Market Briefing For Thursday, Sept. 29

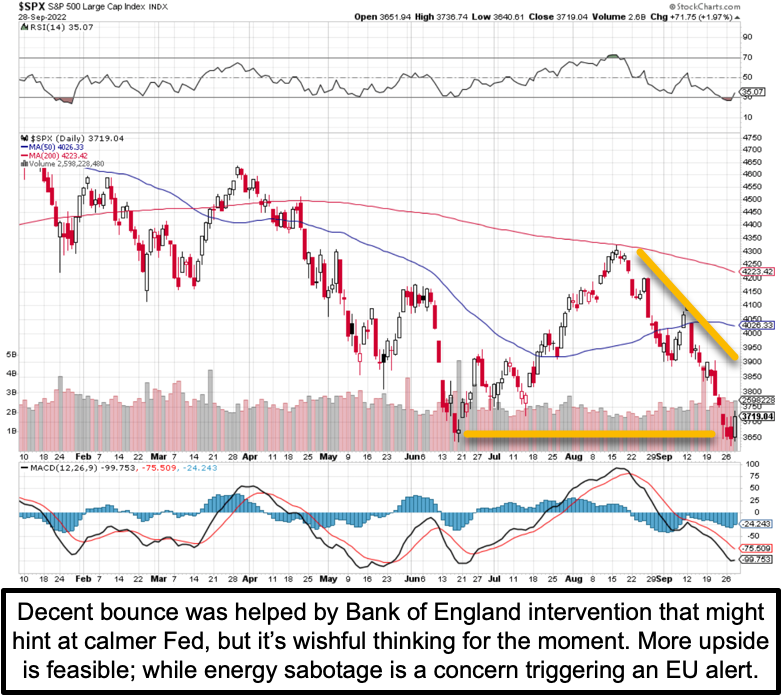

Markets took a respite- with an anticipated rebound try, thanks to the U.K.'s Bank of England 'sort of' pivoting back to Quantitative Easing 'of a sort'. The open-ended part of this is whether the U.S. Fed sees the 'writing on the wall'.

Markers for the fiscal side need to help the monetary side, and the U.K. up to now has been terrible with monetary policy, so what could kill the U.S. hopes would be if 'our' Fed doubles-down on it's excessive tightening, effectively in a fight with the BoE.

Central banks are rolling along a roller-coaster ride between QE and QT, with a realization that most stayed with negative real rates for way too long, and it is challenging to both 'sober' monetary policy, fight inflation and prevent total economic devastation, which is the 'be careful what you wish for' admonition I offered to the Fed, including the 'operation successful / patient dead' analogy if they don't lay off the pressure on a suppressed Country.

The market went up and will see more.

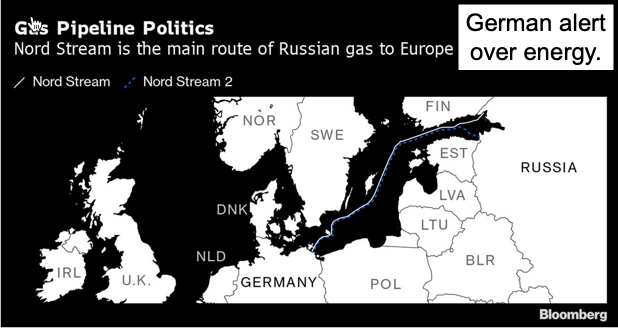

There is speculation about whether 'Putin is crazy enough' to blow-up his own pipelines, although one Polish official was far-afield blaming the U.S. So this is a major issue, because gas flow is truncated regardless 'who did this'.

There is also the domestic refining shut-down due to Hurricane Ian, and my thought about price supports suggesting Government buying to replenish the Strategic Petroleum Reserves. Not to be over-looked: the German 'Energy Alert' which the US has also endorsed for LNG shipments, after the sabotage of the Nordstream pipeline. Russian submarine? Hard to imagine how it could occur other than via military sub or some sort of submersible craft.

Bottom-line:

The hurricane smashed the Florida West Coast, and the eye is expected to be over Orlando later tonight, but it appears to be breaking up a bit, although flooding remains the main concern.

Stocks were hoped to try to rally again before possibly breaking anew, but so many are so negative it was good timing for the Bank of England to intervene even if there's two perspectives on their efforts (doesn't fight inflation, but sort of is seen as a pivot, which since the ECB and Fed often coordinate might be why some curmudgeons are unhappy with London for taking this action.

More By This Author:

Market Briefing For Wednesday, Sept. 28Market Briefing For Monday, Sept. 26

Market Briefing For Thursday, Sept. 22, 2022

This is an excerpt from Gene Inger's Daily Briefing, which includes videos as well as more charts and analyses. You can subscribe here.