Market Briefing For Thursday, July 1

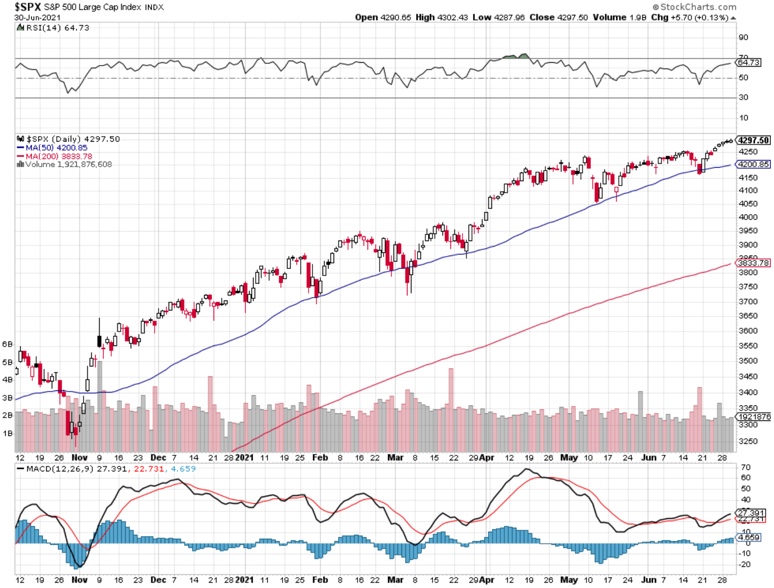

The second quarter of 2021 concluded on a high note, a new record S&P high, which was a part of Wednesday's rotational action focused primarily on big cap stocks influential enough to contribute to the effort.

Executive summary:

- Record S&P high Close, more on-tap, but a bit ragged (SPX, SPY).

- Late news regarding the effort to prosecute Trump's group.

- Warnings about COVID are getting wider than our early concerns.

Meanwhile...

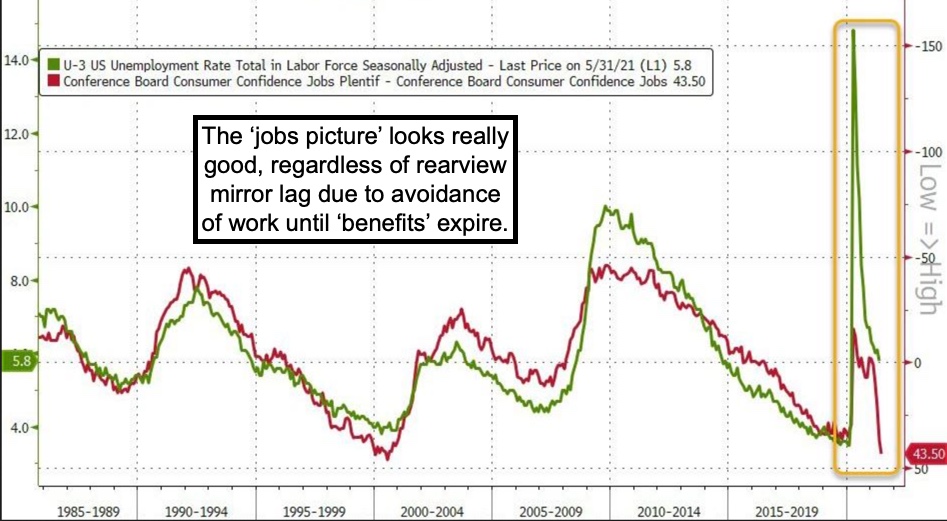

A threat of tapering lingers for the year's second half, buy that didn't prevent S&P finishing the first half at a record, while many stocks vary in performance.

Oil stocks have become the main idea of some analysts now, while it was Oil (OIL) and Banks as our key for continued S&P strength since the year's beginning (to complement big tech and so on). Oil itself has doubled from where we did go against the majority who were fearful in the 30's / bbl, and now talk of 100, but I will still hold for stability and modestly higher prices, but wouldn't enter. (I have shared that I have oil interests and like Chevron (CVX) for years, as persists.)

As to the Summer, well this is normal behavior, a Summer market. Some are going to be up and some will be down. Chinese restrictions can cause Crypto winter conditions (people think that's over, but not necessarily) and can harm overall markets. However, they may try to show a touch of goodwill and not be too aggressive (like starting wars!) ahead of the Olympics. Afterwards...hmm.

Bulls are straining at their logic to talk about 2% ten-year at year-end and hike goals for the S&P, which has already attained all our goals and then some. So I understand 'how' 4600 S&P could be reached, though I'm more focused on a few stocks, and again you have to have Oil remain as a leader, and maybe at least the core Semiconductors (SMH) like our AMD (record highs, 5x our entry price AMD).

Good news / bad price action was a feature for Micron (MU) after the close, but we were out of that long ago (as I recall it was a pick of the year at 5 or 15..really cheap and sold too soon probably in the 50's... again mistake as didn't say to 'sell half and hope you're wrong', which is why I'm prone to do on winners that double or more. In the case of AMD we simply held, retrieving just investment if anyone was so inclined, so as to play with house money.

Tech was the growth engine during the pandemic, and part of the resurgence relates to concern about a COVID resurgence. If that occurs you know the risks as we've discussed all week. If that is effectively contained with no outbreaks, of significance or global concern, great. But we don't know the outcome yet.

In the year's second half starting now, besides Oils, Banks, healthy rotation and so on, you need those Semiconductors and 'if' COVID Delta+ variants are spoilers of everything, then leadership ameliorates a bit and we return to S&P dominance by the likes of Amazon (AMZN) and Apple (AAPL). Specialty stocks are just that, and a Sorrento (SRNE) will benefit more from simply proving it's multiple products not from whether or not there's an outbreak this Summer.

This is an excerpt from Gene Inger's Daily Briefing, which is distributed nightly and typically includes one or two videos as well as charts and analysis. You can subscribe more