Market Briefing For Tuesday, Aug. 15

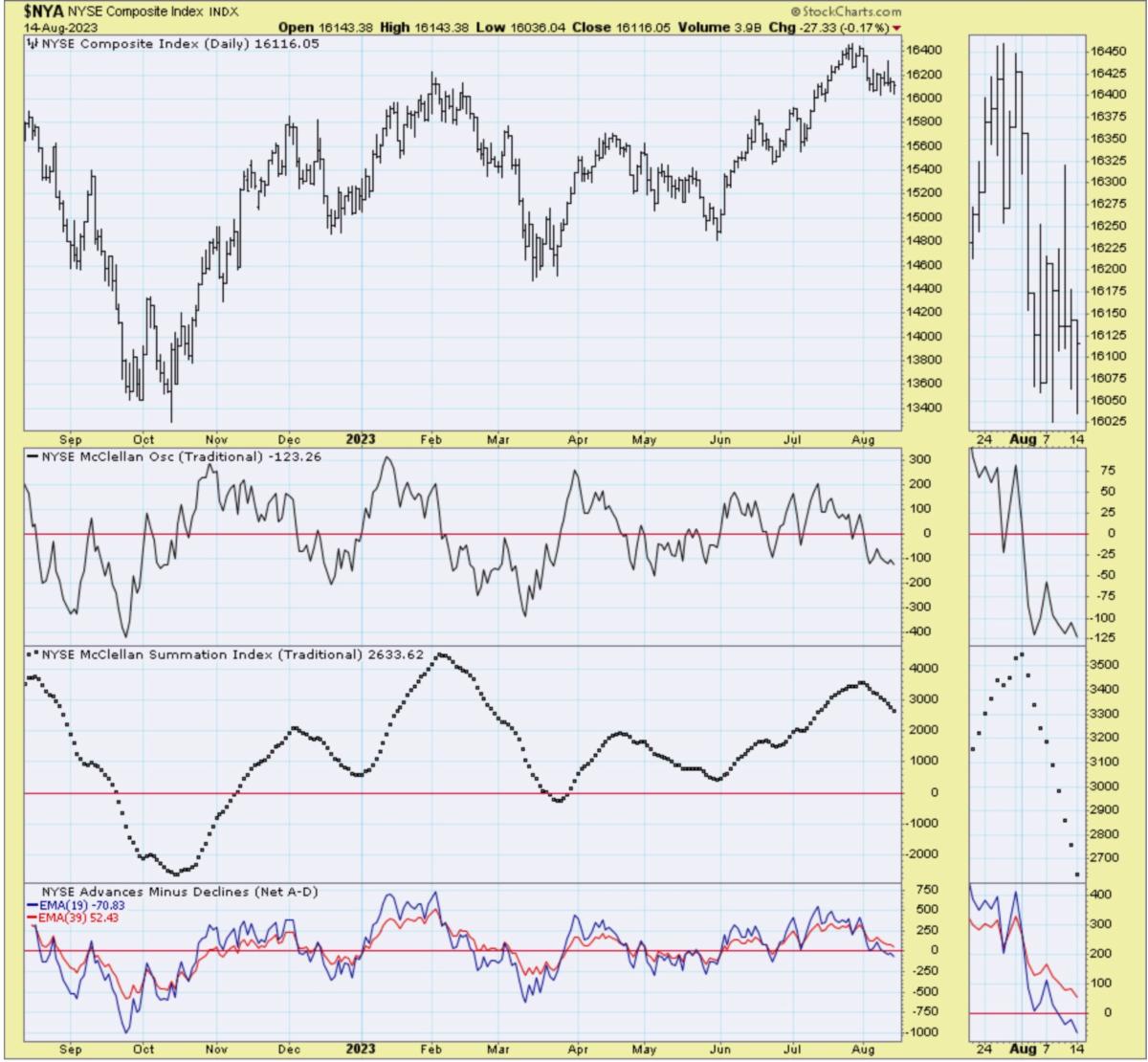

August's swoons persist swirling, but that means sometimes winds seem to come from alternating directions, as mostly was the case in Monday action.

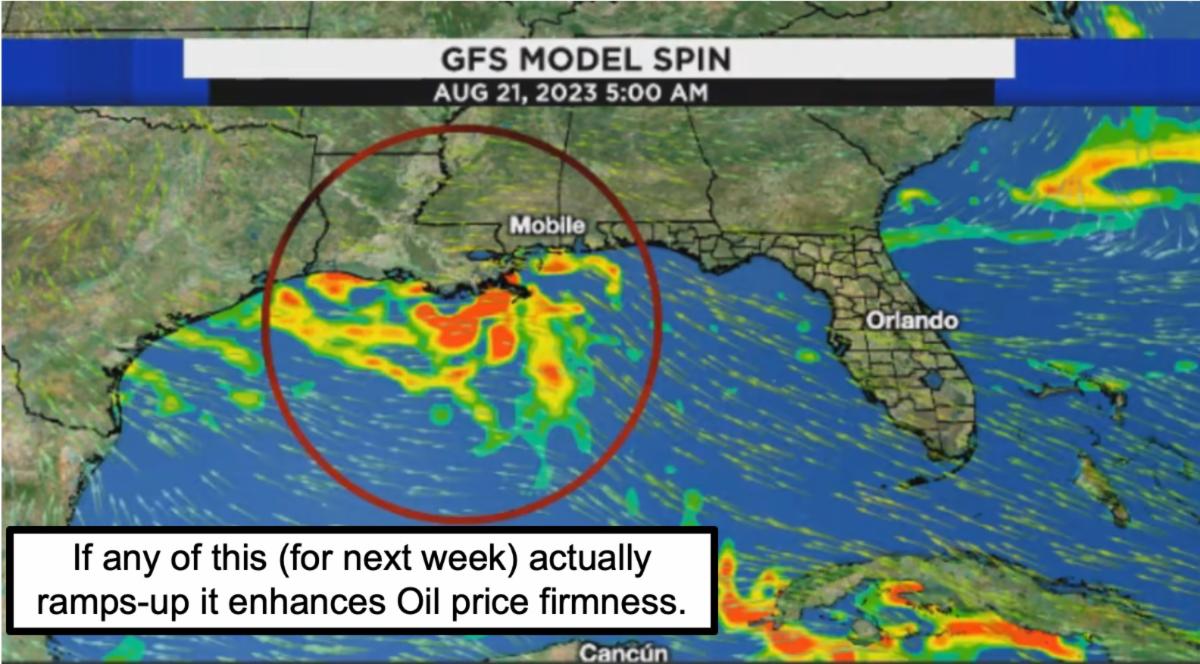

Significant issues, besides the Fed and usual discussions, include whether or not China's real estate market collapses (because many have cash balances in U.S. Treasuries for example), the war (which isn't going well for either side), Oil prices (firm and debatable should a storm hit), as that takes us to the Gulf of Mexico, in which some weather systems may form in a week or two, plus of course there are more variables that include the Dollar's action.

As to the storm risk, that's basically what triggered the firestorms rushing into Lahaina as poor Maui was devastated. And whether or not there's a hurricane developing in the Gulf will determine evacuations of drilling platforms, refinery shutdowns and so on... that would be a risk from now into Mid-September.

In-sum:

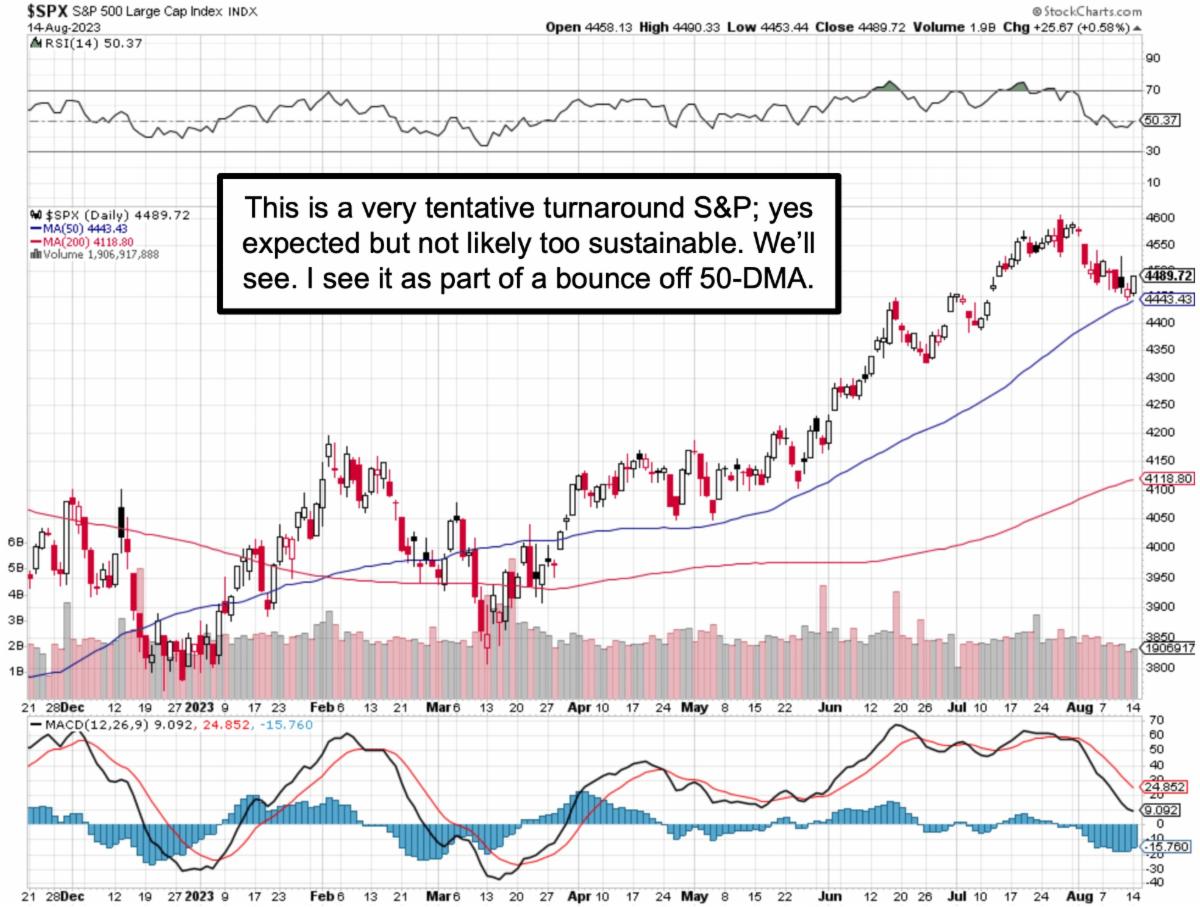

Nothing changed overall, S&P was expected to washout a bit, then to rebound and it did, especially in the final minutes. This should continue into or beyond Tuesday and we'll see. I doubt it will be particularly sustainable.

So no, I don't think anyone was so evil as to 'want' fires to envelope Lahaina, but there are opportunists who will exploit the situation (even mutual benefit, if the resident wants to get away). That won't work so well in Florida, because it is broadly known that brackish water (salt water intrusion) already is evident in Dade County, even before sea level rises eventually inundate Miami Metro. A couple cynics say I 'sold too soon' when my home's 'elevation' dropped from 6 feet to 4 feet after Super Storm Sandy, and that's correct. But like some stock moves, sometimes better too early than too late.

In the current case, say of our leading pick these past two years, AEHR, I'm thinking it's now (after moving independently) somewhat lifting or retreating in a slight 'sync' with Semiconductors, even though it's a testing gear provider. I note that Semi's bounce, AEHR a bit, but proximity to that 'gap' is too close for comfort still, so there's reticence to push it higher too soon without news.

That is hard to pinpoint, but one might contemplate that revenue-enhancing new is not far off. I also noticed that Nvidia bounced a lot, we don't own it, but they were an early investor in absolutely speculative SoundHound. So last week I'd switched back to preferring common over options (because under 2 it was just like a never-expiring option). Anyway it bounced solidly today and will likely try to extend that tomorrow. I suspect there are lots of greedy shorts and option writers trying to get out of bearish-leaning positions. Expected rebound and open-minded to more upside.. as the bears there go hibernate for awhile.

There are other stocks that are struggling (really majority of the market aside a handful of leaders), BigBear.ai (BBAI) has more institutional investors and we shall see if it's preparing for a move. No particular new enthusiasm and it's August, but here and there are a few special situations. One might be Terran Orbital, which reports in the morning, but it's a couple months before the non-takeover or anti-merger 'standaside' with Lockheed (LMT) passes. That doesn't mean LMT has a desire to do so. However their business plans seem to be progressing.

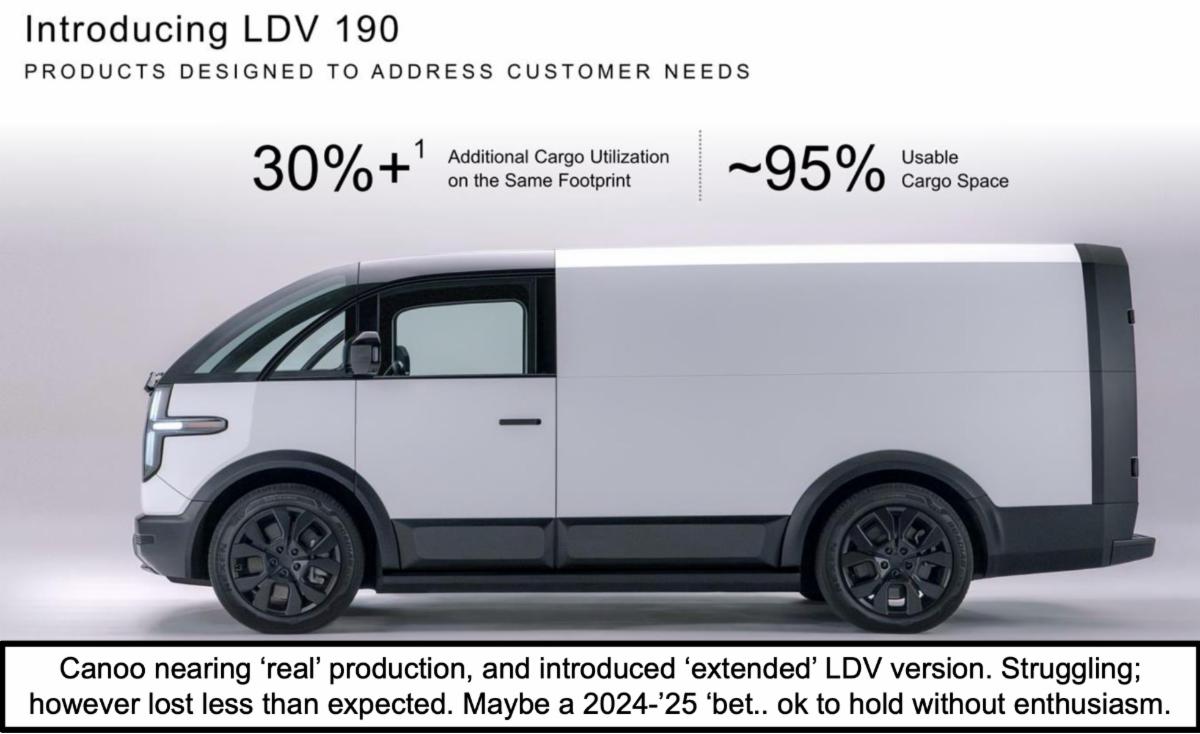

Lastly there is Canoo (GOEV), which is still around the .51 rank speculation level I'd mentioned. Well they lost less than analysts expected, but sounds slow. Yes I listened to the Quarterly Call and detected frustration, and understanding, as it too CEO Tony a lot of family money to essentially 'fund' the company over. I do think they'll muddle through, but talking a 20k production annualized rate in a year is almost no volume in the automotive industry so it will take time.

More By This Author:

Market Briefing For Monday, Aug. 14Market Briefing For Thursday, Aug. 10

Market Briefing For Wednesday, Aug. 9

This is an excerpt from Gene Inger's Daily Briefing, which typically includes one or two videos as well as more charts and analyses. You can follow Gene on Twitter more