Market Briefing For Wednesday, Dec. 16

An excess liquidity case - is the latest explanation for driving equities higher in the near-term. It's not really that simple, though if one means the managers who denied the rally from the March lows (Inger Bottom) for months, well yes, some of them have been putting money to work belatedly, trying to improve a summary of their results for the year or perhaps the 4th Quarter.

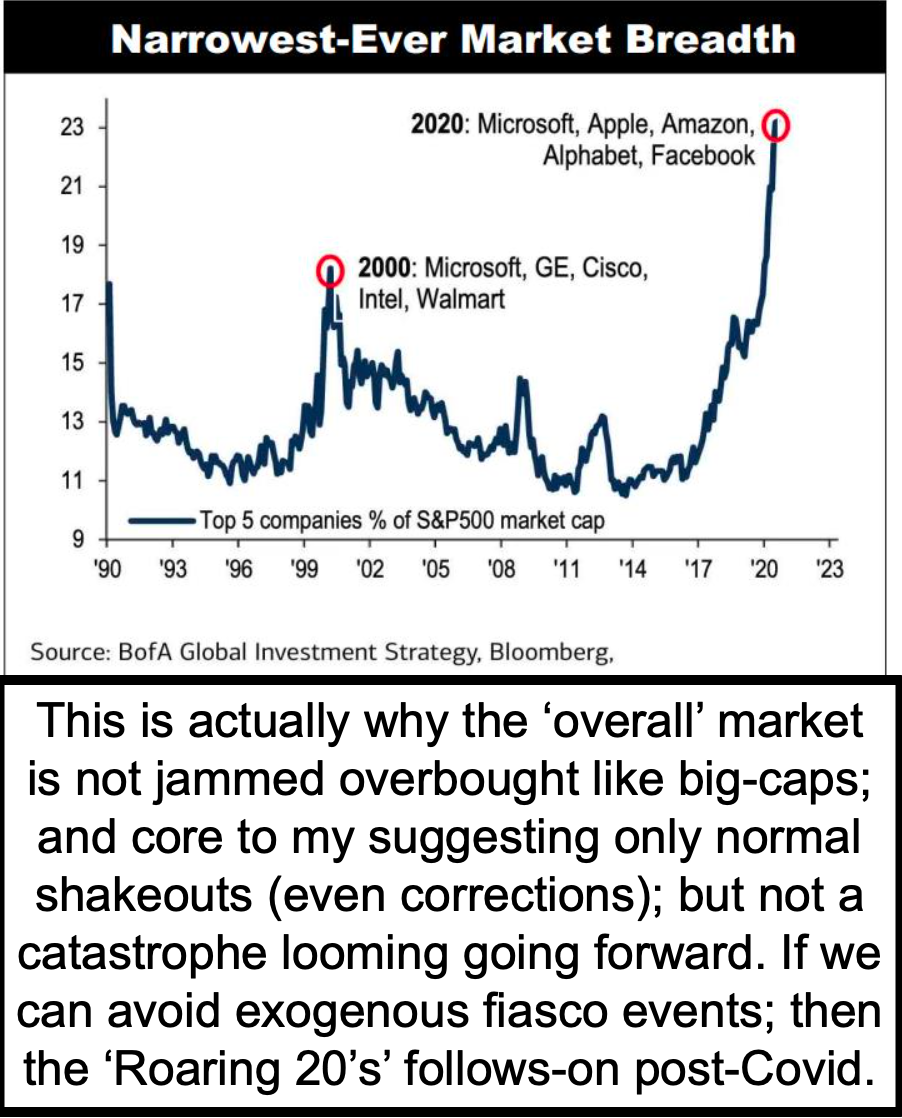

Meandering better describes most stocks here, with the tax-related behaviors often seen (rather traditionally) toward year-end. Many of today's leaders like Apple, which we thought had to lead the S&P higher, are actually rebounding from prior minor shakeouts, and possibly have further challenges in early '21, while concurrently those most-impacted (and depressed) might rebound.

Executive Summary:

- S&P rebound on-cue, but also helped by movement towards 'relief' bill, inline with Buffet's comments (echoing my own), and possibly McConnell emphasizing our Constitutional processes versus candidate preference.

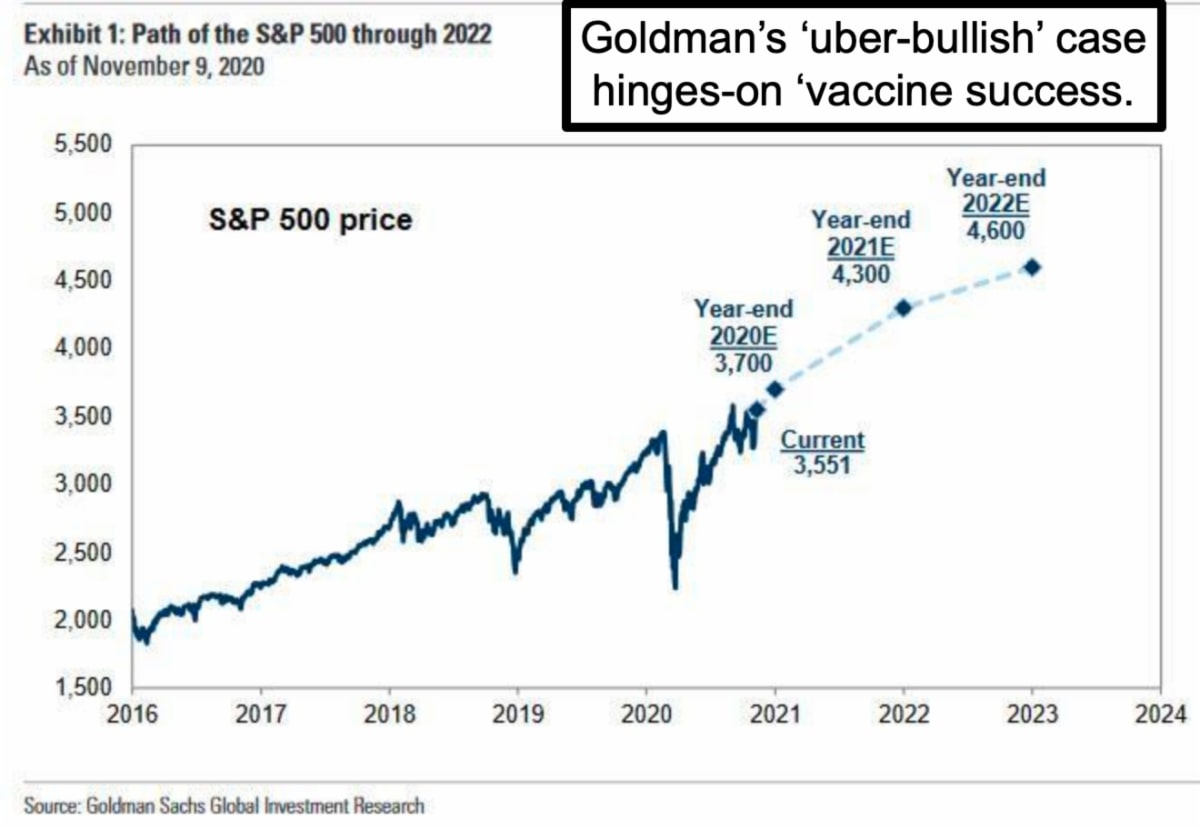

- Combined with the 2nd (Moderna) vaccine approval looming, lots of the angst 'seems' mitigated, while still leaving big stocks at pricey levels.

- After 1 single dose, Moderna's vaccine apparently reduces asymptomatic infections by about 67%, don't know about the 2nd dose, but that's great news.

- Moderna (mrna) showed more reactions after 2 doses than Pfizer (PFE), so this really is encouraging, as I mentioned my personal physician prefers Moderna's but he wasn't clear as to why.

- There will always be people needing 'treatment' and testing, hence we're remaining very interested in monoclonal antibodies, and the two plays are not overpriced, but that doesn't mean they can't weaken near-term, nor of course does it indicated which if any will be successful with the FDA.

- The encouragement to use 'monoclonal antibodies' won't work well with the current dose levels being high, useful only for early-stage patients, and needed long IV treatments.

- This does not invalidate the drug, it recognizes that in early stages most people are advised to stay home and so on, so the antibody drug front is going to be a very big deal once you get low-doze single-shot IM drugs.

- Sorrento is in the hunt to do just that, and having the Dept. of Defense at this point interested in Inovio 'also' looking at that validates the direction we've been talking about, even AztraZeneca (AZN) wants to get into this.

- As for Sorrento (SRNE), it's been under persistent pressure, gives back gains easily after light (the DARPA) good news, and is fatiguing to investors.

- Today is likely to misunderstanding 'why' COVID-patients aren't offered the antibody treatments as a rule (and that's because it has to be very early in the disease, and that requires hospital administered IV's).

- CNBC 'correctly' states thousands of patients would benefit from this, so it has to be a 'shot or nasal treatment', and that's exactly where Sorrento wants to deliver, but it is a continuing enigma as to why this isn't moving forward even faster.

- Apple led the market today, and that's on increased demand and by the way the new IOS, Apple TV and Mac OS updates all work well so far.

- Recent IPO's like Doordash (DASH) or AirBnB (ABNB) are not 'still above the IPO price' as media reports, since both are well below the first 'open' trading price.

- Those stocks and others that have 'lockup expiration' in weeks / months ahead will become interesting 'if' price drives them lower thereafter.

- Pent-up demand for the post-COVID environment is what everyone tends to focus on, while 'reversion to the mean' refers more to S&P leaders.

- The Fed stimulus is of course at the core of the stability ramping big-cap stocks, while there remains the risk of some sort of 'black swan' even to shake stocks in the short-term.

- At the moment that might be cyber-hacking, but clearly markets aren't yet troubled by that.

- However the public doesn't know the depth of it yet, or if other security measures (including financial information) were compromised.

- Wednesday may hinge on progress on a 'relief' bill, meetings tonight.

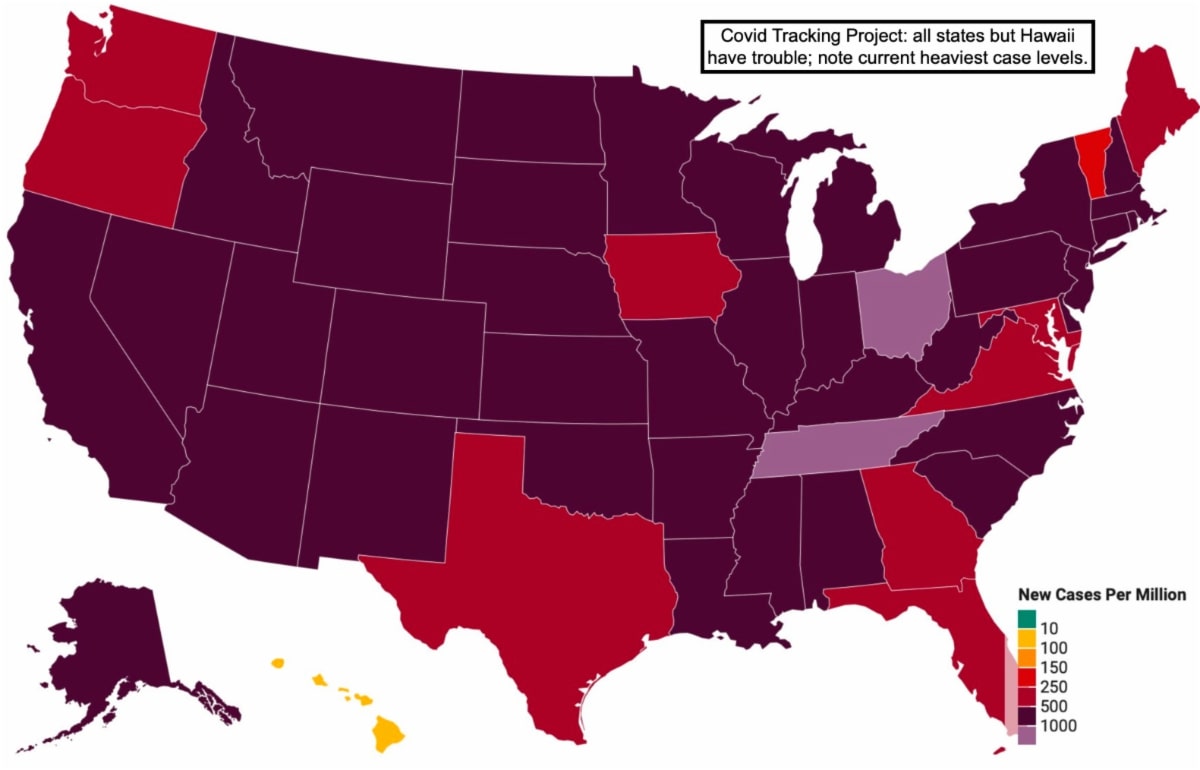

Where we stand with COVID is exponential positivity levels continuing at the moment, and a panic-driven contrast of cities trying to close down while other go about life. The latter are either cavalier and not caring about others, often convinced it's not a problem 'where they live' (as then too frequently turns-out it becomes an issue), or are depending on vaccines and / or therapeutics, to resolve the challenge.

Of course the problem is vaccines take weeks to build immunity, even when they're available, which is no excuse for cavalier behavior now, respecting the majority of the population who desire being careful until they're immunized.

Today we heard a lot about 'why' positive people are typically told (or insisting on their own) to just stay home and do nominal things like supplements and of course stay hydrated. By the time they get sick... if they get sick... it's too late for the 'existing' monoclonal antibodies which could have stopped COVID in its tracks in most cases. Once sick both are not strong enough to matter much. So why the resistance to infusion, and a surplus of those drugs for now?

That's because both Regeneron (REGN) and Lilly (LLY) treatments at this point are huge IV infusions, and that typically means two outpatient visits, at the same time one is contagious. Many are not rejecting Mab's (monoclonal antibodies), they are denying (or hoping) they're very sick, and they take a huge gamble giving time to see if they really get sick, then if they do it's too late for this to be effective.

Lilly, Regeneron and others are working on lower dose variations. Sorrento, it seems, would be ahead of them with greater potency at a lower dose, thus a simple IM shot by a doctor or pharmacy, without any hospitalization. Since it not only is theorized to kill the virus but protect, many would rush to get it just at the first sign of testing positive (if not even before). And perhaps whether or not they had or were willing to have, the vaccine.

We just don't know yet, because Sorrento has been incredibly slow about the approval route even for tests, much less the purported effective therapeutics. I think we have all been patient and I know biotech is always slow. But this is in emergency conditions, the FDA gave them 'Trial' go-aheads, and still nothing even as far as a candid update from management? This matters more to the whole population (maybe beyond), but it sure matters to shareholders as well.

I hope initial suspicions of management were unwarranted about years-ago questionable history, but I am at a loss to understand why they're fairly silent. With DARPA (Defense Dept.) funding, the Trial should be rushed, and even a 'Fast Track' situation with the FDA. Can anyone enlighten us?

Among 'paths to victory' which, in my current opinion is more promising with a slew of monoclonal antibodies, is achieving high, disease-blocking coverage with vaccines in the high-mortality subgroups (age and comorbidity segments) so that continued circulation of the virus is a significantly lesser threat to life and health care systems. But with the elderly already having (normally lower) immune systems, the question remains 'will they achieve protective levels'.

So while they are categorized as an early recipient category, testing wasn't at all sufficient to give an idea if the vaccines will work on that group. Remember that was the point about noting that most trials proved (if anything) that it will work on 'perfectly healthy' people in the middle age years.

If we use vaccines to protect high risk groups then relying on rapid screening tests to slow transmission would work well. Much lower risk to missing small numbers of cases. Might even suppress virus much sooner than reaching the elusive herd immunity goal. Maybe. But about 40% of all cases were in those older or retirement home categories, so it's very important that these vaccines work 'as promised'. If not, then we're back to needing 'fast-tracked' antibodies at scalable levels. And we need them anyway (a bit more later).

So yes I think they're on the right track, but so is Regeneron, which is teaming up with University of Pennsylvania and Jim Wilson (a Gene Therapy pioneer) to try to deliver it's already-well-known (but huge dosing-load like Trump got) antibody cocktail via a nasal spray. That's competitive action in-theory to what Sorrento is working on, until you consider that Regeneron is not only 'friendly' with Sorrento, but listed their STI-1499 (the weaker of their already-stronger vs. others) antibody solutions, which creates curiosity about any relationship.

In any event, of course there are a number of 2nd generation vaccines and as it seems already 2nd generation antibody therapies being developed. Of all of the public companies Sorrento, perhaps because it was so controversial long ago, has the lowest overall market-cap. Twist Bio (TWST) is about 140 (from very low a year ago), Regeneration we all know about, so because the 'play' is late for the first phases, we leaned toward stocks like Sorrento or even Innovio (INO) as a possibility to advance meaningfully into next year (perhaps even after selling of a tax nature for some), but because they are speculative, preferring options to the common stock, and even then not too heavily (by definition).

With the lack of news, I ponder whether Sorrento, funded by Defense Dept. urgency, will utilizing a top-tier contract research organization (CRO) with the capacity to rapidly and effective execute trials and deliver findings. Any further delay clearly could inhibit their prospects, as antibodies are not an exclusive, so their best prospects are to either get this done ASAP, or hire someone to do so, and that's perhaps where the DoD funding can play a decisive role.

In-sum - the pandemic continues (that is no surprise and generated overdone optimism about early vaccines, though I know many of you . .. maybe me too .. will be taking one of them... maybe). Clearly I'm interested in what's not yet available (perhaps not even properly tested), and we'll see if we can resist the temptation (is it a temptation?) to get the vaccine as soon as it's offered.

For now everyone looks at both the future economy and an existing pandemic economy, which for now continues to bifurcate the market as it eases from the formerly quite overbought condition, at least as the superficial Index showed.

Comments

No Thumbs up yet!

No Thumbs up yet!