Market Briefing For Tuesday, Dec. 22

Post-expiration sell-offs - such as Monday morning's, are not uncommon at all, and we discussed that. As well the prospect of a turnaround albeit not that dramatic going forward, even though we had a dramatic turnaround today.

We expected that Monday morning. It doesn't mean a shakeout can't occur in the near-term but actually it just did. Lasted a whole 45 minutes. Seriously this just show how the shakeouts -for now- don't gain real traction.

To a degree the S&P absorbed a lot of selling-pressure from re-balancing, as well as the inclusion of Tesla (contributed to volatility), and some rotation has not occurred as dramatically in bonds or financials as Wall Street focuses on.

Largely (aside the normal decline after Expiration) there was response to the horrendous situation we wrote about in the UK over the weekend.

Manipulation . . . might be commencing, in an odd way. You've had massive run-up's in many stocks, lots of bad news relatively ignored by markets (the cyber-attack being the outlier, while the dismissal of post-election autopsies is debatable as to whether unsettling repercussions are still forthcoming), and of course COVID and the lack of an effective 'relief' bill, at least as of press-time (but forthcoming it must be assumed).

While I think the Fed sees the behavior and is making use of its toolbox early in this situation, the allowing Banks to resume 'buybacks' might signal more in terms of 'stabilization' efforts, than merely fortifying the economy (or market).

Big-caps remain extended, as bears continue 'fighting the Fed', even as for sure, a post-Expiration pause would be normal, but Tesla might mix that up.

Now, S&P prices aren't cheap in the leadership area, compelling focusing on overlooked issues. That's more key, so actually minimizes the behavior of the big-caps in a sense as predictive of money-making approaches to 2021.

I explained this week, that even as a shakeout is due I prefer listening to the 'messages of the market', which haven't reinforced odds of significant decline. That's been in-part by virtue of internal corrections, with a host of small stocks never really recovering to the Summer highs, working off their 'then' extended levels, or now encountering some year-end tax selling too. Some of these will probably do fairly well in January, after such pressures tend to abate.

Executive Summary:

- The insidious cyber-attack would not bring a new 'cold war' with Russia in a Trump Administration (he has barely said a word about it apparently as he suggests it was China), but with a new Pres., (or woman) it just might.

- Saturday's tweets by Trump directly contradicted Sec'y. of State Pompeo, as whoever is, the attacks are insidious and dangerous, not overstated.

- Hence I elevate the 2021 geopolitical risks, aside the 'Roaring 20's' stock market call that otherwise should prevail once we 'pass peak COVID'.

- What will be done about Russia, taking center-stage away from China, is going to be assessed as more is grasped, but sounds pretty dire overall, and the 'bull market' extension case does 'not' include ramping tensions but actually a calmer time to rebuild infrastructure and expand innovation.

- England confirms 'new variant' of COVID-19 with faster transmission and alerted the WHO, as well as told the British people in impacted parts that activities around Christmas are cancelled (complexity late in this report).

- Whether the mutation is vaccine resistant is a big question, as too many bets were placed on big-pharma vaccines, not antibody therapeutics, now even the politically-beholder 'experts' are coming-around to admitting this.

- The reason for the drastic UK measures is that the new mutation spreads in the south of England at lightning speed, and that it now accounts for as much as 60 percent of all COVID infection in London, 'Number 10' is clearly stating that the new virus variant is more contagious than the prior ones.

- The Tesla situation is the rowdiest stock to enter the S&P now, and even a gander at the last 30 minutes Friday (and after) reveals the volatility that a stock like this contributes with implications for Teslas (TSLA) and the S&P (SPX) itself.

- When S&P's biggest constituents are volatile, it increases volatility, and for sure makes no consideration for competitive pressures lying ahead.

- Nobody survived shorting Tesla (we did not try), but warning becomes a reasonable assessment, though so many will say that now it's more likely to thrash around and mess-up anyone that tries shorting, before dropping on a grander basis, if it all, stay tuned as we'll continue following EV.

- Remember, much of Tesla's advance post-split defines market norms (as is just a perception of a cheaper entry, hence retail spectacle), and just looking at this year's sequencing suggests some sort of setback looming after the shuffle.

- Tesla ran-up about 60% since the S&P-inclusion announcement, and that is further evidence that it needs to consolidate soon.

- On the other hand, strength in Tesla has nothing to do with actual growth of business and it's multiple anticipates perfection going forward (caution is thus justified, even though competitive results-date are in the future).

- One more thing: German biotech CureVac, is collaborating with Tesla not on electric cars, but to make mobile molecule printers Musk described as 'mRNA microfactories', if successful (by mid-2021) it's a delivery method that follows-onto a concept Sorrento has of unconventional inoculation,.

- The S&P swings will be beyond the shuffle of a diversified stock basket, a definition of what S&P 'thinks' are the 500 biggest best companies.

- Correlation among them increasingly focuses on volatile technology stock components, so maybe that takes it a bit higher, so keep that in mind.

- Then we have the Fed (intervention?) by allowing 'banks' 2021 buybacks that will probably achieve what I wanted to see for to enable any broader advance, Bank & Oil leadership or at least decent participation.

- We had a bit of both already, but clearly the Fed is using an 'insurance' tool in the market now, perhaps thinking they'll protect bank solvency in a manipulative manner (hard to fathom aside free money basically) during the rest of the economic drought related to COVID.

- What we don't know is whether bank loan reserves (or some red flags for that matter) prompted this action, as otherwise it might be premature.

- Among stocks with superior percentage gains this week was LightPath, as it broke-out to the upside as suspected likely, then consolidated in a very mild manner, suggesting more upside soon again (former resistance is now support so optimistically after this pause to refresh, higher highs).

- Thursday I emphasized that while I don't know, it wouldn't surprise me if LightPath was the supplier to most, if not all, of the recently-hot Lidar players in the U.S. (or abroad?) related to automotive or military too.

- Most 'Lidar' plays (like Luminar, Velodyne Lidar or Innovitz) are trying to consolidate after thrusting higher, not just as we had anticipated, but with the ensuing profit-taking we looked-for after excessive media hype, this will remain an interesting area going forward (we'll monitor all).

- Note the late buying in a couple of Lidar plays suggests re-balancing not about the S&P particularly, but overall hints at managers interests for 2021, and that enhances interest in some on meaningful pullbacks.

- S&P itself might surprise with mediocre percentage moves in 2021, while individual issues, Oils, Banks, or 'innovative tech & biotech' do well.

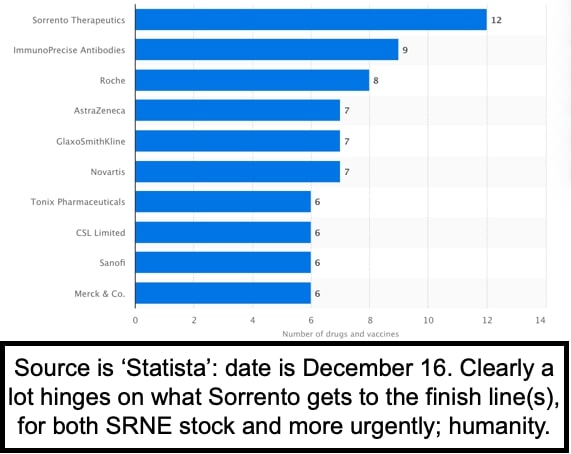

- None of this is not bad for Sorrento (which will move on its merits or lack) as it washed-out Thursday then rose as outlined, before consolidating a bit, pending possible FDA decisions or submissions, there are a mixture of both pending (little transparency).

- Also no vaccine approvals affect Sorrento’s value, as therapeutics are a complement to a vaccine, not a substitution, though they can be, and as I explained before, vaccines do NOT cure anyone already sick or carrying the virus, hence only antibody therapeutics may help if already infected.

- Yes, antibody therapeutics can also be prophylactic, I realize confusion is widespread about this, but vaccines can only help prevent, whereas the therapeutics have both preventative and curative properties, but only for now when administered quickly after positivity or symptoms 'present'.

- A misunderstanding partially is because Lilly (LLY) & Regeneron (REGN) aren't potent enough to help advanced hospitalized patients, whereas Sorrento (SRNE) claims theirs does, but this is yet to be proven through various Trials, if SRNE is able to substantiate this, demand may overtake most of the rivals.

- For hundreds of millions of people in the world that will not get a vaccine in the next few years, therapeutics (oral and nasal especially) will help or enable recovery, hence possibly a life line to those that get COVID both in the underdeveloped world and in first-world countries.

- That's why I noted nobody that is infected gets cured by a vaccine, hence need for 'antibody therapeutics', possibly even bolstered by new T-Cell vaccines (like Heat Biologics), although less is known about that so far (Heat just stated vaccine study by Univ. of Miami complete, ready for the Phase 1 Trial, but again barring a partner, it's very much slow-go there).

- Elsewhere: just learned that Mesoblast, a (foreign) stem-cell company, failed in a trial backed by Novartis, so that's disappointing (no interest but note the varying approaches) among the 3 stem-cell players most noted.

- One of which one is Athersys (ATHX) in Ohio, which isn't doing much, but their product MultiStem passed Phase 1 & 2 results in ARDS, received Fast Track designation from the FDA, so 'maybe' something will pan-out.

- Sorrento does have a small stem-cell subsidiary, which may or may not be useful with COVID, as it primarily was working in oncology, of course they are not in the lead with 'stem', their focus for ARDS is STI-5656.

- The market pattern remains about as outlined, defensive Expiration and still on hold for 'relief' from Washington, so the 'channel' persists.

- Friday concluded Quarterly (Triple Witching) Expiration, so some degree of volatility in certain stocks was related to this Quarterly occurrence.

- Now we get fast volatility related to Tesla's inclusion in the S&P, and that might only be partially offset by the Fed's move helping the Banks (unless everyone ponders 'why' the Fed is doing that at this particular stage).

Remember, you can get shakeouts, or even a correction, but no catastrophe, of course barring an exogenous event, or so-called 'Black Swan', swooping-in to disrupt the dynamics. The grand-scale cyber-attack was a potential terribly disruptive event, but either 'they' have control of it, or are minimizing what has been shared with the public, because so far it's not really influencing markets.

As I noted yesterday, an excess liquidity case is an explanation for the driving of equities higher in the near-term, and that doesn't change just because lots of traders are alert for a decline, or even coveting the prospect of shorting.

In-sum: the pattern is unchanged as we've noted. However the risk matrix is a bit varied, not just because of the Fed allowing bank buybacks, not just the cyber-attack 'divide' that really makes one ponder 'why' Trump & Pompeo do appear split on this, and now the concern of a wilder faster COVID spread that occurs concurrently with media saying the 'cavalry is on the way with the 2nd vaccine', but that's no signal of near-term relief, even though most people do understand this horrible situation isn't really at a pivot-point yet.

Bottom-line: the dynamics of an economic re-acceleration matter, and it may be troubling as many investors won't grasp an environment where small-caps might be outperforming the 'super-caps' handsomely, with speculation strong at times next year, while the stocks that prospered this year, pullback.