Market Briefing For Tuesday, May 18

The internal dynamics of this market are essentially unchanged. After a spooky series of shuffles last week, we see no confirmation of a holiday-seasonal rally or immediate resumption of decline.

However that's likely forthcoming, even though there are technical concerns that remain. So perhaps that's the takeaway from today, nothing resolved as of yet. I did call for a rebound on a couple intraday comments, and we finally got recovery to a good extent late in the day. Expecting more on Tuesday.

It was a rough semiconductor session, in our view that's not a surprise given not just supply shortage issues, but failure of most analysts overlooking an association with Servers used to a degree for 'mining' cryptocurrencies, and ideas that sector may be amply filled with servers, at least for present cycles. Now there are stocks like Texas Instruments (TXN) or even Advanced Micro Devices (AMD), that don't directly produce specialized servers, but their components may be present.

Executive Summary

- The S&P generally features alternating jabs less than thrusts, as bull/bear skirmishes resume.

- This should be resolved with temporary strength, albeit skeptically.

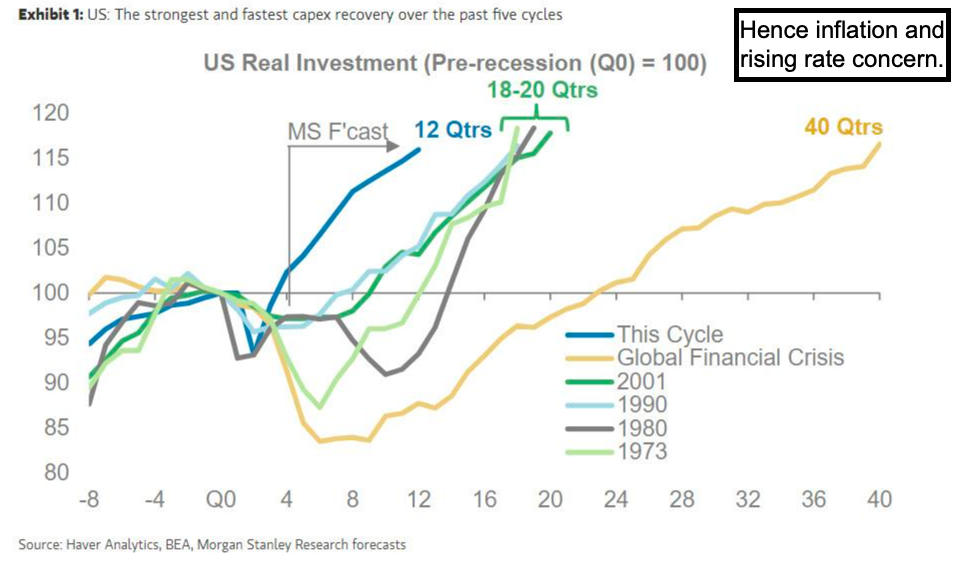

- Fed Vice Chairman Clarida's comments about (again) transitory inflation and more work to be done, actually was not favorably received by stocks.

- That would be so if markets would rather prefer 'biting the bullet' sooner rather than later, idea being a short-term hit, versus a more serious drop.

- AT&T (T) merging it's media operations with Discovery Networks, it creates the (likely) world's largest streaming operation, and could ultimately cause an upward multiple valuation on AT&T shares, while short-term there will be a push by bears to press the common lower due to likely dividend cuts if the deal goes through (without much regulatory scrutiny).

- Shifting cash flow 'could' result in 'resizing the dividend', which is how the CEO Stankey described it, organic growth being prioritized, the shares of course did an 'intraday up-down reversal' based on the 'dividend' issue, of course Stankey now will have an excuse to cut that, but long-term growth is likely better-ensured by this move.

- So that assuredly brings selling by 'purely dividend' holders, but also this signals actual growth that could cause more interest in AT&T which will be a 71% holder of the yet-unnamed new combined company, and 43 Billion comes in from Discover to make this deal, seriously reduces AT&T debt.

- Yes Stankey 'spun' the Warner goof earlier, but he's been at the helm for 10 months now, and successfully launched HBO Max, now you get scale from Discover/Warner and AT&T Wireless is doing quite well too, against Verizon (VZ) especially with T-Mobile (TMUS) becoming the prime competitor.

- This is a mechanism here for AT&T to diverge but also profit from media, so longer term that matters, and I suppose shareholder pressure might in the fullness of time (this can take a good year to go into effect fully) exert influence on Stankey 'not' to allow the dividend cut, but we shall see, I do not like how it was presented to the world today, but I sort of like the deal.

- Berkshire Hathaway (BRK-B) cut its Chevron (CVX) sales in half, and divested nearly all its holdings in Wells Fargo (WFC), plus big sales in General Motors (GM) too, it's likely generalized as a tactical move of lightening-up in a stretched stock market, which he has been pointing-out in recent weeks.

- Small LightPath (LPTH) is getting larger space in its corporate headquarters, in fact they signed a lease for 26,000 sq ft which doubles their Orlando HQ, I will be interested to see if they simply grabbed it while available or have an immediate need to build the space out for new business (or both).

- Most likely pattern is continued churning within this S&P range, viewing Monday as a 'consolidation session' as it was an inside day (high, low and close within the prior session's range), odds favor another rebound effort Tuesday even if S&P initially tries-out the downside, but mildly.

Speaking of crypto currencies at the outset, the break we've looked for goes on, despite Elon Musk (who does matter in this field) claiming he didn't sell his Bitcoin (BITCOMP) holdings, while leaving Dog-e-coin (DOGE-X) holdings not directly addressed. I would say a drop into the 36,000 range isn't out of the question, although they might bounce it in-between now and then. (The chart above was to show the Sunday response, on Monday the 'regular' way net change was down 5650 in the June Bitcoin contract.) We're not active traders in crypto and warned odds favored a break in this sector more than a couple times in recent weeks.

The crypto-craze may very well be collapsing but don't presume permanently, although I've warned that eventually central bank endorsed digital currencies are likely to mitigate enthusiasm for such speculations, which are often more or less multilevel marketing schemes for the smaller 'coins' and 'below radar' capital movements (illegal or avoidance of national rules) especially in Asia.

I think the Oil market is showing continued stability or strength as we've been contending since the brief foray under 40 / bbl. Now, not then, so many others are promoting buying Oil or Oil stocks. While it is a bit of a read on inflation for sure, the Middle East 'could' be a slight influence. We're just holding any or all positions related, and are not eager to sell nor is there reason to buy with now all the new bulls, since we're in at far better levels (OIL).

In-sum: the market didn't buckle, even ignoring even Fed Vice Chair Clarida for hours, then the inability to take it lower triggered significant comeback late in the day. Last week's suggestion that we simply bounced off the 50-DMA is still valid, and while the market doesn't have to follow the 10-year Treasuries (SPTL) at all times, so far these rates are very flat for the moment.