Market Briefing For Tuesday, July 6

Fireworks are seasonal and nevertheless stretch the 'risk-curve' further. So whether it's China interfering in their own IPO's (makes American companies even more reticent to get involved with the CCP, which is both good and bad; depending on the short-run or further along); or a recalcitrant OPEC member, there are pinpricks around the edges that should get investor attention.

For now the debate rages between (for instance) Bank of America saying 'the party's over' (I believe it's year two for that view); or Goldman saying 'we're in the best two weeks of the year now' (they usually are bullish most of the time; how could they not considering who they do investment banking for). I know; investment banking is separate from securities analysis; they don't talk. Sure.

There's a cloud 'expanding' over this market; almost like thunderstorms blow up in a late Summer afternoon. Hurricanes also build under the daylight sun, as well as absorb moisture from the hottest seas below (which is why Elsa will be more dangerous as she enters warmer Florida Straits / Gulf water).

But in this case I'm referring to the 'meme' stock fanaticism that generally has been disassociated from run-of-the-mine normal investment-grade securities. I'm just unconvinced it's going to stay that way. While a resurgent Covid is the single greatest potential 'economy-wrecking' catalyst for now to fret about (it's not political so it's ok to fret); the bushwhacking of the market could be 'meme stock liquidation waves'. So I'm fairly concerned after this (nod to Mom's b'day seasonal rally) runs it course; we'll have such risk pressing the market overall, even if most managers don't think a break in those memes would give broad exposure to the general market. I think it could indeed be excuse for a shake.

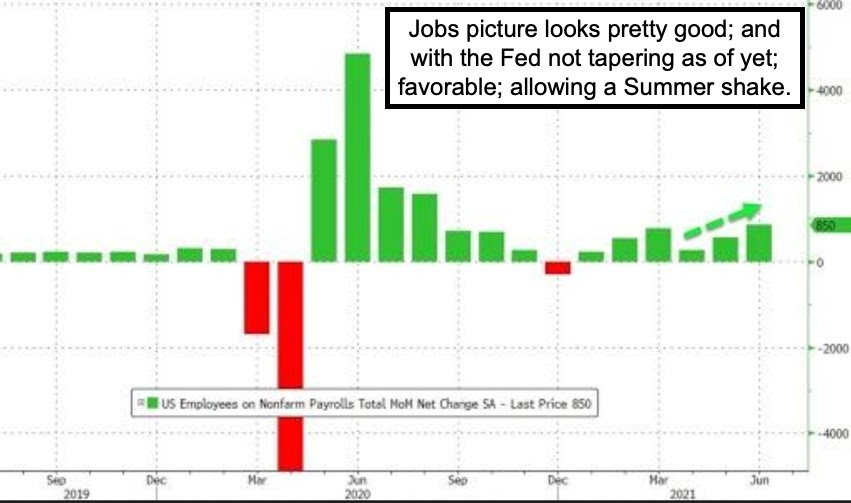

There's been concern for this market for a long time, as I've opined before. So that's actually helped the S&P and NASDAQ achieve these highs; and we've not fought that or the Fed through this entire time. The Fed was at the core of my raging bullishness on March 23rd 'last' year; nailing that low. Besides that, it is the general skepticism (we have that too; but not coming off the lows and all along like some who are bears even if fully invested..hah)... the skepticism has helped the market; compelled periodic short-covering and defeated bears on every effort to shakeout the S&P for more than a few percentage points.

It won't always be that way; as we speculated what the catalyst for a Summer solstice (shakeout) will be; however we suspect one remains 'in the wings'. Of course what's not in the wings are the two attacks from Mother Nature; which include a horribly oppressive 'heat dome' out West (little AC in the Northwest) and Hurricane Elsa, making her way towards my home (unwelcome!).

As for the stock market; it might more likely be influenced by the OPEC meet; which has been postponed until Monday; so we could hear details before the NY market opens Tuesday.

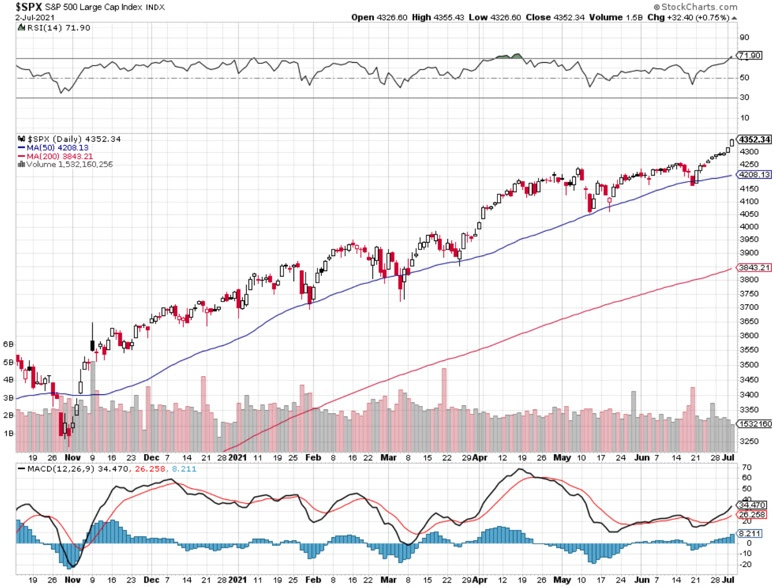

Technically... the NDX (Nasdaq 100) has advanced 7 consecutive weeks; and that's uncommon. The odds of being up next week are strong; and weaken in the weeks thereafter; but this is almost irrelevant.

What is relevant is that the VIX did not move in-inverse-sync with S&P much of Friday; although did near the Close. A VIX under 15 tells you low volatility's the condition; and in many cases it reflects upside exhaustion (or hedging the long side of Indexes like the NDX or S&P); but the Indexes have extended far from the 50-DMA and 200-DMA for some time; and not pulled back much.

The timing aspect of this is so tricky; and fortunes have been lost by fighting the S&P or NDX strength. But you have lots of complacency; which elevates the prospects of a pullback; and that's something we've pointed-to as likely. It just might not occur immediately; however we are looking for more volatility in the near future.

I know people are thinking about September as the typically weakest month (and though crashes have occurred in October; usually both are not weak); however struggling in this high range until then is doubtful; although if things remain copacetic with China (debatable); Oil prices stay not too hot or cold (I am one who seriously views Oil prices as important to stock market behavior); the Fed doesn't talk-taper too much; and money managers disengage a bit as relates to aggressive moves; well this S&P range could linger a bit longer.

I suspect July's second half will see increased risk 'if' S&P holds-up until then. Just Saturday's 'final'; as power outage preempted Friday afternoon reports.

Core technicals are either toppy or flat-out strange in some stocks. This may range from Citigroup (C) or even other banks that had tailwinds subsiding of late; and remember that was a required component from this year's start. I'm unwilling to bet against banks; but I also think the higher thrust diminishes.

Then there's the Oil stocks; up and acting great; but there's a reticence to buy them now; with an understanding of where the future energy 'themes' will lead (as I've pointed-out, that change far in the future. So for now lower production increases (still fairly high) allow price stability and solid earnings reports since less money is spent on exploration and development (in traditional realms).

It's Oil itself, which has been most stellar; reflecting rising demand with minor influence from concerns about the future. Actually even with flat demand, the limited production should enhance Oil's ability to retain strength for years. Not the 100+ idea some oil bulls just came out with (I hope they're right); but high enough; which is inline with my take on oil since it was in the 30's / bbl. Hold.

Yes people are thinking about hedging; me too; but not aggressive; and more or less I'll look at this after the holiday and see what kind of follow-through we get, or not. Again it may have impact one way or the other by OPEC or other developments over the long weekend.

Not the least of those factors could be a small hurricane; because if it hits on the West Florida coast (remember 'water up Tampa Bay results in flooding all downtown Trampa'). Kidding aside on that typo; Tampa has revitalized nicely; but it still has the low-lying risk I spoke too. Miami is another story; also low in areas (showed an elevation-risk map the other day); but high in old buildings, not just new.

Remember a key to which can fall over easiest: those of poor construction in the pre-1992 improved code days; and because until then ALL Dade County (greater Miami) required that 'pilings' supporting foundation slabs basically, only had to go down 'to resistance'. New code says down 'to bedrock'. Not to panic our members living in condos on the beach; but there's a reason that HOA's are typically tardy in addressing big repairs like concrete restoration or anything (understandably) bringing resistance from older mostly-retired folks.

Before I engage in storm coverage and miss my point; just know the storm could hit Tampa, move over Orlando, then more or less up I-95. If it does that and heads towards New York 'next' weekend, well I think markets will get quiet as macro resolution are deferred, as traders look elsewhere; preferably not from their Hamptons patios if that occurs. The best news up North is that the storm won't be at its worst in Florida until late-Monday-Tuesday; so mass driving or flying in the Northeast might be out of the way.

However, know that airports in Florida will start 'ground halts' if various wind speeds (depending on the length and 'degree' of their runways) are reached; well before Elsa. It's going to be a colossal mess at MIA, FLL and MCO (and the them parks) for all who overstay the weekend, if this storm keeps trucking and tracking as it is. I'll be right here; greatest risk is likely power failure. Thus please be understanding if I struggle to do reports if fiber or cellular is down.

Enjoy the long weekend; help the new generation understand what the 4th of July is really about (for the few who might not.)

This is an excerpt from Gene Inger's Daily Briefing, which is distributed nightly and typically includes one or two videos as well as charts and analysis. You can subscribe more