Market Briefing For Tuesday, Apr. 20

Portfolio 'convexity' - as managers term internal sector rotation (rebalancing in a sense), is really what the market is counting on to hold together. Extreme liquidity being shoved into the capital markets (because credit markets remain unattractive) includes pension funds that normally steer away from stocks.

Does this set-up a big problem? For them at some point; but not comparable, of course, to the leveraged hedge and other funds that have nebulous margin essentially. That's leverage as varies depending on their banking relationships and can't be quantified, unless or until one of them 'blows up' like we've seen.

We'll get to a point where the Fed starts reducing liquidity (policy tapering), at the same time they are loathe to actively contemplate that (at least publicly) at this point. When that happens, choppy won't be the term to apply to the S&P.

In the interim, we're not in an 'end-game' unless it's just the short-term froth. If the Fed does 'not' begin to remove it's accommodative stand, corrections likely will stay within context of the super-cycle that we believe began March 23, '20 rather than a decade ago. (Not just because I called it the 'Inger Bottom' that day; along with stating the S&P will not see lower lows for years to come, but as short-lived as the preceding early 2020 plunge we also identified was; that was technically a 'bear market', and most dismiss that assessment. We don't.)

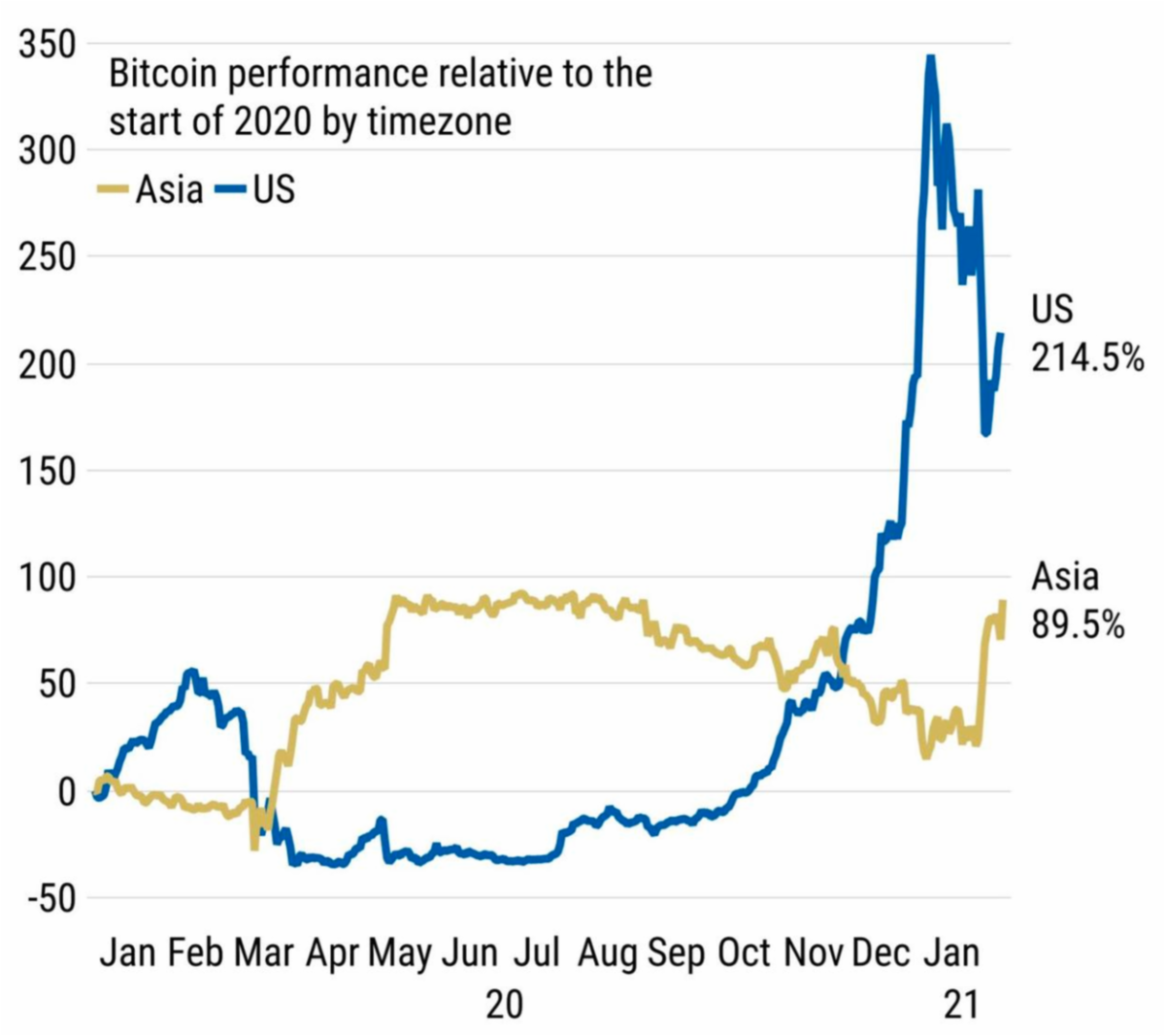

Also, an unwind of equity euphoria should still be on-tap; and we've identified late April and parts of May as likely rocky. So the 'antenna are up', but there is still concentration in the 'heavy lifters'. On Monday the appropriate break over the weekend in Bitcoin (BITCOMP) couldn't hold a rebound; and like I suspected with that Coinbase (COIN) direct listing; that was a time to exit not enter, on the excitement. It's separate (but relates) to 'everyone' asking me about crypto while in-hospital.

We should focus on the 10-year (and we do) and 'real' rates in the mortgage and other lending markets. Even 2% on the 10-year is still reasonable; but we might see that contribute to some of the agitation in big stocks nearer-term.

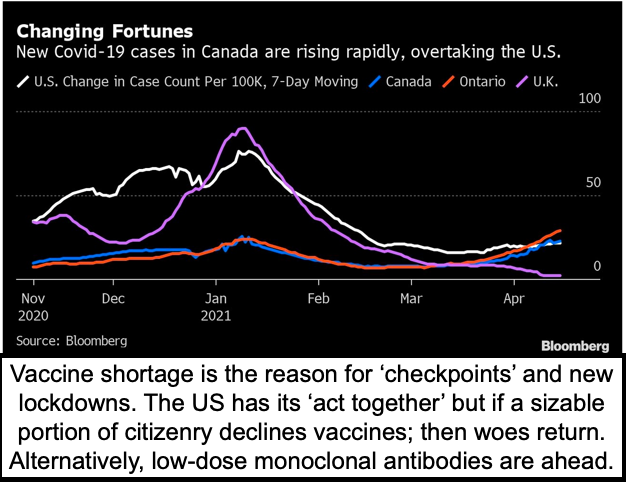

Meanwhile, outside the U.S. (and increasingly in some parts of the U.S. and of course Canada), the COVID-19 virus continues to rage. The variants are at least as much a problem as I've mentioned in the last couple weeks; and now the media is focusing more appropriately on these risks. Nevertheless they're seemingly 'pained' to advocate vaccines (J&J included later this week), with a reluctant admission that they may prevent being 'very' sick but not immune to infection or illness with the variants (now the majority of COVID cases) (SPX, JNJ, SPTL).

Again a reason we support 'new' vaccines; alternative treatments (antibodies and pills) and a move away from merely funding the major pharmas (who now have Government pushing the vaccines. They may be ok but raise suspicion).

In-sum: this was really normal consolidation after an Expiration week; and of course the weekend break in Bitcoin and related crypto-plays awakened the complacent speculators about risks of chasing a game already played. That the British said they have no immediate digital currency plans; and China also said they won't soon compete with the digital Yuan, also helped sober it all (CYB).