Market Briefing For Thursday, Sept. 7

Disinflation without overarching recession is likely what some analysts perceive as the 'Goldilocks' scenario facing the Fed. I see it as more complex, primarily in response to stronger Oil and Dollar behavior. It's all wavering.

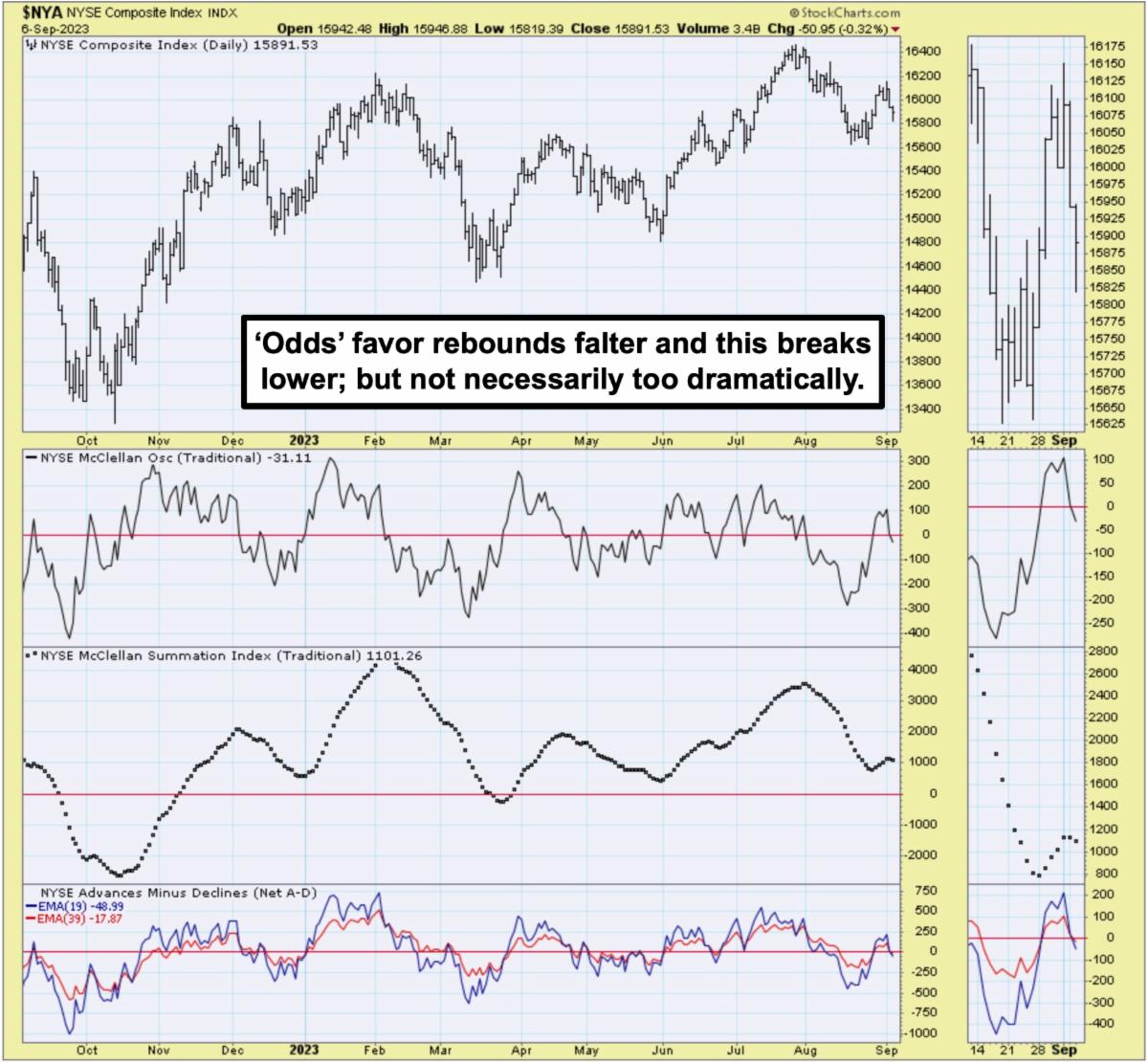

Plus, simply it's September as the weaker erode, while big-caps get riskier. To be more direct: failure of intraweek rebound to overwhelm the high last Friday, and faltering at the 50-Day Moving Average, is really the control for S&P. And you had Apple (AAPL), a benchmark Index stock, fill the gap we looked for, not more.

I resist getting into valuation discussions that dominate financial chatter since it is pretty obvious how distorted levels are, actually in both directions. Major mega-cap techs are very expensive, the S&P itself (influenced by them mostly as is the Nasdaq 100) is on the historically high side of multiples.

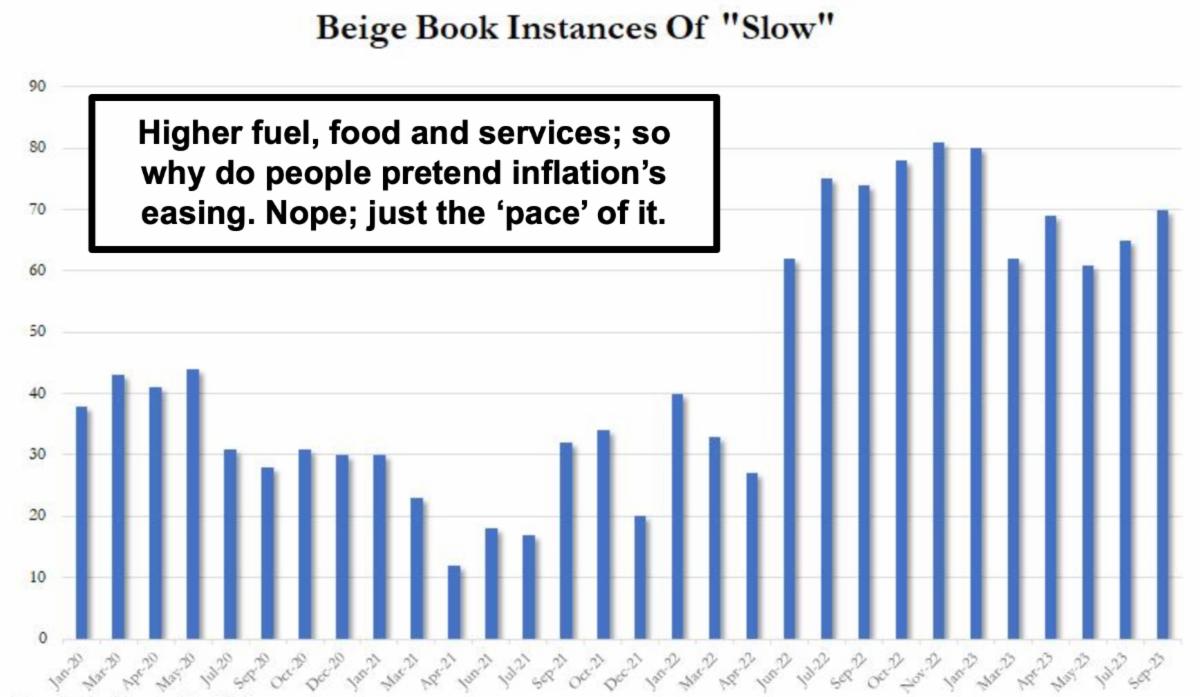

But take out the so-called 'magnificent seven' and a couple others, and you'd find nothing but average multiples for a majority of 'also-ran' stocks in many of the primary economic sectors. And that's probably a range where they should meander for now, as even the Beige (tan) Book suggests mediocrity but not a dire situation in most economic areas.

Maybe I should just say I don't know if Apple will drop more or rebound then drop after the iPhone 15 launch next week, and I don't know if Disney (DIS) will get hit by another 20 points either, although I might like either one 'if' they did. Of course if you hit Apple, Disney and Tesla (TSLA), guess what S&P does... (lower).

'Market X-ray':

The market is failing so far in trying to rebound, although it did come back somewhat as looked for this afternoon, but impossible to be really impressive with yields up, Oil up and the Dollar firm.

Apple, Tesla & Airlines are a focus below, in-addition to AEHR. For Airlines it's more capacity, slower seasonal flying, 'turbulence' (unfortunately weather and climate related), higher fuel costs, and lower load factors (passengers). It is not an existential issue for airlines, but even Tom Brady has to rest now or then (an allusion to Brady becoming 'strategist' for Delta Airlines.. fine by me as I have consistently felt Delta was the best airline overall domestically). (I'm just disappointed that the 'old 767' flying transatlantic won't have the satellite internet the newer domestic fleet has, though by next year they all will have it ... Delta makes money by refurbishing the old reliable 767/757 fleet...paid for...and from American Express who spends about 2 billion a year with them to buy miles to promote 'Card' offerings.)

Lest I digress more: a heavy market with faltering revival efforts sums it up.

Lingering softness could presage a sharper break in the S&P, however the majority of already repressed stocks would barely erode in such activity as a lot of investors and managers long-ago liquidated those holdings. Hence the ones that migrated to survival and decent business models may actually be a bit attractive, but with patience required. Nvidia, Apple, Tesla... already down and typically S&P should be down more.. but outside the big ones it's calmer.

Distinct from such stocks is a singular issue we follow: AEHR Test Systems of course. I've been pointing-out its relative strength here and on 'X' (Twitter) for awhile and it should be attracting attention more broadly given behavior of so many others, and with 'earnings' just about a month from now. Note that its been awhile since they reported (not that they must) any new contract orders or sales achievements. Nevertheless, the shares are a couple points from all time record highs. How can this be? Anticipation that not only good results will come in early October, but probably expecting CEO Gayn Erickson won't go into the Quarterly Call without improving prospects already achieved.

'We' are not buying Apple (you may hold some all the way from the 50's when we did), it is key to S&P, their earnings growth is minimal due to buybacks, as well as more growth from their 'services'. Maybe the main point is that Apple 'and' Tesla both have big involvements with China, and can impact the S&P.

Bottom-line:

As goes Apple so goes the market, well that's been my view of the S&P for awhile, nothing changes. Dollar higher against the Yen might be more important, Yields going higher for the 10 year might be more important, but yes, Apple and Tesla can move the 'market' (index), and it's September.

While AEHR is certainly not the only stock we track or own, it and Chevron (CVX) maybe, are the strongest in the current environment. And Disney continues sort of heavy, but not that everyone piles-on it negatively, I'd back-off from being too negative. Hence, I say less bearish the lower it goes (for months).

Failing S&P rallies is the characteristic of the 'superficial' market preparatory to more roller-coaster behavior this month, which can include turbulence (but hopefully not on my flight to Spain next week). Seriously even Airline stocks have turbulence, and I've talked about that before: higher jet fuel, lower load factors in what I call the 'shoulder season' (after the last leisure travelers for the Summer), and pricing that is not supportable to average U.S. travelers. I believe the Airlines are likely back in the usual cycles such as pre-pandemic (and fingers crossed that we don't get a variation of the pandemic again).

We also have a trial against Google coming, and the UAW strike risk... so.

More By This Author:

Market Briefing For Wednesday, Sept. 6

Market Briefing For Tuesday, Sept. 5

Market Briefing For Thursday, Aug. 31

This is an excerpt from Gene Inger's Daily Briefing, which typically includes one or two videos as well as more charts and analyses. You can follow Gene on Twitter more