Wednesday, May 5, 2021 3:57 AM EST

Less accommodation talk - on the part of US officials was today's dominant expression of concern, where higher rates (or preliminary tapering concerns) will have an impact (discounted in-advance). Janet Yellen said 'interest rates may need to rise moderately', and that's a part of the backdrop, though S&P has been set-up for decline for awhile.

Pixabay

S&P managed to claw back up (a turnaround we looked for with questionable sustainability), helped not just by short-covering, but Janet Yellen 'pressed' to clarify her comment. Hah. she sure did. As follows: “It’s not something I’m predicting or recommending,” Yellen said to the Wall Street Journal online.

“If anyone appreciates the independence of the Federal Reserve I think that person is me.” Yellen, herself a former Fed chair, said she didn’t anticipate a bout of persistently higher inflation, but that if one occurred the central bank has the tools to deal with it. (And we think a 'bout' of inflation is already here.) Yellen concluded: “The Fed can be counted on to do whatever is necessary to achieve their dual mandate objectives". Really? Price stability?

And many stocks have been fragile for some time, with the backdrop of higher taxes probable, along with big growth expectations. These factors can indeed exist concurrently. Sort of interesting if you view this as 'sparring' between the Fed Chairman Powell and Treasury Secretary Yellen taking the other side.

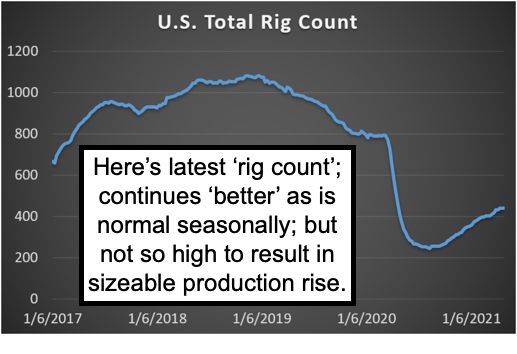

So the Treasury Secretary talks of 'closing the spigot' of liquidity a bit, much in the way I postulated last night with probably reduced liquidity injections (refer to chart and it's available below in the highlights from last night). You run risks of overheating and I think Yellen is certainly recognizing that, regarding of her back-pedaling a bit later in the day. What's interesting is that inflation now is (where you'd expect) primarily in physical things people use of daily necessity, more so than digital services (though those are creeping up too).

The Fed knows they'll have to pare-down the excess quantitative stimulus and let Treasury bills move up a bit, and perhaps the sooner the better, given that a slew of stocks have already been retreating. Other issues that might impact markets include of course China (with any impact on Apple being a big deal).

Tonight I will add to last night's 'catalyst' list, by splitting the 'summary' into two sections, first relating to China and then on other market matters today.

|

Executive Summary (this portion focuses first on China/Taiwan):

- Renewed threats by China and another of their Air Force flyovers, follows our emphasis on the insane (fanatic) objective of President Xi to conquer Taiwan basically (beyond what he did with Hong Kong.. so far anyway).

- The response by the United States has been fence-straddling even as we arm Taipei regularly, the EU concurs with standing-up to China, but really we should issue a clear policy statement on where we stand in-defense of Taiwan (or not).

- Not to do so invites Chinese aggression (think of 'Chamberlain in Munich') and threatens (at least temporarily) the global semiconductor supply (that was the direct stock market implication we've mentioned).

- I don't wish to associate this with my cynical (though I felt it) desire for a personal retaliation against the CCP for attacking me with their virus (:)), but let's face it, China's dream (as the old 'Brick & Road' initiative made so clear) is implementation of a world-wide communist one-party system based on a Chinese model, people try to argue that but look at the trail.

- So I'm 'not exactly' saying the release of COVID was a biological attack on the human race to seize political power, but even if inadvertent, that might be the outcome (especially had they intentionally done so).

- There is no doubt that China benefits economically from what COVID has wrought in much of the world (especially competitors like the US and EU, and arch-nemesis India).

- The long-range after-affects of COVID you will be reading more about (like permanent heart and lung damage that seems to be seen in nearly half of all long-term COVID survivors) are going to risk or hinder the basic health of millions in those nations, and they don't even realize that (only fools tend to equate COVID with the Asian Flu or anything that preceded it).

- Enough on China, the concern basically is that President Xi is not thinking as logically (like how both sides need Taiwan economically so avoid wars) as normal diplomats would presume he ponders matters (time will tell).

|

|

|

Executive Summary (non-China related):

- Market internal structures have been weekend for about two months, we will probably try to hold the S&P in this range briefing, but it's touch & go.

- It's been a dragged-out 'process', but the idea of vulnerability increasing a good bit in late April and early May (or beyond in May irregularly) proved a prescient view, while also noting many stocks declining for weeks.

- The tech tumble reflects spreading caution, it has been about the most overextended sector there is, as forewarned really for a couple months.

- Semiconductors are among the market movement keys, and when one views them on an equal-weight basis within the Index, they were and are warning, this is not so much stock-specific, as sector-general.

- Several technology analysts are 'talking down' the demand for chips (not just the supply chain delays), and while I discussed this in recent reports, there is no doubt that such stocks got too overheated and have shown a series of distributional patterns really since early Spring.

- Nvidia (NVDA), AMD (AMD) and TSMC (TSM) aren't exactly in the same business, but to some degree will tend to move in-harmony, if not lockstep, AMD especially led on the way up (our entry was from 16-18, with some off the table between 80-100), and AMD 'if' it drops significantly, will be important on the way up that ensues after this period of correction or however this evolves.

- Many of the big-pharma stocks (Bristol Myers (BMY) included) were played well before now, and are not attractive again yet, as others like dividend plays (especially AT&T) remain 'relatively' cushioned because of their dividend, and should be comparably stable (in AT&T's (T) case there's also improved fundamental assessments to make, that we've written about).

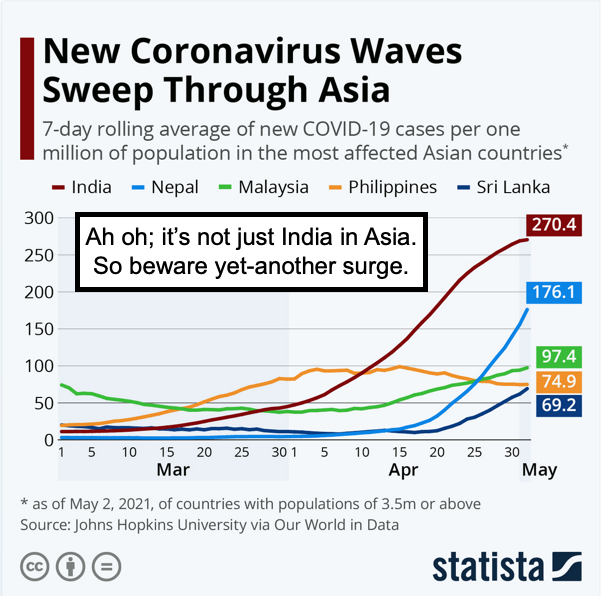

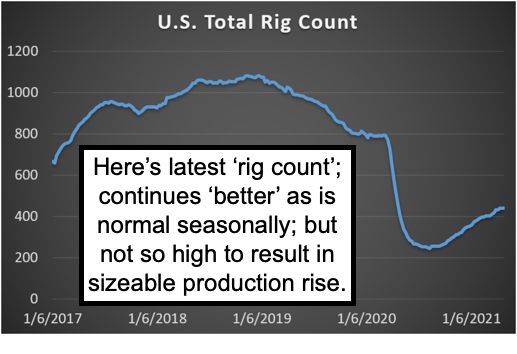

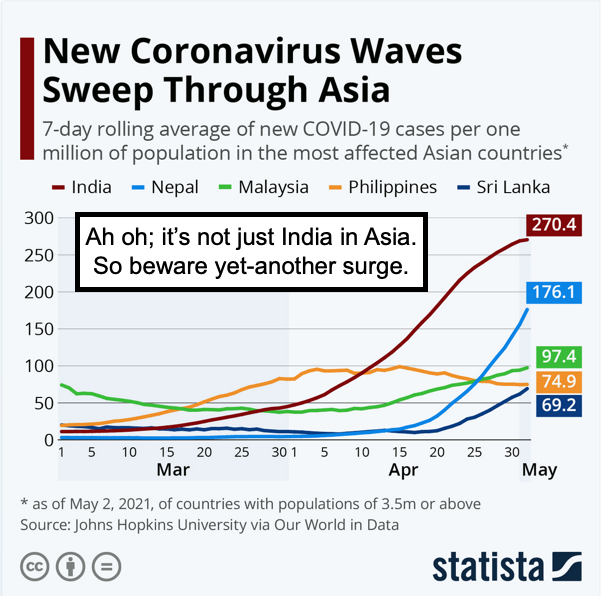

- In COVID developments, cases are rising rapidly in Asia beyond India and even in China (which acts in Draconian ways), they have new variants.

- Eli Lilly (LLY) has begun clinical development of an anti-SARS-CoV-2 antibody designed to work against all currently known circulating variants, note the action is weeks after FDA revoked single-use emergency authorization of Lilly’s first COVID-19 antibody due to the rise of variants (this is a field of multiple players now, including Sorrento (SRNE), Merck (MRK) and others).

- Among small stocks, LightPath (LPTH) announced the retirement of Bob Ripp, the long-time Chairman, he said a couple years back he'd retire after he supervised realignment of the Company, which is largely achieved.

- LPTH should get interesting now: new VP Finance, new Operations VP, new General Manager for the China plant, and soon new Chairman, all under the leadership of their fairly new CEO who seems to produce (and a new website design that better describes their expanding capabilities).

- We look forward to hearing more about several new key staff changes, as well as their vision going forward, during their earnings report Thursday, I am very disappointed by their stock performance, but they surely are too, if it got any serious visibility or institutional interest, that could help.

- By the way Chairman Ripp was responsible for finding Sam Rubin, the new CEO, who has been very busy semi-reorganizing matters there, I'm thinking Ripp retired based on optimism, rather than simply not running for the Chairmanship at the next Annual Meeting.

- Finally, the risk that while my 'Inger Bottom' 2020 low was key and definitely a bear cycle low, there is an alternative that the Nasdaq double-top is actually leading the S&P, which rotated higher on the back of sector rebalancing included infrastructure beneficiaries.

In-sum: the Fed knows they need to backstop the Nation's economy, and as you know that was the heart of our bear-to-bull reversal in late March 2020. If we go into a serious correction 'beyond the stall' we already have experienced during the somewhat frustrating grinding market of recent weeks.. if we do so, the odds of a more significant sell-off would increase.

|

|

How did you like this article? Let us know so we can better customize your reading experience.