Market Briefing For Wednesday, June 30

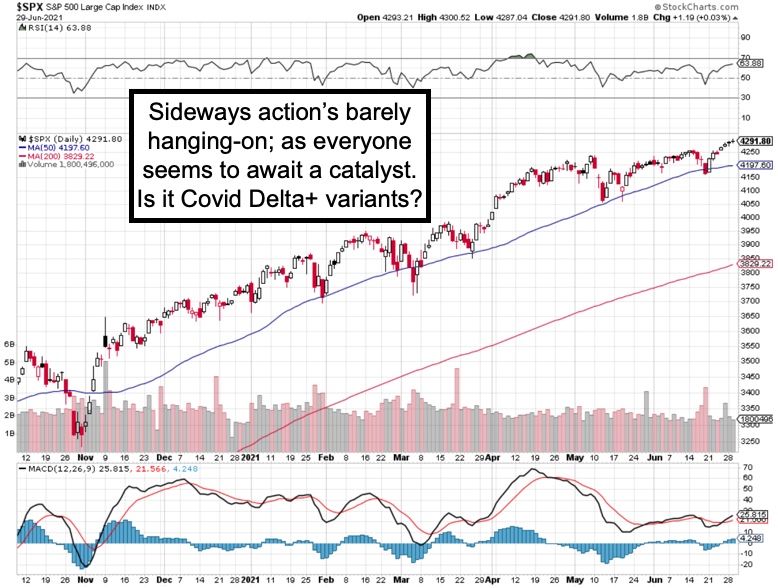

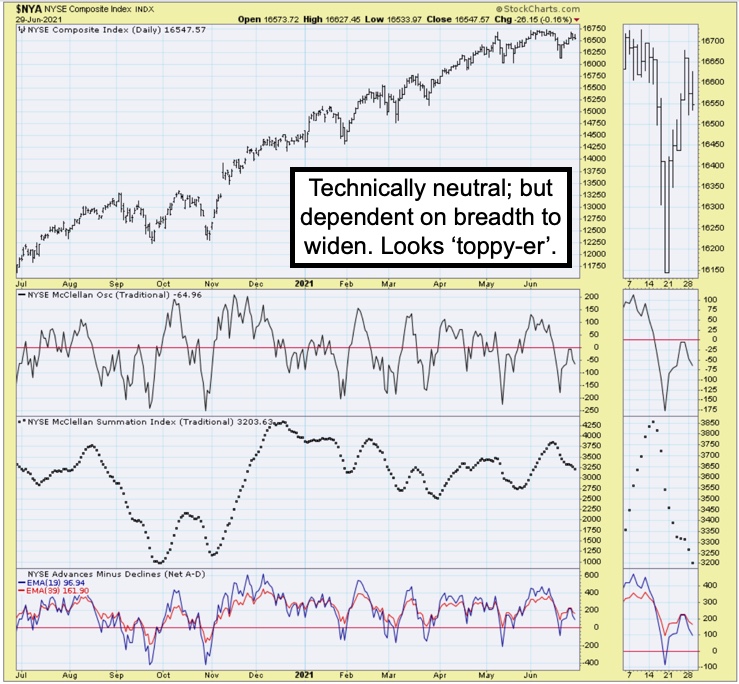

Market optimists are generally avoiding the single issue that holds potential to disrupt a required 'combination' of industrial, infrastructure and technology stocks, in-order to hold the S&P together much longer.

That's why the Dow Industrials were down Monday and barely up Tuesday as suspected anyway, while Nasdaq, NDX and SOX led the way. Some pundits call this 'old versus new' or 'dividend hunting'.. not exactly. Rather if managers 'perceive' the synchronized global recovery will be 'on the rocks', they'll flee a slew of stocks that would benefit in that environment. Is that where we are? (NDX, QQQ, SPY)

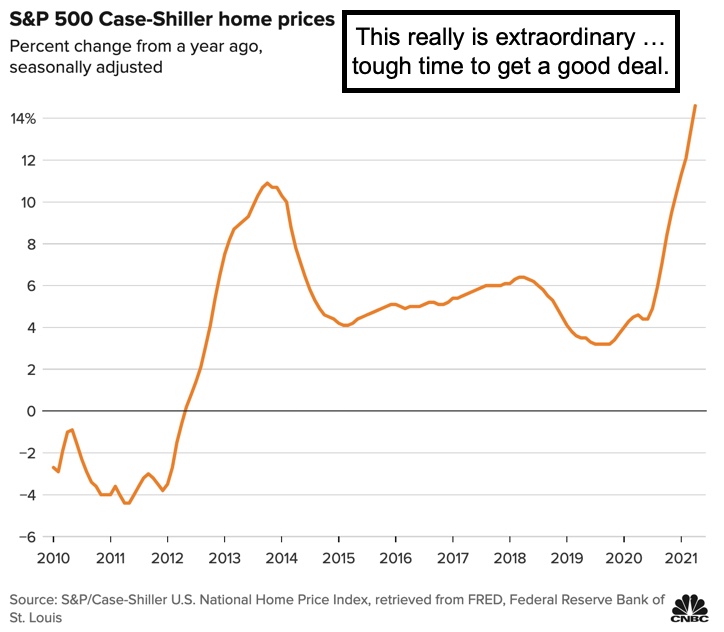

We're not quite there, but there is risk of disrupting the aggressive reopening, and 'celebration of COVID Independence' as reports say the President wants to call it late this week. I mentioned this yesterday and used the Virgin Atlantic & Orlando tourism issues to describe how it impacts stocks like Disney (DIS), etc.

Of course I hope 'COVID Independence Day' is real, and not a slogan that will have to be walked-back. I want to see the country out of this. Having quite a time with it myself earlier this year (a bit lingers but much better) I find it totally implausible that some people still dismiss it, or believe warnings somehow are aimed at controlling population behavior. I can't speak for other countries, and we know how some governors behave compared to others, but none of that is changing the fact that the variants are out there. Some reports say vaccines are so good they'll protect for life (that would be nice), others say break-thru cases are increasing. Still others say Delta+ is far more communicative or far riskier for older people. That's where I agree it's confusing or really unknown.

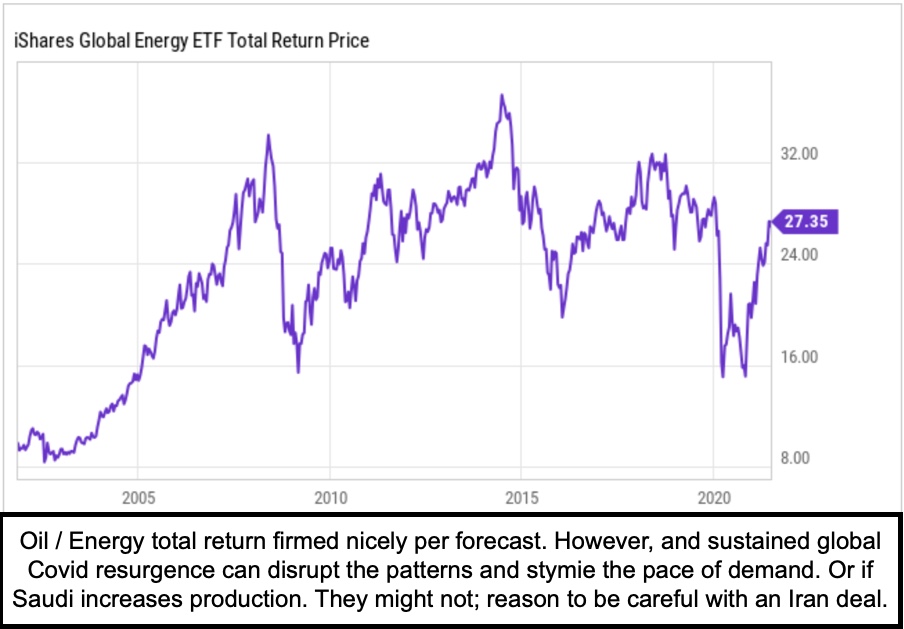

Regardless, earnings growth may peak anyway soon, and stocks have acted tired, as you know, for some time (hence the internal corrections and lack of big break). So far the shifting between growth or tech and so on has worked for many, so that persists until it doesn't. But nominal GDP growth is going to be spotty as the Bank & Oil led rally didn't expand too broadly, and welcomed selling while techs firmed. I warned that Oil was being pumped by people with talk of 100 / bbl, when I was (and remain) very pleased doing so in the 30's at the same time delighted with the 70's / bbl. Unless we have the global growth, without COVID disruptions or Saudi production increases, much higher for now is not particularly logical (OIL).

Today was a ragged rally, but that probably relates to global variations related to the Delta+ variant concerns, and actual lock-downs and restrictions rapidly being reimposed in a number of countries. Financial media avoids that topic, for no reason I grasp, since steady demand for stocks requires broad growth (IXC).

This is an excerpt from Gene Inger's Daily Briefing, which is distributed nightly and typically includes one or two videos as well as charts and analysis. You can subscribe more