Market Briefing For Thursday, March 12

A 'cap' on market valuation - was anticipated ahead of the 'peak S&P', (SPY) and that's important, not just because we expected upside in January but because we thought that upside was fueled in ways unrelated to value at all; but simply the combination of 'seasonal retirement money' thrown-at the S&P fairly inanely by money managers, and often via passive ETF's, a bubble in-and-of themselves, plus 'coronavirus' flight-capital mostly out of Asia, which added to the artificial nature of the pre-peak upside.

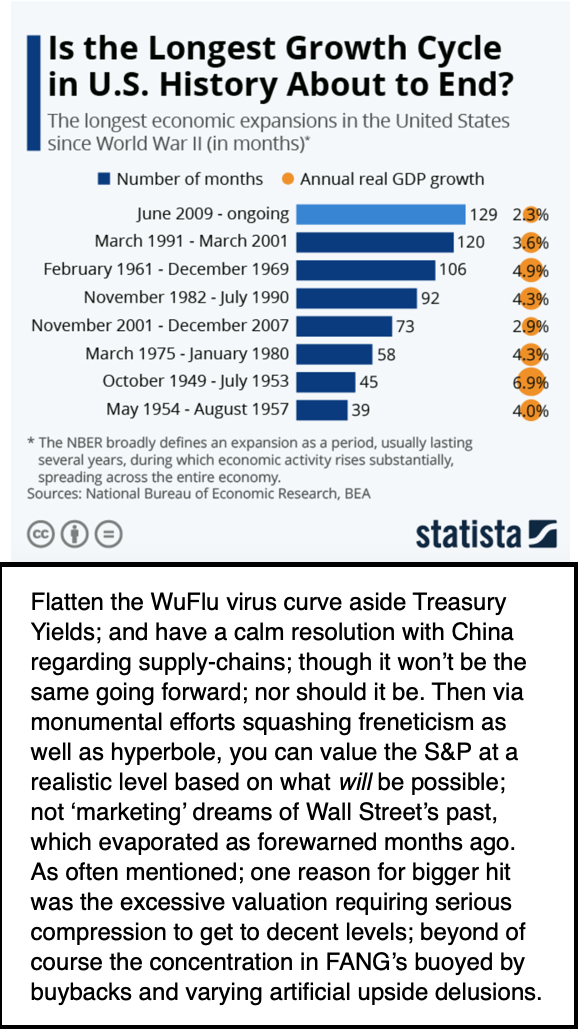

So we viewed the concentration in FANG and MAGA stocks suspiciously, calling for a February decline (internally slightly before the S&P peak), a pattern that seemed reasonable given our original forecast in December for a seasonal rebound in January, and then trouble.

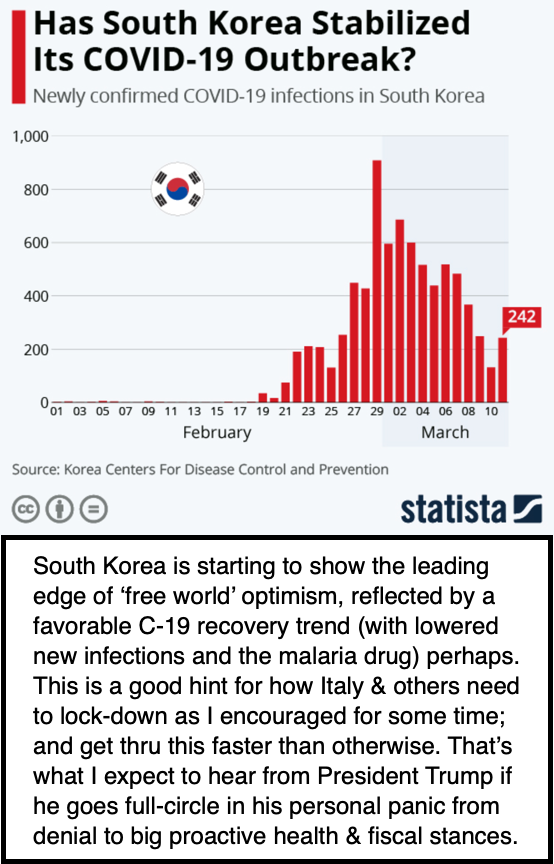

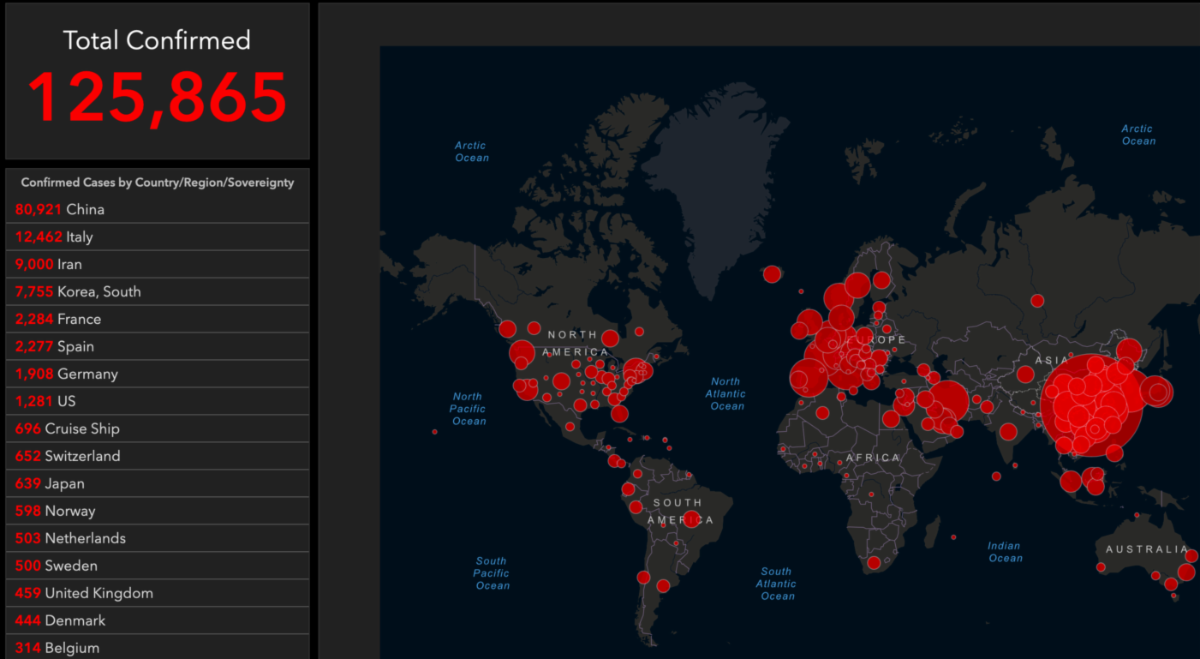

Sure, had a China 'not' had the virus, disrupting trade and supply-chains, there was a shot at a drop, then a Spring rally, which might even last into the Election, which is of course part of why the President rationalized lots of things in recent weeks, rather than proactively jumping on to this issue with more urgency. And sure, if by miracle China 'really is' recovering as a slew of reports suggest, and South Korea follows, there's hints of how it will look several months from now. My view has been that the USA could expedite all of this by 'biting the bullet' and locking things down now. And yes I thought President Trump was sort of in panic, but knew the reality.

Yesterday I reflected my belief his personal panic entered a new phase in realization that he had coronovirus-exposed Congressmen on Air Force One, and both he and Vice President Pence encountered guests at two political gatherings the prior week, who also are all in 'quarantine' now. If nothing else, Trump is a known germaphobe, so that got his attention.

In my own take, he has known, does know, and as I said this morning to our intraday members, I thought he would declare a National Emergency today, and shared that before the WHO finally called it a 'Pandemic' (and I was and remain critical of their hubris 'as if' they forewarned, since they held-off despite half their members favoring the declaration weeks ago as you know, for whatever reasons, those Pandemic Bonds taking-down the big banks or hedge fund investors, or whatever rationalizing they had).

Back to the future, and The White House. All along, on the other hand we learned that in the background, largely unnoticed by the media hyperbole on either side, President Trump knew what in fact had to be done, and we believed that would gel into proactive action before 'the window closed', a thought I again expressed concern of in last night's report.

As we said before, in some aspects the 'containment window' closed say three weeks ago, when Seattle wasn't isolated and all flights stopped 'in' the USA, at least to that Airport (SeaTac). We realized we were sounding a bit alarmist, but tried to convey that we were making a point of realism, regarding how you cannot continue to do the same things that got others into trouble, then somehow expect different results with a US experience. Again: ignorance is bliss until it isn't.

We put a timeline on this too; and it's all progressing from the highs; to a low that will reflect the future prospects, irrespective of anyone's forecast politically or financially before fear gripped the world (although it seems it is still not accepted widely, as I have personal acquaintances who don't yet get it, and that's presuming our concerns were valid, as I'm confident they were. I hope we get another rebound; but don't count on it holding.

I don't know if it's cyclical erosion or a big credit event, or both. Many big companies ARE at-risk and we're sort of buffered in the banking system compared to 2008 (my forecast 'Epic Debacle' a couple months ahead of that fiasco), but companies can't roll commercial paper now, and lots of uncertainty about firms being able to pay their debt will impact finances, and the banks. It's a secondary effort of the 'Wartime' virus battlefront, so be aware that 'even if' the President proposes everything just right, there is no safe-harbor financially for business yet (and we don't just mean for cruise-lines, where ports of call are thinning quickly as virus spreads).

P.S. Carl Icahn just boosted his stake in Occidental Petroleum (OXY), an embattled producer. I'm not sure that would be my favorite in Energy (maybe Halliburton (HAL) or others), but the idea would be distribution as everyone was chasing big stocks a couple months ago, re-entering on a scale into extreme weakness. Generally premature other than bounces and most experienced investors would rather pay a bit more after an S&P technical pattern (aside fundamentals) shows some sort of successful or classic bottom pattern; and nothing like that (other than a snap-back) yet appears probable. (The President looks very tired and stressed through all that bronzer. I sincerely hope he's o.k., we don't need an eruption of chaotic financial moves or Fed challenges or firing attempts now.)

I agree Gene. Lock stuff down now. Waiting may make things much worse.