Market Briefing For Wednesday, May 12

A massive reversal lagged for a couple hours before catching a 'real bid'. Once it did great, but not very broadly, so the prospects for this being just the kind of reprieve I talked of before today is enhanced. To wit: a relief rally.

Leading into these past few days of erosion (preceding washouts normally as I tried to outline), the large caps (especially FANG types) under-performed for at least a couple months, and corrected more going into late April / early May, which happened to be my ideal time-frame for such selling to accelerate.

It's also 'why' I pointed-out yesterday that the acceleration is typically closer to what you see at the end of a shakeout than the start of anything big, with just a few historical instances where bottoms totally fell out. This wasn't and isn't one of those. And barring some exogenous event (like China invading Taiwan for-instance) this phase, even if it has another effort to break of test today's lows, is not the catastrophe so many keep looking for.

I don't blame anyone for questioning the debt structure of excess valuation. I'd do that too and often have mentioned these issues. But this is not the mania a lot of analysts think it is, although it clearly was in that handful of 'momentum' stocks. Today I heard Stan Drunkenmiller call this a 'mania like no other'.

He's a smart guy but I must disagree with him as far as the 'broad front' (while he said everything is going up, that's the departure, everything is not although it did for awhile, and ironically that was while he was still negative and admits it, coming off the March 2020 lows). Then he got with it as it climbed higher, a time that we didn't get bearish (still not really) but having bought the low didn't see any reason to chase price higher.

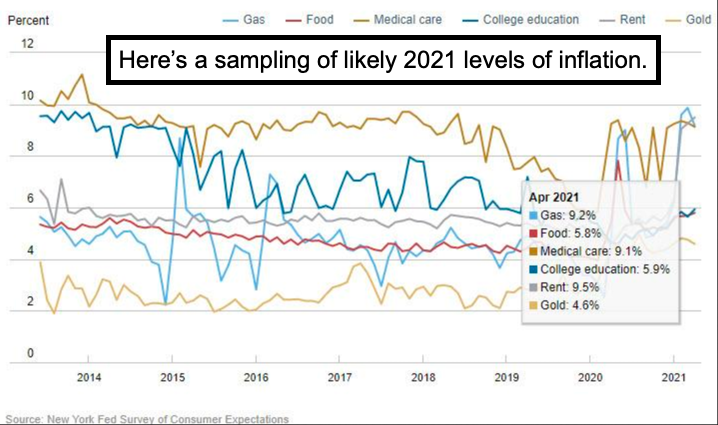

Again I concur with most of views that he shared, but not all of them. Actually I was reinforced by so many issues we feel similarly about. Foremost is what's the insane 'policy' of 'wanting' inflation, which is horrible for the poorer people in our society. Stan said he will always afford fresh vegetables while poor folks will have to buy less expensive frozen vegetables. Honestly I have never even compared fresh vs. frozen, so have no clue as to price differences. (A bit of a tongue-in-cheek comment, as long as Calif. Pizza Kitchens can make my very fresh chopped Italian salad I'm fine with their locally-grown fresh ingredients.)

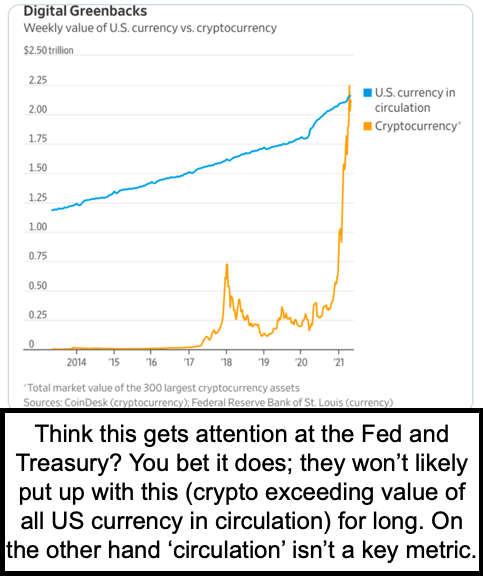

Seriously, I 'sort of' share the view that long-term risks from asset bubbles and fiscal dominance are there, but not that they dwarf the substantial short-term risks of putting the brakes on a booming economy this year. But in 2022? Yes and in-fact hints of tapering and backing-off could (should) come at FOMC in June, 'if' the Fed guys and gals have any backbone left.

I do understand that while dramatic stimulus was needed in March of 2020 (it was a Fed comment to that effect the day before we called 'The Inger Bottom' that encouraged my doing so, amplified by seeing panic unfold in the next day from people who should know better), after we were well off the lows and U.S. economy was on the way to a spirited revival, such dramatic spending was ..I will put it mildly.. nuts.

Bottom-line: corrective action is viewed as a continuation pattern interrupted by today's Tuesday turnaround. However the 'super-high multiple' stocks and ETF's had reversals from down-to-up (which we required for today to have a bit of validity beyond short-covering, and that's hard to extrapolate of course), they had reversals that generally held sufficient traction to see a bit more.

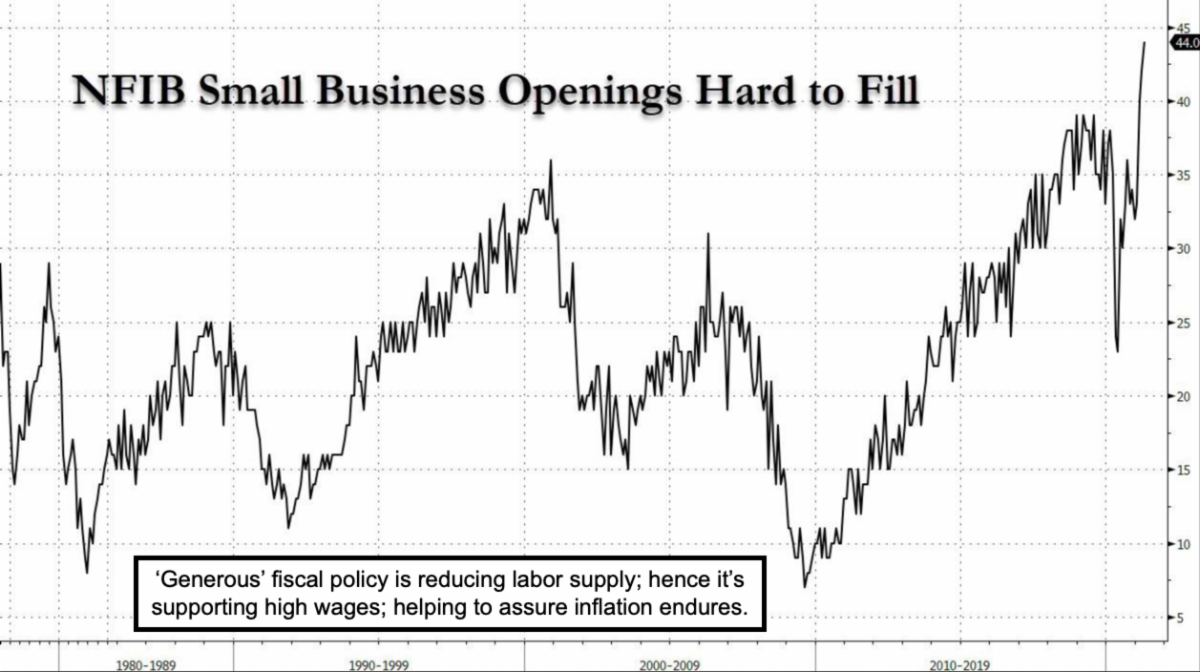

However, besides the pattern evolving as desired, the rotation is ongoing, the participation in the rebound was not impressive in an overall sense, and what is being keyed-on as a catalyst (inflation) is really here, despite many others parroting the Fed's 'theme' that inflation is only temporary. Ask workers now getting higher-than-even asked for wages if they'll welcome a cutback later. I suspect you know the answer I've felt all along, and that's why higher inflation is real and to some extent at least... inflation is here to stay.

I think that this is the first time I have seen the comment that "inflation hurts the poor people." More correctly, though, is that it hurts them the most, because it does hurt ALL of the "non-rich" people, but not as much as those who are poor. ( the definition of poor here is sort of relative.)

At last it is announced that the goal of the federal reserve gang has been hurting some class of people!!! This is not something new, ithas been going on for a long time.