Market Briefing For Tuesday, Jan. 24

Inflation fears have been fading for at least 6 months now, even though persisting (and continuing) strength in Oil prices will make disinflation difficult.

Monetary policy has a lag, and so do financial media perceptions. That's a factor here, where 'inflation fears' have really not fade until now in the 'press', probably because the stock market is extending it's rally and they're figuring out that must be why. What they miss is everything that already happened.

Another aspect of being late to the plate is how they debate whether S&P is going to be able to hold above the long declining trend line. We've already on several occasions noted the series of higher lows in S&P daily action, plus an already achieved upside breakout in the New York Composite that I've talked about almost daily. That doesn't mean we won't set-back or something tricky occur, but does means there has been a solid forecast 'January Effect' move.

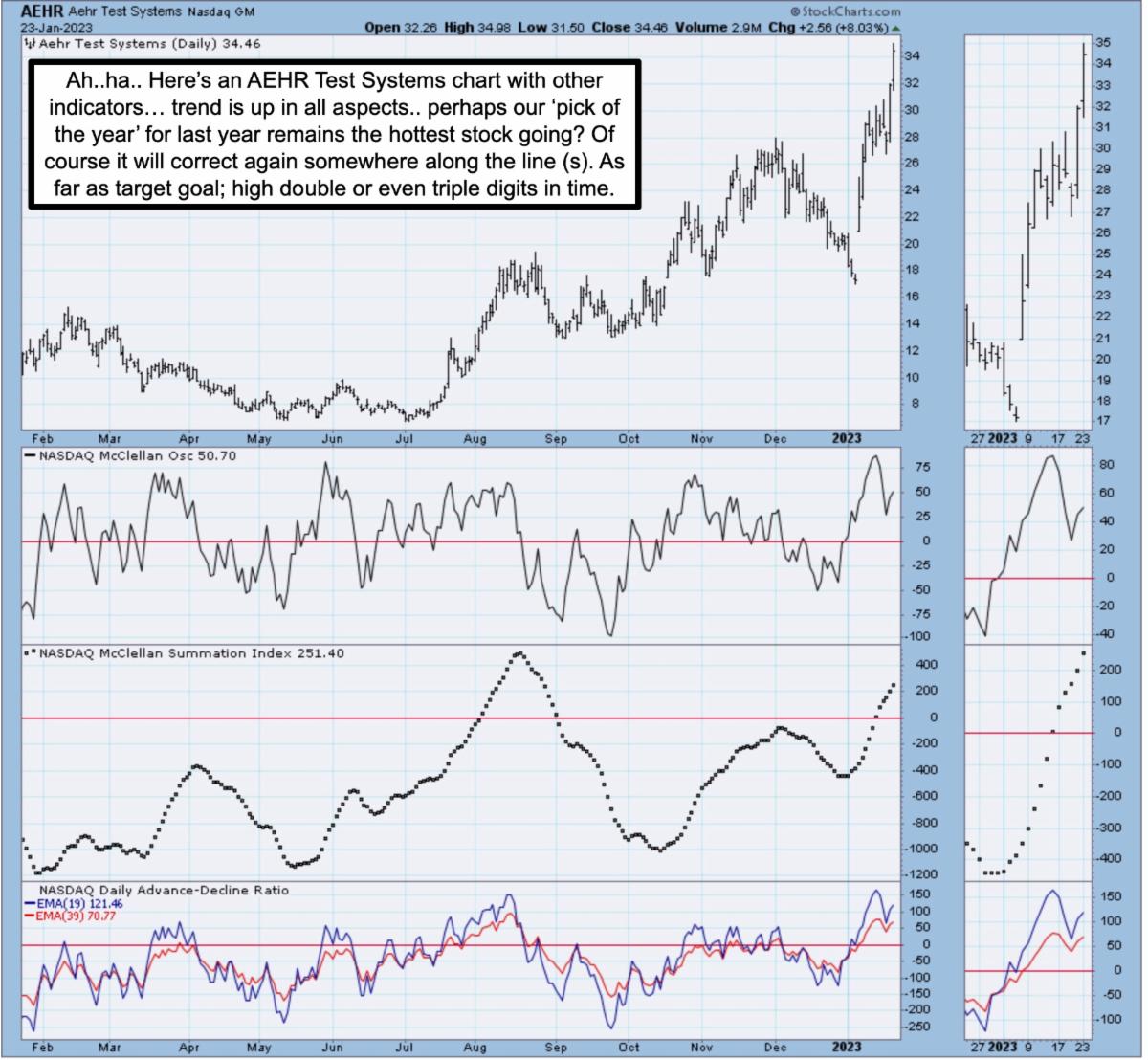

Earnings are not collapsing, China is coming back, and avoiding short-selling has been a warning here for weeks, and appropriately so. Meanwhile some of us who embraced AEHR Test Systems, are slightly stoked by the advance. I note that it was 'pick of the year' for last year and continuing, not merely one of a handful of speculative 'sprinkled' stocks we added. Some of those show a flurry of life-signs, but others have yet to perk-up much, but may be pending.

In-sum:

Pattern of 'inverse head & shoulders' developing for months indeed persists, along with a slight breakout for S&P, while broad market already did (exemplified by a series of higher lows on pullbacks when they occur).

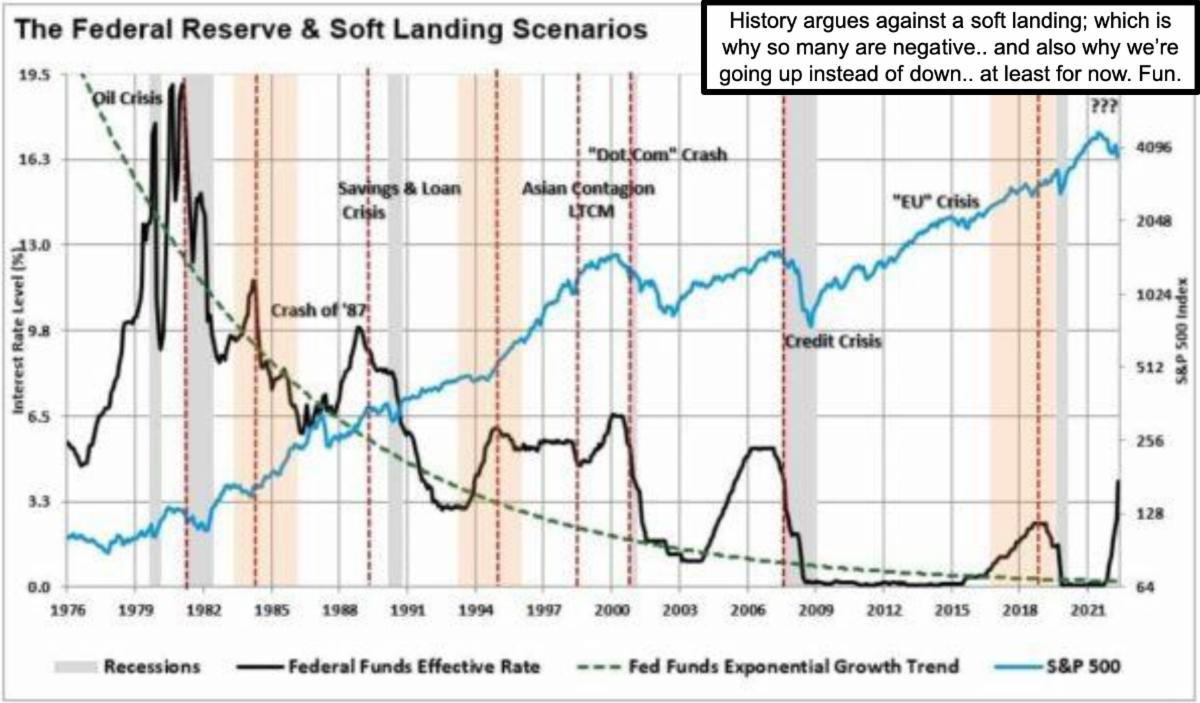

This strength and resilience defy everyone worried about recession and rates from the Fed. Our view has been that's behind, the Fed isn't likely to cut rates (yet), but recession is partial in the economy already, while economy buoyed by huge spending programs. No deep recession is on the horizon, barring at least a couple exogenous disruptions (like an expansion of the Ukraine war).

Debates continue about how to handle high-beta names like Microsoft, but I believe those are yesterday's stocks, able to advance but big gains behind. To us it's the new-generation 'gear' and eventually Microsoft (MSFT) and other old timers getting into AI likely pans-out (their Azure is superb but factored-in for now).

Of course it's riskier to speculate in newer disruptive stocks, even AEHR Test Systems (AEHR) has a volatile history and can give one angina (I resemble that once in awhile... sort of wry humor), but works higher (and still will) over time.

Growth is accelerating not contracting, and maybe the Fed will be offended at the USA doing well after all this tightening. So that's a paradox (two doctors is a pair-a-docs to me) in a way and might be an obstacle a few weeks from now of course, but the dynamics are actually falling-in-line with our 'softish' ideas.

More consumer spending is unlikely, and we probably have a bumpy road for February, but frankly we're focused on a handful of 'active investing' stocks for now, and not the financial media's frustration and infatuation just with S&P. At the same time S&P is working higher, it simply lagged other major Indexes.

Bottom-line:

Key S&P declining trend battle shaping up for Tuesday, bulls at this point have the upper-hand and you could see a scramble higher at some point, with eventually a retreat to be evaluated, but not a colossal catastrophe.

More By This Author:

Market Briefing For Monday, Jan. 23

Market Briefing For Thursday, Jan. 19

Market Briefing For Wednesday, Jan. 18

This is an excerpt from Gene Inger's Daily Briefing, which includes videos as well as more charts and analyses. You can subscribe here.