Market Briefing For Tuesday, Jun. 15

Conclusions can't be drawn about the upcoming FOMC meetings by analysts, who mostly continue to debate the issues we know: hot inflation numbers that skewed the CPI, whether that's transitory or not, and when tapering begins.

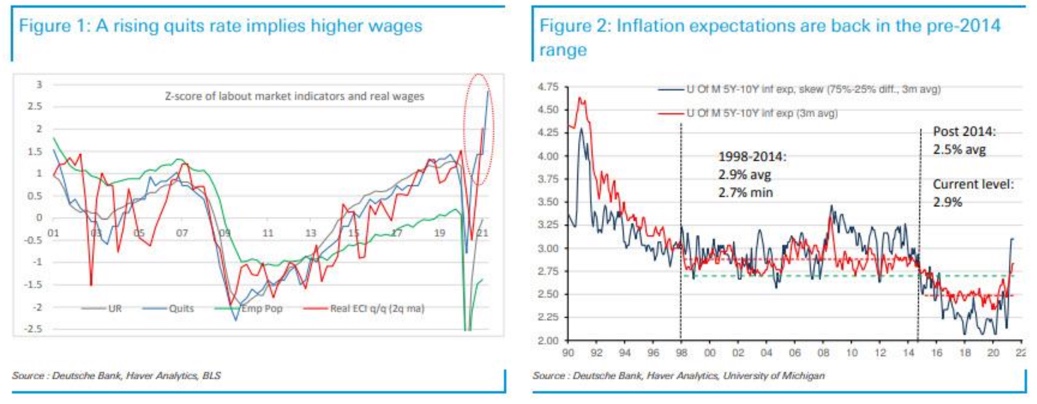

On inflation, our view is it's not transitory in several key ways, especially due to wage pressures which will be passed-thru to consumers (or business) and relatively high energy prices even as the IAEA uncharacteristically calls for a higher level of Oil production, even as they proclaim a carbon-free future.

We already achieved our price goal for Oil, hence the only worriers are those funds or other players that more recently trotted-out 80-100 goals (one day for sure that will be the level). Our bullishness is retained, since the high 30's/bbl. with a note that the mid-60's to 70's is a sufficient level to maintain for us (OIL, BNO).

Oh, and of course with inflation it's certain commodities that will be transitory, as I think I've more than once discussed. But you have a horrible drought out West, so it's conceivable that food price increases won't dip as much as many traders (and possibly the Fed itself) expect. Chairman Powell might reference the drought concerns if he chooses to sort of 'cover' his 'transitory' theme with a caveat related to the climate, not anything under the Fed's control.

But yes I think the general level of pricing is up, may sort of retrench a bit later but not reverse significantly, and while they won't say it, the Fed wants this for another reason: diminish the buying power of the Dollar so eventually debt will be partially paid (an Austrian Economist's dream?) with depreciated Dollars.

But there again they want interest rates low now to avoid a huge increase for 2022 Social Security payments, with its 'cost of living adjustment' determinant. I suppose one could argue they want to 'scare' the markets to temper the US economic revival, but on the other hand they don't want the implications that might bring. We don't know for sure, but my view is that Christine Lagarde told us what the FOMC will do (indirectly) by saying the ECB won't halt purchases of bonds in Europe for the foreseeable future, and I'm presuming she wouldn't say that unless there was personal discussion with Jerome Powell. We'll see.

In-summary:

The market remains mostly on-hold pending the FOMC. Oh, for Sorrento followers, news that later this month (SRNE) will be 'removed' from a Russell 'microcap-index', might have weighed on it a bit for anyone totally not understanding. It's actually bullish news, means Sorrento is not a 'micro-cap' stock, as it's market-cap exceeds the upper limits for that category. So now it is just a normal NASDAQ stock, with abnormal speculation and controversy.

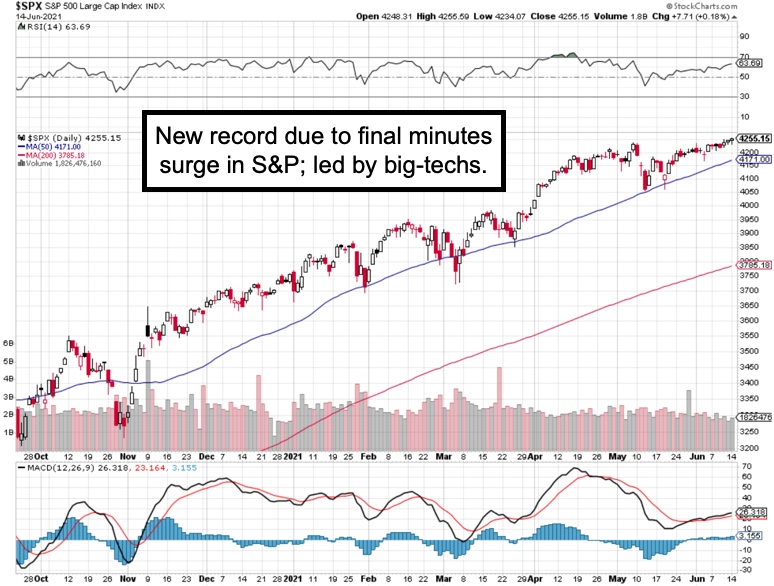

One pundit called this market a 'three-legged race'. That's the same as what I have called 'rotation' but simplifies the segments a bit: growth vs. value vs. all the momentum stocks, and FANG types (not to mention Memes). All of this is I suspect a continuing effort just to maintain equilibrium ahead of the FOMC.

That's not to say the S&P won't decline after the Fed, and if Powell avoids the trap of over-playing the 'tapering' issue, well, you can get a relief S&P rally but it won't necessarily get far or last long. Then odds of a June shakeout rise (SPY, QQQ, DIA).

This is an excerpt from Gene Inger's Daily Briefing, which is distributed nightly and typically includes one or two videos as well as charts and analysis. You can subscribe more