Market Briefing For Thursday, July 23

Actionable ideas emanating from most technicians and strategists continue more or less the same tune they've been playing for months, ie: the S&P must decline. It's not that I disagree, though we have approached it differently: given our belief this is an S&P with overhanging 'correction risk' clouds. However it's also a persisting S&P (and Nasdaq) ongoing advance with the 'silver lining' being the noted bifurcation I have pointed-out for months at this point.

Such a 'bipolar' nature of this market contributed periodically to a 'broadening-out' of the upward evolution (we have had shakeouts along the way) and more recently the sector rotation, that was a good thing with respect to holding S&P up in the trading range and even a bit above, but not so good because it wasn't a true broadening in the most recent phase, but rather an either-or situation.

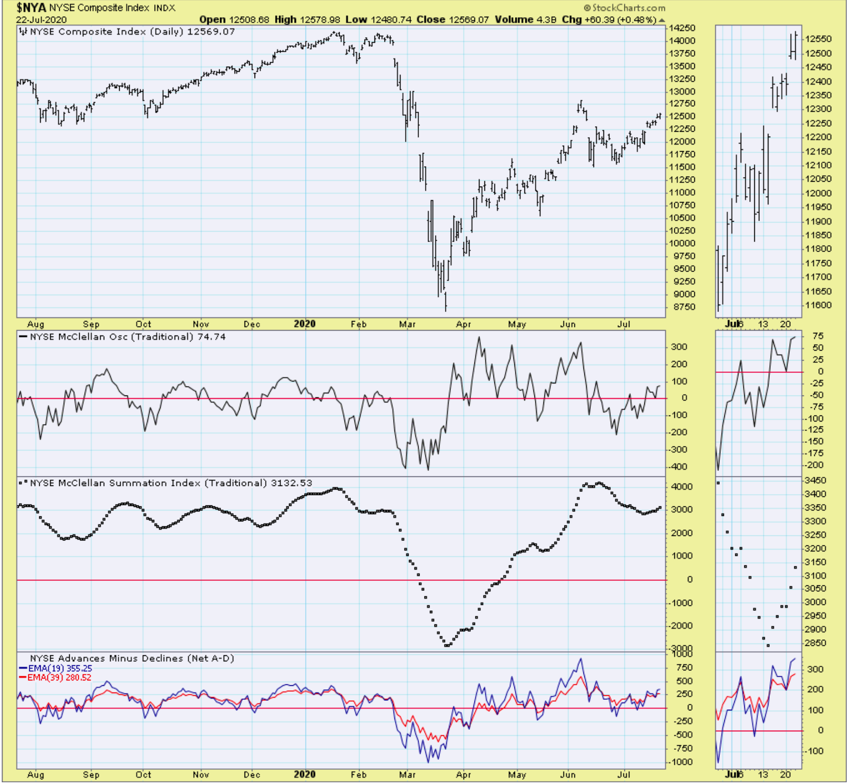

(Hint: it might dip, but it's not a jammed overbought market as naysayers contend.)

That was demonstrated less by individual stocks but my labeling the 'market' as sort of a 'rope-a-dope' pattern. Whether the super-cap monsters or the biotech super-hot speculations, they alternate almost daily (sometimes hourly) with 'circuitous' action, which isn't necessarily a bad thing if the evolution evolves to higher levels.

While it's incredibly difficult to divine that short-term behavior for individual issues, it is notable that every time it happens the rotation kicks-in and you jockey too-and-fro. So that's the 'silver lining', while I don't at the same time deny the prospects that this is long-in-the-tooth, ironically more so for the super-caps than for the biotechs. Now that Pfizer (PFE) (we mentioned them as a contender weeks ago) got a commitment from the President (provided further testing is successful and so on), it should move into the low 40's (perhaps after 'sell the news' profit-taking in the morning, initial jump or not, since the story came out at noon).

But more important was a report we've described for almost a week now, regarding the importance of T-Cell proliferation and activation, to fight COVID-19 invaders. Last night after a long read, I commented on the Stockholm study. Tonight ABC News actually reported the same bottom-line: vaccines tested so far have short half-lives, meaning the antibodies are not neutralizing or protective after about three months.

Then ABC noted that complimentary treatments (T-cells) have a much longer life if I recall (not recalling the exact words), although they didn't mention Stockholm. Now there are some vaccines that are elicit a better T-cell response, which is desired in a cohort of patients (especially elderly and immunocompromised), but not always all.

It sets-a-stage for 'niche patient populations' for different vaccines. So yes; Sorrento (SRNE) has one aiming that way, or Heat Biologics (HTBX) .. it's a main focus. We're following both but as mentioned last week, it is indeed a sector minefield, and not for the faint of heart, even if you have an assortment. As once the initial moves occur; stretching isn't quite so instant or dramatic (some traders are spoiled) and requires patience to see how it goes not only with testing, but with trials, and with funding incidentally. So some will work out, others will not. Always think about risk, not only potential.

In-sum, we're prepared for a seasonal S&P adjustment but not catastrophe, barring of course some 'black swan' (like kinetic war with China, which must be avoided). It is not impossible that certain areas, like biotech, will move independently even with a 'dog days of Summer' scenario which is possible in the weeks ahead.

Daily action: While noting the brewing risk from extended 'super-caps', at the same time does not believe it's a certainty that simple seasonality prevails. The Oscillator is in neutral (see below), the breadth is rotating and internally consolidating (in some areas for weeks), and there is no robust 'to the moon' general euphoria some say.

There is excitement in the biotech / COVID-19 area, but those are 'wartime stocks'. For that matter fortunes were patriotically made during other wars in our history, and it's despite the Averages diverging from the actions of some individual stocks. This isn't a manufacturing transformation like World War II, but it's not particularly unethical, if things evolve in a satisfactory way. That's just how things work, and lots of younger Americans are betting their introduction to trading in the midst of this, perhaps part of why more are gradually turning-away from radical left week extremism even though that is what makes the TV news. If people will compromise and come-together more or less in the 'center', that should be fine for most citizens, and some who instantly were quick to endorse groups with agendas 'other than for the greater good', might tend to back-away from that enthusiasm. This would also be good for the market.

Markets don't like uncertainty, although in this case the uncertainty allowed a crash back in February and March, we caught it in both directions, so it's only logical to be open-minded for a correction. It's technically a possibility (not baked in the cake so much as some technicians proclaim), it being seasonally feasible is normal, how the Election impacts this is unknown (except the market does not like higher taxes as a rule), and whether the situation with China mushrooms (please don't associate that with ...clouds...at this point) is unknown. That China is holding a fugitive from the FBI at their San Francisco Consulate (same day we ordered their Houston Consulate closed) is news that most citizens haven't even heard yet. We await more details.

Oh by the way, Tesla (TSLA) made numbers (exploding higher but risky), their giga-factory will be near Austin, Texas, and the speculation goes on.

There is often a lot of noise from the crowd hoping to make a fast buck from the frantic churn. and the noise does tend to obscure the more rational indications and make it harder to spot trends not driven by emotions.

Thanks for an educational article.

Thanks kindly William... I usually delve into the 'psychology' of the market more in my nightly videos; which are not posted here in fairness to paying subscribers at my www.ingerletter.com website. In fact I should require these excerpts be reduced further in fairness to me! haha. Stay safe in this crazy time.

You are right about that William!