Market Briefing For Wednesday, Nov. 2

The 'Past was Prologue' over the past two months, as our belief that either September or October would be heavy, but 'not' both of those months. Many ignored that axiom to look for more decline, and they got it but only where the market had not 'yet' crashed, and that was the (mostly tech) mega big-caps.

|

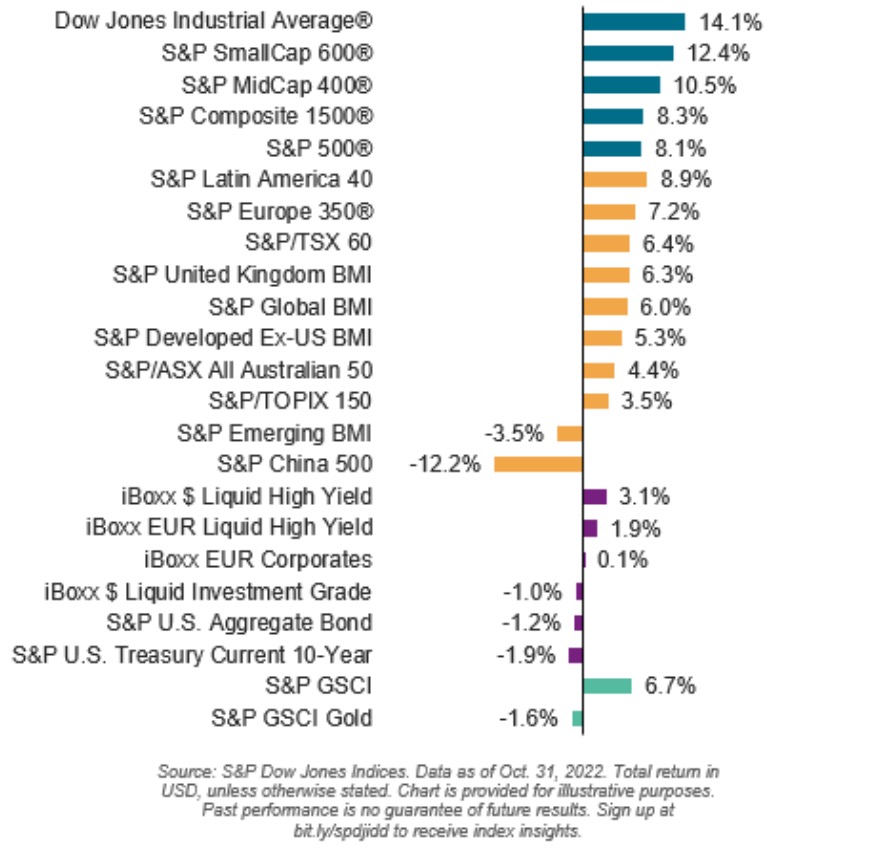

That was the 'Generals retreating' to the trenches to join the battered troops, a 'last man standing' approach which is an expression I didn't use because of my belief that the troops (often called 'value stocks') and many Generals will in the future 'rise anew' as the Index already did from our 'erratic bottom' during the month just past. (Last man standing suggests demise versus regrouping.) I'll show below numbers areas over the past month, while we indeed 'ebb and flow' a bit ahead of the Fed's latest rate hike coming right up. |

|

|

|

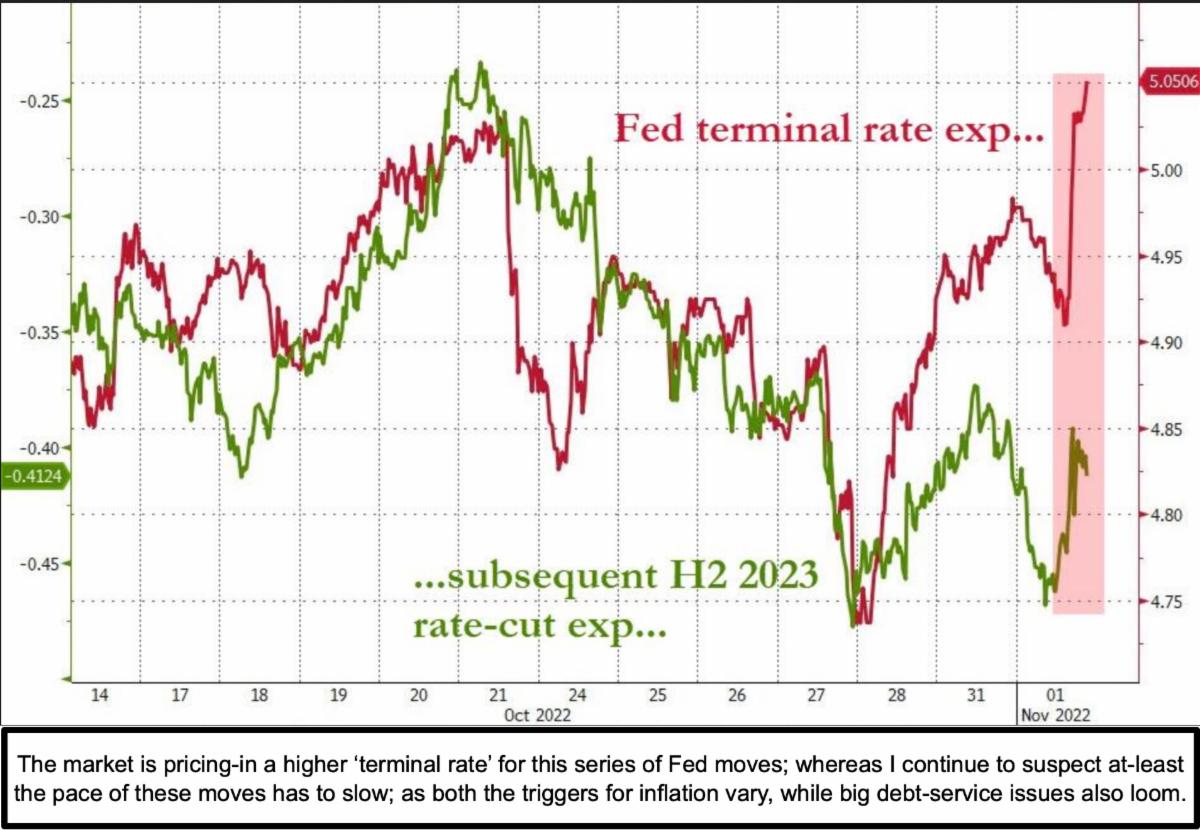

There's no clear indication as to how long the Fed will stay 'tough' aside views like mine that Powell will hedge, but can't really stay hawkish for too long. So I suspect some of this sorts-out with an effort to spin-things somewhat, while the Chairman won't say they'll be on-hold, and he can't really (unless pressed by reporters) address the debt-service challenge. Or admit Fed impotence on inflation, which is high regardless of what the Fed does (waited too long as I'd argued constantly last year). The Fed could conceivably pivot if inflation dropped, but that's next year. We did hear an economic advisor 'hint' (or misspeak) about the President's view of the Fed pivot. Well there is no known pivot, and now they're in a tougher spot because 'if' President Biden actually believes they'll pivot, they it's either a 'fix' rather than an FOMC decision, or the President's advisor expressed the wishful (political) thinking that would give 'stocks' and mail voters a tailwind a few days before Elections. I have no idea, but interesting to hypothesize. |

|

|

In-sum:An acknowledgement from the Fed that they cannot keep hiking at the pace we've seen is what the market desires tomorrow, while the Fed is in a tougher spot since they also don't want stocks to fly ahead of themselves. |

|

|

|

Lots of angina about the Fed's forthcoming move, and we need not take a lot of time discussing whether they hike 75 bp and then indicated 50 bp likely for the future. That may well be what they do, but I think because 'debt service' is going to become a bigger issue that they so far won't even address, they've got little choice. Some rumors swirl about an already 'signaled' forthcoming 'pivot' by the Fed, and White House Advisor Bernstein either slipped-up or misspoke. So we'll see. Also there are intermittent software glitches with ConstantContact this afternoon (which caused me to spend an hour with them after similar time in the morning with SnagIt/Techsmith), so I'll try to abbreviate my work tonight. It is nothing different for the market than what you know.. awaiting the Fed. |

|

|

|

After the close AMD missed 'slightly', not worrisome and not surprising. I still am not interested in putting more money back into it, after selling three times, mostly at well above double the current price. We like the Company, but AMD remains tied at the hip to Taiwan and that's part of what limits enthusiasm. We have no indication of AMD moving heavily to Silicon Carbide, but I'd assume they've got to be looking at that, which hasn't been discussed that I noticed. |

|

Meanwhile Natural Gas collapsed, the Med has more, and Netanyahu may return as PM of Israel, but he's a guy who deflected both Turkish and Russian entreaties to get involved in the Leviathan field, which kept them out. This is significant because with Israel (and Lebanon making a deal) combined with a core customer base of Egype and Jordan, and Cyprus and Greece pleased, it triggers friction between NATO members Greece and Turkey, but for once it's out of dependence on anything from the Persian Gulf 'or' Russia, and nobody seems to focus on the importance of that. I think it matters a lot for Europe. |

|

|

Bottom-line:Nothing has changed, while there are rumors of China chilling a bit with regard to the COVID lock-downs (the 'quarantining' of thousands within Shanghai Disney was sort of crazy, but now they'll letting them 'escape'). If anything the CFIUS posture and FCC commissioner commenting about the possible 'ban' of TikTok was very interesting (we've noted a couple years ago the data harvesting by China whether denied or not). After that they talked of a deal being close with the U.S. Government, so we'll see where that goes (it doesn't impact anything we're watching, though some will believe it helps the prospects for Meta, although we are not favorable towards it for a couple of years also.. it might be a beneficiary for SNAP, though also too speculative). 'Data Privacy' legislation is likely where this is all headed over some time. The short-term got overbought with Friday's monstrous rally, and consolidation is quite reasonable. Oil prices rallied on a draw-down, and U.S. troops are 'in' Ukraine for 'auditing' purposes (I comment about that in the 2nd video). That's fine (to know where are expensive gear is going), but risks engaging Russia, so I supposed that's why the Pentagon told Army guys to avoid the border. It's a risk, but we really do need to know where all this weaponry is ending up. As usual the market will swing after the FOMC decision, then await Powell's conference call, which is a little more testy given the coming General Election and the failure of 'core' inflation to respond 'much' to the Fed's prior moves. It's been my view that the Fed was an early instigator of inflation, but Russia stimulated it, and the Fed can't win the war, military forces have to do that. If the war goes to negotiations sooner rather than later, all dynamics change. |

More By This Author:

Market Briefing For Tuesday, Nov. 1Market Briefing For Monday, Oct. 31

Market Briefing For Thursday, Oct. 27

This is an excerpt from Gene Inger's Daily Briefing, which includes videos as well as more charts and analyses. You can subscribe here.