Market Briefing For Thursday, Oct. 13

Calibrating 'when' to pivot was the subliminal message in the minutes from the last FOMC meeting released today. Yes the majority said there's a need to keep firm until the 'labor market' breaks, which of course goes against political pledges and efforts to 'not' break the economy.

We had incredible fiscal stimulus (much corruption and abuse along with that) and a wage component to the inflation, with both parties doing little to reign all that in, and impossible to claw back wages, hence some layoffs increasing.

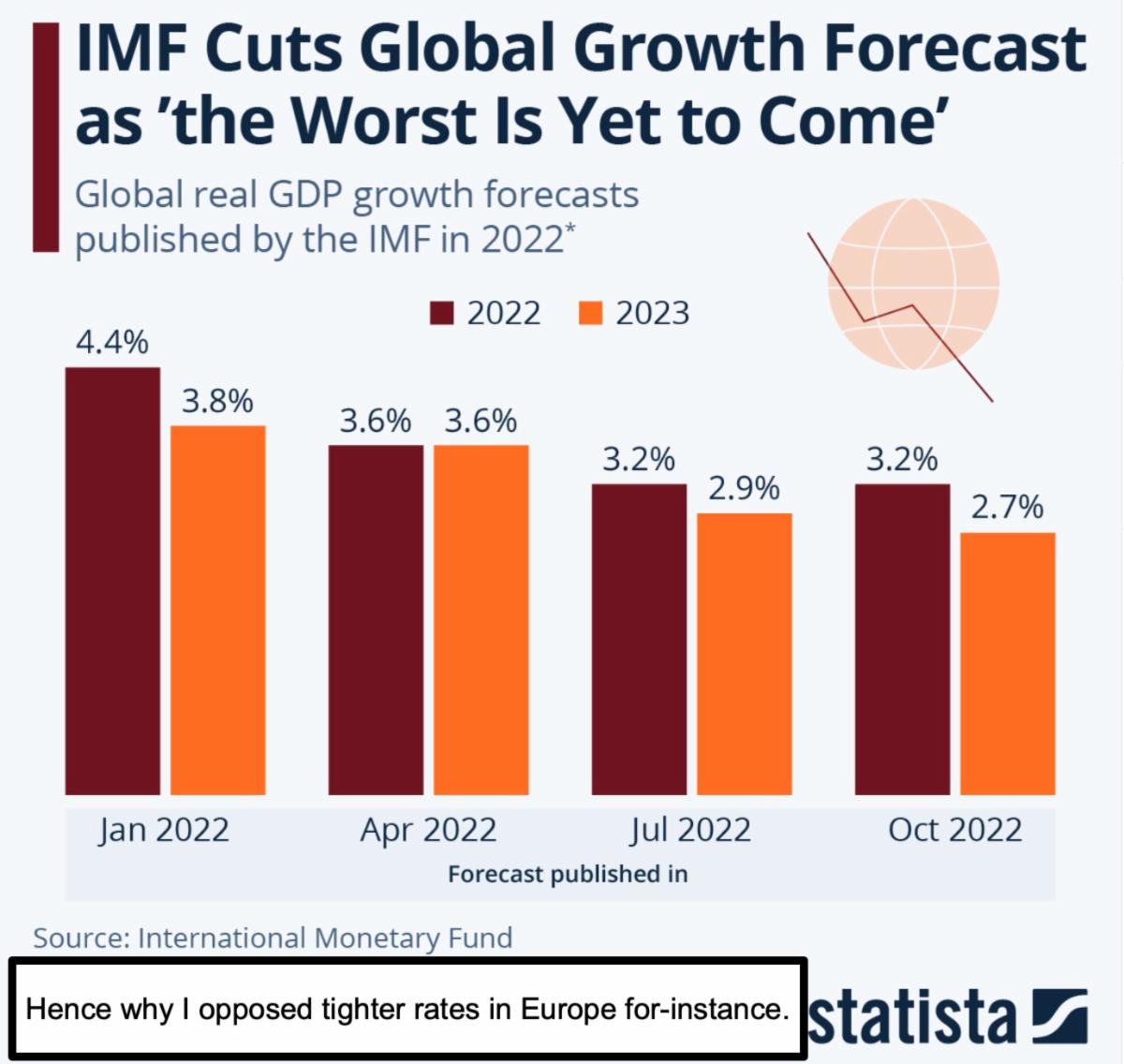

Global fungibility led to global slowness, the stronger Dollar, and all that plays havoc with the myopic (domestic centric) perspectives expressed by FOMC in this report. Of course the Minutes are backward looking, and 'calibrating' how quickly the Fed can move from one direction to the other, is not just tricky, but not assured to achieve their inflation-busting goals .. without casualties.

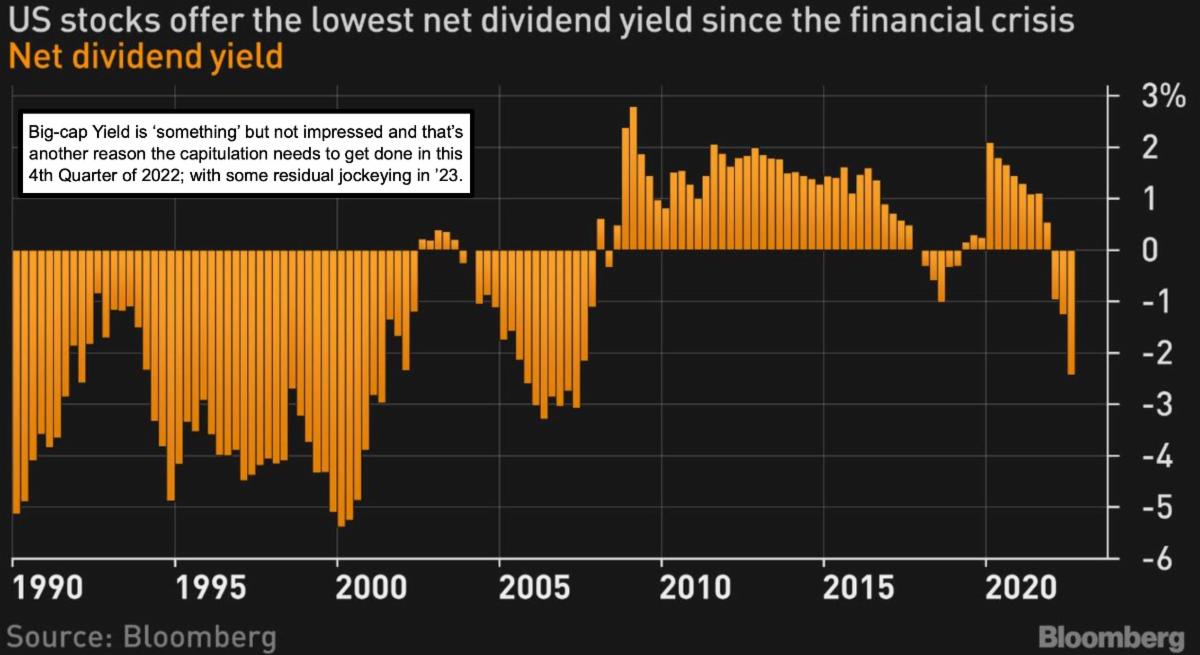

In the stock market, much of the impact has already been seen, distribution in my view has dominated (you know my view) under-cover of a strong S&P and buybacks for almost two years, and perhaps the 'blah' response of markets in the wake of Wednesday's Minutes, as well as a strong PPI earlier in the day, infers that much of the so-called new bearish concerns, are largely priced-in.

In-sum:

Notice Fed-head comments in this recent Fed Meeting were actually more hawkish contrasted to the preceding FOMC gathering. So, the majority of the Fed-heads are still urging hawkishness or essentially near-term caution for a few markets, even if they're neutral (or just jittery) for the moment.

Of course if an exogenous event, or systemic breakdown arrives (event) then the Fed may shift quickly regardless of what they say here. Also, my view that they're limited in 'duration' of high rates due to impossibly high 'debt service' costs, which (while never mentioned) might be why they try sounding tough at the moment, quietly aware they can't keep this up for very long.

This gets interesting should 'the market' (meaning S&P) largely ignore the CPI in the morning. The PPI already suggested higher wholesale costs and with a presumption of pass-through to consumers or end-users, it infers warm if not hot inflation readings. S&P's generally ambivalent about how this comes forth.

Of course Oil (and retail gasoline) has been alternating in the data period, so that's tougher to gauge. The Administration's draining the Strategic Reserve in a sense would contribute to a lower fuel segment in the CPI, however that's a bit of a misnomer since it's sort of a fake way to get prices down (meaning it softened the retail product, gasoline, but not the basic commodity much, Oil).

I'd call this a market 'hesitation' more than rebound, but again crowded bears in-event anything favorable is interpreted. Behind the backdrop of today's PPI must be noted that there's limited 'elasticity' in pricing, if you disbelieve ideas like Pepsi suggested, that consumers are willing to pay the higher prices. So I am not on-board with that comment, just acknowledge sales didn't collapse.

Wage growth remained strong, and some can argue people don't feel prices on the ascent, but again I'm thinking (based on history) people will adjust to an extent, but what would really make that feasible would be lower rents and a plunge in Housing. Yes, existing homeowners 'on paper' would feel poorer, but it's really the rental side of Housing that has residents more sensitive. At the same time total Housing costs for anyone buying now are likely far-higher as a proportion of income, and debt-service, Utilities, HOA's and so on aren't likely to ease significantly anytime soon, and that might contribute to 'thrift'.

Bottom-line: a spooky neutrality shuffles with nominal moves, and there is a crowded 'short-side' again (having noticed record Put buying last week, which means there's a crowd that can be run-in 'if' the market fails to break).

Even if that occurs it can again be rinse & repeat, as this is a tough to trade or irregular market. The trend overall is down until it's not, the Fed is tight until it is not, and the global macro situation is increasingly illiquid, also until it's not.

Much of the downside is 'priced-in' relative to interest rates, as limited action's implying too. That doesn't mean the S&P's out of the woods, but with Dimond and everyone talking of risk, one assumes most lightened quite awhile ago.

More By This Author:

Market Briefing For Tuesday, Oct. 11

Market Briefing For Thursday, Oct. 6

Market Briefing For Monday, Oct. 3

This is an excerpt from Gene Inger's Daily Briefing, which includes videos as well as more charts and analyses. You can subscribe here.