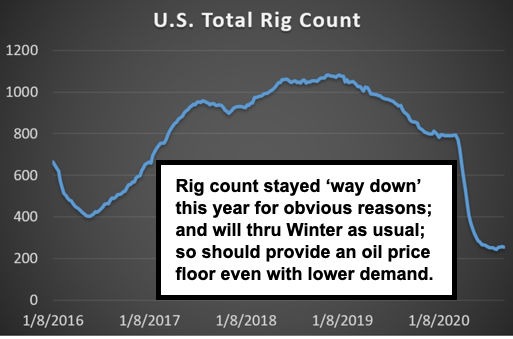

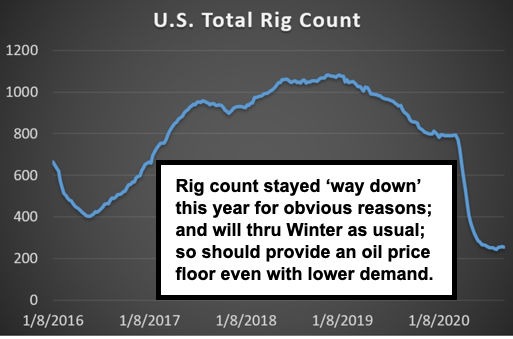

Technically, the S&P is looking more like a faltering rebound, sort of trying neutrality in a pre-Fed scenario. Analysts thinking the Fed won't move until early 2023, invites a lot of inflation between now and then. But that's a more macro concern for now, with higher prices (including food) obscured by lower Oil (OIL) and other prices, even currently. I suspect the aftermath of West Coast fires won't help Central Valley agriculture either. Overall even the economy is bifurcated (part of the social divisiveness as well).

So, rather than a catalyst forthcoming as some see that's either behind or ahead, we are in that clearly-visible technical zone of a bounce that is struggling where it should. Economic activity fell in an unprecedented way, and got relieved by unprecedented large stimulus. That's missing now, as is any cure, effective vaccine, or therapeutic.

Executive Summary:

- Market dynamics are basically static, with S&P (SPX) having a requisite rebound off of a last-ditch short-term technical point as outlined, but needs more time to resolve.

- Ultimately we still have a Fed (unless they modify posture tomorrow and won't) that pivoted to unbridled expansionism, excess liquidity, and the prospects for amazing economic growth in the next two years, with certain caveats to that,

- And that's even aside 'catches' surrounding the key Election outcome, and we get that, it is the short-term aspect we're focused-on right now, and that's a short-term spot in the middle of a technical range (for the S&P at least).

- We visualize a sustainable broad economic recovery, see a structure for it in the context of 'this' Fed posture, but there are incredible near-term uncertainties, and short-term market risks regardless of where this could go in 2021-2022.

- I did not say 'insurmountable obstacles' because they may not be insurmountable but that does depend on the Election (and stimulus before that), lots pending.

- Meanwhile we congratulate the President (mostly Jared) on the signing of Peace Agreements brokered by the Administration between Israel, Bahrain and UAE.

- If indeed the President gets a Nobel Peace Prize, Jared would deserve Honors, and by the way Trump's critics should congratulate not fulminate over this, Tom Friedman of the New York Times is at the helm, upset with Trump's latter part of the COVID handling (notably not the start), while thrilled at the Mideast dealings.

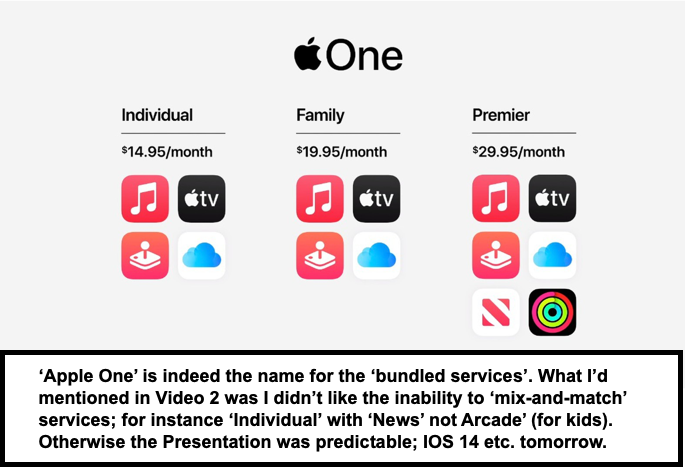

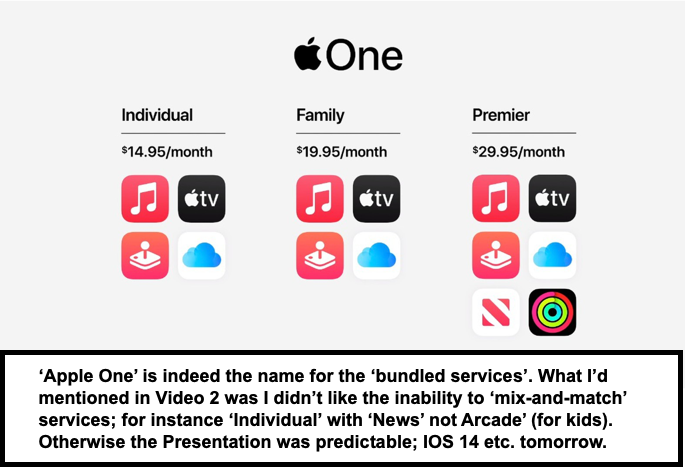

- Apple (AAPL) releases new IOS and other software tomorrow, while the services 'bundle' was released, and as suspected was named 'Apple One' (a 2nd video focus), at least to me the new software is really significant, due to picture-in-picture both for IOS and Apple TV, and big improvements in how 'text messaging' will work.

- The Apple 'bundle' approach is more a threat to competitors, I'm just being picky about wanting mix-and-match within bundles, and they may eventually do that or tie it into purchase of an iPhone 12 (what a brilliant idea ..hah).. next month.

- The healthcare services 'are not' part of a required bundle (though will show for that Health/Fitness App as well), while the Pulse-oximeter function is included in all Apple Watch 6's, but not in the price-leader SE model.

- Apple should be able to hold margins and upsell somewhat, with the incremental increased income from services, which is a trend we've noted for a long time (it's the wisdom of leveraging the ecosystem which Sony (SNE) failed to do years ago when they were really pioneers in most of the areas, from laptops to music devices).

- So yes, 'if' (as we suspect) relations won't deteriorate so far with China that needs Apple redefining their manufacturing more than we already know is underway, it's not impossible that Apple works higher over the next year (even essential given it as the dominant leader for the S&P).

- Bottom-line: Wall Street overly fixated on the importance of a 5G iPhone ramp to sustain Apple, that will help but people realize the range limits of mid-band 5G as well as the reality that low bands so far are often slower than good LTE signals, I will address this more when I see if they use the Qualcomm 865+ chipset, too (QCOM).

- FedEx (FDX) (beat numbers), it and UPS (UPS) are both flying, and that lends support to ideas that we don't need more stimulus, but again a great many small businesses (not merely neighborhoods) are in big trouble and won't make it to next year without.

- Federal Stimulus to 'plug the leaking hole' in the economic dike through elections is essential to get most of the population below the top 30% through this ordeal in a remotely adequate way, so whether grasped or not, this is important right now.

- Around elections is 'coincidentally' also likely about the time the first vaccines will be submitted for approval, with (more urgent) therapeutics perhaps a bit faster, a couple new antibody approaches are forthcoming (like the one from U. Pittsburgh and perhaps one or two more).

- Incidentally, if reports that The White House insisted the Israeli delegation should 'not' wear masks at today's ceremony (and they did not, which may be why it was held outdoors) is true, they should be embarrassed (an Israeli security official told their Prime Minister to stay in the hotel, while White House staff tried dismissing need for masks, and the story is that compromise was the outdoors setting).

- If the above is correct or not will probably be TV media 'fodder' but there's another thought, some suspect Trump isn't worried about masks, if he had a COVID case a couple months back, that responded well to Hydroxychlorquine, Zinc and Z-pack, if so it would explain specific accurately-spoken references to the combination.

- The 'sedition' accusations by the recently-appointed HHS spokesman are totally inexcusable (and he may resign), but they do reveal efforts to politicize handling of health and COVID-data issues, which again does little to foster faith in what the CDC or FDA have to say, and may include favoritism for certain big pharmas.

- What this all comes down to is 'stress analysis', and so in my usual tendency of blending influencing factors, I think all this contributes to uncertainty, to stresses in every way (not just political or the Fed), including food and survival necessities for a significant portion of the population to 'survive' these next few months.

- Behind all that is the reality that COVID 'will' collide with the seasonal influenza, so while politicians (both sides really) don't want to talk about that, it's an economic challenge to the people, the health services, and the stock market, like it or not.

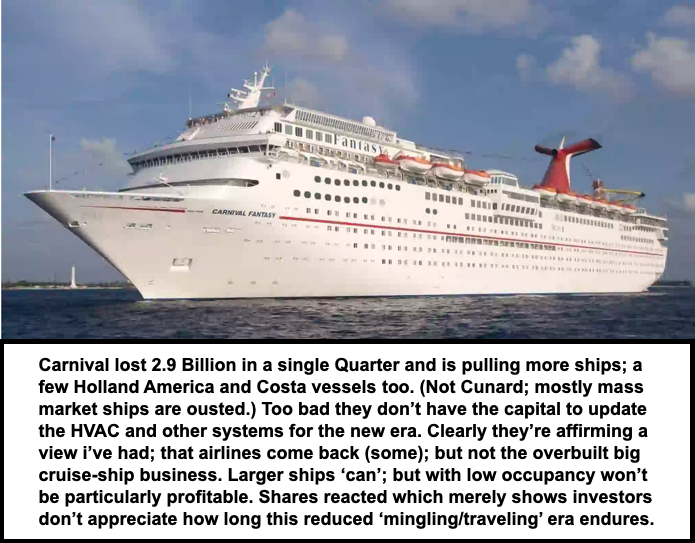

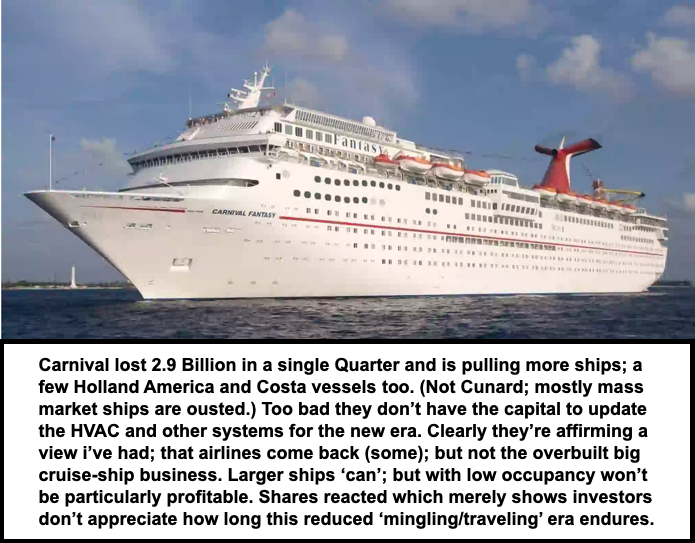

(Carnival also announced a dilutive offering, so that impacted it as well.)

Many variations of 'COVID relief' are on-the-horizon but they're not here now. Saying it is nowhere near resolved is not political, while to say otherwise is coloring the reality that the Nation, or for that matter much of the world, still finds itself contending with.

There is 'rumination' that a 1.8 Trillion further bailout is being batted-around in DC, to which I'll say it's about time, given the proximity of more mass suffering, also reduced discretionary spending by many lower-income families on-the-edge yet-again, and an impact on the ability to respond to current disasters, that itself has economic outflow.

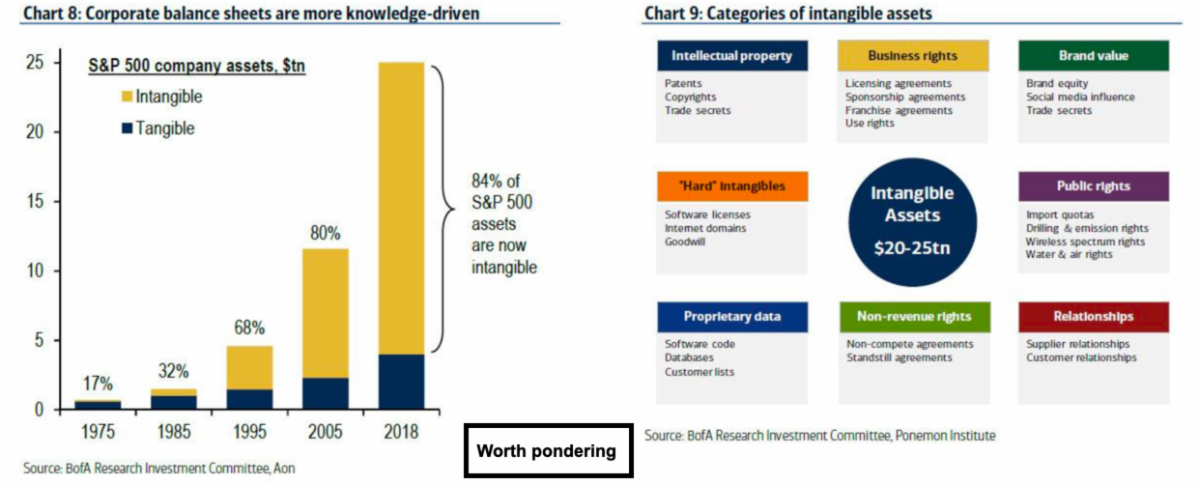

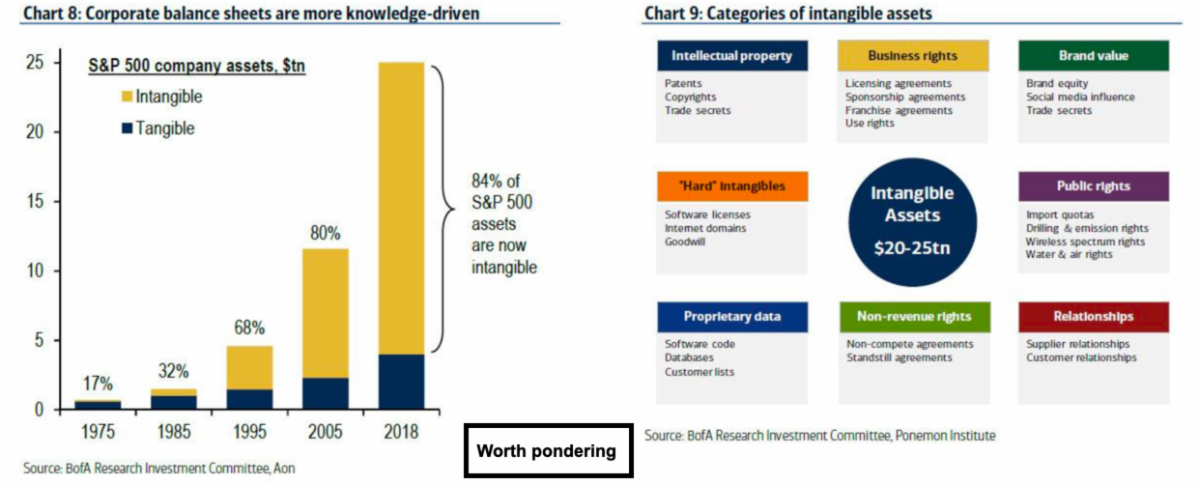

The stock market's been delusional in a different way, as some analysts contend it's all very expensive, others argue that many stocks are in bear markets, and we've (at least I think so) been very candid about the bifurcated nature of sector-rotation that's not really gained sufficient traction to significantly broaden things out, leaving much of the markets stability still dependent on a small universe of 'super-cap' leaders.

While Apple matters because of 'capitalization-dominance' for the S&P, what now is a residual depressed economic situation, with the job not finished (and kudo's for a bipartisan early-on bill, but the ball's been dropped), as help from DC is needed. And it's as political as you want to make it: I am just saying the situation is fairly grim, and I do hope that the parties will get back into a realistic negotiation.

Politicians have bad habits in terms of addressing the urgency of this, and yes I still believe it's shameful not to take this up in an 'emergency' manner, because we are nowhere near where the Nation is needing to be, or in some cases pretending to be, which is ridiculous, because just a glance at New York or here in Florida, there is not the willingness of the public to just throw care to the wind and 'get out there'.. even if some parts of the US behave 'as if' all is o.k.

In-sum: where we are is not sustainable, and in the continued absence of stimulus, the defensive S&P situation continues, and that's my point. If you want this rebound to have any chance to evolve into a stronger move, you need favorable news from DC, that's my point. Otherwise expect the 'Hail Mary' rally effort's swan song.

|

No Thumbs up yet!

No Thumbs up yet!