Market Briefing For Tuesday, Jan. 5

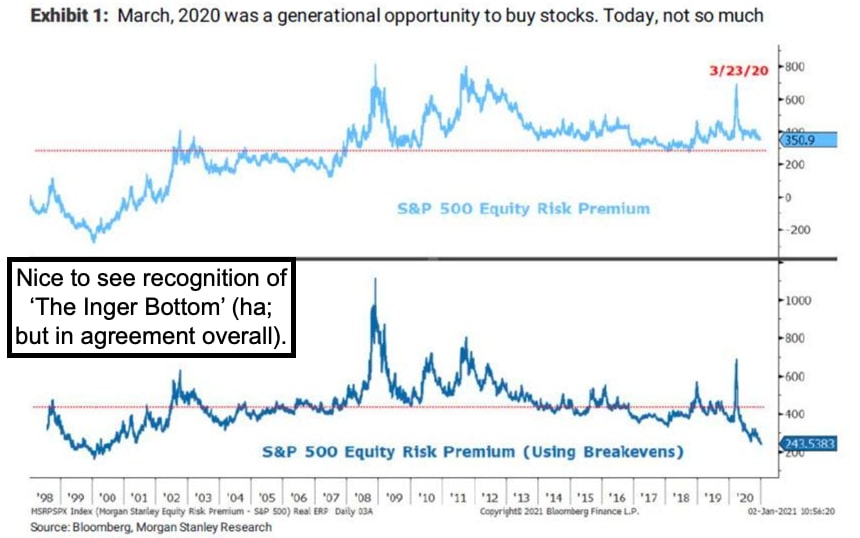

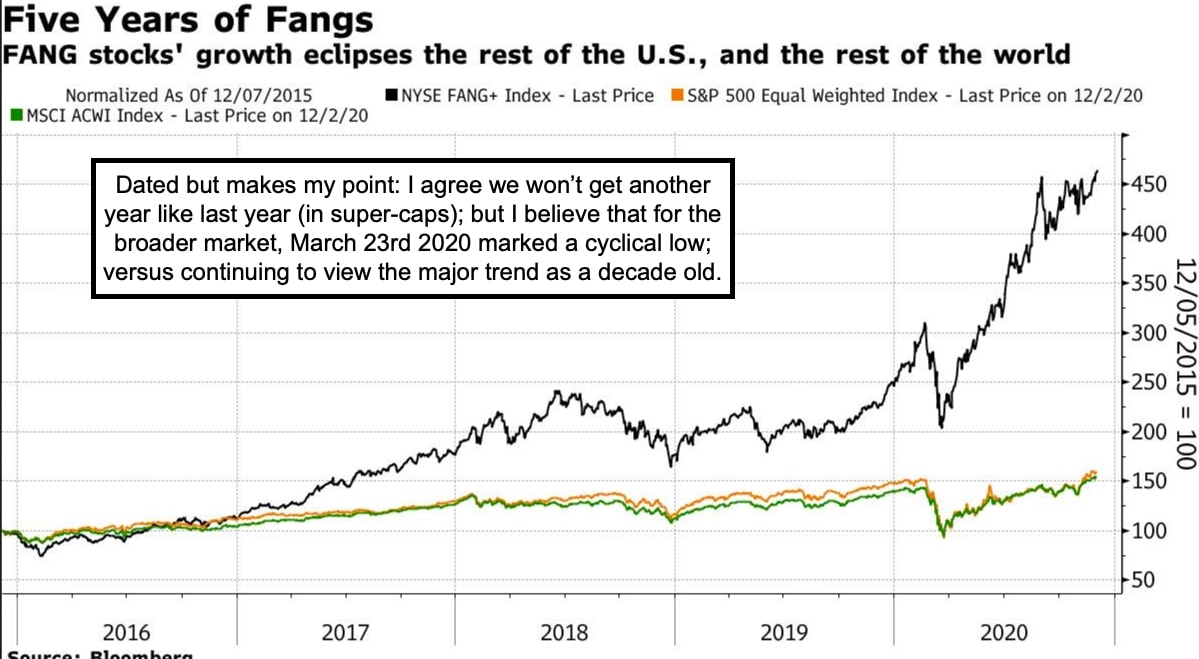

A stiff hangover - greeted the big-cap market to start the year, while relative stability or rebounds were seen in a number of small-cap stocks that struggled late in 2020. This reinforced my suspicion about some 'super-cap' gains being shepherded into 2021, so as to push profits into a new tax year (regardless of whether capital gains rates go up or not).

However, along those lines, the market will likely be more pleased if Georgia's Senate race goes favorably to leave the Republicans in control, and it's tough to tell if that loomed as a factor in Monday's slide or not. For sure it matters at least somewhat more than the political theater surrounding Trump's efforts to 'claw back' votes in Georgia, which might bring him more legal woes (though it's pretty clear for years that he's not troubled by that... an aspect noted years ago that may well date from his being mentored by the legendary Roy Cohn).

I suspect the big-cap sell-off is primarily the first issue (new tax year / overdue profit-taking), more so than the other issues, but 2nd would be Georgia's race and 3rd (perhaps overriding all) is COVID's 'fast-variant' expanding globally, as not only is the UK locking-down again, but Japan reports a huge surge.

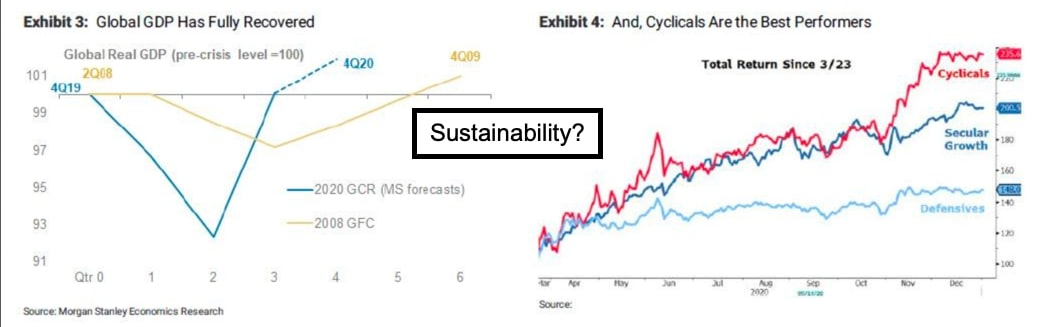

Meanwhile .. COVID spreads, and really has more to do with economic odds of a broad recovery, rather than just being on 'Fed-watch' or worrying about the 10-year, although it all matters.

Today's 'deal' to allow a huge Chinese company (with manufacturing capacity) to license Inovio's (INO) INO-4800 vaccine, should push the FDA off its duff, or at least the Defense Department, which has been backing INO's delivery system that is not itself being licensed to China. Remember though, technology often licensed to China tends to stay there and get knocked-off, even after a deal evolves (for better or worse). The 100 million initial royalties is fine, although chicken feed relative to eventual Chinese market, much less US approval.

So things are progressing. And to the FDA it's simple: get off your coddle duff with big pharma, and do it fast. The year of questionable pharma deals that at least a few ponder relates to promises to officials in their retirement years has started to attract attention of some biotech executives who gather what game is going on, but are in a 'Catch-22' (I've heard) as they don't want to accuse or otherwise impeded the agencies or officials that seem to 'string them along'.

I wonder what DARPA or DoD thinks of the FDA’s inertia directed toward INO for awhile, or lack of urgency in approving at least Sorrento's (SRNE) Covi-Stix test? It remains probable that Sorrento's approval is coming (and authorization from Mexico within 5 days thereafter), but people need all these tests yesterday. As a friend who does IT for MLB mentioned, they have been stunned by a heavy number of 'false negatives' from the testing kits they've been using. If, after all this time Sorrento has one of the 'best' with reliable data, it's a home-run deal.

Back to Inovio, I’m sure the fear of Intellectual property transfer to China has been considered, but we haven't been shown the full agreement. If FDA came to the table prompting the DARPA Phase 2/3 funding and needed to convince INO to pull out of this deal, they could 'if' that's needed. For sure they saw this news today, and likely knew all about it in-advance. So 3 million with promise of another hundred million based on performance is nothing compared to the money the Feds flooded into Moderna (MRNA) and Pfizer (PFE) for vaccines that;

1) Have questionable cellular response, but rather humeral response; 2) are tricky to boost due to ever-increasing sensitivity reaction to adjuvants; 3) are possibly positioning frontline healthcare workers as carriers (or even lots of people who innocently might be after being protected themselves.. perish that thought); 4) require millions in expenses to transport and distribute (chilled), 5) and an unknown: moving forward may make those vaccinated with 'first generation vaccines' more vulnerable to successive related infections, these last are known unknowns generally not being discussed in open forums, yet.

If you wonder why I question Washington, well Operation Warp Speed gave Sanofi (SNY) and GlaxoSmithKline (GSK) $2 billion of taxpayer's money. Thus far those two haven't yet produced even a single dose of vaccines. At the same time, OWS gave ZERO dollars to Inovio who had the vaccine ready for testing in the first quarter of 2020, had a unique delivery system with a 'hold' that later was released, and is not complex for shipping, storage or shelf-life.

And in the case of Sorrento, they were not 'in' OWS, have the only 'antibody therapeutics' 50x more potent than Lilly (LLY) or Regeneron (REGN), also very low-dose with almost immediate efficacy on a single injection. After some initial flurry, they're not even talked about except in occasional news releases but never discussion, so maybe that relates to big pharma advertising with mainstream media too, but I wouldn't know about that.

Regardless if this looks to you that OWS has shown good conservatorship of US taxpayers' money, and took the best possible care of our citizen's health, it is pretty clear that the next-generation tests, treatments and vaccines get just the slow boat (to China?) and not 'fast-tracked' as deserved by FDA / OWS.

Executive summary:

- S&P clobbered, small-caps mixed given the beginning of a new tax year.

- NYSE will 'not' delist Chinese telecom stocks as previously intended, and that is contributing to the S&P futures being solidly ahead this evening.

- Impossible to gauge proportion of S&P / DJIA shakeout seriously related to pushing super-caps into a new tax year for investors take gains (as I've speculated likely) or whether it's the prospects of Georgia's Senate race.

- The President's phone call to the Georgia Secretary of State does not at all help the Republican Senate contenders in Tuesday's Election, and that indirectly is a contributing factor to the market's jitters too.

- The market would welcome a Republican retention of the Senate, while it generally views (I think) the belabored Georgia Presidential vote-count as just political theater, orchestrated by a President who thinks he's merely repaying what he thinks was done to undermine his candidacy.

- Remember I thought that even Joe Biden wanted the Republicans to 'win' the Senate seats, because it would reduce pressure on him from the Left, if it now looks like Trump actually hurt Republican chances, the markets in this interpretation, are more concerned than they were.

- Hence 2 days ahead that politically are more crucial than ...the Election, and it's tough to figure since the 'telephone disruption' was on the holiday weekend and this is the first trading day of the New Year with something like this introduced into the basket of challenges for the market.

- Geopolitical concerns, Iran, as apparently our Carrier Group withdrawal was seen as a 'retreat' rather than as an 'olive branch' gesture, so clearly if any other provocation (after the Korean tanker or refusal to release it) occurs, that's possibly going to trigger another unsavory contingency.

- Another being the disappearance of Alibaba (BABA) co-founder Jack Ma, he's missing for a couple months now, after calling the Chinese Communist Party a bunch of 'out-of-touch old men', well they weren't pleased.

- That we already know, but is he in hiding, just low-key for awhile, or did he flee, or has he been 'disappeared' by the notoriously evil CCP (?).

- We already know Beijing nixed ANT, and are trying to suppress the large corporations from accumulating too much power (they're not alone in that of course), but their methods 'could' create a new financial split which by no means is in the mix as of yet, and it's not related to trading issues.

- Now to COVID-19: AstraZeneca / Oxford (AZN) rolling out its vaccine in the UK, while also (I hear) exploring a deal with Russia for the Sputnik V vaccine (dubious citizens will be enthused about it, although some countries are trying it and as evidenced by the hoards of Seniors trying to get vaccine in my state, there is a sense of panic to be among early recipients.. for the rest of us, a bit more patience 'if' we are willing to take the vaccines),

- As to 'half-doses' of vaccines 'here', as researchers say it's 'just as good' as the full-dose, well that's not reassuring, if it's the same protection, why does the US pay huge sums to 'big pharma' if half of it would suffice (?).

- Of course it's not the same and one should follow the science which was developed by different dosing and timing levels for a few months.

- Now this suggests not just panic, but dare we add perhaps the pharma companies are trying to get as much of the 'current' vaccines into arms, before the possibility of the 'new variant(s)' not being protected against.

- Once (if) that becomes the case, you'd have to modify the vaccines and that would probably (even if the present ones 'sort of' work) trigger more boycotts of wanting the initial ones.

- Well that takes us back to the lack of pushing 'antibody therapeutics' in a faster way, whether Sorrento's or Merck's (MRK) or others, not it can happen but the rush is on.

- Additionally there are other vaccine types, like Inovio's INO-4800 which is a DNA vaccine that can be modified (designed) swiftly to engage new or shifting variants of the virus from what I understand.

- Furthermore the demand for 'accurate' rapid testing will grow even faster, while acceptance of 'flip-a-coin' testing will be cast asunder rapidly.

- Mandatory lockdown 'thru' mid-February now ordered for 'all' the UK, this is a warning that they can't control viral spread, more vaccines or not.

- Meanwhile, INO has two feet in the door in China, which is a technology or export risk, but the royalties will be helpful and push the FDA faster (I will address this particular development a bit more later).

- Inovio might however be on the inside-track with with vaccine deals with other Chinese vaccine producers with their deal announced today.

- This morning I suggested Sorrento would rebound solidly as more shorts become fearful of holding overnight given prospects for an FDA ruling on their Covi-Stix EUA (nasal rapid test, with advantages vs. others), we do not have that yet, but expect an FDA decision this week or next.

- Also: the 'cash-hit' that Boeing (BA) may take because of delayed deliveries due to the extended nature of COVID, is precisely the kind of problem that I had in mind about travel, tourism and returning to normalcy, which isn't as much a 2021 prospect as it is for 2022, sorry to say, but.. let's face it.

- Flir Systems (FLIR) (that we've liked and watched all year) is being bought-out by Teledyne (TDY), arbitrage took FLIR up over 20% today as a result.

- I cannot evaluate the significance other than growing business, but as far as I recall Teledyne 'and' Flir are both customers of LightPath, as (LPTH) consolidates on light volume, it could prep for a sharp rebound soon (but to generate that volume it probably requires news or a large buyer).

- S&P 'probably' will rebound on Tuesday but then go into sort of a period of suspended animation, perhaps related to the Georgia Senate vote as being more important than even Wednesday's Electoral College final vote in Congress, because nobody with Constitutional sense expects change.

- As to damage to the country from all this 'regardless', I'd like to demur as an optimist, and say finally the young generation had a civics lesson.. in some cases it seems it's their adult brethren that could also benefit.

- Bottom-line: how we coordinate and navigate COVID 'is' still key to the market ahead, although very short-term there's a political aspect too.

In-sum: If I had to pick one 'fundamental' concern that's not discussed, might it be the speculation that all the so-far approved vaccines 'may' not work on a couple even-newer variants of the Coronavirus. I do not know if that's so, and at least most pharmas 'say' that they 'think' theirs does, but tests continue so it may very well be that the market is contemplating what we've talked about: it may be more like late this year or 2022 when we 'really' get through this for a large proportion of people and 2023 before cruising and so on 'truly' return.

'If' (and that's all a big unknown 'if') so, that also supports everything from new delays in cruising (where even with 30 cruise ships sold for cheap or scrap in the pandemic), there is an increased capacity of 40% within a year due to the arrival of previously contracted (mostly 'super-size') new cruise ships, which is the last thing the industry needs now.

Combine likely delayed Boeing jet deliveries, regardless of business or lack with China, and you have part of the answer to what the market might worry about, besides SPAC's, super-caps, EV, and all the rest. Speaking of 'the rest' we'll be covering CES just a bit, as this year's is virtual of course, as is much of our lives it seems. So expect a rebound, but beware sustainability.

I can sense the 'COVID-Panic' based on the half-dose discussions alone.

Thanks fir the large collection of information and insights, Just what UI needed!!