Market Briefing For Tuesday, Feb. 7

The 'magnitude' of a pullback - is mostly what's debated now. It's unlikely to shake things up like a 'real' temblor did (sadly) in Turkey today.

However it will be a bit like the aftermath of a seismic event, shaky shuffles that one worries about being as bad a temblor, but 'usually' turns-out to be relatively minor. (Of course we extend empathy and sorrow at the great loss of like today in Turkey as well as concern about aftershocks, severe in this type of slippage quake.)

I'll mention I do not believe pullback occurs without rebound after comment from the Fed Chairman then minor shuffles ahead of State of the Union.

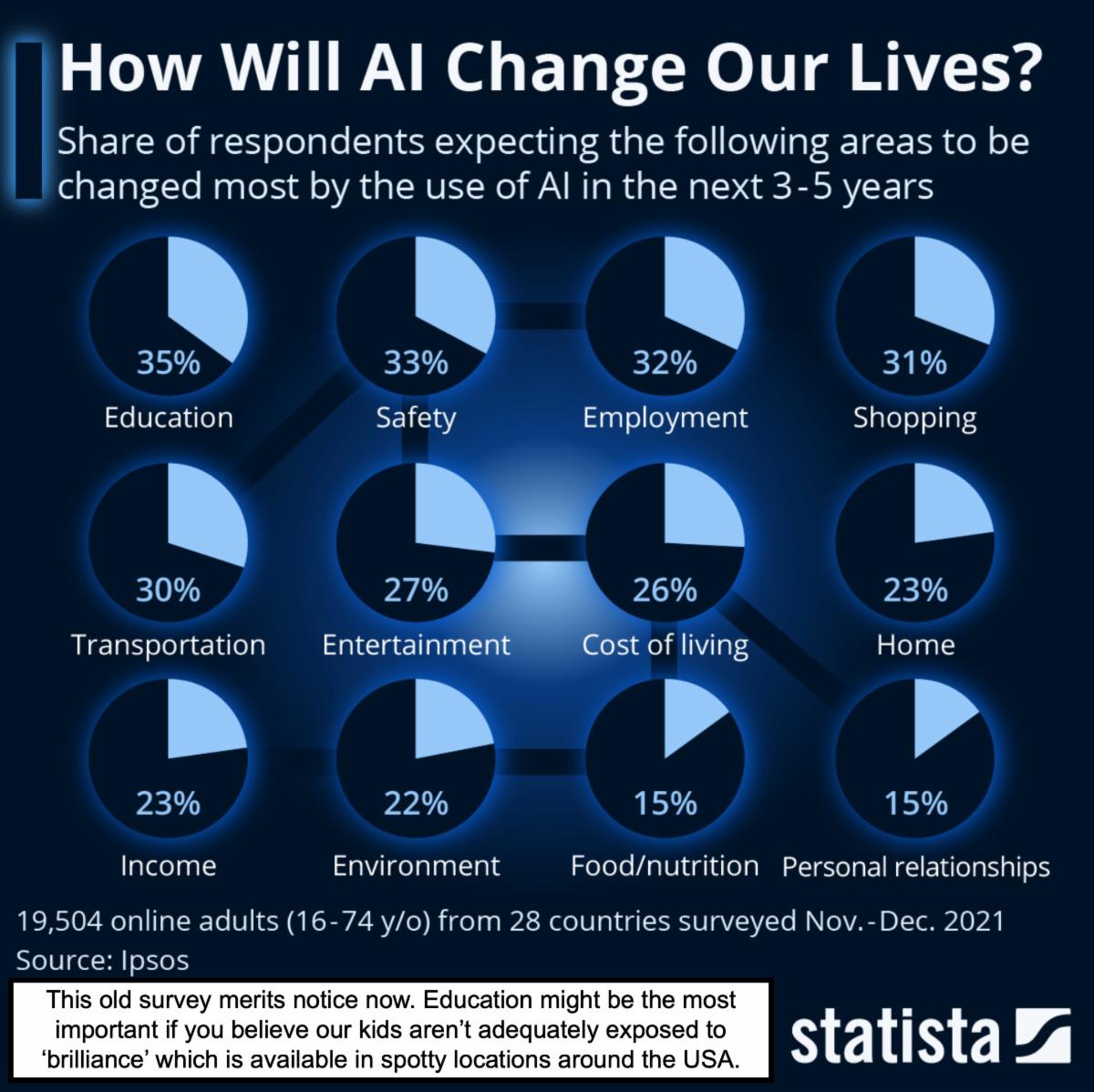

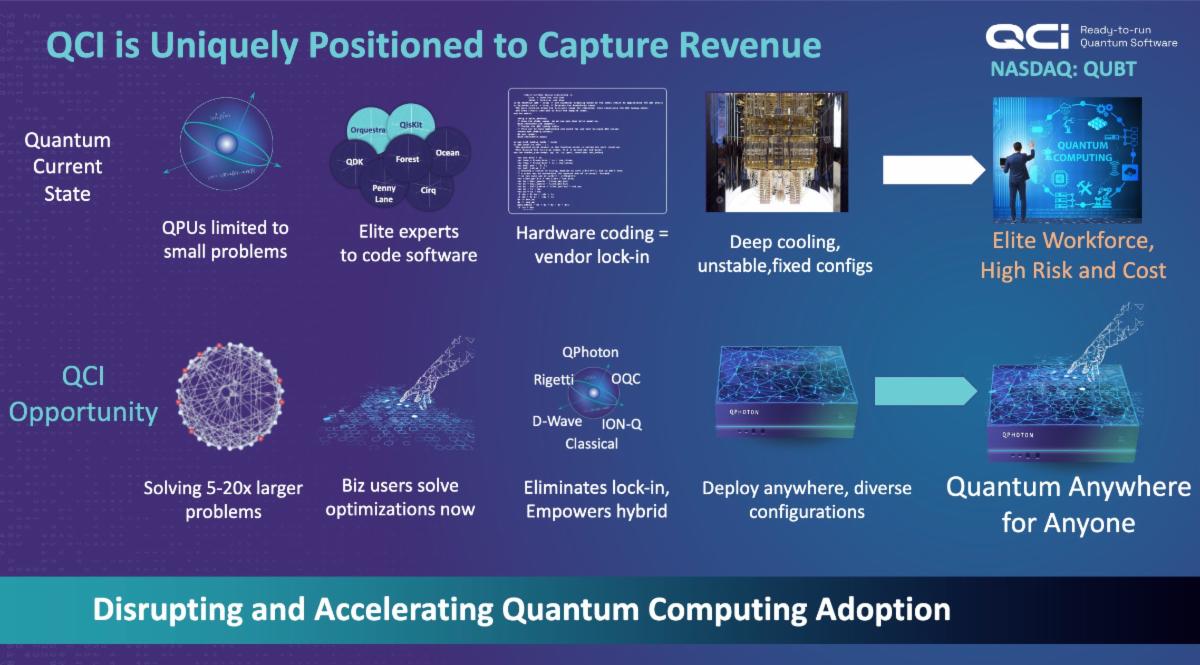

Market: analysts are now trying to focus on how 'technology' won't be a leader in the future, which by the way is utter nonsense. Mostly it's because they've invested excessively in 'only' conservative 'so-called' safe stocks, for which a lot of them are struggling to pay dividends, because their business is slower. I think there are terrific avenues in tech, including the new Ai and Quantum realms, however these are speculative and barely emerging into real uses.

It is with caution we venture into Ai & QC, generally into extreme weakness knowing most such stocks had multiple run-up's and multiple failures over the past year or so, and during which we 'never' had a pure-player in that area. It is because of the volatility that we will not chase the bigger plays off their lows and recognize the moves by major 'old' tech companies like Google, Amazon and Microsoft (etc.) will have an influence on winners and losers in sectors.

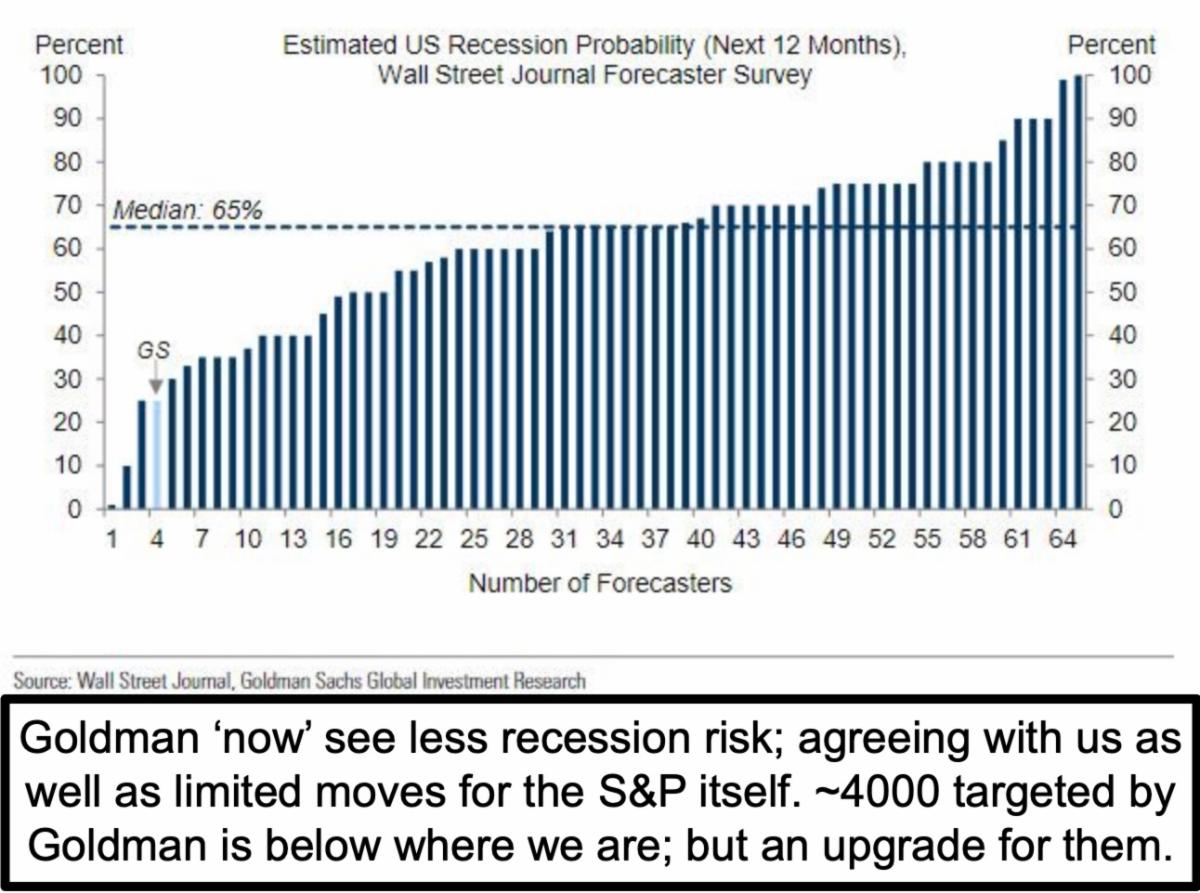

Many analysts overestimated deep recession prospects, others are now trying to wiggle their way out of negative forecasts (such as say avoiding recession but higher S&P targets still below where we are), and a handful suspect we're just going to cool-off a bit and then gradually ramp forward to higher levels. If anything dampens enthusiasm for S&P, it might be President Biden (expected to lean hard against buybacks by big-caps... I actually don't disagree but sure, sometimes enjoy the higher prices the shares receive, although not preferred as a destination for surplus funds that could be better used for 'actual' growth.

The White House will be calling for 'quadrupling tax on corporate buybacks' at the same time they demurred on the so-called billionaire minimum tax, which I tend to agree isn't fair. But lots in life isn't fair, including excessive spending in Washington and failure to account for Billions (Trillions?) in pandemic relief or stimulus theft, which the IRS and others have barely attempted to reconcile. I know 'they' (White House) thinks fighting buybacks is good politics, but while I totally support the intent of the Chips Act and Infrastructure spending, much of the spending hasn't been audited and there is 'pork' everywhere but the farm.

I also suspect Biden will beat up on the Oil companies, again inappropriately. I suspect Chevron's (CVX) buyback in-particular brings this to the State of the Union, while they can get away with beating-up on Oil (politically correct) if illogical. I don't think they'll damage much though, and expect Oil to hold low 70's.

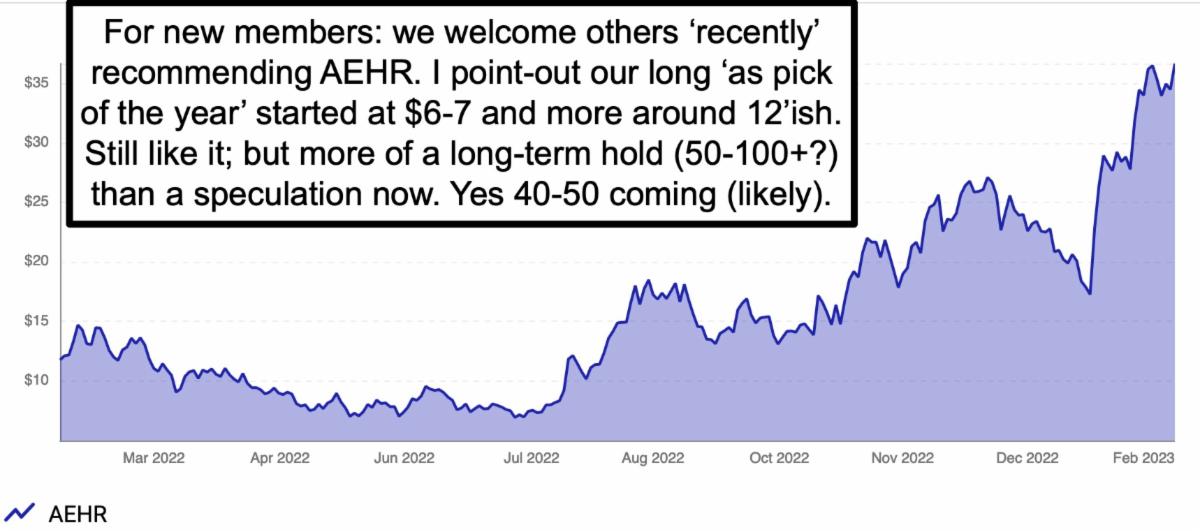

For now there's no change in my view that we had the projected thrust off-of year-end 2022 selling, and that it would run out-of-steam temporarily after a bit of shuffling in early February. That's for the S&P, but here and there we'll have a few stocks that diverge (favorably or unfavorably) depending on event risk, or event opportunity. Probably the best opportunity will be 'if' AEHR gets a new customer or larger order from an existing customer, or for-instance if a recently added BigBear.ai sees significant progress with military contracts.

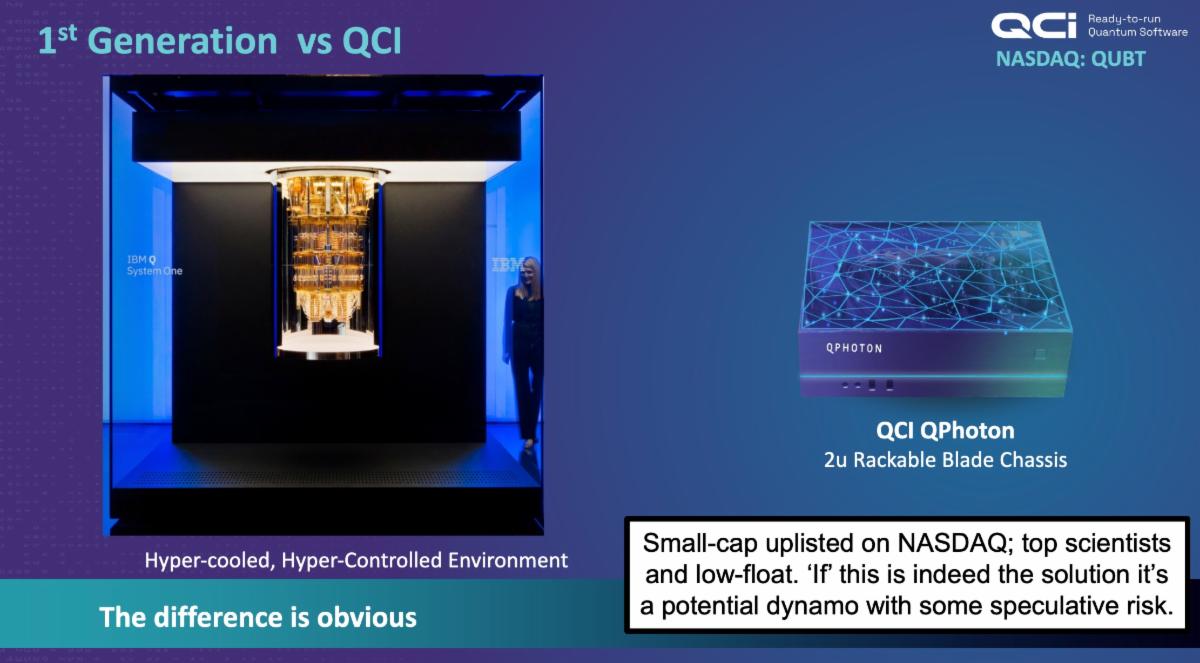

So yes I see these as the 'new tech leaders' and in the wings we've got very controversial Quantum Computing, about which we're not as enthusiastic of course (because that is even earlier stage), but want at least slight presence (hence in the 'sprinkles' category of speculative stocks... like QUBT, which is really small with really smart people, albeit really hard to forecast movement). It's almost like our LightPath (LPTH), sometimes surprises and runs, after patiently waiting rather than reacting after some sort of favorable news surfaces.

So I don't know what we don't know, however I ponder a bit more since last week's Chinese surveillance balloon violated U.S. sovereign airspace, as well as Canada's as apparently a 2nd 'threat' balloon overflew Costa Rica and part of Columbia (and beyond). I believe 'Ai' will dovetail with other technologies in a sense getting more focus in the wake of China's 'testing us' (slow reaction).

Bottom-line:

This week I'll highlight a couple speculative stocks very likely to benefit from the progression into new technologies, primarily militarily in terms of 'urgency' (which just the Air Force Commander's recent memo pointed out).

I spent hours of my weekend delving into a number of AI/CC stocks, intending covering them a bit more as the week progresses. I physically can't do it now, other than share the name of the one speculation (sprinkle) just adding today.

The market should ebb and flow, even react to Chairman Powell's comments at the Economic Club Tuesday, but suspect S&P to rebound after digesting it.

P.S. so-called 'smart money' continues piling into (not out of) AEHR. We hold.

More By This Author:

Market Briefing For Monday, Feb. 6

Market Briefing For Tuesday, Jan. 31

Market Briefing For Monday, Jan. 30

This is an excerpt from Gene Inger's Daily Briefing, which includes videos as well as more charts and analyses. You can subscribe here.