Market Briefing For Tuesday, Jun. 8

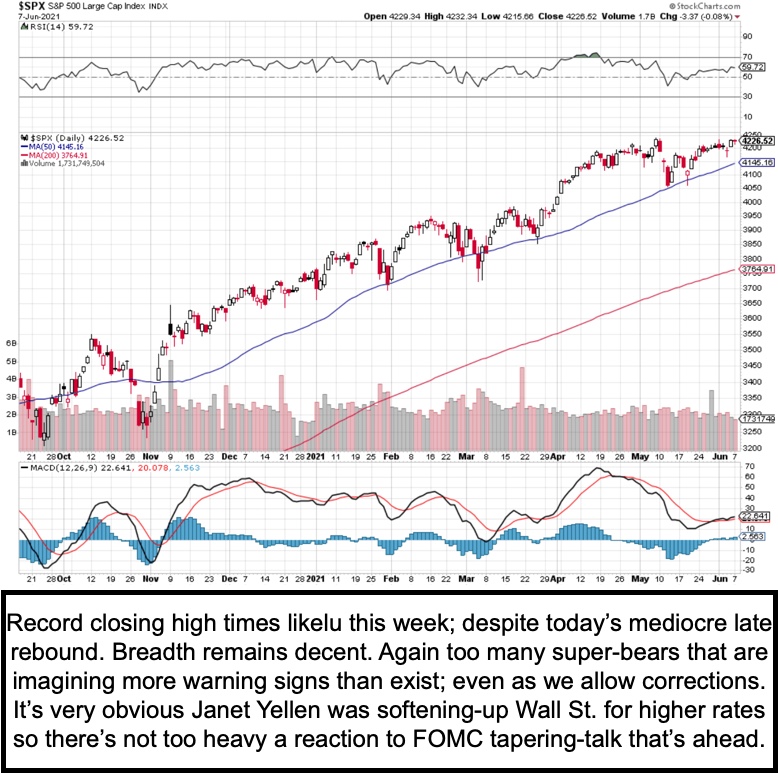

Benign market behavior generally persists, as an out-of-the-box rally effort to start Monday was reversed, as is typical since traders want a pullback first.

This consolidation may persist a bit on Tuesday, although speculation about a more-feisty Federal Reserve discussing their initiating 'tapering' is a focus that omits how many stocks have internally been correcting for months now. Sure, though FANG types remain not just vulnerable, but sometimes very risky.

The 'tax' Agreement by G-7 on Saturday (mentioned in the weekend report), for some reason had pundits surprised that the market wasn't more negative. My gosh, corporations have to pay something, with global cooperation they're getting an even playing field, and it reduces incentives to offshore the (at least official) domiciliary of US companies. The 15% deal may be simply favorable. Hence it might actually be a 'sigh of relief' for worried corporations.

(A whole lot of improvements to everything from Maps to privacy. This will be macOS Monterey, and similarly to IOS15. Some 'soon', others in the Fall.)

Meanwhile . . . I spent time listening to Apple's WWDC Keynote and aside a few graphics I'll share of 'tweaks' and improvements, I really thought they are making progress not just in privacy, or digital transformation, but integration or syncing between Apple platforms. I especially liked the ability to not just use a second device (like iPad or even the MacBook Pro) as a 2nd monitor, but to use a single keyboard and trackpad or mouse on your Mac to control both (AAPL).

I do that right now with an iMac and an adjacent 32" 4k monitor, so it will be a new experiment to see if I can simply add my MacBook Pro as a 3rd monitor.

(I sort of do this now, but single keyboard/mouse controlling all is welcomed.)

The Biogen (BIIB) approval for an Alzheimer's drug is obviously welcomed and very well discussed in every media, so I won't attempt to explore that. I will observe that the outsize response of Biogen shares refocused a bit of attention on the other stocks working in key areas, not just Alzheimer's. Amarin's (AMRN) Vascepa for sure has been a lifesaver for me (aside surviving severe COVID)...normalized lipids, and remember, it's being considered as also helpful with dementia and even Alzheimer's, because it generally reduces plaque in the bloodstream. I'm actually surprised, aside the stock, that even with advertising more physicians are not aware or prescribing it. It actually works and I'm not a spokesman :).

(Besides 'fall alerts', now 'walking stability'. I wonder how many alerts I'll get? Joking -sort of- aside, the health App coverage is getting better, and 'if' we do get Apple Watch 7 with 'blood sugar/glucose' by sensor... will be a big deal. Of course Apple has to get past the Epic lawsuit decision in Oakland in August.)

Sorrento (SRNE) benefited a bit today, and ignored the 2.5 million share registration on Saturday. Good, as it has nothing to do with the stock and just registers a bunch of stock associated with last year's deals. Holders don't have to sell. Of course SRNE still swings, but probably is in an upward consolidation of sorts. I say it thusly because the volume was 'only' 8 million, and it gained .36, while the general feeling is that there ought to be more progress reports pending, if not just the long-awaited FDA EUA for the Covi-Stix test approved in Mexico.

(This is really useful. You can set the iPhone health to notify you or a friend or family member 'if' heart rates or blood/oxygen levels deviate from norms.)

What's interesting here is that Amgen (AMGN) was surprised last week by approval by the FDA of their non-small-cell lung cancer drug. It had a 37% favorable result but only provided about one year of extra life for the patients. Some hail this as a 'break-thru' and it is for a KRAS drug, but there's more work to do. That's interesting because Sorrento is 'also' working on a MAB approach to address similar tumors. 'If' Sorrento's has a higher efficacy, the FDA would almost be compelled to approve it, as they just approved one with limited survivability.

Little LightPath (LPTH) is quiet, in terms of news, but active with 4 million in volume. I continue to think it's being picked-up by certain trading groups for swings that may have nothing to do with long-term fundamental progress (that is expected of course), but but takes share price higher if they are able to corral it right.

(This feature I might turn off if it annoys me. Maybe it will adapt to me?)

In sum, this was basically a quiet day with little changed in outlook.

This is an excerpt from Gene Inger's Daily Briefing, which is distributed nightly and typically includes one or two videos as well as charts and analysis. You can subscribe more

An interesting marketing effort here.

What marketing effort? I don't get paid by TalkMarkets; I do not allow advertising on my ingerletter.com website or in my reports sent by email to our subscribers; and it's the sole income. It would be nice to be compensated by at least a few of the many readers of my 'free' reports posted here. Thanks sir.

The glowing description of all the new Apple offerings came across to me as a marketing effort.It was undoubtedly intended to show why the stock prices rose,, I suppose, but it seemed a bit like many of the releases that I have seen.

And it was uncommon to be found in his particular venue. I did not intend to cast aspersions, or stones. Sorry.

P.S. I didn't intend being grumpy; but I'm in pain; recovering well for the most part (other than the wound) from Covid; and have returned to putting my heart & soul into this passion. And been right about the market for a few years straight; avoiding shorting the S&P too. So it's reasonable to expect some new members from the 'tire kickers' after this long a time. I could retire and just go to Puerto Vallarta; but it's not healthy there yet haha.