Market Briefing For Wednesday, May 26

Foretelling a disaster isn't an easy task. Perhaps I'm honored to have done that a few times over the years; the post-real estate slippage 'Epic Debacle' in 1997-'98 was definitely the big 'call' until a pandemic 'crash alert' early in 2020 and perhaps more significantly the ensuing March 23rd 'bottom call' last year.

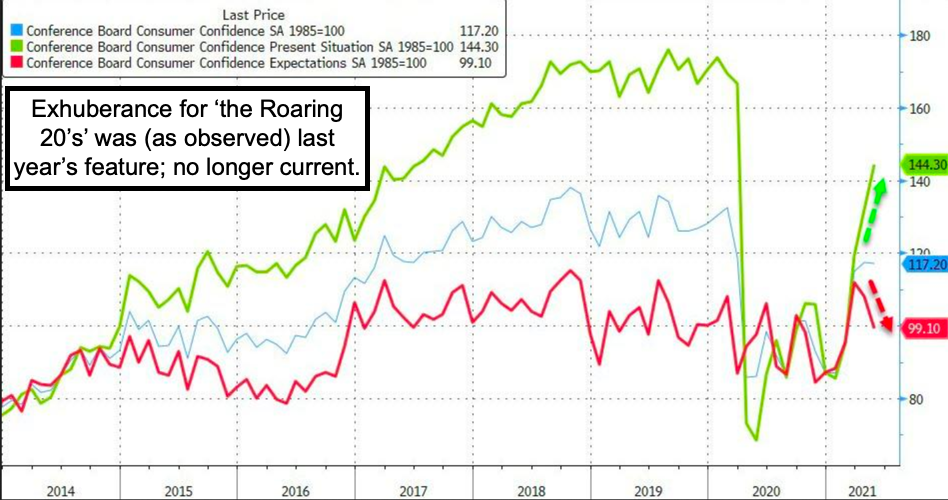

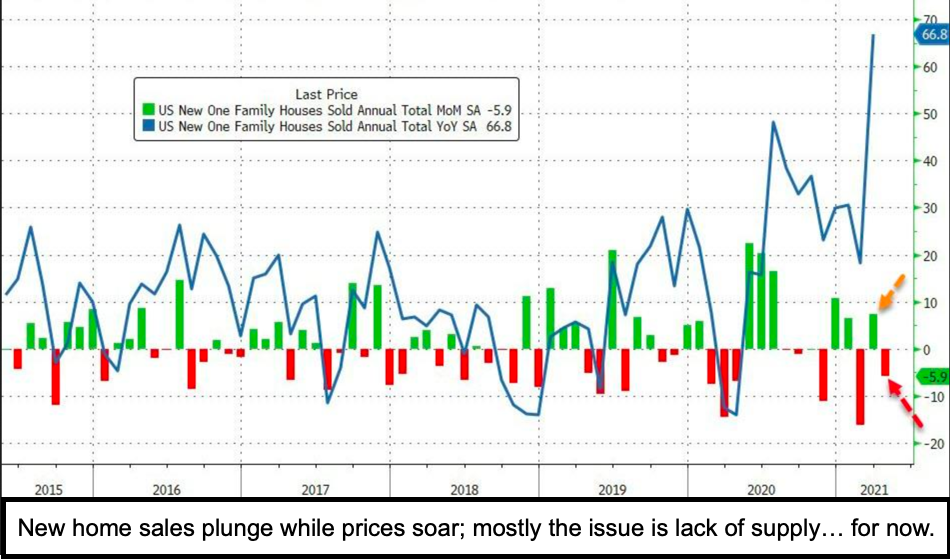

But premonitions of gloom among analysts and economists this year focus for the most part on 'monetary policies', a resurgence of COVID (especially in Asia as likely threatens holding the Olympics at all), and not on domestic division it seems (which believe it or not seems to be calming except for how the media keeps pounding on topics which are historical now, so not widely focused on).

These topics indeed are in my thoughts as well, especially longer-running Fed policies, but realizing the Fed's not going to do much but chatter until volatility in prices actually becomes stable (or beyond if indeed inflation is transitory). If so we may get some 'tapering talk' signaled from the Fed, but avoiding actual policy change. They will not say the 'job is done' yet.

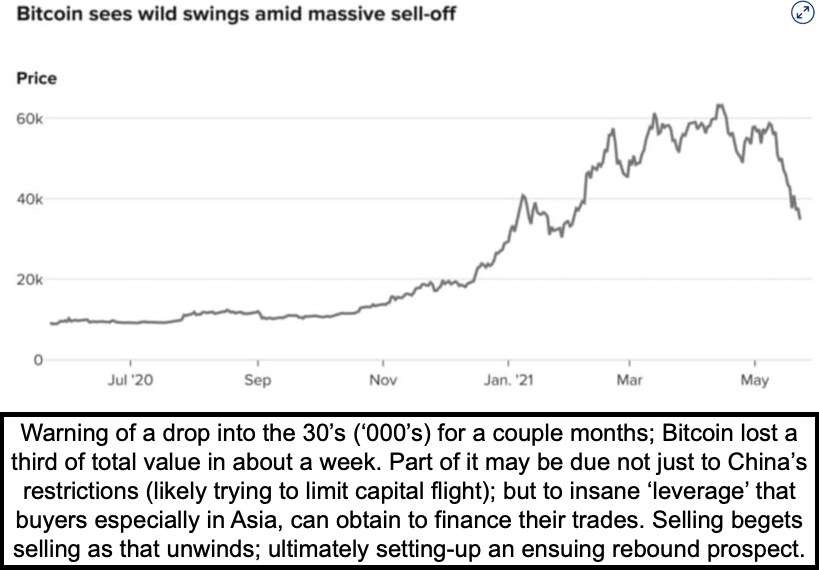

Now, if I had to single out one factor that can foretell trouble, it's hinted at by a collapse in Bitcoin and other crypto's, but not because of Bitcoin (BITCOMP). It's because of what the majority of players (in Asia not America) use to engage in trading it, and that's 'leverage'. So sure, that contributed to the plunge we projected in a series of concerned and negative comments on Bitcoin (even with rebounds as I wouldn't want to be called a 'permabear' on anything), rather specifically a call for 36,000-38,000 to be seen (got it). The point though is 'leverage'.

Executive summary:

- Although factors like the DC AG taking a shot at Amazon (AMZN) conjure-up lots of antitrust memories, if not concerns, that's not a big deal today.

- Even Fed Vice Chair Clarida's remarks that the Fed may begin talking about 'tapering' at forthcoming meetings was more of an influence (and oddly it already has been a topic as the prior FOMC Minutes revealed).

- The near-historically high short-interest in the S&P (SPY) is actually supportive of a market not declining precipitously at least for now (rebound try likely).

- The global threat of COVID accelerating in Asia is a little-noted factor, if this indeed causes the Olympics to be cancelled, that's a very big deal.

- Plunging Bitcoin has triggered stops and forced liquidation (more later), while altruistic ideas about digital currencies are separate issues for now.

- Noteworthy given the heavy tourist flow to Mexico: the FAA downgraded the Government of Mexico. It's authorities do not not meet International Civil Aviation Organization (ICAO) safety standards.

- So, the FAA has downgraded Mexico’s rating to Category 2 and will help them recover to Category 1. It is the second time in Mexico’s history this has happened. The first one occurred eleven years ago, in 2010.

- While this is about the 'oversight agency' ... Air Traffic Control as well ... flights continue, but code sharing is revised until this is corrected, as an example: Delta (DAL) can no longer code share Aeromexico flights, frequent flyers still earn SkyMiles (also called SkyPesos by cynics) on AM flights.

- Also no new service to or from Mexico is permitted during this restriction (crosses my mind there are many countries and airports I'd view as more dangerous for commercial flying, doesn't excuse poor safety, just saying).

- Summit possibilities are subdued, both by the White House and Kremlin, as Putin & Biden sorting things out for a stable relationship or at least better understanding of positions to mitigate confrontations, matters, so Geneva June 16, could be important, perhaps mostly for Ukraine,

- S&P should find today's consolidation absorbed and try more upside.

Leverage of 50x or more exists in Asia they say, and in America, the financial media is content to talk of 50% margin, which is bad enough but nothing like a 4 or 5 x leverage not uncommon among hedge fund gamblers. Since they get a percentage of profits typically, many are less risk-averse than normal people are when it comes to playing the markets with borrowed money.

Isn't this properly regulated in the U.S. or controlled by the bankers to avoid a fiasco? You'd think so but apparently not. (Shades of Long Term Capital Mgt.) Earlier we had the implosion of Bill Hwang’s Archegos Capital Management, the investment firm that was forced to liquidate more than $20 billion worth of stocks, prompting a sense of deja vu not just about LTCM, but about neglect it seems in a time of low rates and hungry bankers, who actually allowed this. It was noted at the time that a couple institutional brokerages weren't moaning at all about this, regardless of the 'muted' losses they took, because they don't really want depositors and clients to think they are as reckless as they were.

And as the old saying suggests 'where there's one cockroach more are likely', it is probably the situation going forward. That might even be why the 50-DMA has held for the S&P, fear that breaking it would unleash 'trap door' selling as well as triggering compelled liquidation at retail, and forced at institutional. So as we 'celebrate' the S&P going sideways while internal rotation continues, do keep in mind that what's happening is reminiscent of some past concentration of assets (events) into a handful of 'nifty' momentum stocks.