Market Briefing For Thursday, May 20

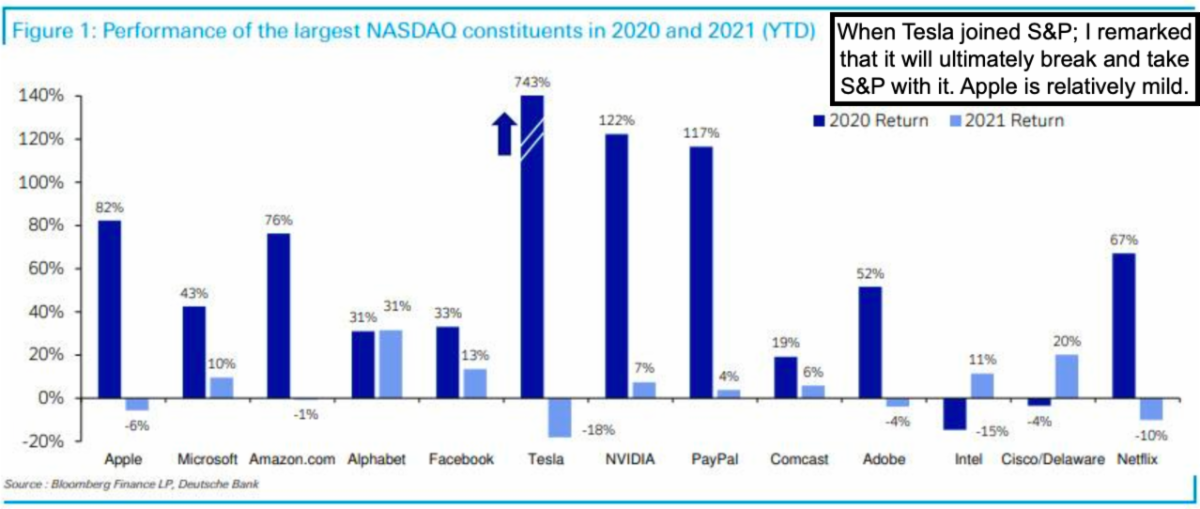

Many years of expansive monetary policies lie behind a stretched S&P in the views of many analysts. They are correct about the Fed underpinning most of this, while often omitting the reality that last year's targeted washout and turn to the upside (in March of 2020) was a totally new cycle, at least in our view.

Of course that cycle can be impacted not just by consolidations (streaming is just one sector engaged in that), but by realizations of excessive multiples as well as 'for instance' a Fed that increasingly chats about 'tapering' policies that allowed all this attraction to equities to develop.

Today Citi (C) issued the newest 'Citi Economic Surprise Index', and it's neutral in terms of overall action. In our view we have an economic blip as the broad economy tries to catch-up to pre-pandemic levels, while we dispute optimism that unfortunately pretends COVID has gone away 'globally'. It's that aspect so worrisome still, as there are upticks in cases in many parts of the world.

If we are extremely lucky that won't happen in the USA, however commerce is so global that you can't dismiss what happens abroad. A great example sadly is the pharma companies talking about possible 'booster' shots. I've probably mentioned this before, but what they are really admitting is that their existing vaccines were based on controlling the 'Italian mutation', which was a version of the Chinese virus that overtook New York City after Milan's Fashion Week.

That's the same virus that dominated Europe and even went back to China. It matters because most experts (not the ones typically on TV) believe not only that the virus came from the Wuhan Lab, but that what will be coming will be a new round of vaccines, not really just a 'booster'. And better lower-dose-levels for monoclonal antibodies, which kills the COVID-19 virus, rather than prompts an immune system response in the conventional fashion. The term booster is a like way of mitigating a broad understanding that everyone vaccinated likely will go through the entire process again, absent real 'herd immunity'.

What makes this interesting here was a comment (an interview in length) of a leading think-tank researcher at Beijing University, linked to the Communist Party hierarchy. In a publication translated to English today, he says (with for sure more than a tinge of propaganda) that China 'won' the biological war with America and Europe, as the 'CCP Virus' brought America into shape.

That Professor might get in trouble for telling such a tale, if it's true and as so often is the case it's a single fairly obscure source and not reported in major media. They might avoid it due to obvious estrangement literal interpretations would provoke, or because whatever he said was less than the writer went on to postulate (creative license). I will update this topic if I get verification, while I do believe as I wrote even before Washington did anything, that it came from the Lab in Wuhan, and even the Chinese doctors who died early, said so.

Technically all S&P (SPX) did was again test (slight irrelevant penetration ) of the 50-Day Moving Average. So fighting the so-called uptrend is less risky versus months ago in a sense, with allowance for very short-term behavior that might well get an interruption of bearish action by stability ahead of Memorial Day.

The crypto issue won't direct the S&P as some think, but it does impact many Semiconductors as we've discussed. I think AMD's share-buyback decision today is unrelated to that, and Nvidia is even more involved. AMD is watched daily here because being the best gainer, it's up 5x of so from our entry point at the end of 2018. As it got into the 80's and 90's we contended just to hold, and that a holder could sell 'some' so as to be playing with 'house money'. At this point I'd hold and see if they can maintain high level support assisted by a slew of buybacks (as much as I disdain using capital for that purpose) (AMD, NVDA).

In-sum there really was little that's new requiring more comments, the crypto sector did a washout and rebound and we forewarned of that for weeks, with Bitcoin (BITCOMP) having an extremely wide & wild range today (30,000+ to 38,000, and that was essentially my preceding forecast for the breakdown).

Interesting, isn't it, that while the cause of the spread was known and obvious, the fools in charge did not do the one thing that could have stopped the spread, which would have been to close the borders TIGHT immediately. That might involve parking tanks on the runways to stop planes from landing, with ample warning given before they would even plan to take off. It might also require quarantine of a few cruise ships for a while. Certainly it would have had some economic impact, but far less than the total lockdown. that we had instead.