Market Briefing For Thursday, June 4

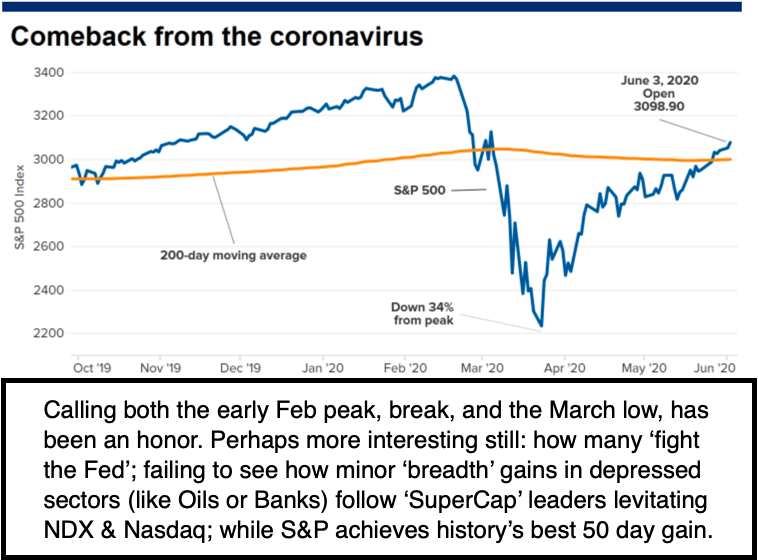

'We shall overcome' - could well have been a mantra for the stock market these past two months, as neither headwinds from valuation, from COVID-19, or from recent social upheaval, were able to deflect the S&P and Nasdaq comeback, which was of historic proportions. Ah, but by what mechanism is this extended, and what implications - without precedent - are put-in-motion, that potentially (ultimately) create a systemically destabilizing situation.

Not even a vague recollection that all of this is on-the-back of a 'Fed Put', which establishes moral hazard (created, whether emergence is delayed until the point where the Fed has to stop buying corporate debt, or in any other way precipitates a 'day of reckoning'). Systemic disruption ultimately is a risk. That's possible if you try to finance everything in ways that primarily help big corporations, but not so much small business, which is the heart & soul of America, and customers of those huge firms too. And the result then becomes a lack of persistent growth which could offset that outcome.

The risks to 'capital markets' and destruction of reasonable 'price discovery' are going to be real, down-the-road, partially as it allows use of excessive leverage by crazed high-frequency and hedge trading crowds (and we've seen it before). In this remark (and remember we called for this rally) I am not saying it has to unwind yet, crumble, or hit huge air-pockets right this moment. In fact I think not quite yet. But aside political madness or societal challenges, it's worth keeping-in-mind the Fed can't bailout insolvent firms in-perpetuity. That matters when you think about the next 'taper tantrum', as the Fed inevitably must chose a spot to back-off open-ended financing.

Executive Summary:

- A mood of 'emergence' from both the coronavirus 'and' social turmoil, seems to be sensed, even if there isn't a clear determination of either.

- However, the President is on-edge and probably really concerned that the assembled authorities won't be able to save New York City (it's been pillaged and looted already, so let's not even mention property values).

- Tonight protestors near my old Sutton Place neighborhood on the Upper East Side were routed mostly by the heavy rain on 3rd Avenue / 50's), elsewhere the 'riots' in London and Stockholm were sort of stunning, as maybe some feel like they're missing out of the action lately.

- Media contradicts itself with regard to increasing lawlessness, versus a more peaceful backdrop, while the Sec'y. of Defense sort of did likewise, after first ordering a couple hundred Federal troops to go home, then he had a meeting at the White House, and reversed that order 'for now'.

- Notable remarks on 'governance' came from 'Mad Dog' Jim Mattis (the first Defense Secretary under Trump), and former Joint Chiefs Chairman Admiral Mullen, both of which were highly unusual statements ripping President Trump for 'dividing America' (their words).

- S&P continued to grind higher, primarily as 'breadth' expanded more into value stocks, and generally ignored everything from political theater (yes on Capital Hill, not referring to the protests) to Dr. Fauci's concern there may not be a vaccine providing lasting immunity, but is more optimistic for therapeutic drugs coming very soon (as I have thought all along).

- The market's advance was largely away from 'super-caps', drug stocks, or even weapons plays related to aspects of both the police brutality or COVID-19 crises, and focused on small-cap and value plays.

- Liquidity remains awash despite individuals often financially challenged, and these issues are not resolved, but the adrenaline-fueled aspects are ebbing, at least on the surface, and maybe not just for the moment.

- The stay-at-home / work-from-home economy prevails, but we should increasingly be in a phase were people in most areas want this to calm, an example would be Yukaipa, California or Idaho, where Antifa-types were either beat-up when they tried protesting in suburbia, or citizens stood their ground with automatic weapons to protect properties.

- Meanwhile in certain cities (New York in-particular, San Francisco for other reasons) we have called for urban flight because for two years, and realtors continue to affirm the significant undermining of prices.

- It has been recognized that governments have done nothing meaningful to address housing issues, inviting economic 'tales of sorrow' for cities, so despite the lure of theater or events, lasting change may occur.

- The tax structure of major cities will perpetuate the downward trend.

- Notably Chancellor Merkel has signed-off on a huge stimulus plan for Germany, which focuses on infrastructure and EV incentives too (keep in mind there's a huge presence of Tesla coming, and VW/Audi heavily going into EV's as well'.

- Concurrently ECB's Lagarde pointed-out risks of their ongoing stimulus, mostly relating to bailing-out Italy, with many reasons why they must.

- No change in our view of a market extended and subject to consolidation over time, but not catastrophic decline, more likely rotation persists.

We were optimistic on America throughout this, including believing the drop in February and early March would set-up a capitulation and turn higher. Of course the broad market has had partial rebounds, and that's part of why we to this day are not as concerned as some others (most big strategists, nearly all technicians, and many hedge managers).

Those partial rebounds remain a factor in 'why' the overall market was never as overvalued as superficial views of multiples and so on constantly suggest to a majority of pundits, and definitely not any sort of 'historically overpriced' danger, though no doubt the big-cap techs are certainly not bargains, and to us have delivered rewarding gains since nailing the March lows.

Now, that's not to say we won't have shakeouts, but it is to say corrections in all probability based on what is known or suspected likely, will be in-context of the overall uptrend, and though overbought, not at-risk of catastrophe, at least not as of yet. Corrections yes, new collapse, not really. Exogenous or black-swan events could change that, but for the moment it's not copacetic, but it's not a time of impending doom, apocalypse or even debt implosions.

The comeback in Oil we looked for relieved pressure on banks (they provide most lending to smaller Oils), as those were the two sectors we primarily did require to 'chip-in' to help the broader market participate enough to lift this. I should add that 'liquidity' was sufficient to bolster this market, and not hinder the advance, which is solidly over 40%, even for the more-stoic DJIA.

In-sum, market opportunity is not in the big-cap leaders, even as they grind a bit higher, but rather in the smaller-cap and neglected value sectors. Odds of a correction remain high, but not promulgated by instinctive emotions, as both the pandemic and protests evoked in some.

I'm the author.. Gene Inger... I didn't see any recent comments or questions until today... sorry.. I never logged into properly before. Questions can be posed on our ingerletter.com website feedback, or we'd welcome you to join our regular daily service. During the crisis we include full MarketCast service (intraday as well as the nightly) at NO extra charge. I'll be glad to respond to questions about the service if you email me; but I probably won't see questions here. Thanks; and I appreciate the warm comments about our warning of a crash back in early February and nailing the max-fear low around March 22. Now it's a bit more dicey. Visit us.. www.ingerletter.com (you won't see a mention of the free upgrade; just subscribe to Daily Briefing). Questions? Email me: gene@ingerletter.com

Hi Gene, first of all, thank you for your article. As you mentioned in your executive summary, there as so many moving parts to the current market climate. Specifically, you mentioned that the S&P has continued to rise, as you also mentioned the belief for therapeutic drug soon. Obviously, there are so many factors at play with the "emotions" of the overall market and the S&P, but how do you see the possible effect of the therapeutic drug search not going as fast as some believe it to be?